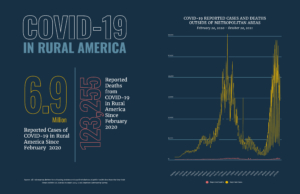

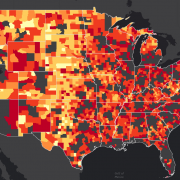

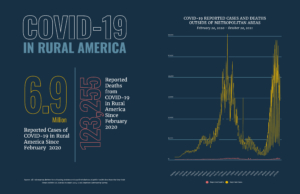

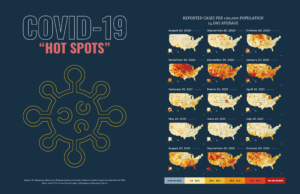

Over the past a year and a half, the coronavirus pandemic has profoundly reshaped the world. COVID-19 has killed well over 4.5 million people across the globe, including approximately 96,600 in rural America. It closed down large segments of the economies of nearly every country, including the United States. It changed the way our children attended school. It deepened our political disagreements. And it altered our housing markets, the ways we work, and the needs of the low-income rural people we serve.

This issue of Rural Voices looks at some of the pandemic’s impacts on affordable rural housing efforts in the U.S. It also examines ways these impacts may be turning into lasting changes – a “new normal.”

VIEW FROM WASHINGTON

Listening and Learning to Better Serve Rural Communities

by Steven K. Washington

HUD offers flexibility to help rural nonprofits weather the pandemic.

FEATURES

Rural Housing Efforts Continued Through Closures, Natural Disasters, and Financial Challenges

Four rural housing leaders describe how the pandemic changed the ways their organizations work.

Resilient in the Desert: Self-Help Housing Blooms in Arizona Despite the Pandemic

by Thomas Ryan

Housing America Corporation and its self-help housing program faced a series of challenges but adapted to a new normal.

Study Reveals Pandemic’s Impact on Oregon Farmworkers

by Jennifer Martinez-Medina

Survey results describe the pandemic’s threats to farmworkers’ family finances, housing conditions, and both physical and mental health. Community-based housing and rental aid programs have provided some relief.

Wisconsin Works to House Rural Residents and Eradicate Homelessness

by Carrie Poser and Michael Basford

The pandemic has exacerbated the homelessness situation, but federal aid helps.

Keeping Rural Renters Housed During the Pandemic

by Victoria Bourret, Daniel Threet, And Rebecca Yae

NLIHC presents best practices for ensuring rural tenants receive emergency rental assistance.

New Faces at HAC

We welcomed several new HACsters to the team this year. Their work will improve our ability to serve more rural Americans and bolster HAC’s efforts to support affordable housing in rural communities.

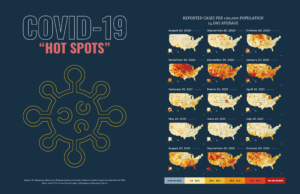

INFOGRAPHIC

Rural Voices would like to hear what you have to say about one, or all, of these issues. Please comment on these stories by sending a tweet to #RuralVoices, discuss on the Rural Affordable Housing Group on LinkedIn, or on our Facebook page.