HAC News: May 21, 2019

News Formats. pdf

May 21, 2019

Vol. 48, No. 10

Competitive Indian Housing Block Grant funds available • HUD proposes to evict mixed-status families • Comments invited on changing inflation measurement for poverty limits • Mortgage data comment deadlines set • USDA announces top sites for ERS and NIFA relocations, agency staffs vote on unionizing • Congressional updates • Recent publications and media of interest • HAC Section 502 packaging training for nonprofits in Nashville set for June 19-20 • Need capital for your affordable housing project?

HAC News Formats. pdf

May 21, 2019

Vol. 48, No.10

Competitive Indian Housing Block Grant funds available.

Tribes and tribally designated housing authorities can apply by August 8 for IHBG funds. HUD will give priority to new construction, rehabilitation work, and infrastructure projects that will enable future construction or rehab of housing. For more information, contact HUD staff.

HUD proposes to evict mixed-status families.

A proposed regulation would require public housing authorities and private landlords with HUD-assisted tenants to check tenants’ immigration status and to evict those who are not eligible for HUD aid. (Eligibility is not determined solely by citizenship or undocumented status. Some non-citizens who are legally in the U.S. are eligible and others are ineligible.) Currently, when ineligible immigrants have family members such as citizen children who are eligible, the dollar amount of the assistance is pro-rated and all members of the mixed-status family are allowed to live in the unit. HUD’s analysis of the proposed change estimates that 25,000 families, including 55,000 children who are eligible for HUD assistance, would have to separate, move or be evicted. Comments are due July 9. Rep. Sylvia Garcia (D-TX) has introduced H.R. 2763, which would block the rule. Keep-Families-Together.org also provides an opposing perspective. HUD’s contact for information is John Gibbs, 202-402-4445.

Comments invited on changing inflation measurement for poverty limits.

OMB is considering changing the inflation calculation that is used to adjust the Official Poverty Measure every year. It seeks public comments for consideration by a working group it has assembled to make a recommendation. The poverty guidelines that determine eligibility for a number of housing programs are calculated based on the Official Poverty Measure, so a change in the OPM would lead to a change in eligibility. Comments are due June 25. For more information, contact Bob Sivinski, OMB, 202-395-1205.

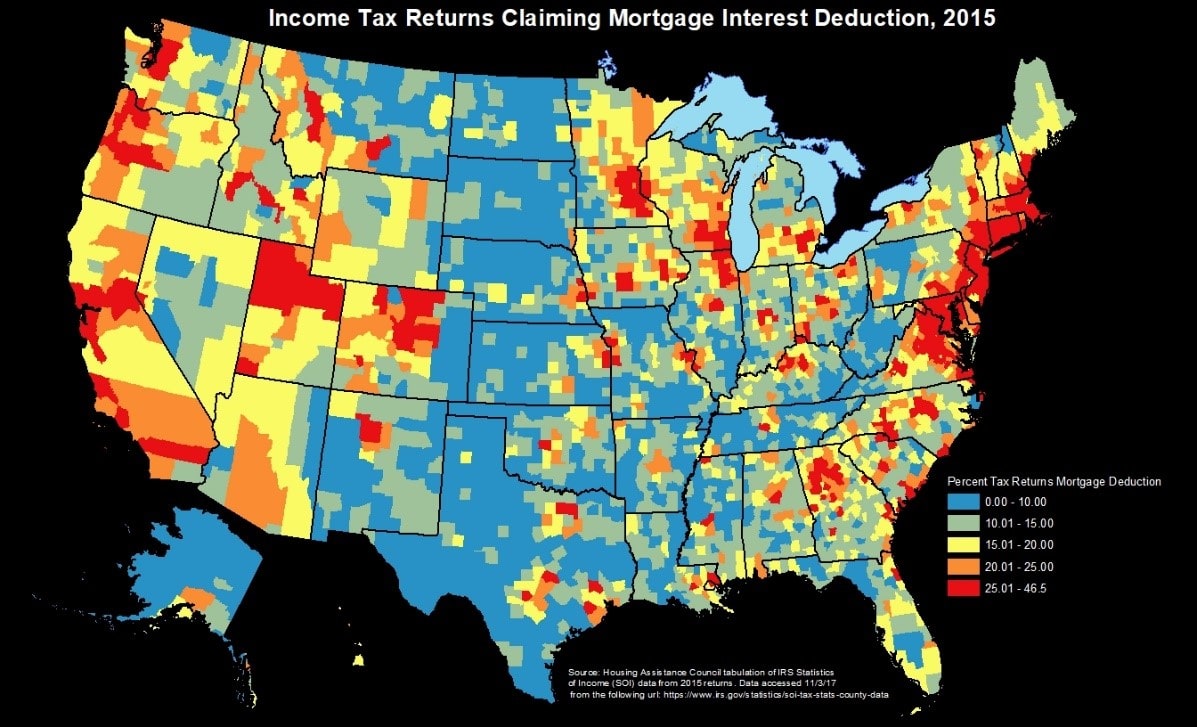

Mortgage data comment deadlines set.

Comments are due June 12 on a rule change proposed by the CFPB that would exempt small-volume lenders from Home Mortgage Disclosure Act reporting requirements. Comments are due July 8 on HMDA data points required by a 2015 CFPB rule. For more information, contact CFPB’s Office of Regulations, 202-435-7700, or submit a question online.

USDA announces top sites for ERS and NIFA relocations, agency staffs vote on unionizing.

USDA Secretary Sonny Perdue announced the finalists for relocation of the Economic Research Service and National Institute of Food and Agriculture. The proposal to move the agencies has generated opposition from concerned parties in the field, members of Congress and former USDA officials. On May 9, ERS employees voted 138-4 to join the American Federation of Government Employees, and a union vote at NIFA is scheduled for June 11.

Congressional updates

- A HUD oversight hearing was held by the House Financial Services Committee on May 21. Secretary Ben Carson’s written testimony was posted in advance.

- Several appropriations bills for FY20 have been developed and passed by the House Appropriations Committee, but work has not yet begun on a USDA spending measure. The Transportation-HUD subcommittee will take up the T-HUD spending bill on May 23. The Senate Appropriations Committee has not considered any FY20 bills. Party leaders and the White House are scheduled to begin discussions May 21 on lifting the spending caps imposed by the 2011 Budget Control Act.

- A disaster assistance bill, H.R. 2157, passed the House on May 10. The Senate may vote on its version of the long-delayed bill the week of May 20.

- Short-term reauthorization for the National Flood Insurance Programpassed the House on May 14. The program is scheduled to expire May 31. The bill, H.R. 2578, reauthorizes it through September 30.

Recent publications and media of interest

- USDA Rural Development Housing Funding Activity: FY 2018 Year-End Report, HAC’s annual compilation of data on USDA rural housing spending, reports that 131,487 loans, loan guarantees and grants totaling about $18.4 billion were obligated in FY18. Under the Section 521 Rental Assistance and Section 542 voucher programs, about $1.37 billion assisted 274,867 tenant households. All funding in the Section 502 direct loan program was obligated, with almost 33% of the funds going to very low-income households. The report includes tables and maps showing obligation data by program and by state, as well as data by fiscal year for each of the programs since program inception.

- As Americans Spread Out, Immigration Plays a Crucial Role in Local Population Growth, published by the Brookings Institution, covers the importance of immigration in U.S. population increases. For the past two years growth rates have declined in large metro areas, while nonmetro areas have gained population.

- Most of America’s Rural Areas are Doomed to Decline,a recent analysis by an Iowa State University economist, provides a gloomy economic outlook for many rural areas. Data indicates that most “smaller urban areas and rural counties are not growing and will not grow.” This is due, the author writes, to outmigration of people of prime working age and loss of skilled workforce.

- A Small Bank Tackles Rural Housing Affordabilityis an episode of the ABA Banking Journal Podcast featuring Christie Obenauer, president of the family-owned Union State Bank in Hazen, ND. In the 19-minute conversation Obenauer discusses how her bank addressed a housing crunch brought on by a fracking boom in a neighboring county, approaches for financing housing deals, using manufactured housing to build quickly, and succession planning for small rural organizations.

- This Map Shows How Much More Expensive It Is to Own a Home than to Rent in Every U.S. Stateis a CNBC analysis of American Community Survey data. The difference varies from $1,100 per month in New Jersey to $300 in Arkansas.

HAC Section 502 packaging training for nonprofits in Nashville set for June 19-20.

This three-day advanced course trains experienced participants to assist potential borrowers and work with RD staff, other nonprofits, and regional intermediaries to deliver successful Section 502 loan packages. The training will be held June 19-20. For more information, contact HAC staff, 404-892-4824.

Need capital for your affordable housing project?

HAC’s loan funds provide low interest rate loans to support single- and multifamily affordable housing projects for low-income rural residents throughout the U.S. and territories. Capital is available for all types of affordable and mixed-income housing projects, including preservation, farmworker, senior and veteran housing. HAC loan funds can be used for pre-development, site acquisition, site development and construction/rehabilitation. Contact HAC’s loan fund staff at hacloanfund@ruralhome.org, 202-842-8600.

Please note: HAC is not able to offer loans to individuals or families. Borrowers must be nonprofit or for-profit organizations or government entities (including tribes).