USDA Rural Housing Services Administrator Tony HernandezNewly appointed Rural Housing Service administrator shares his thoughts and priorities for USDA’s housing initiatives.

USDA Rural Housing Services Administrator Tony HernandezNewly appointed Rural Housing Service administrator shares his thoughts and priorities for USDA’s housing initiatives.

I am honored and pleased to be the new administrator at the U.S. Department of Agriculture’s (USDA) Rural Housing Service (RHS). For more than 60 years, USDA has helped millions of rural residents become part of the American Dream of homeownership. I look forward to the opportunity to continue and expand this agency’s historic accomplishments.

I have now been on the job for some time and have been impressed by the vital work that we do to provide housing and community facilities in Rural America. In my 26 years in community development, I have strongly believed that housing is a conduit to family, neighborhood and community. I see RHS as a community development agency. The multiple roles we play—catalyst, partner, advocate, regulator and investor—improve people’s lives and create better communities.

With its wide open spaces filled with lush, natural beauty, combined with its small-town charms, rural America is a great place to live and raise a family. And, although rural America is changing due to the rise of new technologies like the Internet and the advent of globalism, one thing still holds true: homeownership remains one of the single-most important factors that help our rural communities thrive and prosper economically.

The resources in our community development toolkit include homeownership programs for rural families. USDA has two primary Single-Family Housing Programs that are a major provider of homeownership opportunities in rural communities. The direct homeownership loan program helps very low- to low-income families. It is designed to open the door to homeownership to those who do not qualify for mortgage credit from conventional lenders. These loans are available to families and individuals with reasonable credit history and dependable income. This is not a government handout. Direct loans are repaid and subsidized to lower the monthly loan payment at a relatively small cost to the government.

My major priority is to focus on enhancing customer service through improved business processes.

For moderate-income families, we offer a guaranteed homeownership loan program and partner with participating private-sector lenders to provide home loans in rural areas at reasonable rates and terms.

For many Americans, especially those in rural areas, a home is the largest asset they will buy in their lifetime. Homeownership provides multiple, long-term benefits. It leads to greater economic security for families, who often can use the equity in their homes to build their credit, finance their children’s educations, improve the value of their property, or finance other necessities such as health care. Homeownership also helps families to plant long-term roots in their community.

Many rural residents who buy homes through USDA programs are first-time homebuyers. We also help current homeowners improve their homes through USDA rehabilitation loans or grants. Very low-income homeowners who are age 62 or older can qualify for grants to make health and safety improvements – such as accessibility accommodations – in addition to repairs. We are proud that USDA helps families start on the path of economic stability and a more secure future through homeownership.

The benefits of our housing programs extend beyond the homeowners themselves. USDA home loans also create economic opportunities for home builders, providers of durable goods such as lumber or appliances, and Realtors. USDA home loans often represent the majority of the business volume for many Realtors. Finally, local governments also benefit from increased revenue through property taxes. In fact, in many jurisdictions, property taxes from homeowners are the largest source of revenue. This is particularly true in rural communities where there are relatively fewer businesses compared to homeowners.

Homeownership is essential to the fabric of life in rural America, for our families, and for the communities in which they live.

Creating viable communities also means providing opportunities for families and seniors to have good rental housing as well as good housing for farm workers. In partnership with multi-family property owners and their property managers the USDA Multi-Family Housing programs assist in creating rental homes that support and encourage families to be part of their communities. USDA also provides rental assistance to help very low-income families and senior citizens find safe, decent housing at an affordable cost. USDA provides these rental assistance subsidies to these families to offset the difference between market rents and a monthly amount they can afford.

I would be remiss if I failed to note that USDA offers several other forms of assistance to rural communities to complement our strong housing programs. In addition to housing, successful communities need community facilities that help them to be and remain a viable community. Our RHS Community Facilities program helps communities finance the development of essential services and buildings such as hospitals, child care centers, libraries, mental health clinics, first responder vehicles and equipment, and other community assets that help make communities strong and self-sufficient.

Our successes are our families. Here are some numbers:

- In Fiscal Year (FY) 2008, USDA guaranteed loans created approximately 63,000 homebuyers. By FY 2013 (which ended September 30, 2013), annual loan volume had climbed by more than 100,000 loans – an increase of more than 158%.

From the start of FY 2009 through the end of FY 2013, the program financed more than 700,000 homeowners. Rural Development financed about 3.6 times the number of loans the agency had financed during the previous five years.

- Loans are only part of the story. The full story is about the people. My major priority is to focus on enhancing customer service through improved business processes. With the reduction of staff that RHS has experienced over the last few years doing more with less requires the team to implement new business processes to better serve our customers, improve the predictability of the process, and enhance productivity of our great staff. Many of the RHS processes have not had dedicated budget dollars to automate. This year’s technology budget has created the opportunity for RHS to implement automation solutions that will improve the quality, standardize processes, improve staff productivity, and provide better customer service.

And to better serve the people, one of my first priorities is to help improve processes and service at our Customer Center in St. Louis. Our success there will enhance customer service, reduce financial and regulatory risks, improve staff productivity, improve staff morale, and create employee development opportunities.

We recently assembled a Single-Family Housing Rapid Improvement Team of experienced staff from St. Louis and Washington, D.C. The team also included lenders, a representative from the Department of Housing and Urban Development, a USDA Rural Development State Director, and a USDA Rural Development Program Director.

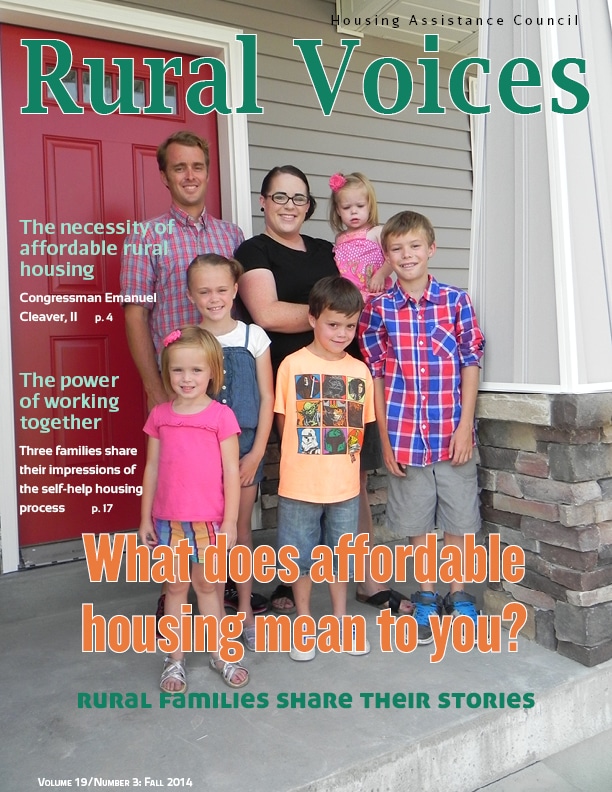

Johnston Family, USDA Rural Development Home – Creative Commons photo

Johnston Family, USDA Rural Development Home – Creative Commons photo

I have implemented various business improvement techniques to identify other business processes for improvement. The following are some of the areas of focus:

For our Single Family Housing loan guarantee program, we are working to improve our processes for loan loss mitigation to help borrowers who are in danger of default. We are improving our front-end image processing for loan documents. And we are implementing an automated process for loan closing. We are also working towards implementing delegated loan underwriting to reduce workloads for both lenders and RD staff. In addition, we’re working on a single close, construction to permanent loan to streamline processes and reduce costs.

For the Single Family Housing Direct loan program, we are working to improve our processes for acquired properties (Real Estate Owned) to better manage these properties. We are streamlining our loan origination system and implementing a program to work with loan packagers for outreach and loan application submission.

In our Multi-Family programs, we are working on an electronic loan application, we are streamlining the processes for transfers of properties when an owner wishes to sell. To streamline property inspections, we are investing in hand-held devices. We are also working on an electronic loan/grant application for our Community Facilities program.

One of the critical success factors to better customer service is implementing program processes that are understandable, easy to go through, predictable, transparent, and done in partnership with our customers and stakeholders. As part of RHS’s business process improvement, I welcome the wisdom and input of all our great partners on how we can better serve the needs of rural America. Please do not hesitate to contact RHS with your ideas.

As the Administrator of USDA’s Rural Housing Service, I can assure you that I and everyone on our team are committed to improving the lives of rural Americans and creating ladders of opportunity. Using all of our community development tools and through our strategic partnerships we make a huge difference in the lives of millions of rural Americans every day.

I look forward to working with all our stakeholder groups to make a difference through partnership, collaboration, investment, and advocacy for rural America.

Tony Hernandez is Administrator of USDA’s Rural Housing Service.

Continue the Discussionby Tom Collishaw, Self Help Enterprises, CA, and Selvin McGahee, Florida Non-Profit Housing, FL

Continue the Discussionby Tom Collishaw, Self Help Enterprises, CA, and Selvin McGahee, Florida Non-Profit Housing, FL

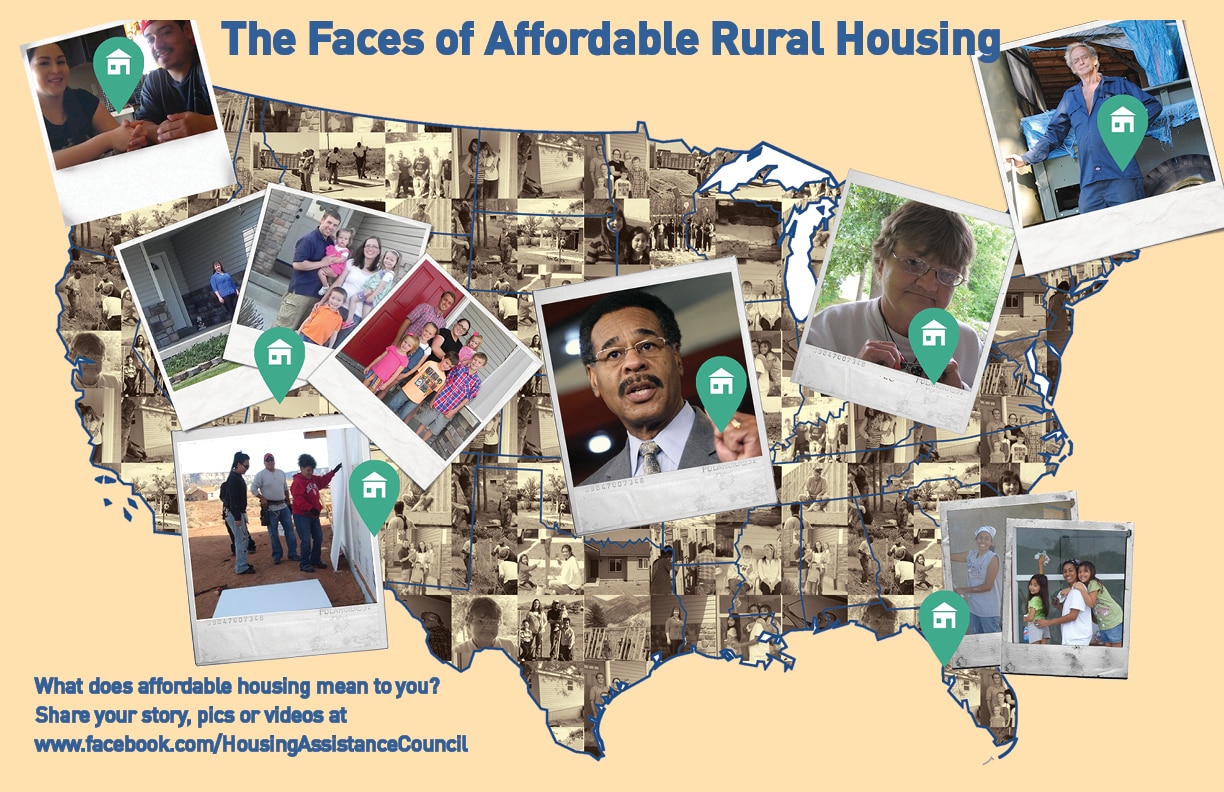

The Faces of Affordable Housing

The Faces of Affordable Housing