HAC News Formats. pdf

November 6, 2017

Vol. 46, No. 22

Tax plan proposed in House would cut mortgage interest deduction • USDA begins periodic review of rural areas • RHS names new deputy for multi-family • VA offers transitional housing funds and amends regs on homeless veterans • CDFI Bond Guarantee Program accepting applications • Lead exposure strategy input sought by HUD • USDA multifamily financial reporting requirements revised • USDA RD extends foreclosure moratoriums for Section 502 guaranteed loans in disaster areas • HUD sets operating cost adjustment factors • House Financial Services chair Hensarling to leave Congress • Senate hearing addresses cost and coverage of 2020 Census • November 11-19 is Hunger & Homeless Awareness Week • Maine case studies address rural seniors’ housing • “Meeting Native American Housing Needs” subject of Rural Voices • HAC offers symposium on Affordable Housing Solutions for Rural Veterans

HAC News Formats. pdf

November 6, 2017

Vol. 46, No. 22

Tax plan proposed in House would cut mortgage interest deduction. H.R. 1 , introduced on November 2, would retain the Low Income Housing Tax Credit, eliminate private activity bonds and the 4% credit, end the New Market Tax Credit Program, and reduce the mortgage interest deduction. Homeowners would be able to deduct interest payments made on up to $500,000 in home loans, rather than the current $1 million. The funds generated by this change would be used to cover the cost of lowering other taxes. The House Ways and Means Committee will consider the bill on November 6.

USDA begins periodic review of rural areas. An Unnumbered Letter dated October 19, 2017 provides guidance for RD field offices’ five-year review of service areas for the rural housing programs. Currently eligible areas that have grown in population may still be considered rural if they are “rural in character.” The UL states that a population density of under 1,000 persons per square mile indicates a place is rural in character.

RHS names new deputy for multi-family. Effective November 12, Bryan Hooper will become RBS’s Deputy Administrator for Business Programs and Joyce Allen will become Deputy Administrator for Multi-Family Housing, leaving her position as Deputy Administrator for Single-Family Housing. Cathy Glover will serve as Acting Deputy for Single-Family.

VA offers transitional housing funds and amends regs on homeless veterans. Nonprofits and state, local, and tribal governments can apply by February 28, 2018 for Homeless Providers Grant and Per Diem funds to provide transitional housing beds. For more information, contact Jeffery Quarles, 877-332-0334. VA has also broadened its definition of homeless veterans eligible for VA aid, and will increase the per diem payments for homeless veterans placed in transitional housing that will become permanent housing. For more information, contact Guy Liedke , 877-332-0334.

CDFI Bond Guarantee Program accepting applications. CDFIs can apply by January 9, 2018 to become Qualified Issuers that will issue bonds, and by January 23 to receive bond guarantees. The bond proceeds will be loaned to other CDFIs, which will make loans for community and economic development. For more information, contact CDFI Bond Guarantee Program staff by January 16, 202-653-0421, option 5.

Lead exposure strategy input sought by HUD. HUD co-chairs the Lead Subcommittee of the President’s Task Force on Environmental Health Risks and Safety Risks to Children (established in 1997), which is developing a new federal lead strategy. HUD requests comments by November 24 on the strategy, especially on priority risks and goals, strategy development and implementation, and messaging and outreach. For more information, contact Warren Friedman, HUD, 202-402-7698.

USDA multifamily financial reporting requirements revised. Instead of requiring annual audits based on the number of units in a rental property, RHS will require them based on the amount of federal assistance used. For borrower fiscal years beginning on and after January 1, 2018, annual audits will be required for properties with combined federal assistance above $750,000 for nonprofit owners and $500,000 for for-profit owners. HUD will accept RHS audits for properties with Section 8. For properties below those thresholds, owner certifications will be required. Also, all borrowers will now be required to certify there have been no changes in ownership, real estate taxes are current, and replacement reserve accounts have been used only for authorized purposes. For more information, contact Janet Stouder, USDA, 202-720-9728.

USDA RD extends foreclosure moratoriums for Section 502 guaranteed loans in disaster areas. The moratorium in the presidentially declared disaster area for Hurricane Harvey will last until February 21, 2018; for Hurricane Irma until March 9, 2018; and for Hurricane Maria until March 19, 2018.

HUD sets operating cost adjustment factors. The OCAFs will be used to adjust rents for project-based Section 8 contracts being renewed under the Multifamily Assisted Housing Reform and Affordability Act with an anniversary date on or after February 11, 2018. For more information, contact Carisa L. Janis, HUD, 202-402-2487.

House Financial Services chair Hensarling to leave Congress. Rep. Jeb Hensarling (R-TX) announced on October 31 he will not run for reelection in 2018. As chairman of the Financial Services Committee, he has overseen efforts to reform the financial system, including housing finance.

Senate hearing addresses cost and coverage of 2020 Census. Asked about reaching rural residents, at an October 31 Senate Committee on Homeland Security hearing Commerce Secretary Wilbur Ross summarized planned outreach and advertising efforts including possible installation of census kiosks in Post Offices. He also described a potential relationship with Post Office employees, who know the communities where they work and are more likely to be trusted than outsiders are. Government Accountability Office testimony prepared for the same hearing focuses on GAO concerns about data security, progress on systems and testing, and costs.

November 11-19 is Hunger & Homeless Awareness Week. The occasion , sponsored by the National Coalition for the Homeless and the National Student Campaign Against Hunger and Homelessness, features events in hundreds of locations nationwide.

Maine case studies address rural seniors’ housing. A HUD article, “Housing Challenges of Rural Seniors,” reports HAC research on needs and also describes efforts in three rural Maine communities that focus on accessibility, home repairs, and volunteer assistance to help seniors age in place.

“Meeting Native American Housing Needs” subject of Rural Voices. The fall 2017 issue of HAC’s quarterly magazine focuses on the progress being made in improving the housing conditions of Native Americans.

HAC offers symposium on Affordable Housing Solutions for Rural Veterans. The session, to be held December 5 in Washington, DC, will showcase model programs that are providing homeownership, home repairs, service to the homeless, and rental housing options. There is no registration fee, but space is limited and advance registration is required. For more information, contact Shonterria Charleston , HAC, 404-892-4824.

NEED CAPITAL FOR YOUR AFFORDABLE HOUSING PROJECT?

HAC’s loan funds provide low interest rate loans to support single- and multifamily affordable housing projects for low-income rural residents throughout the U.S. and territories. Capital is available for all types of affordable and mixed-income housing projects, including preservation, farmworker, senior, and veteran housing. HAC loan funds can be used for pre-development, site acquisition, site development, and construction/rehabilitation. Contact HAC’s loan fund staff at hacloanfund@ruralhome.org, 202-842-8600.

Please note: HAC is not able to offer loans to individuals or families. Borrowers must be nonprofit or for-profit organizations or government entities (including tribes).

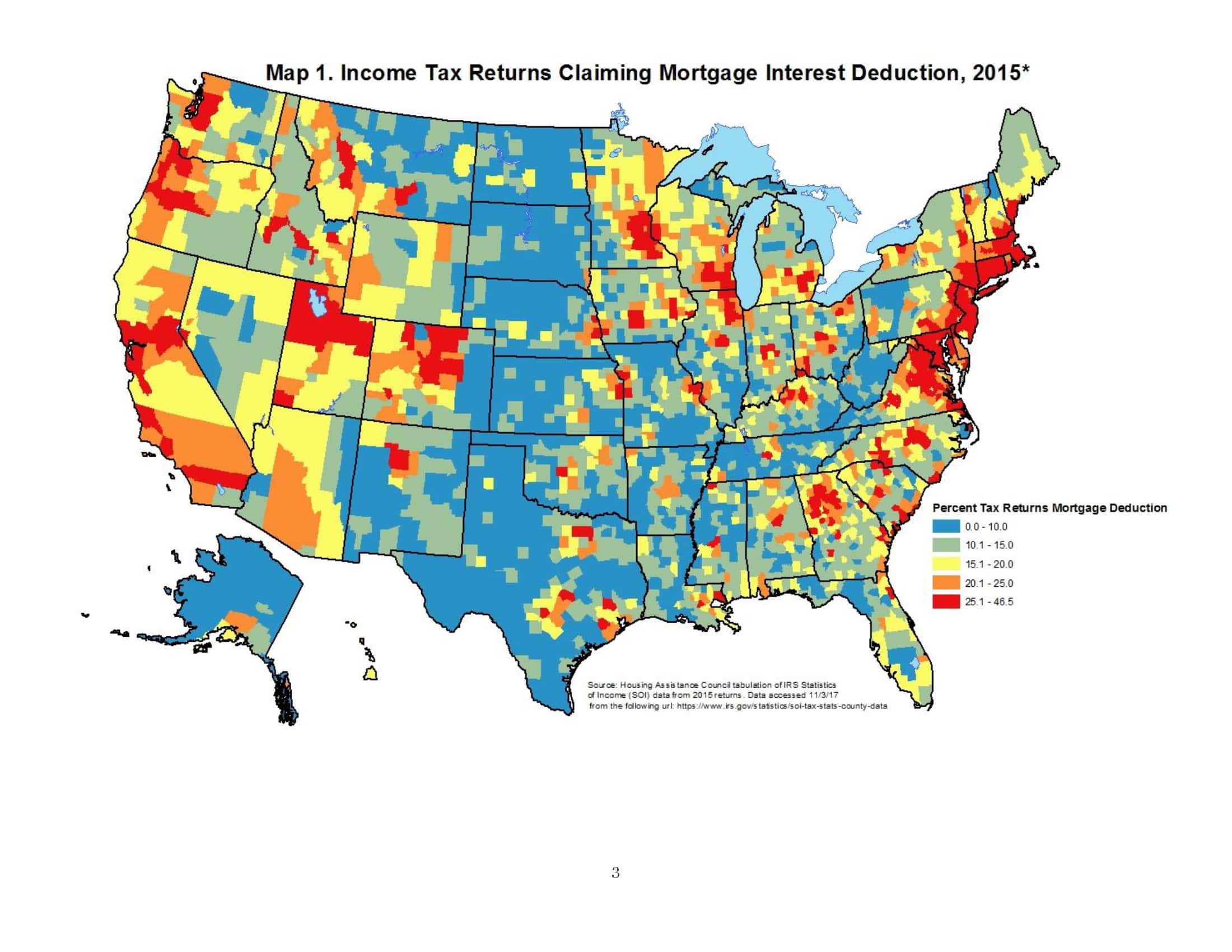

Recent legislative proposals to lower U.S. tax rates have included, among other elements, modifications to the mortgage interest deduction. The proposed limiting of the mortgage interest deduction to the first $500,000 of a home loan, just half of the current $1 million limit, has drawn the public’s attention. Questions on the potential cost to taxpayers associated with the more stringent deduction limits have naturally followed. The following discussion looks at the role of the mortgage interest deduction in rural areas.

Recent legislative proposals to lower U.S. tax rates have included, among other elements, modifications to the mortgage interest deduction. The proposed limiting of the mortgage interest deduction to the first $500,000 of a home loan, just half of the current $1 million limit, has drawn the public’s attention. Questions on the potential cost to taxpayers associated with the more stringent deduction limits have naturally followed. The following discussion looks at the role of the mortgage interest deduction in rural areas.