HAC News: September 30, 2015

HAC News Formats. pdf

September 30, 2015

Vol. 44, No. 20

• Continuing Resolution keeps federal government open • USDA uses all 502 direct funds • House Financial Services Committee chair invites suggestions to improve housing assistance • AmeriCorps opens FY16 application period • Whole house inspections instituted for 502 direct loans • CFPB amends rule on rural credit access • EPA rule adds pesticide protections for farmworkers • HUD publishes General Section for FY16 NOFAs • Continuum of Care NOFA released • Administration selects Rural IMPACT poverty reduction locations • Rural mortgage lending declined in 2014 • Increase in cost-burdened renters projected

HAC News Formats. pdf

September 30, 2015

Vol. 44, No. 20

Continuing Resolution keeps federal government open. Funding will continue, mostly at FY15 levels, through December 11. The CR includes language providing a short-term fix for Section 521 Rental Assistance contracts that run out of funds before their one-year term ends and could not be renewed (see HAC News, 9/2/15): it gives USDA authority to waive the prohibition on early renewals. It also includes the “anomaly” the Administration requested (see HAC News, 9/2/15), enabling USDA to spend a disproportionate amount of RA dollars early in the fiscal year.

USDA uses all 502 direct funds. By September 22, USDA RD obligated 7,043 Section 502 direct loans, using all of its Section 502 direct funds for FY15. This is the first time since FY12 all available money for that program was used. Very low-income borrowers received 31.8% of the total. Another 6,104 applications were submitted by September 22. RD also used all its FY15 Section 504 grant funds, but not all of the Section 504 loan money.

House Financial Services Committee chair invites suggestions to improve housing assistance. Committee chairman Rep. Jeb Hensarling (R-TX) requests specific proposals and recommendations on HUD restructuring, innovative approaches to address housing affordability that respect individual rights and promote individual responsibility, targeting housing assistance to address generational cycles of poverty, and examples of successful implementation of such proposals. Send ideas to transformhousing@mail.house.gov.

AmeriCorps opens FY16 application period. The Corporation for National and Community Service covers part or all of the cost of a community service position. Funding priorities include disaster services, veterans and military families, and more. Organizations that propose to operate in only one state must apply through State or Territory Commissions. Deadlines vary among states.A separate funding notice for Tribes will be released later this fall. Contact americorpsgrants@cns.gov.

Whole house inspections instituted for 502 direct loans. Beginning October 1, a Section 502 direct borrower purchasing an existing home must have a whole house inspection rather than separate inspections on the home’s major systems. Contact a USDA RD local office.

CFPB amends rule on rural credit access. A new Consumer Financial Protection Bureau final rule on mortgage lending by small creditors makes changes including expanding the definitions of small creditors and rural places. Contact Jeffrey Haywood, CFPB, 202-435-7700.

EPA rule adds pesticide protections for farmworkers. A new final rule enhances requirements for training, recordkeeping, protective equipment, and more. The rule requires workers applying pesticides to be 18 or over. On family-owned farms, immediate family members are exempt from many provisions. Most changes will take effect in about 14 months. Contact Kathy Davis, EPA, 703-308-7002.

HUD publishes General Section for FY16 NOFAs. The General Section’s provisions apply to funding notices issued during the fiscal year.

Continuum of Care NOFA released. CoCs can apply by November 20 for FY15 homelessness program funds. Contact a local HUD CPD Field Office or ask questions at https://www.hudexchange.info/get-assistance/.

Administration selects Rural IMPACT poverty reduction locations. Ten sites will participate in the “Rural Integration Models for Parents and Children to Thrive” (Rural IMPACT) technical assistance demonstration. HHS will run the effort in collaboration with USDA and others, providing technical assistance to the selected sites to plan and implement changes to alleviate child poverty.

Rural mortgage lending declined in 2014. A HAC analysis of recently released Home Mortgage Disclosure Act data shows that home mortgage lending in rural areas dropped by about 25% from 2013 levels. Almost the entire change was due to decreases in refinances. The rate of high cost mortgage lending increased from 2013 to 2014. The level of high cost rural loans for manufactured homes was six times higher than the national rate for single-family homes. Additional analysis will be posted at www.ruralhome.org. Contact Keith Wiley, HAC, 202-842-8600.

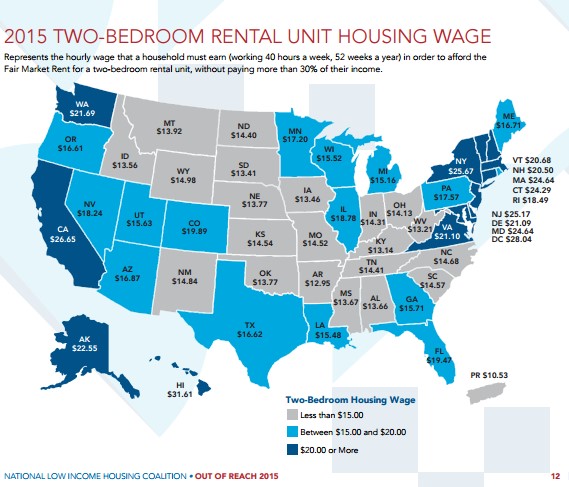

Increase in cost-burdened renters projected. The number of households spending 50% or more of their income on rent is expected to rise at least 11% by 2025, according to Projecting Trends in Severely Cost-Burdened Renters: 2015-2025 by Enterprise Community Partners and the Harvard Joint Center for Housing Studies. The numbers of severely burdened households ages 65 to 74 will rise by 42% and those ages 75 and older by 39%. Hispanic households will have the largest increase among racial and ethnic groups, with the number of severely burdened Hispanic households increasing by 27%.