HAC News Formats. pdf

November 13, 2013

Vol. 42, No. 22

• November is Native American Heritage Month • November 16-24 is National Hunger and Homelessness Awareness Week • Fewer rural jobs, more poverty, and declining population, research shows • RD changes multifamily transfer process • HUD considers risk sharing initiative for small multifamily properties • FEMA issues final rule on assistance for housing damage • Housing counseling comment period extended • USDA used most Section 502 funds, but not Section 504 loans, in FY13 • USDA encourages local partnerships to address veteran homelessness • HUD and DOT launch site on housing and transportation costs • Sequestration’s impact on government activities, including housing, described • Research from sources including HAC covers veterans housing issues • Record share of young adults living at home • HAC reports on farmworker housing

November 13, 2013

Vol. 42, No. 22

NOVEMBER IS NATIVE AMERICAN HERITAGE MONTH. President Obama’s proclamation also designates November 29 as Native American Heritage Day. A USDA press release highlights support for Native Americans.

NOVEMBER 16-24 IS NATIONAL HUNGER AND HOMELESSNESS AWARENESS WEEK. Information, planned events, and ideas are available from the National Coalition for the Homeless.

FEWER RURAL JOBS, MORE POVERTY, AND DECLINING POPULATION, RESEARCH SHOWS. The USDA Econom-ic Research Service’s annual “Rural America at a Glance” report says rural unemployment is declining, but – with exceptions in some areas – the change is due to declining populations rather than job creation. An article in the online rural news source the Daily Yonder summarizes ERS’s findings. A separate Daily Yonder analysis of unemploy-ment data in August 2012 and August 2013 includes an interactive map with figures for every county in the U.S.

RD CHANGES MULTIFAMILY TRANSFER PROCESS. An Unnumbered Letter dated September 30, 2013 focuses on determining the financial feasibility of a transfer or preservation transaction, including reducing Rental Assistance. Contact RD State Office preservation staff.

HUD CONSIDERS RISK SHARING INITIATIVE FOR SMALL MULTIFAMILY PROPERTIES. Comments are due January 3 on a proposal for mission-driven lenders, including CDFIs, to originate, underwrite, and service loans with HUD mortgage insurance for refinancing or rehab of small properties. Lenders would assume 50% of the risk on each loan. Contact Lynn Wehrli, HUD, 202-402-5210.

FEMA ISSUES FINAL RULE ON ASSISTANCE FOR HOUSING DAMAGE. Revisions to FEMA’s repair, replacement, and housing construction assistance regulations are intended to clarify the eligibility criteria for assistance and to implement legislative changes. Contact John Carleton, FEMA, 202-212-1000.

HOUSING COUNSELING COMMENT PERIOD EXTENDED. Comments are now due December 12 on changes to HUD’s housing counseling program regulations, published September 13 (see HAC News, 9/11/13). Contact Ruth Román, HUD, 202-708-0317.

USDA USED MOST SECTION 502 FUNDS, BUT NOT SECTION 504 LOANS, IN FY13. Despite USDA’s success-ful efforts to attract borrowers near the end of the year (see HAC News, 8/1/13 and 8/28/13), HAC estimates that USDA used only 53% of its Section 504 home repair loan funds in FY13. Section 504 grant funds were fully used, and Section 502 direct and guaranteed loans were almost entirely obligated. HAC’s final USDA obligations reports for the year are posted online.

USDA ENCOURAGES LOCAL PARTNERSHIPS TO ADDRESS VETERAN HOMELESSNESS. An Unnumbered Letter dated November 8, 2013 suggests that RD field staff inform local organizations about RD housing programs.

HUD AND DOT LAUNCH SITE ON HOUSING AND TRANSPORTATION COSTS. The Location Affordability Portal is intended to provide consumers, researchers, and policymakers with data and resources on combined housing and transportation costs for all parts of the U.S. including remote rural areas.

SEQUESTRATION’S IMPACT ON GOVERNMENT ACTIVITIES, INCLUDING HOUSING, DESCRIBED. Faces of Austerity: How Budget Cuts Have Made Us Sicker, Poorer, and Less Secure, published by NDD United, compiles data, quotes, and individual stories. The Center on Budget and Policy Priorities has updated its data on use of HUD vouchers, including the number of vouchers that will be lost in each state if sequestration continues in FY14.

RESEARCH FROM SOURCES INCLUDING HAC COVERS VETERANS HOUSING ISSUES. “Housing Our Heroes: Veterans in Rural America,” a HAC research brief, summarizes data on demographics, housing conditions, and homelessness. USDA’s Economic Research Service provides demographic and economic data in “Rural Veterans at a Glance.” (ERS uses data for nonmetro areas, while HAC uses a definition of rural based on census tracts.) Housing Instability Among Our Nation’s Veterans, a National Low Income Housing Coalition report, examines housing issues for veterans nationwide. “Rental Assistance Helps More Than 300,000 Veterans Afford Homes, But Large Unmet Needs Remain,” from the Center on Budget and Policy Priorities, also covers the topic on a national basis.

RECORD SHARE OF YOUNG ADULTS LIVING AT HOME. More than one-third of Millennials aged 18-31 are living with their parents, according to A Rising Share of Young Adults Live in Their Parents’ Home, published by the Pew Research Center. A Forbes analysis of the report suggests that federal policies favoring homeownership led to high housing prices that young adults cannot afford.

HAC REPORTS ON FARMWORKER HOUSING. Housing Conditions for Rural Farmworkers explains character-istics of farmworker housing and obstacles to its improvement.

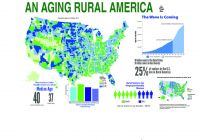

An Aging Rural America (jpg)

An Aging Rural America (jpg)