Despite mass adoption, greater functionality, and more access points, the internet remains out of reach for many Americans, especially those in rural communities. One of the primary reasons for this disconnect is geography, where long distances between homes raise the cost of installing the infrastructure for broadband in rural areas, leaving rural homes with less access to fast, reliable internet.

Despite mass adoption, greater functionality, and more access points, the internet remains out of reach for many Americans, especially those in rural communities. One of the primary reasons for this disconnect is geography, where long distances between homes raise the cost of installing the infrastructure for broadband in rural areas, leaving rural homes with less access to fast, reliable internet.

As broadband becomes less a luxury and more a daily necessity, this technology gap can leave segments of the rural population technologically behind, causing slow economic growth, and limited access to advancements in areas, such as telemedicine.

More Than One-Quarter of Rural Homes Do Not Have Internet Subscriptions

Overall, 27 percent of all rural households lack any type of broadband subscription, compared to 17.1 percent of metropolitan households. This amounts to more than 4.7 million rural households without a broadband internet subscription – cellular data plan, cable/DSL/fiber optic, or satellite.

In addition, 129,963 rural households with an internet subscription are still using dial-up. This is 1 percent of all rural households with internet subscriptions, while only .04 percent of subscribers in metro areas have dial-up subscriptions.

The digital gap applies to most types of internet access, as measured by subscription data from the U.S. Census Bureau. Broadband subscription rates, at least in part, reflect access to the internet based on existing infrastructure and affordability. For example, rural households are less likely to have a cellular data plan than metropolitan area households, 57 percent to 70 percent. The one exception to this gap is satellite-based service. Nine percent of rural  households, compared to 6 percent of metropolitan area households use satellite internet services. Greater isolation and more sparse populations in rural areas likely explain the more common use of satellite technology, where cable or fiber optic services are not available.

households, compared to 6 percent of metropolitan area households use satellite internet services. Greater isolation and more sparse populations in rural areas likely explain the more common use of satellite technology, where cable or fiber optic services are not available.

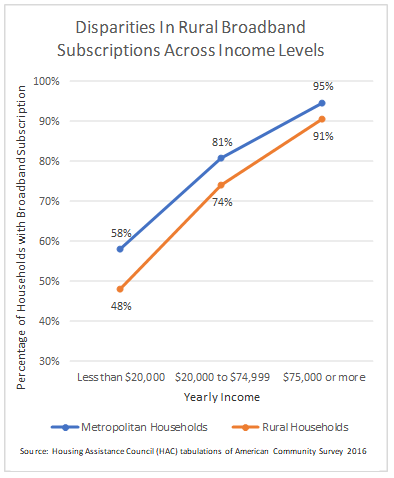

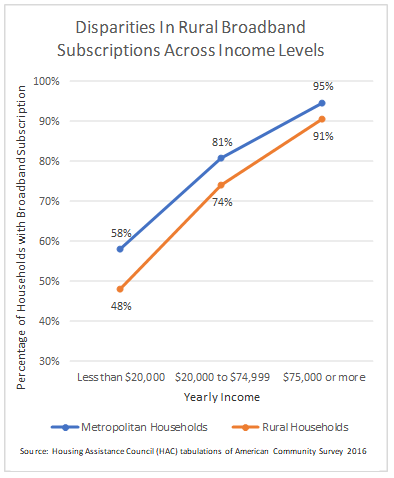

The broadband gap between rural and metropolitan area households exists at all income levels. For households with incomes less than $20,000 a year, rural broadband subscriptions are 10 percentage points lower than in metropolitan areas. For households with incomes from $20,000 to $75,000 the gap persists albeit slightly smaller at 7 percentage points. Even at higher income levels – $75,000 and above – rural households have lower broadband subscription rates, 91 percent to 95 percent.

The same disparity in connectivity exists at all age ranges as well. Rural residents under 18 years old are less likely to have a broadband subscription compared to their metropolitan counterparts, 84 percent to 89 percent. The trend follows for residents between 18 and 64 years old, 81 percent to 88 percent, and for those 65 years and older, 62 percent to 73 percent.

So, while income and age may exacerbate the disparity in broadband subscriptions, subscription rates in rural areas continue to trail metropolitan areas across the board.

Rural Homes Lack Device Diversity

Rural households also have fewer computing devices than their metropolitan area counterparts. About 83 percent of rural households have at least one computing devices (smartphone, tablet, laptop, etc.), while 90 percent of metropolitan area households do. Furthermore, less than 67 percent of rural households have at least two devices, compared to almost 75 percent of metropolitan households.

Rural households with access to some type of computing device are more often limited, with access to either a smartphone or a desktop computer, rather than having the capability and benefits of both forms of technology. While seemingly a small issue, fewer devices directly impacts rural households’ ability to take advantage of ever increasing technologies. This means that a rural home buyer with only a smartphone may not be able to obtain detailed information on mortgage products, and a veteran without a smartphone cannot get on the road directions to a VA healthcare facility for an appointment.

What the Disconnect Means

While it may not be surprising that rural households have less broadband access and fewer devices, it can be consequential. Less dense areas where there are large physical gaps in infrastructure is where the internet can be the best utilized. Households without broadband subscriptions are unable to access services effectively, such as online banking and shopping, telemedicine, and more reliable communication.

Investing in broadband infrastructure in rural areas can help diminish the disparities in access between rural and metropolitan households. While initial infrastructure investments may not be deemed profitable by traditional providers currently, small and local municipalities may need to consider creative methods of bringing broadband to their rural communities.

“Rural” in this Note refers to population and territory outside of a Metropolitan Area, as designated by the Office of Management and Budget.

Housing Assistance Council

Housing Assistance Council

households, compared to 6 percent of metropolitan area households use satellite internet services. Greater isolation and more sparse populations in rural areas likely explain the more common use of satellite technology, where cable or fiber optic services are not available.

households, compared to 6 percent of metropolitan area households use satellite internet services. Greater isolation and more sparse populations in rural areas likely explain the more common use of satellite technology, where cable or fiber optic services are not available.