HAC News: July 26, 2019

News Formats. pdf

July 26, 2019

Vol. 48, No. 15

Deal clears the way for FY20 funding •House committee approves disaster recovery bill • Updated, “banded” income limits posted for USDA single-family housing programs •Broadband increases market value of rural homes • Changes finalized for Section 502 construction-to-permanent loan guarantees • Labor Department suggests changes to H-2A farmworker program • RuralSTAT • Federal court tells FHA to delay restrictions on downpayment aid • Rural areas farthest from cities more likely to lose jobs since May 2018 • HAC is hiring • HAC and Fannie Mae to hold webinar on colonias in Arizona • HAC offers Section 502 packaging training for nonprofits, August 6-8 in Michigan • Need capital for your affordable housing project?

HAC News Formats. pdf

July 26, 2019

Vol. 48, No. 15

Deal clears the way for FY20 funding.

On July 25 the House approved H.R. 3877, the Bipartisan Budget Act of 2019. The Senate is expected to pass it during the week of July 29 and President Trump has said he will sign it. The measure raises the 2011 Budget Control Act’s spending caps for FY20 and 21 and suspends the public debt ceiling until July 31, 2021. Now that spending totals are established, Congress can proceed with its appropriations bills for fiscal year 2020, which begins October 1, 2019. The House has already passed funding bills for USDA and HUD. The Senate will begin marking up its bills in September after its August recess.

House committee approves disaster recovery bill.

The Reforming Disaster Recovery Act of 2019, H.R. 3702, would permanently authorize the federal government’s primary long-term resource for rebuilding after a disaster, the Community Development Block Grant-Disaster Recovery program. The bill, passed unanimously by the House Financial Services Committee, is intended to help ensure housing recovery efforts are administered consistently, transparently, and with a priority for those most in need.

Updated, “banded” income limits posted for USDA single-family housing programs.

Implementing the regulation that adopts income banding nationwide for its single-family programs, USDA has posted new income limits online and incorporated them into its eligibility website.

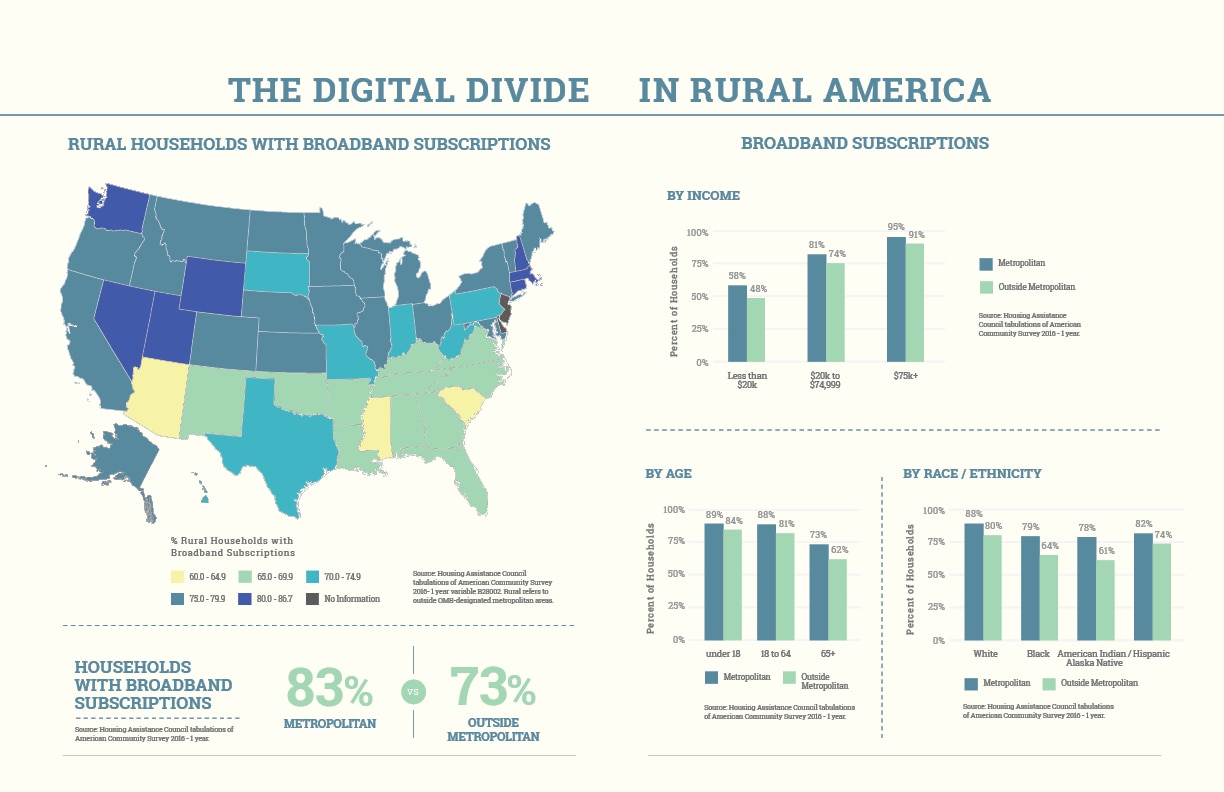

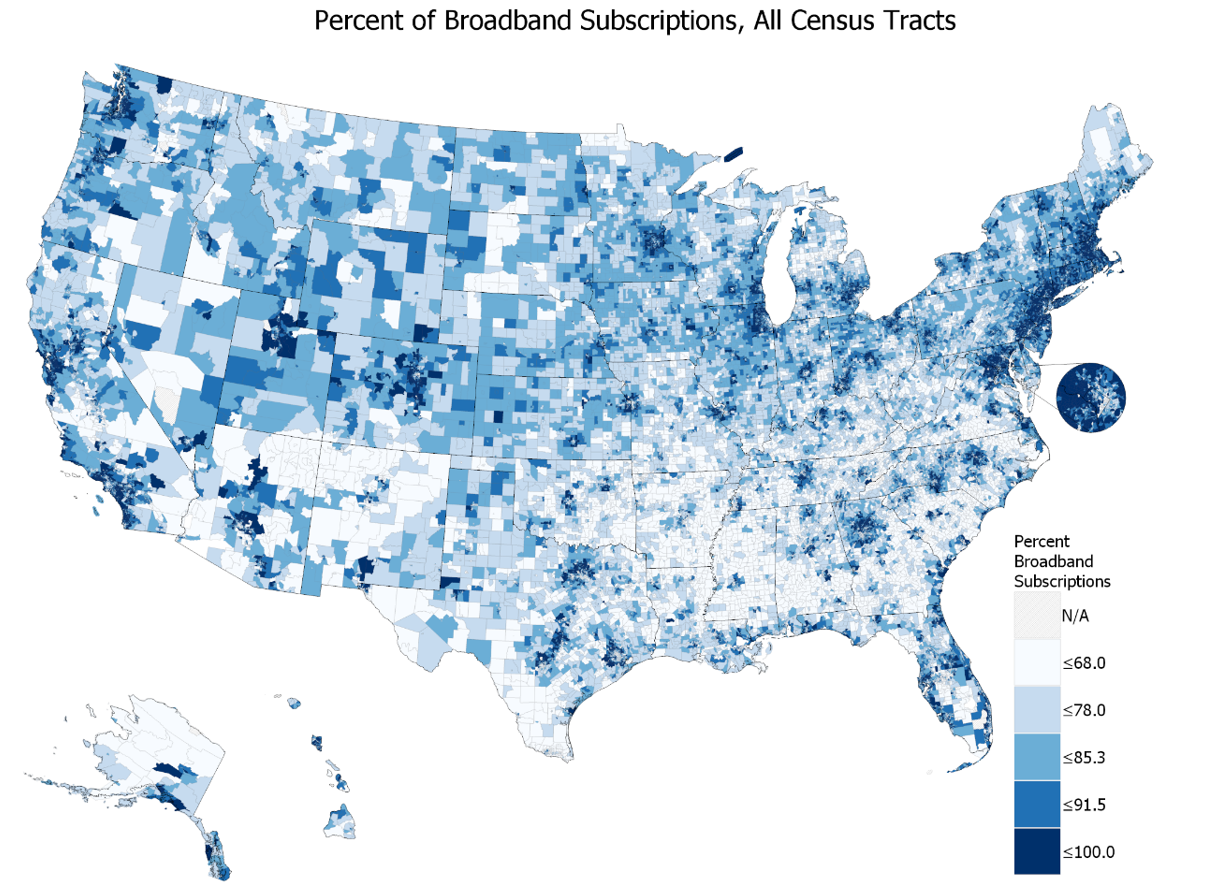

Broadband increases market value of rural homes.

Based on a study of 887 “remote rural” U.S. counties, professors from Oklahoma State University and the University of Wisconsin Madison estimate that a 10% increase in the percentage of county residents with 200 kbps broadband access would create a $661 average increase in the housing value in that county. They project the increased housing value would result in increased property tax collections in remote rural counties that struggle to find funding for local services.

Changes finalized for Section 502 construction-to-permanent loan guarantees.

USDA has adopted changes it proposed last year for “single close” Section 502 guaranteed loans, including allowing lenders to charge a higher interest rate for the construction phase. It will also make single close loans available for the purchase and rehabilitation of existing homes. For more information, contact Kate Jensen, USDA, 503-894-2382.

Labor Department suggests changes to H-2A farmworker program.

The Department of Labor is proposing numerous changes to the regulations that govern employers’ use of the H-2A temporary visa program for farmworkers. Among the revisions are clarifications to the minimum standards required for H-2A worker housing, which must be provided by employers. DOL also hopes to streamline its process for reviewing employers’ applications. Comments are due September 24. For more information, contact Thomas M. Dowd, DOL, 202-513-7350.

RuralSTAT.

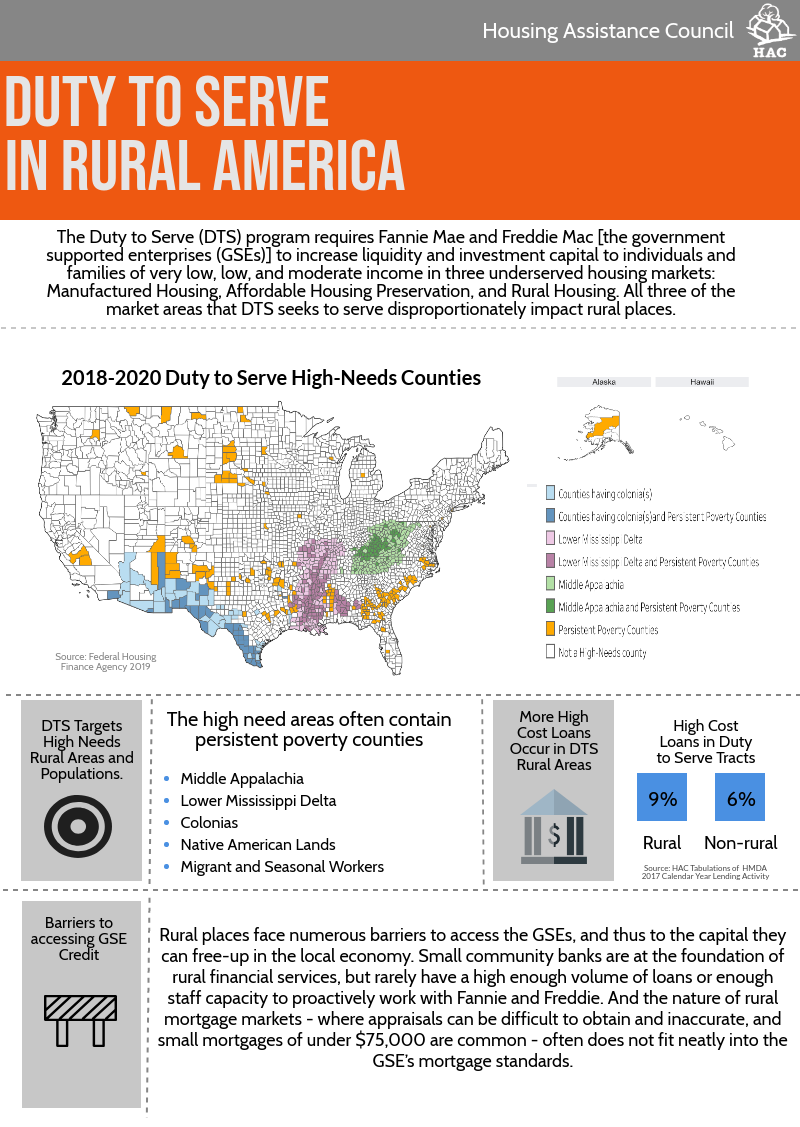

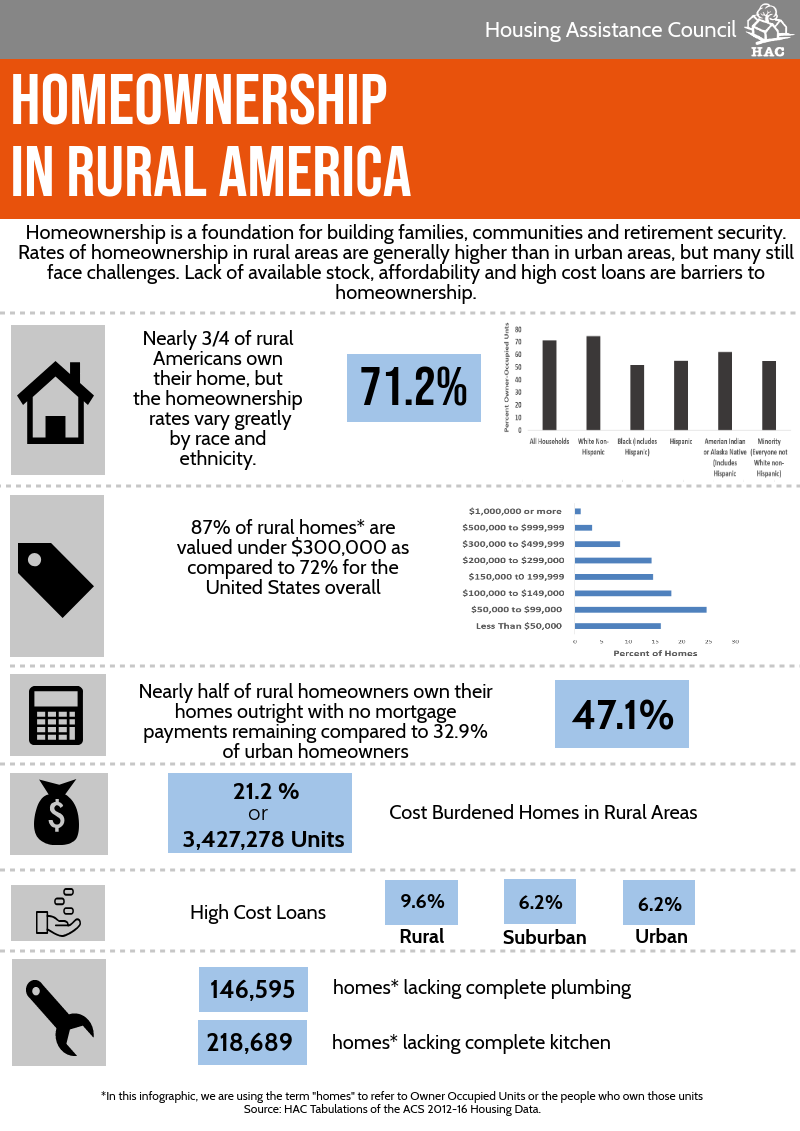

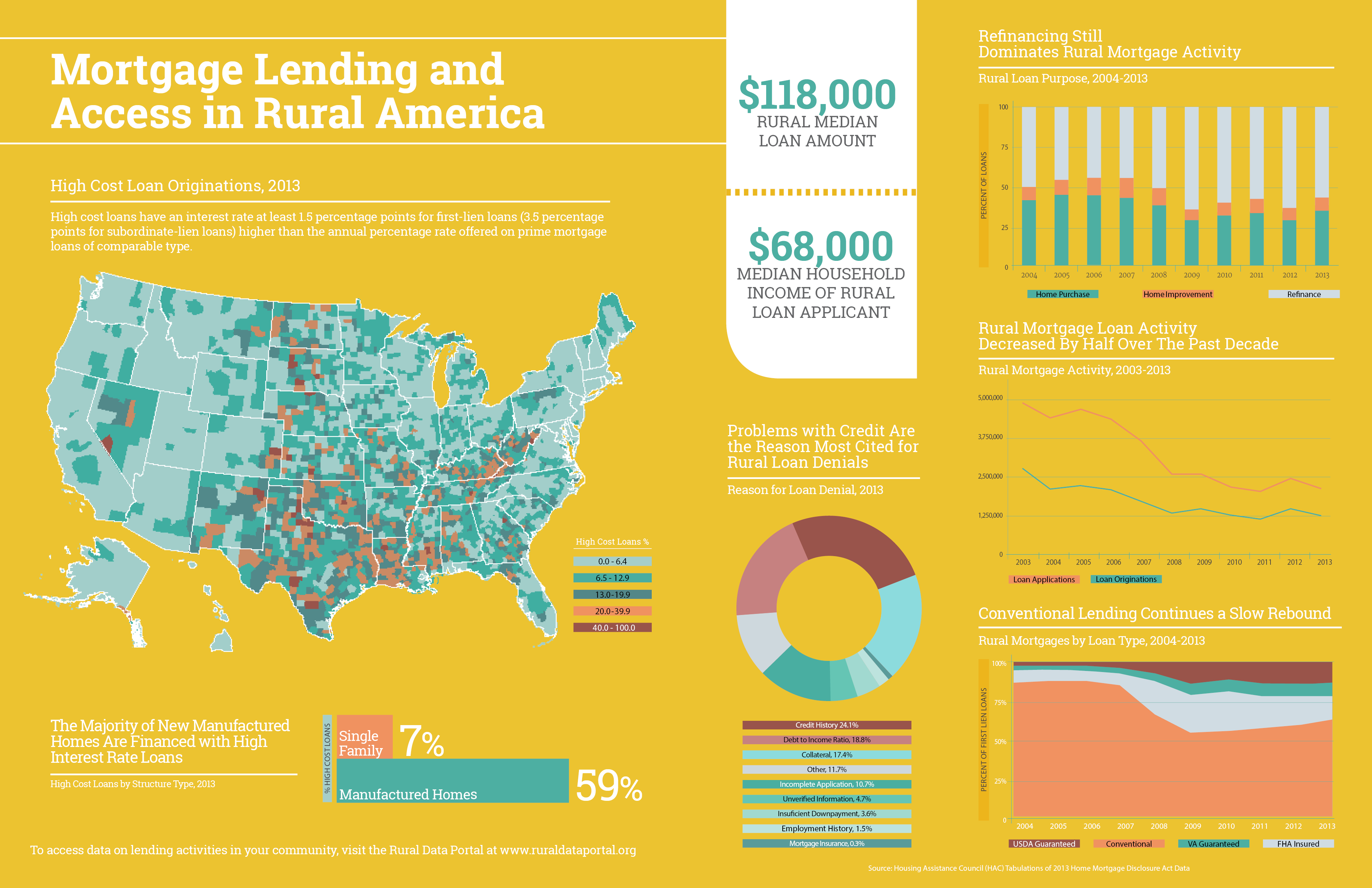

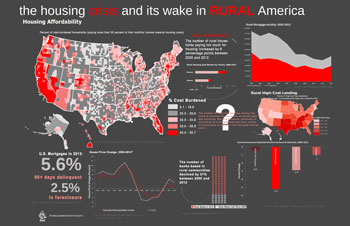

According to 2017 Home Mortgage Disclosure Act data, nearly 30% of all “high cost” home loans nationally were made in rural high need areas as identified under the Duty to Serve mandate for Fannie Mae and Freddie Mac. HAC provides more information on Duty to Serve and mortgage data online.

Federal court tells FHA to delay restrictions on downpayment aid.

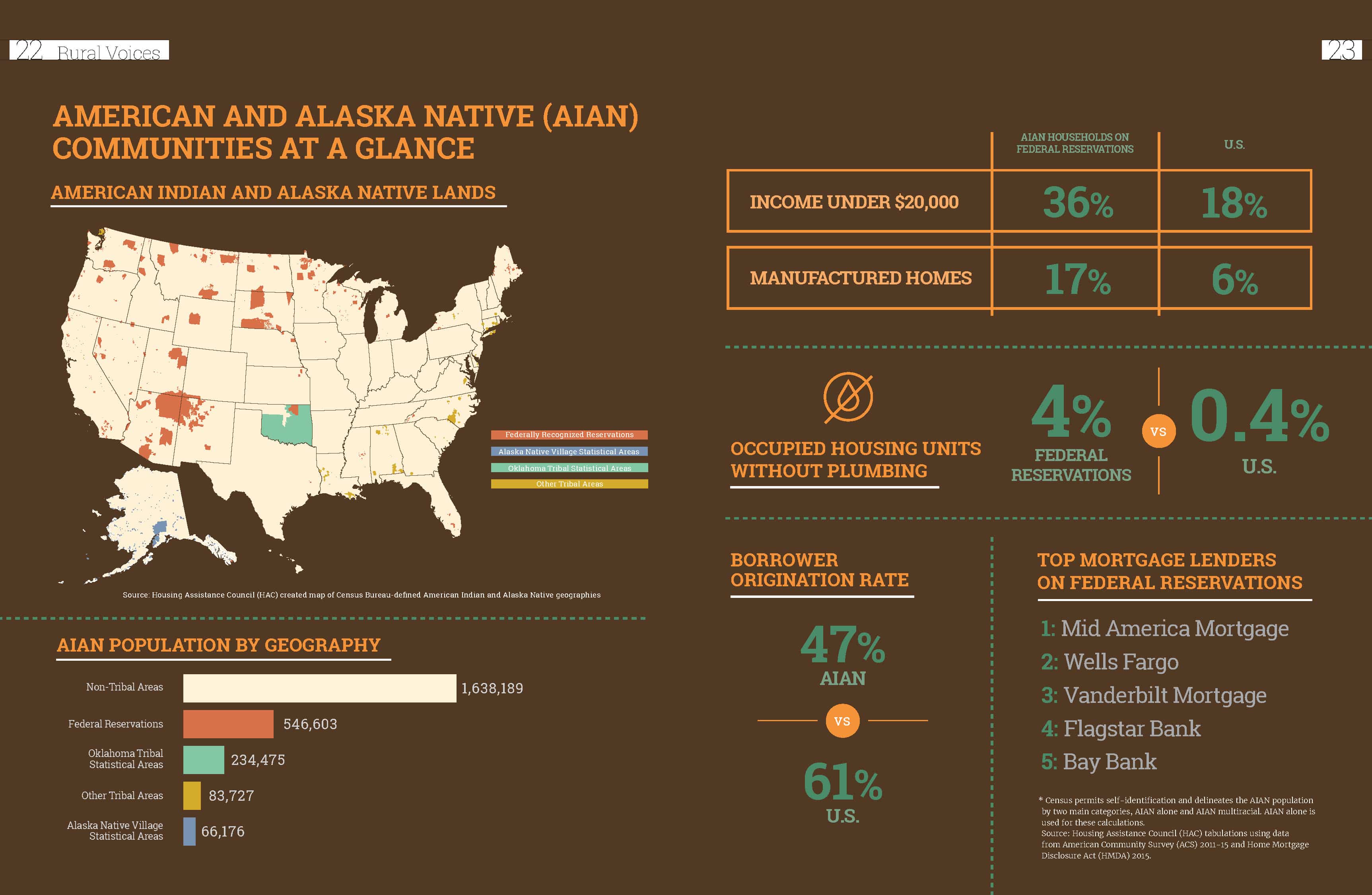

After a ruling in an ongoing lawsuit, HUD has suspended the effective date of Mortgagee Letter 2019-06, which would have made it more difficult for government entities to provide downpayment assistance to homebuyers seeking Federal Housing Administration insurance. The Cedar Band of Paiutes and its mortgage agency, which filed the suit, announced on July 22 that the judge granted a preliminary injunction allowing current downpayment assistance guidelines to continue at least until a final determination is made in the case.

Rural areas farthest from cities more likely to lose jobs since May 2018.

A Daily Yonder analysis of Bureau of Labor Statistics data found that major cities continue to account for most of job growth, with the central counties of major metropolitan areas gaining six out of 10 new jobs. Rural America accounted for 5.5% of the total increase.

HAC is hiring!

Housing Specialist: based primarily in the Southwest or Western U.S. to provide direct technical assistance, coaching and training to nonprofits, government agencies and others.

Portfolio Manager: based in DC to manage a portfolio of loans made to entities engaged in affordable housing activities in rural communities.

Both positions come with competitive salaries, generous benefits and the opportunity to work in a fun and mission-focused environment.

HAC and Fannie Mae to hold webinar on colonias in Arizona.

HAC, in partnership with Fannie Mae, will hold a webinar presenting data and research on Colonias Investment Areas, a geographic concept developed to target mortgage finance and resource investment in colonia communities along the southwest U.S. border. The August 7 webinar will focus on Arizona. For more information, contact HAC staff, 404-892-4824.

HAC offers Section 502 packaging training for nonprofits, August 6-8 in Michigan.

This three-day advanced course trains experienced participants to assist potential borrowers and work with RD staff, other nonprofits and regional intermediaries to deliver successful Section 502 loan packages. The training will be held in East Lansing, MI on August 6-8. For more information, contact HAC staff, 404-892-4824.

Need capital for your affordable housing project?

HAC’s loan funds provide low interest rate loans to support single- and multifamily affordable housing projects for low-income rural residents throughout the U.S. and territories. Capital is available for all types of affordable and mixed-income housing projects, including preservation, farmworker, senior and veteran housing. HAC loan funds can be used for pre-development, site acquisition, site development and construction/rehabilitation. Contact HAC’s loan fund staff at hacloanfund@ruralhome.org, 202-842-8600.

Please note: HAC is not able to offer loans to individuals or families. Borrowers must be nonprofit or for-profit organizations or government entities (including tribes).