HAC News Formats. pdf

June 22, 2017

Vol. 46, No. 13

Anne Hazlett named to lead USDA Rural Development • Administration’s rural task force holds first meeting, requests comments • House passes Financial CHOICE Act • Trump nominates Farias and Rackleff for HUD posts, Otting for OCC • Patenaude nomination moves forward • Cost burden worsens, Harvard reports, and high-poverty areas growing on metro fringes • USDA issues two Administrative Notices about self-help organizations • Hatch requests feedback on tax reform • FEMA asks for input on regulations • HAC sums up rural housing programs’ performance in FY16 • Coalition forms to combat neighborhood hate activity • HAC SEEKS EXECUTIVE DIRECTOR

HAC News Formats. pdf

June 22, 2017

Vol. 46, No. 13

Anne Hazlett named to lead USDA Rural Development. On June 12, USDA Secretary Sonny Perdue named Hazlett the Assistant to the Secretary for Rural Development, announcing she will oversee the department’s rural housing, business-cooperative, and utilities programs. She was Chief Counsel to the Majority on the Senate Committee on Agriculture, Nutrition, and Forestry. HAC has posted an update on USDA’s reorganization plans, including the comments HAC submitted to USDA about the changes, and a collection of links to information from HAC and others.

Administration’s rural task force holds first meeting, requests comments. The Interagency Task Force on Agriculture and Rural Prosperity, chaired by USDA Secretary Sonny Perdue, met on June 15. “Ideas and suggestions on legislative, regulatory, and policy changes” for the task force can be posted to USDA’s website; no deadline is specified.

House passes Financial CHOICE Act. H.R. 10, which would repeal and change large portions of the Dodd-Frank Act, passed the House on June 8 by an almost strictly party-line vote. The Senate is expected to develop its own version of the bill.

Trump nominates Farias and Rackleff for HUD posts, Otting for OCC. President Trump nominated Anna Maria Farias, who served at HUD in the George W. Bush administration, to be HUD’s Assistant Secretary for Fair Housing and Equal Opportunity. Neal J. Rackleff, an attorney and former director of Houston’s housing department, was nominated as Assistant Secretary of HUD. Joseph Otting, who has worked as an executive with several large banks, has been nominated as Comptroller of the Currency.

Patenaude nomination moves forward. After a June 6 hearing, on June 14 the Senate Banking Committee recommended Senate approval for the nomination of Pamela Hughes Patenaude to become HUD Deputy Secretary. A Senate vote has not yet been scheduled.

Cost burden worsens, Harvard reports, and high-poverty areas growing on metro fringes. The 2017 State of the Nation’s Housing report from Harvard’s Joint Center for Housing Studies indicates the total number of households with severe cost burdens (paying more than 50% of income for housing) declined from 2014 to 2015, but most of the improvement was for owners, with 11.1 million renter households severely cost burdened in 2015, a 3.7 million increase from 2001. Nationwide, 70.3% of households earning under $15,000 a year (roughly equivalent to working full-time, year-round at the federal minimum wage) are severely cost burdened.

While the 12-year decline in homeownership rates has slowed, there has been a disproportionate impact on African-American households. From 1994 to 2016, the black homeownership rate fell to 42.2% while white homeownership increased to 71.9%, resulting in the largest percentage point disparity since World War II. Both Asians (55.5%) and Hispanics (46.0%) narrowed their gaps with whites.

Segregation by income is also increasing nationwide. Between 2000 and 2015, the share of the poor population living in high-poverty neighborhoods rose from 43% to 54%, and the number of high-poverty neighborhoods rose from 13,400 to more than 21,300. Most of these neighborhoods are concentrated in high-density urban cores, but their recent growth has been fastest in low-density areas at the metropolitan fringe and in rural communities.

The report concludes that government regulations and public subsidies are needed. “Only the federal government can provide funding at the scale necessary to make meaningful progress toward the nation’s stated goal of a decent home in a suitable living environment for all.”

USDA issues two Administrative Notices about self-help organizations. AN 4840 clarifies use of supervised bank accounts and custodial accounts in conjunction with self-help technical assistance grants. AN 4842 sets guidelines and standards for RD state offices to use in determining whether self-help grantees are high risk. For more information, contact an RD state office.

Hatch requests feedback on tax reform. Sen. Orrin Hatch (R-UT), chair of the Senate Finance Committee, has invited public comments by July 17 on improvements in the U.S. tax system.

FEMA asks for input on regulations. Like other federal agencies, FEMA is reviewing its regulations, policies, and information collections as required by Executive Orders. It requests comments by August 14 on any that may be appropriate for repeal, replacement, or modification. For more information, contact Liza Davis, FEMA, 202-646-4046.

HAC sums up rural housing programs’ performance in FY16. HAC’s annual compilation of data on USDA’s housing activities reports that for the second year in a row all Section 502 direct funds were used. The average income was $30,911 for homebuyers with Section 502 direct loans and $57,962 for those with Section 502 guarantees. Section 538 loan guarantees were committed for construction of 3,037 units and Section 514/516 funds for 1,006 new units for farmworkers. Fewer Multifamily Preservation and Revitalization loans and grants were made than in FY15, probably because some MPR funds were needed for preservation vouchers. The report includes data for each program and each state.

Coalition forms to combat neighborhood hate activity. Communities Against Hate, led by the Leadership Conference Education Fund and the Lawyers Committee for Civil Rights Under Law, is a coalition of diverse national civil rights organizations and neighborhood groups that are providing a safe place for survivors of hate activity to share their stories and to get help. Report an incident online, or call 1-844-9-NO-HATE (1-844-966-4283) to report or to be connected with resources and services.

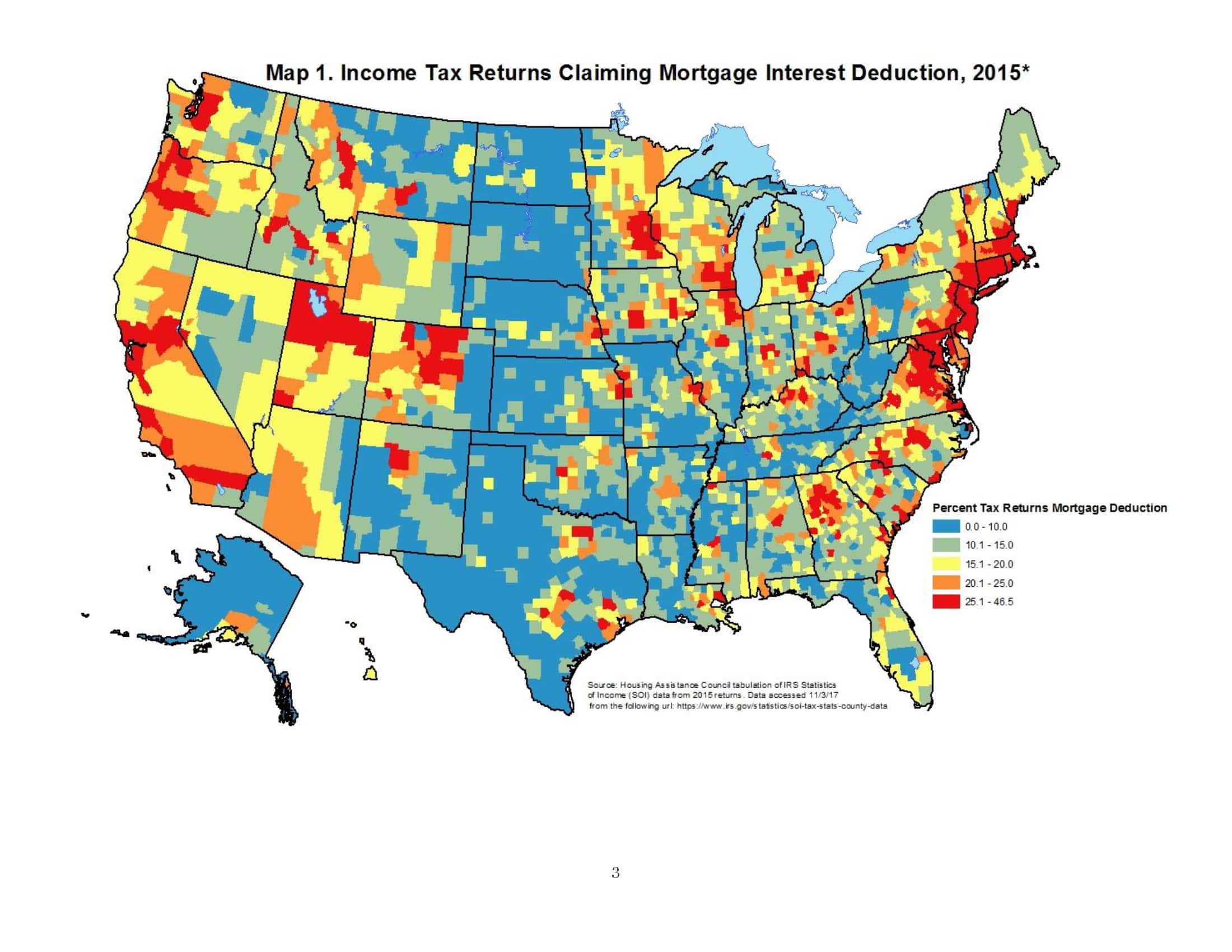

Recent legislative proposals to lower U.S. tax rates have included, among other elements, modifications to the mortgage interest deduction. The proposed limiting of the mortgage interest deduction to the first $500,000 of a home loan, just half of the current $1 million limit, has drawn the public’s attention. Questions on the potential cost to taxpayers associated with the more stringent deduction limits have naturally followed. The following discussion looks at the role of the mortgage interest deduction in rural areas.

Recent legislative proposals to lower U.S. tax rates have included, among other elements, modifications to the mortgage interest deduction. The proposed limiting of the mortgage interest deduction to the first $500,000 of a home loan, just half of the current $1 million limit, has drawn the public’s attention. Questions on the potential cost to taxpayers associated with the more stringent deduction limits have naturally followed. The following discussion looks at the role of the mortgage interest deduction in rural areas.