HAC News Formats. pdf

June 22, 2018

Vol. 47, No. 13

Rescission bill fails in Senate • Rents remain unaffordable at minimum wage • Harvard report addresses housing affordability • Administration proposes moving some rural housing programs to HUD • Sec. 533 Housing Preservation Grants available • Water and wastewater grants available for relending • HUD offers Jobs Plus funds • Grants available to reduce lead paint hazards • Comments invited on fair housing and disparate impact • Strategies for addressing rural homelessness offered in new report • Senate Committee and full House pass different Farm Bills •Changes proposed for construction to permanent mortgages guaranteed by USDA • Final set of Opportunity Zones announced • HUD designates EnVision Centers in 17 communities • Deadline extended for commenting on USDA regulations • Kraninger nominated to be CFPB director

HAC News Formats. pdf

June 22, 2018

Vol. 47, No. 13

Rescission bill fails in Senate.

On June 20 the Senate voted 50-48 against the Administration’s request to rescind previously appropriated funds, including $40 million from USDA’s Section 521 Rental Assistance program and additional amounts from other housing-related programs. The Senate could reconsider the bill, but is unlikely to. The House passed its version of the bill on June 7.

Rents remain unaffordable at minimum wage.

The National Low Income Housing Coalition’s 2018 Out of Reach report shows that, as has been the case for years, there is no county in the U.S. where a full-time worker earning the federal minimum wage or prevailing state minimum wage can afford a two-bedroom rental at HUD’s Fair Market Rent while working a standard 40-hour week. A full-time minimum-wage worker can afford a one-bedroom apartment in only 22 of the more than 3,000 U.S. counties. Data for each state and county is available through an interactive map.

Harvard report addresses housing affordability.

Another annual research report, the State of the Nation’s Housing, was released this week by Harvard’s Joint Center for Housing Studies. It recommends collaboration among the public, private, and nonprofit sectors to tackle the conditions creating the housing affordability gap, and notes that “a more robust federal response is essential to any meaningful progress.” The report states that increases in federal assistance for renters have lagged far behind the growth in renters with very low incomes. It notes that income inequality and the inability of income growth to keep pace with the economy’s growth over the past 30 years have contributed to current affordability challenges.

Administration proposes moving some rural housing programs to HUD.

On June 21 the Trump Administration released recommendations for reorganizing federal government agencies and programs, including moving USDA’s loan guarantee and rental assistance programs to HUD. It would also privatize Fannie Mae and Freddie Mac. It is not clear whether Congress will consider enacting the proposals.

Sec. 533 Housing Preservation Grants available.

A request for applications for grants to repair owner-occupied or rental housing will be published on June 25. Nonprofit, local government agencies, and tribes are eligible. Applications are due in early August. For more information, contact Bonnie Edwards-Jackson, RD, 202-690-0759.

Water and wastewater grants available for relending.

The Rural Utilities Service is offering grants to nonprofits under two programs. Household Water Well System grants can be used to create lending programs for homeowners to construct or repair household water wells. Revolving Fund Program grants establish funds that make loans to entities eligible for RUS water and wastewater programs. Applications for both programs are due July 20. For more information, contact Derek Jones, RUS, 202-720-9640.

HUD offers Jobs Plus funds.

Public housing authorities (not tribes or tribally designated housing entities) that did not receive Jobs Plus grants in 2014-2017 can apply by August 14. For more information, contact HUD staff.

Grants available to reduce lead paint hazards.

State, local, and tribal governments are eligible for Lead-Based Paint Hazard Reduction grants to identify and remediate lead paint in owner-occupied or rental housing. Applications are due August 2.

Comments invited on fair housing and disparate impact.

HUD is reviewing its regulation implementing the disparate impact standard – which applies the Fair Housing Act to practices with discriminatory effect even if the discrimination was not intended – to determine whether changes are appropriate based on the Supreme Court’s 2015 ruling upholding the use of disparate impact analysis, the Administration’s efforts to reduce regulatory burden, or for other reasons. Comments are due August 20. For more information, contact Krista Mills, HUD, 202-402-6577.

Strategies for addressing rural homelessness offered in new report.

In Strengthening Systems for Ending Rural Homelessness: Promising Practices and Considerations, the U.S. Interagency Council on Homelessness describes tactics such as obtaining technical assistance, partnering with service providers, developing creative outreach, identifying crisis housing options, and more.

Senate Committee and full House pass different Farm Bills.

The House Farm Bill, H.R. 2, was defeated in May but passed on June 21. The Senate Agriculture Committee approved its version, S. 3042, on June 18. The Senate bill does not contain controversial House provisions such as expanded work requirements, so after the full Senate votes (possibly before the end of June) a compromise will need to be developed.

Changes proposed for construction to permanent mortgages guaranteed by USDA.

USDA’s Rural Housing Service has proposed amendments intended to increase lenders’ willingness to use Section 502 guaranteed loans that cover both the construction and permanent mortgage phases. Along with other changes, lenders would be allowed to charge a higher interest rate for the construction phase and to escrow principal as well as other payments during construction. Comments are due August 20. For more information, contact Kate Jenson, USDA, 503-810-6855.

Final set of Opportunity Zones announced.

Opportunity Zones have now been designated in all states and territories. The IRS welcomes comments as it develops guidance on Opportunity Funds and eligible investments for taxpayers with capital gains.

HUD designates EnVision Centers in 17 communities.

The Choctaw Nation in Oklahoma is one of the locations selected for Secretary Ben Carson’s initiative, which intends to leverage public-private partnerships to connect HUD-assisted households with services and help them achieve self-sufficiency.

Deadline extended for commenting on USDA regulations.

In July 2017 USDA requested comments on improving its regulations, with a deadline of July 17, 2018. The deadline is now extended by a year to July 18, 2019. For more information, contact Michael Poe, USDA, 202-720-5303.

Kraninger nominated to be CFPB director.

President Trump has nominated Kathy Kraninger to become director of the Consumer Financial Protection Bureau. She currently works at OMB for Mick Mulvaney, who is OMB director and acting CFPB director.

HAC OFFERS GRANTS TO AFFORDABLE HOUSING PROJECTS SERVING RURAL VETERANS These grants, supported by The Home Depot Foundation, will go to nonprofits, tribally designated housing entities, and housing authorities serving veterans at or below 80% of area median income in rural areas. Projects may be new construction or rehab, temporary or permanent housing, in progress or beginning within 12 months. Applications are due July 9. For more information, contact Shonterria Charleston or Anselmo Telles.

HAC SEEKS WORKSHOP PROPOSALS.

HAC is trying something new for the 2018 Rural Housing Conference. We are looking to our constituents and partners for proposals for workshop sessions that engage participants and facilitate an active exchange of approaches and ideas to improve housing conditions for the rural poor. Check the online call for proposals and submit online by July 11. For more information, contact Mike Feinberg, 202-842-8600, or Kelly Cooney, 678- 649-3831.

SAVE THE DATE FOR THE 2018 HAC RURAL HOUSING CONFERENCE!

The conference will be held December 4-7 at the Capital Hilton in Washington, DC. The HAC News will announce when conference registration opens and when the hotel room block is available for reservations.

NOMINATE LOCAL AND NATIONAL LEADERS FOR HAC AWARDS..

HAC is now accepting nominations for its 2018 Cochran/Collings National Service and Skip Jason Community Service Leadership Awards. Nominations are due Friday July 13. The awards will be presented at the 2018 HAC Rural Housing Conference in December. Past awardees are listed on HAC’s site. Complete the online nomination form. For more information, contact Lilla Sutton, HAC, 202-842-8600.

NEED CAPITAL FOR YOUR AFFORDABLE HOUSING PROJECT?

HAC’s loan funds provide low interest rate loans to support single- and multifamily affordable housing projects for low-income rural residents throughout the U.S. and territories. Capital is available for all types of affordable and mixed-income housing projects, including preservation, farmworker, senior, and veteran housing. HAC loan funds can be used for pre-development, site acquisition, site development, and construction/rehabilitation. Contact HAC’s loan fund staff at hacloanfund@ruralhome.org, 202-842-8600.

Please note: HAC is not able to offer loans to individuals or families. Borrowers must be nonprofit or for-profit organizations or government entities (including tribes).

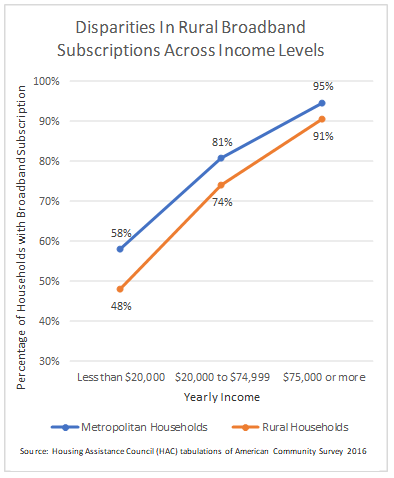

households, compared to 6 percent of metropolitan area households use satellite internet services. Greater isolation and more sparse populations in rural areas likely explain the more common use of satellite technology, where cable or fiber optic services are not available.

households, compared to 6 percent of metropolitan area households use satellite internet services. Greater isolation and more sparse populations in rural areas likely explain the more common use of satellite technology, where cable or fiber optic services are not available.