HAC News: February 18, 2015

HAC News Formats. pdf

February 18, 2015

Vol. 44, No. 4

• February is National African American History Month • USDA offers Household Water Well System grants • HUD-VASH vouchers will expand to Native American communities • Regulators request input on CRA and other banking rules • HUD announces Annual Adjustment Factors • USDA RD revamps website • Worst case housing needs drop • Changes in housing and other policies could reduce child poverty by 60% nationwide • HUD reports on ways housing matters to children • Affordable housing can improve educational outcomes • Sequestration and its impacts described • Economic recovery is bypassing millions of Americans, CFED reports • Regulatory costs may drive small bank mergers

HAC News Formats. pdf

February 18, 2015

Vol. 44, No. 4

FEBRUARY IS NATIONAL AFRICAN AMERICAN HISTORY MONTH. President Obama’s proclamation is online.

USDA OFFERS HOUSEHOLD WATER WELL SYSTEM GRANTS. Nonprofits can apply by April 13 for grants to establish lending programs enabling homeowners to borrow up to $11,000 to construct or repair household water wells for existing homes. Contact Joyce M. Taylor, RUS, 202-720-9589.

HUD-VASH VOUCHERS WILL EXPAND TO NATIVE AMERICAN COMMUNITIES. HUD has announced it will dedicate $4 million to make vouchers for about 650 homeless veterans available in Native communities for the first time. Comments on program design are due February 25 to tribalhudvashcomments@hud.gov. Contact HUD’s Office of Native American Programs.

REGULATORS REQUEST INPUT ON CRA AND OTHER BANKING RULES. Comments are due May 14. The Federal Reserve, FDIC, and Comptroller of the Currency pose questions about ways to reduce regulatory burden, particularly on community banks and small lenders.

HUD ANNOUNCES ANNUAL ADJUSTMENT FACTORS. The FY15 AAFs will be used to adjust Section 8 rents on contract anniversaries. Contact Becky Primeaux, HUD, 202-708-1380.

USDA RD REVAMPS WEBSITE. The new site, https://www.rd.usda.gov, moves regulations, handbooks, and other guidance documents to https://www.rd.usda.gov/publications/regulations-guidelines.

WORST CASE HOUSING NEEDS DROP. From 2011 to 2013 the number of worst case needs – very low-income renter households who do not receive government housing assistance and who pay more than one-half of their income for rent, live in severely inadequate conditions, or both – fell from 8.5 million to 7.7 million. Increases in renter incomes and limited increases in rents are probably responsible, according to the executive summary of HUD’s annual worst case needs report. In 2013 there were still 1.6 very low-income households with worst case needs for every very low-income household that received rental assistance, HUD says. The full report will be released this spring.

CHANGES IN HOUSING AND OTHER POLICIES COULD REDUCE CHILD POVERTY BY 60% NATIONWIDE. Child poverty in nonmetro places could be cut by 68.2%, according to Reducing Child Poverty in the U.S., prepared by the Urban Institute for the Children’s Defense Fund. The report examines the poverty reduction impact of nine policies, ranging from expanding the Earned Income Tax Credit to increasing SNAP benefits. Expanding the availability of housing vouchers would reduce child poverty by 21.3% in metro areas and 16.4% in nonmetro places. The report, a summary of recommendations, and a blog post are available online.

HUD REPORTS ON WAYS HOUSING MATTERS TO CHILDREN. An issue of HUD’s Evidence Matters newsletter focuses on how housing matters for children’s physical and emotional health, achievement in school, and economic opportunity. A HAC Rural Research Note summarizes some of the research’s implications for rural children.

AFFORDABLE HOUSING CAN IMPROVE EDUCATIONAL OUTCOMES. An updated literature review by the National Housing Conference’s Center for Housing Policy presents key findings from research showing that stable, affordable housing may foster educational success by supporting family financial stability, reducing mobility, providing safe, nurturing living environments, and providing a platform for community development.

SEQUESTRATION AND ITS IMPACTS DESCRIBED. The government spending reductions required by the 2011 Budget Control Act are now achieved through spending caps, not across-the-board cuts as in FY13. A new paper by the Center on Budget and Policy Priorities describes the mechanisms established in the law, how policymakers subsequently modified them, and the resulting effects on non-defense appropriations. It notes that under the BCA “in inflation-adjusted terms, the 2016 cap would be 17 percent below the 2010 level.”

ECONOMIC RECOVERY IS BYPASSING MILLIONS OF AMERICANS, CFED REPORTS. Excluded from the Financial Mainstream presents the main findings from CFED’s 2015 Assets and Opportunity Scorecard, which evaluates 135 different policy and outcome measures in five categories including housing. Infographics and interactive maps are also available online.

REGULATORY COSTS MAY DRIVE SMALL BANK MERGERS. The State and Fate of Community Banking, a Harvard Kennedy School working paper, reports that community banks play a major role in rural areas and in agriculture, small business, and residential mortgage lending. Since 2010 the total share of bank assets held by community banks, especially small ones, has fallen significantly, and the report concludes the increased costs of regulation under the Dodd-Frank Act are a likely cause.

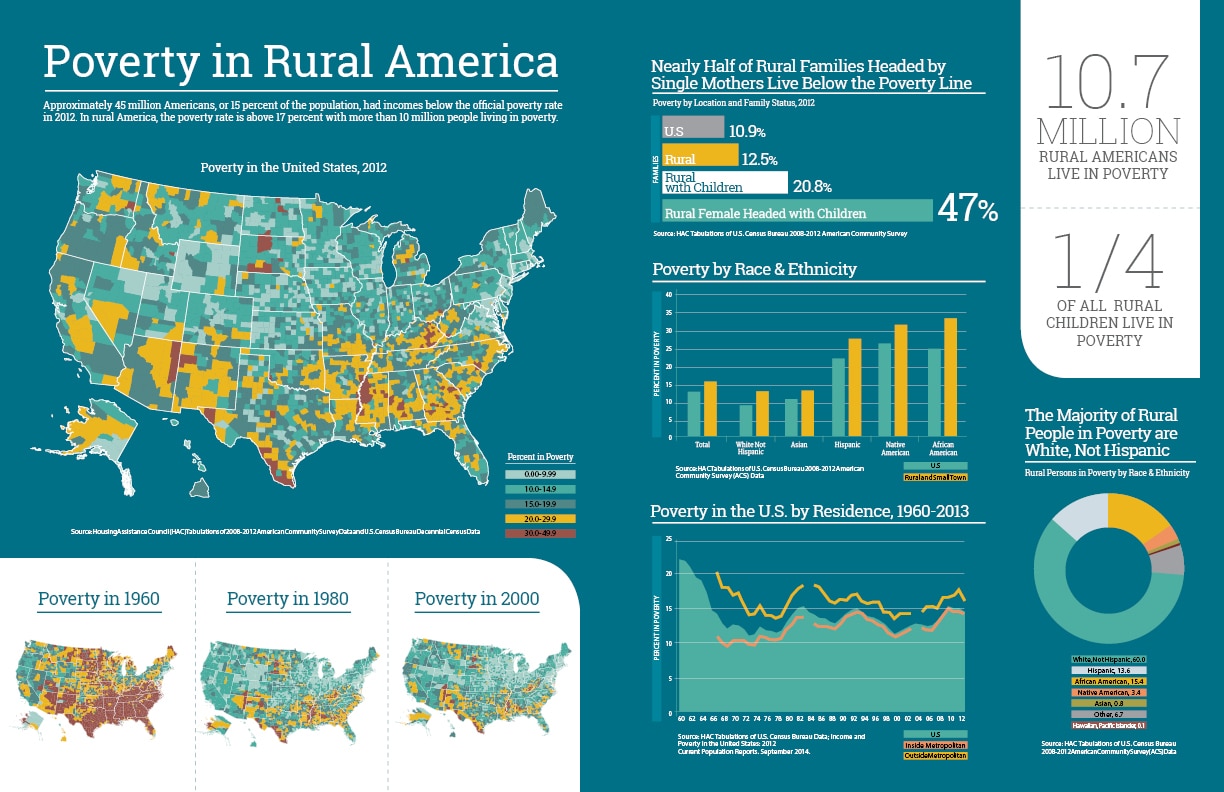

Poverty in Rural America

Poverty in Rural America