The Gray Panthers of El Dorado, Amador, and Placer Counties: How the Good Guys Finally Won

This story appears in the 2015 Spring Edition of Rural Voices

This story appears in the 2015 Spring Edition of Rural Voices

A local citizen-board and a group of rural “housers” kept a project afloat after near-collapse in its early years resulting in a development that now serves the community with 40 units of senior housing

by John Frisk

This is the story of a rural elderly rental housing development in Diamond Springs, CA, the area where the California Gold Rush of 1849 took place. The author originally set out to record only the difficult birth of this project. As the facts revealed themselves, however, the bigger story begged to be told.

The Beginning: RULE 1

If something sounds too good to be true, it may well not be true.

In 1983 the telephone rang in the Loan Fund Division of Housing Assistance Council (HAC). The caller was the late Salvatore Solinas, a beloved and respected program manager at the California Department of Housing and Community Development (DHCD). DHCD staff explained that the “Gray Panthers,” represented by a real estate professional, had applied to DHCD for predevelopment loan funds. Previous proposals by the real estate professional had not proved feasible. DHCD cited a number of concerns but thought the proposal to be possibly feasible.

Within a year, board members and the consultant were threatening and suing each other.

DHCD’s Loan Fund was nearly empty and the agency was unable to fully fund the loan request. Would HAC be interested in a joint venture? Answer: HAC probably would be interested, subject to full staff and Loan Committee review, and approval of the project by both DHCD and HAC.

The Plot Thickens: RULE 2

With a backdrop containing several promising elements, what could possibly go wrong? The answer, as it turned out, was just about everything.

The Project Site – The site consisted of two parts. Parcel A was to be the site for a 24-unit Farmers Home Administration (FmHA)- financed elderly project. Parcel B later became the site of 16 additional units. Problems abounded including unbudgeted development costs, a private access to the site (not a municipal street), allocation of water rights from the local water district, and unfunded school fees required for real estate developments. Ultimately, the site’s owner personally bonded the private access and later defaulted on his bond, requiring HAC and DHCD to fund the bonding. The owner eventually left the area in a welter of legal troubles. Project site control, originally seen as an asset, quickly manifested thorny problems. Nevertheless, site purchase and development, with a loan from HAC in May 1984, followed by the DHCD loan, went forward, paving the way for the FmHA project.

The Gray Panthers, Who or What Was It?

Calling herself the project consultant, the aforementioned real estate agent acted as if she was the “Gray Panthers of El Dorado.” Evidence of this belief began to mount. The national Gray Panthers, a vocal advocate organization for elderly rights, objected to the consultant’s use of the Gray Panthers name and denied any connection with the project. The consultant refused to cease using the name.

The consultant demanded to be paid for her organizing and packaging work on the project, a proposition that HAC and DHCD had no authority or funds to provide. She repeatedly asserted that HAC was a federal agency, part of the federal Department of Housing (HUD). She wrote letters to her member of Congress demanding that HAC pay for her services.

The Panthers’ original board of five local citizens quickly became restive and refused to back demands of the consultant that they found unwise. Within a year, board members and the consultant were threatening and suing each other. The consultant then recruited new board members more compliant with her plans for the project. After the project acquired financing from US Department of Agriculture, Farmers Home Administration (FmHA) in 1985, she attempted to sell the project to a developer, apparently to raise funds to pay for her services. FmHA made clear that they would not permit a change of developer under those terms.

The Lawsuits Begin

In February 1987, the FmHA project was completed. In October, the consultant filed a mechanic’s lien against the property setting the stage for a subsequent legal battle. The consultant sued HAC and DHCD and the Gray Panthers.

Unable to acquire or retain legal representation, she filed suit pro se, that is, acting as her own legal counsel. To the surprise of the lenders, the local court, in deference to a party asserting terrible mistreatment, allowed the case to proceed. First the court required the parties to submit to arbitration, an expensive and time consuming process that came to nothing. When the arbitrator found for the lenders, the consultant insisted on a regular judicial proceeding. DHCD was represented by the Attorney General’s office, a local public service advocate represented the Gray Panthers, and HAC retained local counsel. In October 1987, after a four-day jury trial in the El Dorado Superior Court, the court informed the consultant that, failing an agreement to drop all her charges and claims, the court would direct such a verdict. Her agreement to the dismissal of all claims did not prevent her from a later unsuccessful appeal.

The Gray Panthers Become Diamond Sunrise What is it today? RULE 3

With a modicum of luck and a boost from Divine Providence, even a seriously troubled project can be turned around. (Dedicated rural housing professionals and community people are also helpful.)

The 24-unit FmHA project (later named Diamond Sunrise I) was completed and occupied in 1987, but the years of struggle took its toll. Interested local citizens, FmHA, and DHCD became increasingly concerned with governance and management. In 1990, DHCD asked the Rural California Housing Corporation (RCHC) to make a servicing visit that showed the Gray Panthers to be a “shell corporation” without an effective board. RCHC, with guidance from FmHA, project residents, and community leaders, negotiated a reconstituted board-based nonprofit, Diamond Sunrise Corporation, to assume control and ownership of the project. RCHC staff joined the board of directors, and assisted the board in overseeing the management of the 24-unit development.

The 24-unit FmHA project (later named Diamond Sunrise I) was completed and occupied in 1987, but the years of struggle took its toll. Interested local citizens, FmHA, and DHCD became increasingly concerned with governance and management. In 1990, DHCD asked the Rural California Housing Corporation (RCHC) to make a servicing visit that showed the Gray Panthers to be a “shell corporation” without an effective board. RCHC, with guidance from FmHA, project residents, and community leaders, negotiated a reconstituted board-based nonprofit, Diamond Sunrise Corporation, to assume control and ownership of the project. RCHC staff joined the board of directors, and assisted the board in overseeing the management of the 24-unit development.

RCHC pursued the build out of Parcel B. Six applications were made in 10 years and in 2003, 16 more units of HUD 202 elderly and disabled housing, Diamond Sunrise II, were built and occupied. In 2000, RCHC affiliated with a larger group, Mercy Housing. The two projects have separate, but interlocking boards, and a common management, presently by a management component of Mercy Housing. The specifics of these results could serve as a textbook for small town housing development, but those responsible modestly pass

them off as “all in a day’s work.”

Yet another problem confronted Diamond Sunrise I in maintaining the viability of the original 24 units of USDA FmHA 515 senior housing. The project was unusual in that the rents were subsidized with state funds. When this funding terminated, Diamond Sunrise, with assistance from RCHC/Mercy, was awarded FmHA rental assistance for 23 of the original 24 units. The present 40-unit housing development, whose beginning and early years were so sadly devoid of promise, now looks to the future with a vigorous and viable board, highly competent management, and sound financing and subsidy adequate for the immediate future.

What Can We Learn From This 30-Year Venture?

It Ain’t Easy But It Can Be Done RULE 4

First, a sound sponsor organization is fundamental to a good housing program. In this case, it took years to get to the present positive state of events.

Second, the people who worked with this troubled project over the years came from different points of the compass, but they had a common goal, namely the provision of good quality housing for the older people of this area. They have done this housing work for farmworkers, for the homeless, for families building self-help, for community facilities, and rehabilitation and in countless other forums. They brought their varied skill sets to the affordable housing business with great commitment, in this case, to the community’s elders. They specialize in housing finance, the development process, the law, the art of making government programs work, and a range of private citizen experience, all devoted to housing for their community’s elders. They tend to be modest and self-effacing. This worthwhile

project is a tribute to people who made decent housing happen for poor elderly people in one small community.

John Frisk is the retired Director of the Housing Assistance Council’s Loan Fund.

Credits and Acknowledgements –John Frisk and DHCD Project Manager Georgann Eberhardt were involved, almost daily, for three years of the problematic project startup. Numerous California DHCD staff and HAC staff worked tirelessly and with good humor. The “happy landing” has many parents. A key actor was Stanley Keasling, now CEO of Rural Community Assistance Corporation (RCAC). Mr. Keasling and his staff, during the resurrection of the project, was CEO of Rural California Housing Corporation (RCHC), which, with its affiliate, Mercy Housing California, was deeply involved in the recovery of a healthy Diamond Sunsrise I and II. Special thanks go to Greg Sparks and George Applebaum, now board members of Diamond Sunrise for help with the project history. Mr. Appelbaum was also the attorney for the Gray Panthers in the cited lawsuit. Many others, board members, local and state officials, and FmHA staff, made significant contributions to the survival and success of this housing endeavor.

Celebrating 50 Years of helping families help themselves.(8.5″ X 11″ printable pdf)

Celebrating 50 Years of helping families help themselves.(8.5″ X 11″ printable pdf)

The 24-unit FmHA project (later named Diamond Sunrise I) was completed and occupied in 1987, but the years of struggle took its toll. Interested local citizens, FmHA, and DHCD became increasingly concerned with governance and management. In 1990, DHCD asked the Rural California Housing Corporation (RCHC) to make a servicing visit that showed the Gray Panthers to be a “shell corporation” without an effective board. RCHC, with guidance from FmHA, project residents, and community leaders, negotiated a reconstituted board-based nonprofit, Diamond Sunrise Corporation, to assume control and ownership of the project. RCHC staff joined the board of directors, and assisted the board in overseeing the management of the 24-unit development.

The 24-unit FmHA project (later named Diamond Sunrise I) was completed and occupied in 1987, but the years of struggle took its toll. Interested local citizens, FmHA, and DHCD became increasingly concerned with governance and management. In 1990, DHCD asked the Rural California Housing Corporation (RCHC) to make a servicing visit that showed the Gray Panthers to be a “shell corporation” without an effective board. RCHC, with guidance from FmHA, project residents, and community leaders, negotiated a reconstituted board-based nonprofit, Diamond Sunrise Corporation, to assume control and ownership of the project. RCHC staff joined the board of directors, and assisted the board in overseeing the management of the 24-unit development.

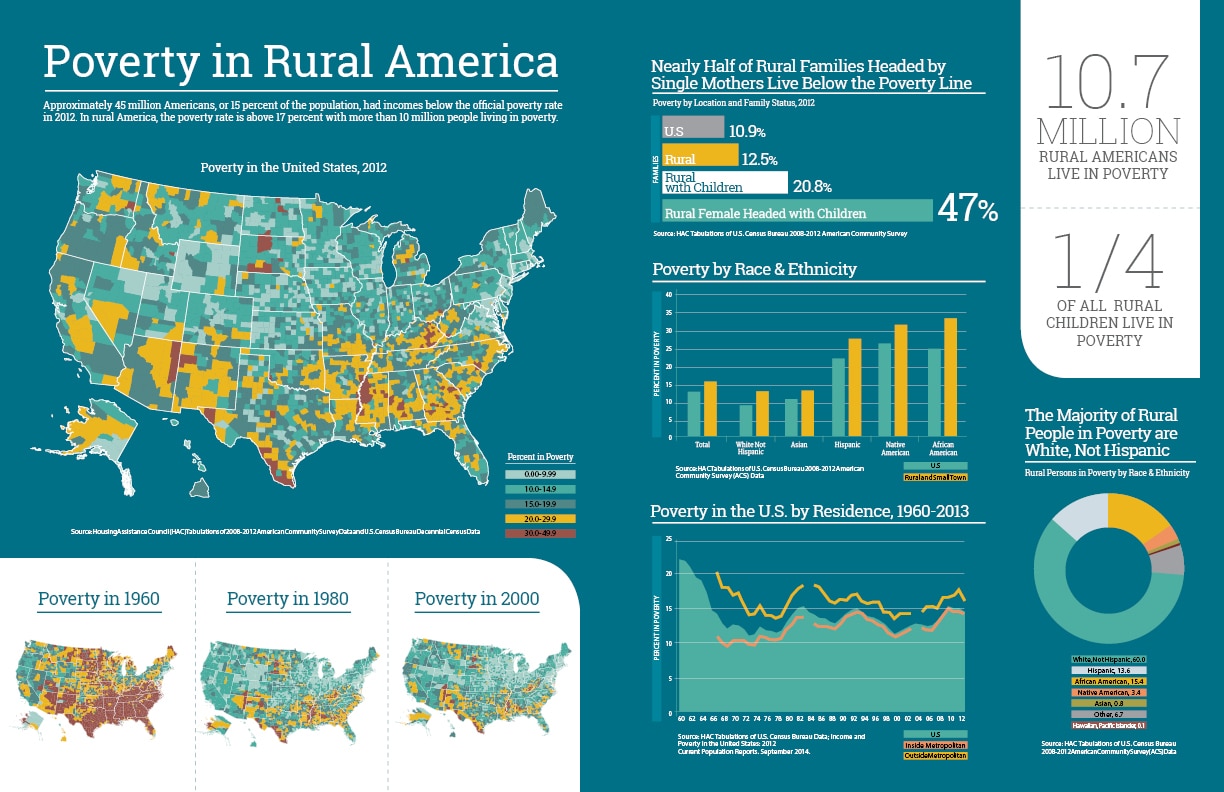

Poverty in Rural America

Poverty in Rural America