Rural Research Notes

Shawn Poynter / There Is More Work To Be Done

Shawn Poynter / There Is More Work To Be Done

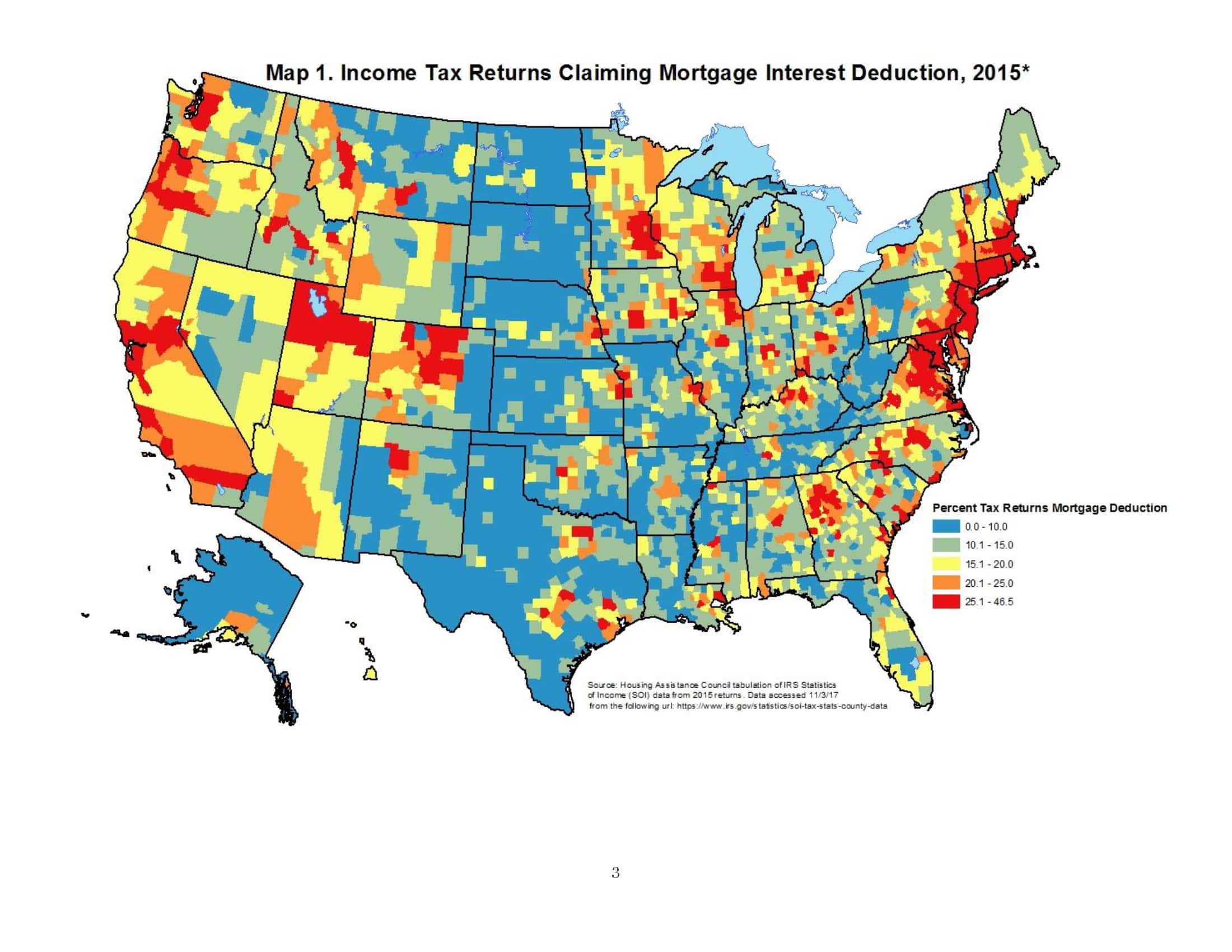

Recent legislative proposals to lower U.S. tax rates have included, among other elements, modifications to the mortgage interest deduction. The proposed limiting of the mortgage interest deduction to the first $500,000 of a home loan, just half of the current $1 million limit, has drawn the public’s attention. Questions on the potential cost to taxpayers associated with the more stringent deduction limits have naturally followed. The following discussion looks at the role of the mortgage interest deduction in rural areas.

Recent legislative proposals to lower U.S. tax rates have included, among other elements, modifications to the mortgage interest deduction. The proposed limiting of the mortgage interest deduction to the first $500,000 of a home loan, just half of the current $1 million limit, has drawn the public’s attention. Questions on the potential cost to taxpayers associated with the more stringent deduction limits have naturally followed. The following discussion looks at the role of the mortgage interest deduction in rural areas.

HAC News: December 4, 2017

HAC News: December 4, 2017