Updated: December 18, 2017

FHFA Publishes Fannie Mae’s and Freddie Mac’s Duty to Serve Underserved Market Plans

The Federal Housing Finance Agency (FHFA) has published Fannie Mae’s and Freddie Mac’s Underserved Markets Plans for 2018-2020 under the Duty to Serve program. The Plans become effective January 1, 2018.

Fannie Mae’s Underserved Markets Plan

Freddie Mac’s Underserved Markets Plan

The Housing Assistance Council (HAC) appreciates the opportunity to comment on Fannie Mae’s and Freddie Mac’s Duty to Serve Underserved Markets Plans for Rural Markets. As a strong advocate for the Duty to Serve provisions of the Housing and Economic Recovery Act of 2008, HAC appreciates the time, effort, and resources FHFA, Fannie Mae, and Freddie Mac have undertaken to develop these underserved market plans. The core of HAC’s work for over four decades has been rural and underserved communities. HAC understands the complexities and difficulties of working in these communities. HAC also understands the promise and possibility of Duty to Serve to affect real and measurable change in these long overlooked and largely forgotten communities and people. We appreciate that FHFA and the Enterprises have not forgotten them, and we look forward to assisting you and the Duty to Serve effort generally to achieve its mandate to improve liquidity and access to affordable housing in underserved markets.

Given its organizational focus on rural housing, HAC focused largely on the Rural Markets component of the plans. HAC presents comments on each Enterprise’s plan separately. After the Enterprise-specific comments, HAC presents general comments and suggestions to the Enterprises and FHFA on issues of rural multifamily housing and preservation.

Read HAC’s full comments.

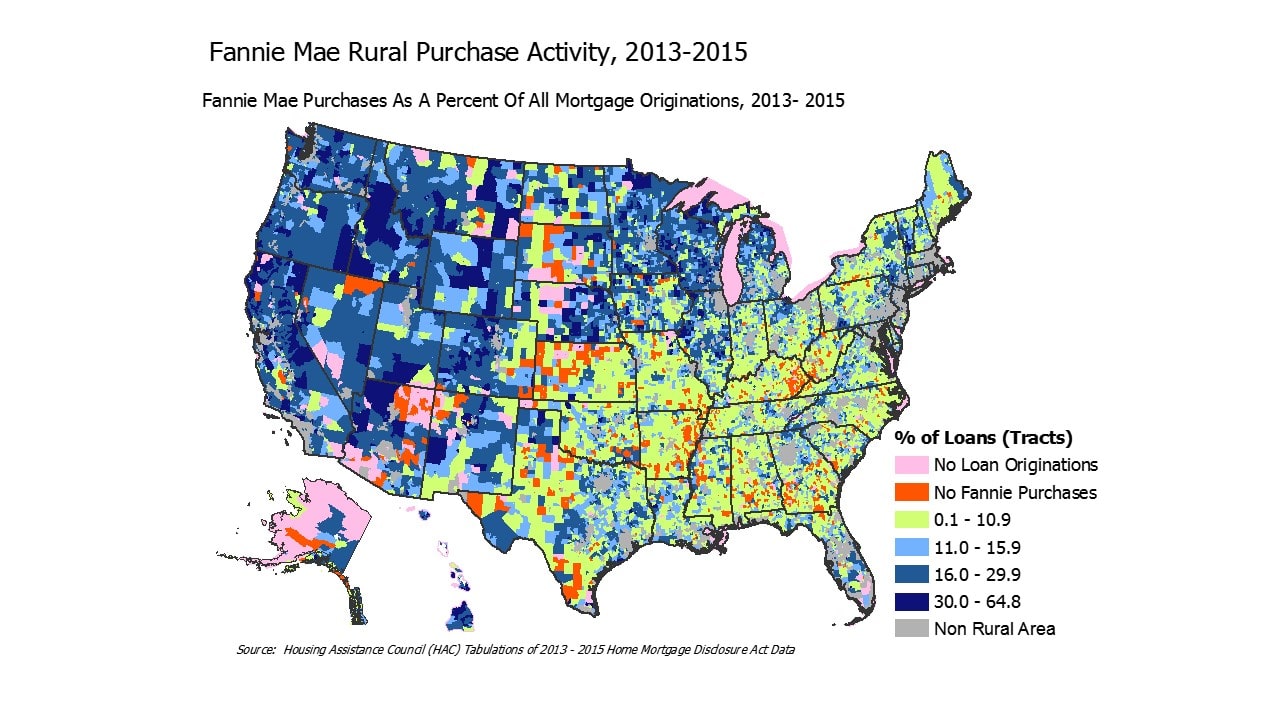

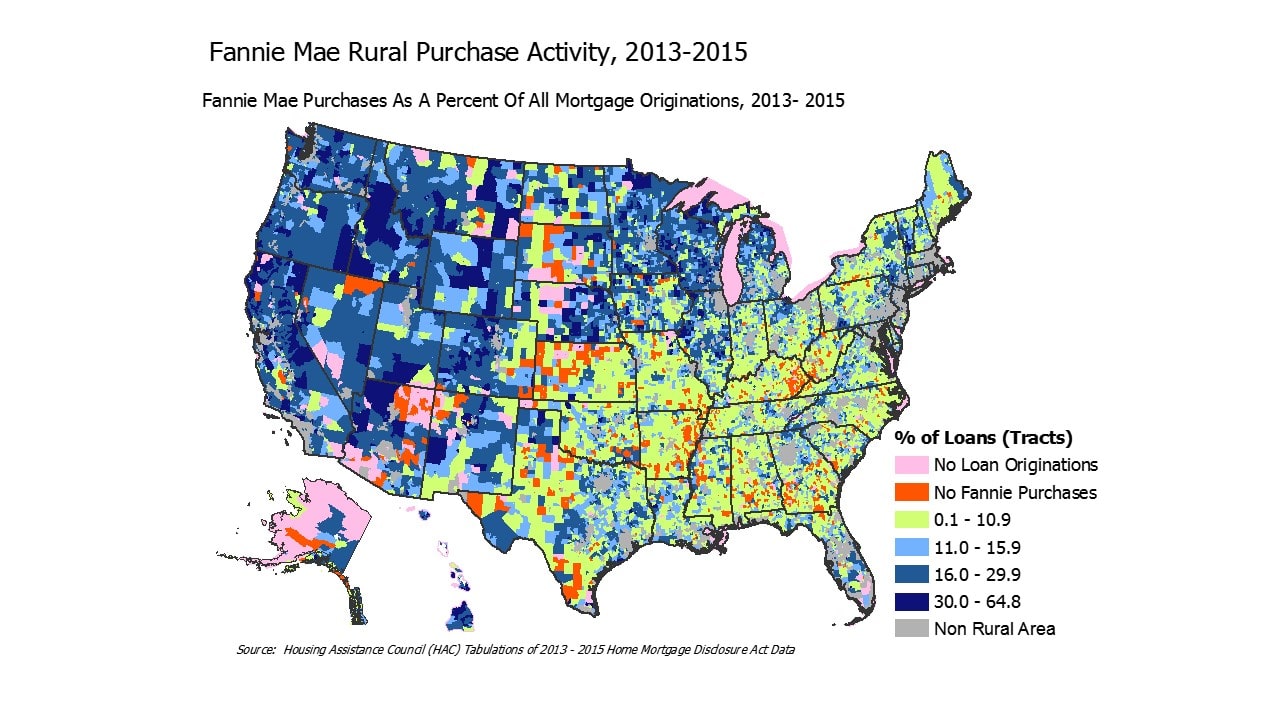

Fannie Mae Rural Purchase Activity, 2013-2015

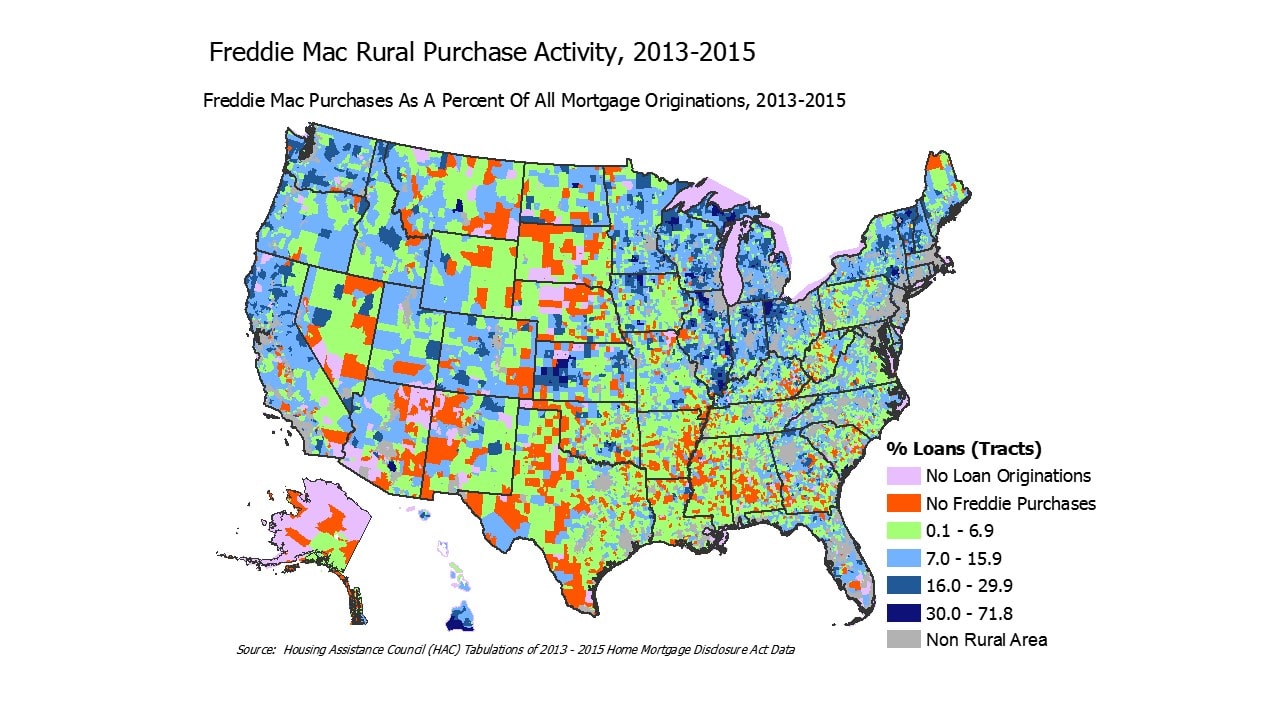

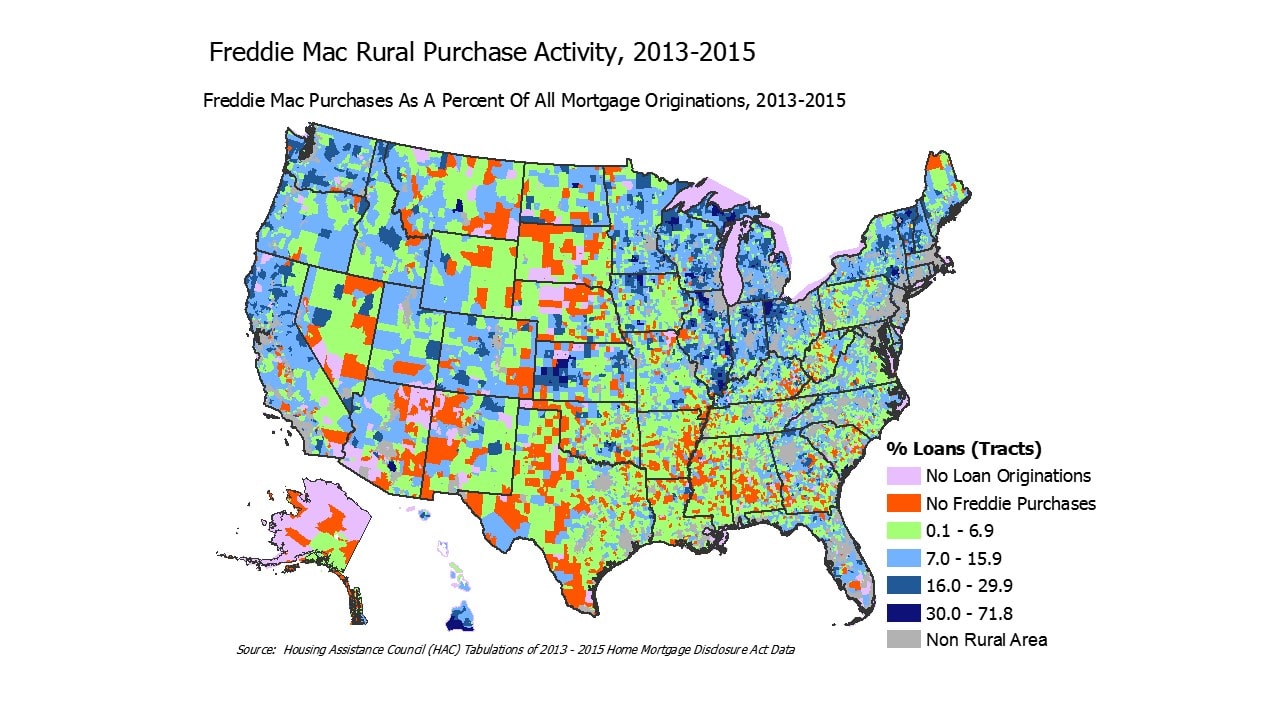

Freddie Mac Rural Purchase Activity, 2013-2015

The Federal Housing Finance Agency issued a final rule to implement the Duty to Serve provisions which require Fannie Mae and Freddie Mac to serve three specified underserved markets – manufactured housing, affordable housing preservation and rural housing – by improving the distribution and availability of mortgage financing in a safe and sound manner for residential properties that serve very low-, low- and moderate-income families.

Visit FHFA.gov/DTS for the press release, final rule, fact sheet, public listening session details, timeline and more.

HAC Will provide a summary of the Duty to Serve Rule soon.

Stakeholder Webinar

FHFA will provide a high-level overview of the final rule and answer stakeholder questions via webinar on Monday, Dec. 19 at 2 p.m. ET.

You may submit questions in advance by emailing DutyToServeStakeholders@FHFA.gov with “webinar question” in the subject line. Please submit your questions by COB Thursday, Dec. 15.

The Housing and Economic Recovery Act of 2008 mandates that Fannie Mae and Freddie Mac have a ‘Duty to Serve’ three traditionally underserved markets of:

- Rural Housing

- Manufactured Housing

- Affordable Housing Preservation

The GSEs are tasked with increasing liquidity and investment capital in these markets.

The Federal Housing Finance Agency (FHFA) issued a Proposed Rule on Duty to Serve on December 15, 2015. Comments to the Rule were due on March 17, 2016.

Link to Proposed Rule sent to Federal Register

HAC Resources on Duty to Serve

HAC Comments on Proposed Duty to Serve Rule – March, 17 2016

HAC Comments on Proposed Duty to Serve Rule – July 22, 2010

HAC Comments on Duty to Serve Advanced Notice of Rule Making – September 18, 2009

HAC Webinar on Duty to Serve

The Housing Assistance Council (HAC) convened an interactive e-learning experience to assist housing providers and policymakers better understand the Duty to Serve Rule, and what it may mean for Rural America. The session was also intended to help inform comments to the Duty to Serve Rule.

Introduction | Power Point Presentation (22 MB) |Webinar Recording

Additional Resources on Duty to Serve

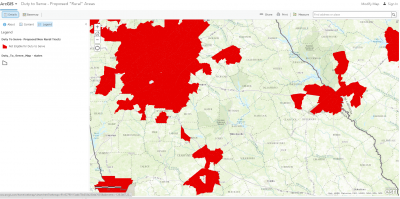

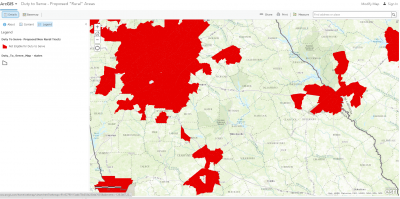

Interactive Map of Proposed Duty to Serve Rural Area

HAC’s Rural and Small Town Typology Database – Technical Documentation

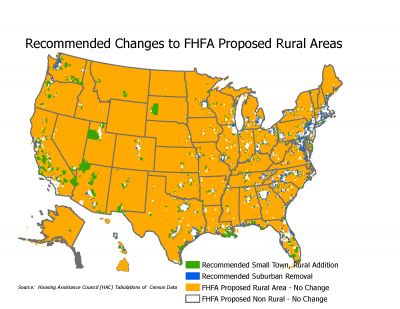

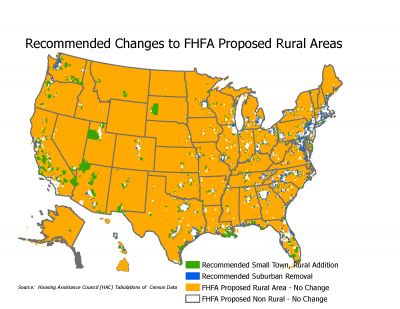

Map of HAC’s Recommended Changes to FHFA Proposed Rural Area

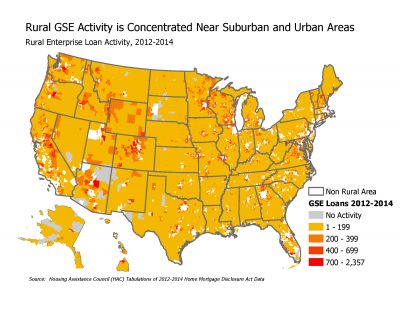

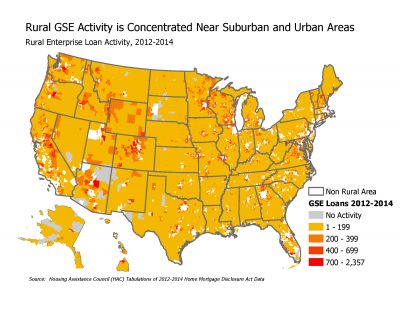

Map of GSE Loan Activity in Rural Areas

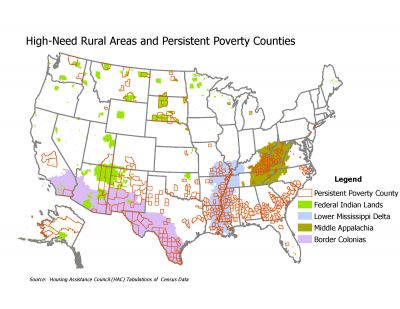

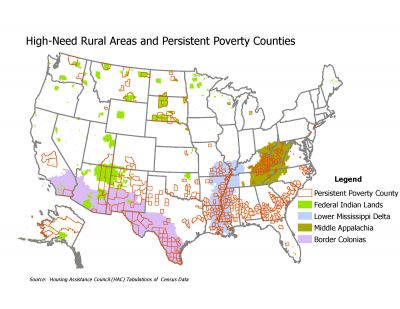

Map of FHFA Proposed Rural High-Need Areas and Persistent Poverty Counties

List of Suburban Tracts in FHFA Proposed Duty to Serve ‘Rural Areas’

List of Rural and Small Town Tracts Omitted From FHFA Proposed Duty to Serve ‘Rural Areas’

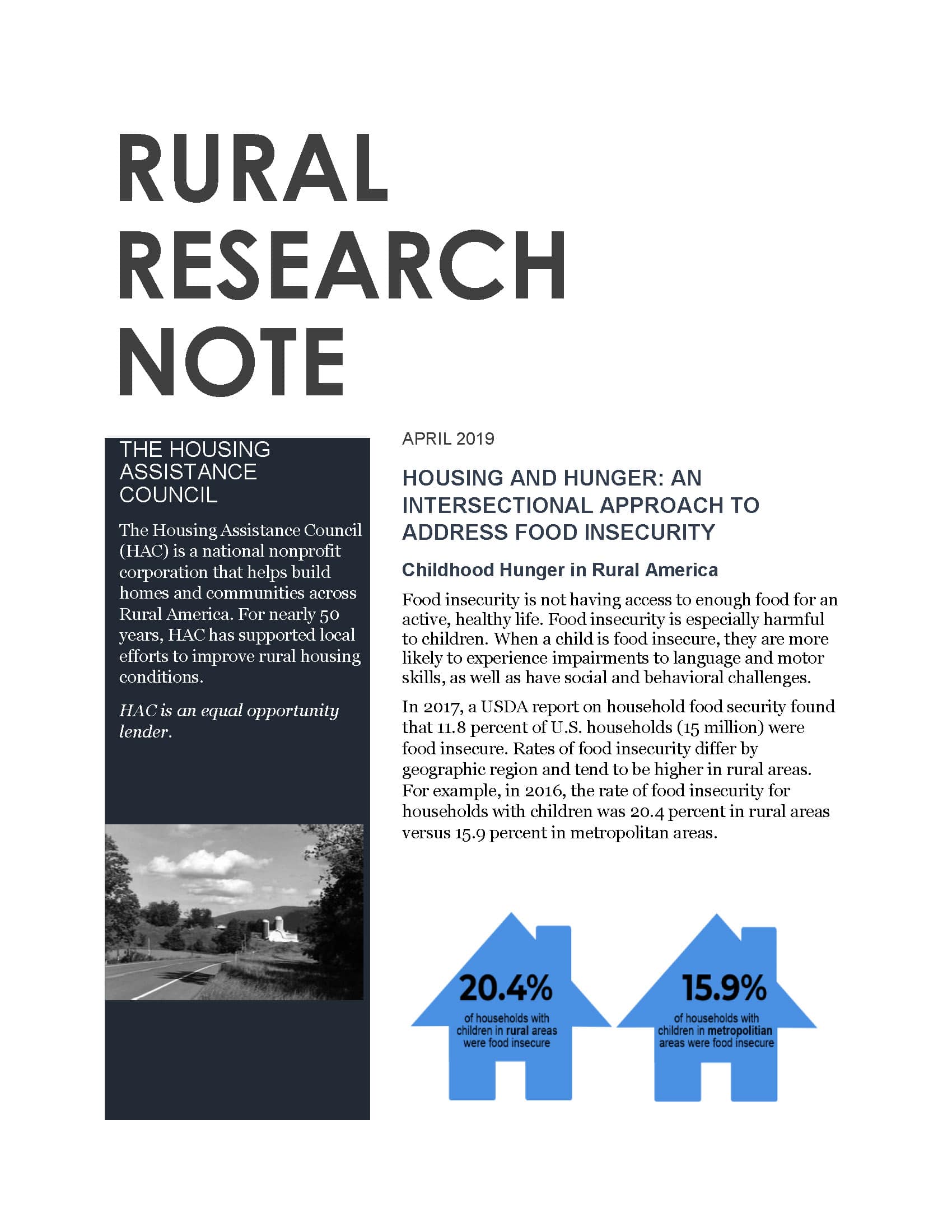

Food insecurity negatively affects childhood development and rural areas have higher rates of food insecurity. The Summer Meals program only serves 1 in 7 eligible students, but an increasing number of USDA multi-family properties serve as meal sites for this program. Stronger and continued collaboration between housing facilities and child nutrition programs will reduce rural childhood hunger during the summer months.

Food insecurity negatively affects childhood development and rural areas have higher rates of food insecurity. The Summer Meals program only serves 1 in 7 eligible students, but an increasing number of USDA multi-family properties serve as meal sites for this program. Stronger and continued collaboration between housing facilities and child nutrition programs will reduce rural childhood hunger during the summer months.