While housing counselors are instrumental in helping people avoid foreclosure, they also provide invaluable resources to help families improve their lives

When someone is facing foreclosure, there is usually a credit card collector calling constantly, a family member struggling with an illness, or a heavy stress over where the next meal might be coming from. The problem that the client comes to us about is often caused by another bigger issue that they may be dealing with. This is why a housing counselor does so much more than just housing counseling.

While we have always provided assistance with housing issues through our Legal Hotline for Michigan Seniors, Elder Law of Michigan has been a HUD-approved housing counseling agency since 2011. We decided to expand our programs to become a housing counseling agency so that we could do a better job of helping clients deal with the issues that may be preventing them from owning or renting a home or apartment.

The goal of the housing counseling program is to help clients achieve their goals. In regards to helping with homeownership, these goals could be to downsize to a smaller, more accessible home; own a home for the first time; or become a home owner again after going through challenges that resulted in a foreclosure of a previous home.

A housing counselor works with the client to figure out the alternatives and then allows the client to make an educated decision on how to proceed. This process is customized to each client but includes budget discussions, information on what resources are available, credit repair counseling, education on fair housing rights, and assistance with finding other housing if that is necessary. Housing counselors provide these services in an understanding, non-judgmental way.

We recognize that there are additional challenges faced by our rural clients: limited access to services and fewer housing alternatives.

These services are invaluable to someone struggling with the constant phone calls from the creditor, the overwhelming amount of incorrect information on the internet, and the fear of what to do if the family loses their home.

As a nonprofit that serves clients in suburban cities and rural counties, we recognize that there are additional challenges faced by our rural clients: limited access to services and fewer housing alternatives.

Many rural residents are perfectly fine with the fact that there aren’t many businesses nearby. In fact, that may be one of the reasons why they choose to live in the rural area. With the tight economy, nonprofits have to strategically locate where they can serve the most clients in a cost-effective manner. A large, mostly rural county in our service area has only one housing counseling agency actually located in the county. For residents on the other side of the county, that means almost an hour of travel each way to get assistance with their housing problems.

Another barrier is access to high-speed internet. Out of efficiency, many of the programs that help with foreclosure issues use a website or an online portal. While this works for those who are computer savvy and have a reliable computer with a good internet connection, several of our clients could only access these services with our help.

Making our services available by telephone means that we can try to provide as much assistance as possible without having the client drive a long distance to meet with us. There are still some issues using this method because there is not a nearby place to make copies or fax documents.

For those clients who commute into the larger cities for work, these issues can be addressed with the services available there. However, for our older, retired clients, that is not always so easy. We also discovered that some clients were not able to contact us because our office hours were the same hours that they worked. We had to make evening appointments available.

There are fewer housing options for some rural clients. In an ideal situation, our housing counselors would be able to work with the client and resolve the mortgage issue, allowing the client and their family to remain in the home. However, that is not always the case. In some cases, we have to work with the client to find alternate, affordable housing. Purchasing another home to live in is not an option at that moment due to credit issues. For many clients in this situation, we help them find an apartment that they can afford. For rural clients, rentals are not very plentiful, so relocating to another community is a reality that they must face on top of dealing with the foreclosure.

Because it is hard enough dealing with the housing issue, rural clients should definitely seek out a housing counseling agency to help. Recently, we had a client from a rural county who lost his job and was faced with foreclosure. Our housing counselor worked with him to go over his budget and determined that if he could get caught up, he would be able to afford to make future payments. They worked together by phone and through the mail to get all of his paperwork together. The client came to our office and worked with the counselor to complete an application for assistance through the Hardest Hit Fund program. After waiting several weeks, the client received notice that he was going to receive assistance and could save his home. Now, several months later, he just emailed us to say how thankful he is for the help.

Unfortunately, this is not always the outcome for our clients. Another client, a widow from a very small town in another rural county, contacted one of our other programs because she needed help buying food. After speaking with her, our benefits counselor realized that the client was also facing foreclosure. She gladly agreed to be helped by our housing counseling program. She was the victim of a fraudulent refinance scheme that took her money but never worked with her mortgage lender. Because she was not going to be able to afford the home any longer, our housing counselor worked with the client to find another place to live. After five months, the client was able to move into a subsidized housing complex in a nearby city and even recovered some of her money thanks to the legal help she received from the legal hotline.

After five months, the client was able to move into a subsidized housing complex in a nearby city and even recovered some of her money thanks to the legal help she received from the legal hotline.

Even for clients who are not able to stay in their home, the dream of homeownership is still possible. Housing counseling programs will work with the client who wants to own a home again in the future. Participating in a structured program to help with saving money and possibly rebuild credit is a good way to return to homeownership faster.

Housing counseling programs also can provide information on fair housing laws and discrimination. Whether you are looking to buy a home, take out a mortgage, or rent an apartment, you should know your rights.

Our housing counseling program, along with our other programs, does so much more than just answer questions and give referrals. Like many other housing counseling agencies, we seek to address the problems that led to the housing issue. It is this assistance that our clients find the most helpful. To find a housing counseling agency in your area, visit www.hud.gov or call 800-569-4287.

Keith L. Morris, J.D., M.P.A. is the President of Elder Law of Michigan, a private nonprofit that assists clients with legal counseling, pension counseling, benefits counseling, and housing counseling. Its new Housing Rights Center of Michigan assists clients of all ages and incomes in counties surrounding Lansing, Michigan.

Housing Assistance Council

Housing Assistance Council

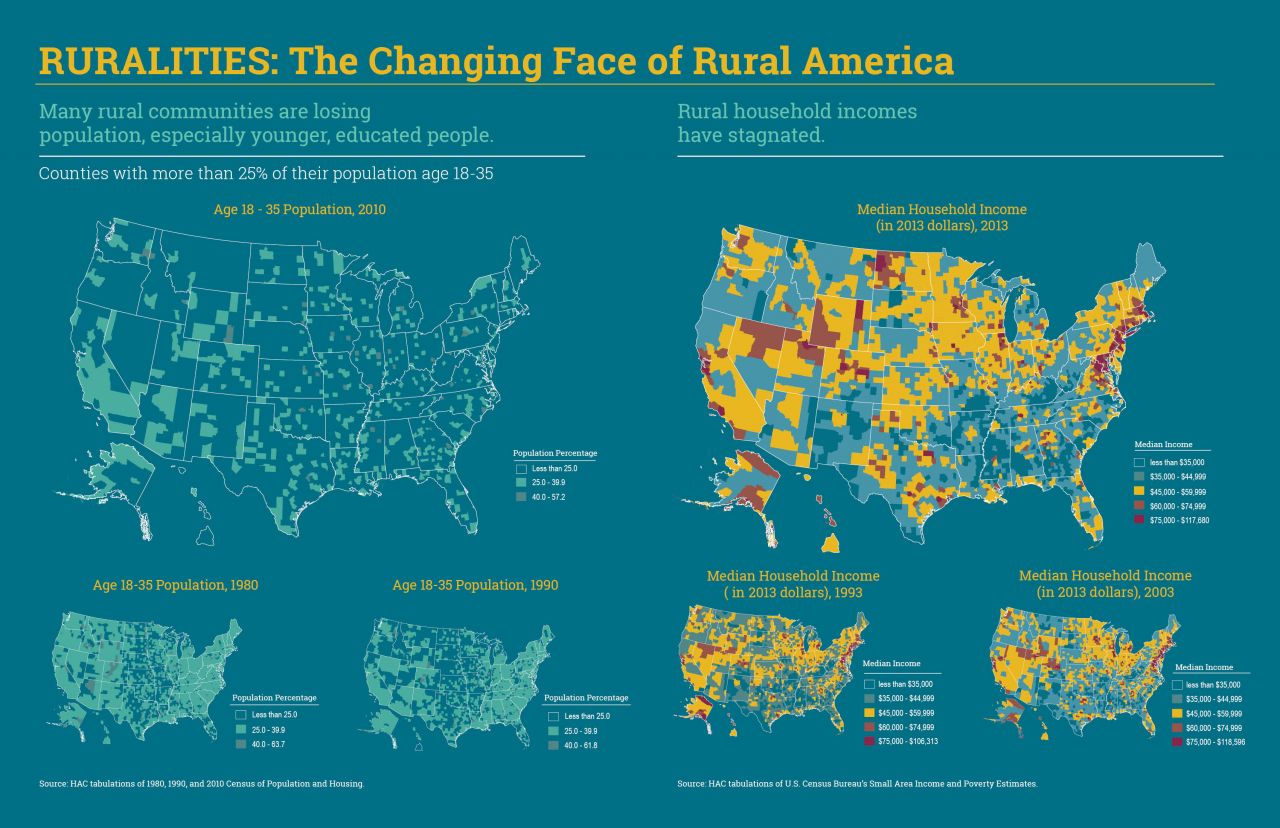

Ruralities: The Changing Face of Rural America

Ruralities: The Changing Face of Rural America