HAC Celebrates Signing of American Rescue Plan Act

March 11, 2021 – Today is a historic day as President Biden signed a $1.9 trillion coronavirus relief and economic stimulus plan into law. The Housing Assistance Council is proud that Congress included significant and desperately needed housing aid—including rural housing assistance—in this new plan.

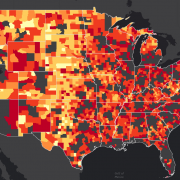

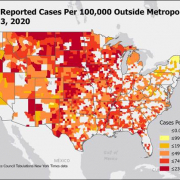

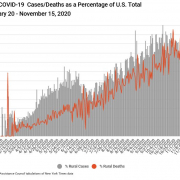

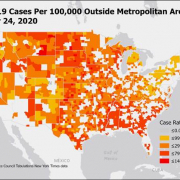

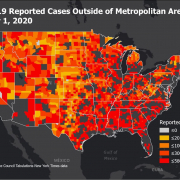

With more than 4 million reported cases and 78,000 deaths outside metropolitan areas, the coronavirus pandemic has raged in rural America. It has driven an economic downturn, as countless rural families have lost jobs and struggled to make rent and mortgage payments. The plan’s $100 million in rural rental assistance will help keep a roof over their heads. The plan also includes $39 million in rural mortgage relief, helping rural families prevent foreclosure.

Housing is vital to public health and economic opportunity and is a cornerstone of community and family. We are glad that the American Rescue Plan recognizes the importance of housing to our nation’s health and economic recovery.

Summary of Relevant Provisions

The American Rescue Plan Act includes two provisions specifically for USDA rural housing programs. The Section 521 Rental Assistance program will get $100 million for tenants in USDA-financed properties who are not already receiving RA and have lost income because of the pandemic. Protections for homeowners will be provided through $39 million for new Section 502 direct mortgage loans and Section 504 repair loans. Because of restrictions imposed by the budget reconciliation process that was used to pass the bill, it could not include funds to refinance loans for current USDA borrowers who are struggling, but USDA will be able to assist them with previously appropriated funds.

The Act also does not include an extension of the eviction moratorium that is currently scheduled to expire on March 31. It, too, had to be excluded under budget reconciliation. The Centers for Disease Control, which imposed the moratorium, can extend it.

The largest portion of housing aid in the bill is $21.55 billion for Treasury’s Emergency Rental Assistance program, along with $5 billion for emergency HUD vouchers, $750 million for HUD’s Native American, Native Hawaiian and Indian CDBG programs, $5 billion for homelessness assistance, $9.96 billion for homeowner assistance, and $100 million for housing counseling. Utility assistance is funded at $4.5 billion and $500 million is provided for water assistance.

The package expands the Earned Income Tax Credit and Child Tax Credit, and also extends expanded unemployment benefits through Labor Day .

More than $5 billion will pay off debts and provide other assistance to socially disadvantaged farmers and ranchers.