Vol. 50, No. 21

TOP STORIES

Some funding needs get short-term solutions in Congress, others still pending.

A continuing resolution funds the federal government through December 3 and provides new disaster recovery funds. The debt limit has also been extended into early December. As negotiations continue in Congress to reduce the cost of the budget reconciliation bill, H.R. 5376, HAC has issued a statement supporting the proposed rural housing and development resources.

Torres Small confirmed for USDA post, first state directors named.

The Senate confirmed Xochitl Torres Small on October 8 to serve as USDA Under Secretary for Rural Development. On October 12 the White House and USDA announced that Rural Development State Directors have been appointed for Alabama, Georgia, Michigan, Pennsylvania, New Mexico, North Carolina, and South Carolina.

Chopra starts work at CFPB; hearings held for HUD nominees.

Rohit Chopra took office as director of the Consumer Financial Protection Bureau on October 12, having been confirmed by the Senate on September 30. Three HUD assistant secretary nominees received tie votes in the Senate Banking Committee on October 5, delaying their confirmations. They include David Uejio, who has been acting director of the CFPB and is nominated to be Assistant Secretary for Fair Housing and Equal Opportunity, as well as Julia R. Gordon for Housing/FHA and Solomon J. Greene for Policy Development and Research. The Banking Committee held hearings October 7 on additional HUD nominations but has not voted on those yet.

Register now for 2021 Virtual HAC National Rural Housing Conference!

HAC invites you to join us virtually on November 30-December 3! This year’s conference features more than 30 workshops, where participants will interact and engage around best practices for rural housing and community development, organizational management, and resource development. The Conference also includes a pre-conference day with gatherings for coalitions, associations, and working groups. Register by October 21 for the best rates. For more information, contact HAC staff, 404-892-4824.

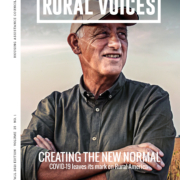

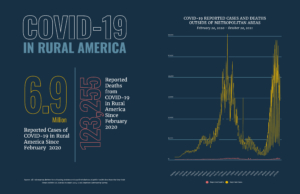

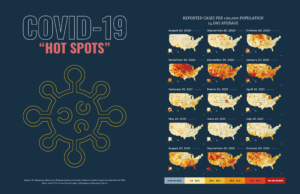

RuralSTAT

There were 12,400 reported deaths associated with COVID-19 in rural communities in September, a 142% increase over deaths in August. Source: HAC tabulations of public health data from the New York Times. A Rural Research Note on COVID-19 in Rural America: October 6, 2021 is available here.

OPPORTUNITIES

USDA posts instructions for strategic community plan setasides.

In FY22, projects that support multi-jurisdictional and multi-sectoral strategic community investment plans will be eligible for setaside funds in certain RD programs: Community Facility Loans, Grants, and Guaranteed Loans; Water and Waste Disposal Guaranteed Loans; Water and Waste Loans and Grants; Rural Business Development Grants; and Community Connect Grants. To apply for the Strategic Economic and Community Development Program setaside, submit a form with the application to the relevant program. For more information, contact an RD state office.

NEW! HAC seeks Housing Specialist and Community Facilities Housing Specialist.

- The Housing Specialist is primarily based in either the Southwest or Western states (within two hours of a major airport) and works with local partner organizations to identify financial resources and funding opportunities to support the preservation and development of affordable housing and community and economic development strategies specifically throughout expanses of Southwest and/or Western rural America. This position is remote location eligible.

- The Community Facilities Housing Specialist identifies and engages community stakeholders and provides direct technical assistance to rural organizations that are developing facilities such as parks, community centers, public libraries and childcare centers. This is a two-year position and is eligible for telecommuting.

REGULATIONS AND FEDERAL AGENCIES

FEMA asks for input on floodplain management.

FEMA requests public views on revising the National Flood Insurance Program’s floodplain management standards, including what standards communities should adopt to become safer, stronger, and more resilient. Comments are due December 13. For more information, contact Rachel Sears, FEMA, 202-646-4105.

HUD to require eviction protections for assisted tenants.

During emergencies, including the current coronavirus pandemic, a new interim final rule will require owners of HUD-assisted properties to notify tenants about emergency rent relief and to wait 30 days between notification and eviction. The provisions will apply to public housing and properties with project-based rental assistance (Section 8, Section 8 Mod Rehab, Section 202, Section 811, and Section 236). The rule takes effect on November 8 and comments are due that day. For more information on public or Indian housing, email HUD staff at PIH-COVID@hud.gov; on other multifamily programs, email mfcommunications@hud.gov.

Details released on Emergency Rental Assistance reallocation.

Guidance issued October 4 by the Treasury Department explains how unspent funds from the first round of Emergency Rental Assistance (under the 2021 Consolidated Appropriations Act) will be reallocated. Treasury will examine the programs, plans, and needs of states and localities that did not obligate at least 65% of their ERA1 funds by September 30 to determine what funds to reallocate. Data to identify those places is not yet available. Grantees that did meet the 65% threshold can request funds be reallocated to them. Treasury will not recapture funds from Indian Tribes, tribally designated housing entities, or U.S. territories prior to April 2022.

VA loan deferment option extended.

Servicers of Department of Veterans Affairs mortgages may continue offering loan deferment as a coronavirus-related home retention option, the VA has announced. Other relief options also remain available into 2023. For more information, contact a VA lender or VA loan staff, 1-877-827-3702.

USDA announces 1-800 number for rental housing.

USDA now offers a toll-free phone number for stakeholders, tenants, and the general public to obtain information about the department’s multifamily housing programs: 1-800-292-8293. The multifamily office’s website has also been updated to make staff contact information easy to find.

Area loan limits revised for Section 502 direct and 504 in some places.

A USDA Rural Development email bulletin summarizes the changes.

PUBLICATIONS AND MEDIA

USDA obligations fell in FY21 for most housing programs.

HAC’s preliminary annual analysis found that overall dollar levels for the USDA rural housing programs’ FY21 loan and grant obligations were about 1.4% lower than FY 20 and the number of obligations was down about 8.3%. The Section 502 direct program used $1.0 billion for 5,355 loans, nearly the same dollar amount but fewer loans than last year. About 36% of Section 502 loan dollars obligated and over 43% of loans were for very low-income applicants. Obligations for the Section 502 guarantee program and the multifamily programs were also generally lower than last year, and fewer Section 542 vouchers were issued. There were more Section 521 Rental Assistance units this year, supported by American Rescue Plan funds. HAC will publish a more detailed FY21 report.

Crisis models address family homelessness.

Immediate and Flexible Crisis Options for Children and Families, a brief and two videos released by the Framework for an Equitable COVID-19 Homelessness Response, focus on crisis options for homeless families, paired with strong housing exits. One case study is rural and the Framework says other models can be replicated, adapted, and scaled up or down as needed.

Much Hispanic wealth is in residential property.

The 2021 State of Hispanic Wealth Report from the Hispanic Wealth Project shows that Hispanics may be on track to achieve wealth goals the project set for 2024. Their wealth is not well diversified, however, with residential property values (both their own homes and investment properties) making up 52% of Latino assets. The pandemic has impacted the stability of these assets: as of March 2021, Latino home loan borrowers were 2.3 times more likely to be in forbearance and 1.5 times more likely to be delinquent on mortgage payments than non-Hispanic white borrowers.

Equity considered in two webinars.

- Shared Prosperity: Driving Change Towards an Equitable Rural Economy explored the positive economic and social potential that comes with improving racial equity in rural places. Related materials are posted online and a recording of the session will be added. This was one of the Rural Opportunity and Development (ROAD) Sessions, virtual exchanges co-designed and hosted by the Aspen Institute Community Strategies Group, HAC, the Rural Community Assistance Partnership, Rural LISC, and the Federal Reserve Board.

- Building Equity into Federal Investments for Housing Resilience, a Joint Center for Housing Studies webinar, examined how to address the ways that federal efforts to make housing and communities more resilient to disasters, especially climate-related hazards, often devalue people and undervalue or overlook the possessions of people of low wealth and communities of color. A related report, Equitable Investments in Infrastructure: A Review of Benefit-Cost Analysis in Federal Flood Mitigation Infrastructure, was published by the Urban Institute.

“Worst case” rental housing needs changed little from 2017 to 2019.

Only 62 affordable rental units were available for every 100 very low-income renters in 2019, according to HUD’s Worst Case Housing Needs: 2021 Report to Congress. Data is not yet available on the impact of the coronavirus pandemic and economic recession that began in 2020. Households with worst case needs are defined as renters with very low incomes (at or below 50% of area median income) who do not receive government housing assistance and pay more than half their income for rent, live in severely inadequate conditions, or both. In 2019 there were 7.77 million such renter households in the U.S., 42.2% of all very low-income renters. About 74% of worst case renters in 2019 had extremely low incomes (at or below 30% of area median), the highest proportion since 2005.

38% of Black rural southerners lack home internet access.

The Joint Center for Political and Economic Studies conducted research on Affordability and Availability: Expanding Broadband in the Black Rural South across 152 rural counties in Florida, Georgia, Louisiana, Mississippi, North Carolina, South Carolina, Tennessee, and Virginia. The research found that 38% of rural Black southerners lack home internet access, and one in four do not have broadband options available around their homes.

Flooding risk assessed for every county.

The 3rd National Risk Assessment: Infrastructure on the Brink, published by the First Street Foundation, identifies flood risks to homes, roads, businesses, and other infrastructure. Risk is increasing significantly along the Atlantic and Gulf Coasts, with large increases in the Northwest and a concentration in the Appalachian Mountain region. Seventeen of the top 20 most at-risk counties in the U.S. are in Florida, Kentucky, Louisiana, and West Virginia.

Need capital for your affordable housing project?

HAC’s loan fund provides low interest rate loans to support single- and multifamily affordable housing projects for low-income rural residents throughout the U.S. and territories. Capital is available for all types of affordable and mixed-income housing projects, including preservation, new development, farmworker, senior and veteran housing. HAC loan funds can be used for pre-development, site acquisition, site development, construction/rehabilitation and permanent financing. Contact HAC’s loan fund staff at hacloanfund@ruralhome.org, 202-842-8600.

Please note: HAC is not able to offer loans to individuals or families. Borrowers must be nonprofit or for-profit organizations or government entities (including tribes).

Housing Assistance Council

Housing Assistance Council

HAC

HAC