HAC News Formats. pdf

December 10, 2014

Vol. 43, No. 24

• Congress nears final action on 2015 spending • House passes NAHASDA reauthorization • New appropriations panel chairs announced • Mensah sworn in at USDA • USDA issues limited English proficiency guidance • VA adopts final HISA program regulation • HUD extends deadline for 202/811 comments • Email list for USDA direct single-family housing loan programs launched • HAC honors rural housing leaders • HAC Rural Housing Conference materials available • Rural Voices covers poverty in rural America • New HAC report examines senior housing

December 10, 2014

Vol. 43, No. 24

CONGRESS NEARS FINAL ACTION ON 2015 SPENDING. A wrap-up spending bill for FY 2015 was unveiled by House appropriators on December 9. The bill (H.R. 83) has been labeled a “cromnibus” because it provides a continuing resolution (CR) for the Department of Homeland Security through February 27 and an omnibus for the rest of the government, including USDA and HUD, through September 30. Republicans opposed to the President’s recent actions on immigration will look further at that issue in DHS appropriations when the new Congress convenes in January. The House is expected to pass the bill this week but the current government-wide CR expires December 11, so another two- or three-day CR may be needed for final Senate consideration. Check HAC’s web site for updates.

USDA. Rejecting most of the Administration’s FY 2015 budget proposals, H.R. 83 retains funding for Section 502 direct loans and the Rural Community Development Initiative and increases Section 523 self-help. It does not adopt the Administration’s request for minimum rents but does prohibit renewal of RA contracts that use up their funding before their full 12-month terms, and directs USDA to report on RA implementation by June 1, 2015. The bill also continues the pilot packaging program for Section 502 direct loans. The table below has details. [tdborder][/tdborder]

USDA Rural Dev. Prog.

(dollars in millions) |

FY13

Approp.a

|

FY14

Approp.

|

FY15

Admn. Bdgt.

|

FY15 Hse. Bill H.R. 4800

|

FY15 Sen. Bill S. 2389

|

FY15 Final

H.R. 83

|

|

502 Single Fam. Direct

Self-Help setaside

|

$900

5

|

$900

5

|

$360

0

|

$1,042

5

|

$900

5

|

$900

5

|

|

502 Single Family Guar.

|

24,000

|

24,000

|

24,000

|

24,000

|

24,000

|

24,000

|

|

504 VLI Repair Loans

|

28

|

26.3

|

26.3

|

26.4

|

26.3

|

26.3

|

|

504 VLI Repair Grants

|

29.5

|

28.7

|

25

|

27

|

28.7

|

28.7

|

|

515 Rental Hsg. Direct Lns.

|

31.3

|

28.4

|

28.4

|

28.3

|

28.4

|

28.4

|

|

514 Farm Labor Hsg. Lns.

|

20.8

|

23.9

|

23.9

|

23.6

|

23.8

|

23.6

|

|

516 Farm Labor Hsg. Grts.

|

7.1

|

8.3

|

8.3

|

8.3

|

8.3

|

8.3

|

|

521 Rental Assistanceb

|

907.1

|

1,110

|

1,089

|

1,089

|

1,094

|

1,089

|

|

523 Self-Help TA

|

30

|

25

|

10

|

30

|

25

|

27.5

|

|

533 Hsg. Prsrv. Grants

|

3.6

|

3.5

|

0

|

0

|

3.5

|

3.5

|

|

538 Rental Hsg. Guar.

|

150

|

150

|

150

|

150

|

150

|

150

|

|

Rental Prsrv. Demo. (MPR)

|

17.8

|

20

|

20

|

20

|

20

|

17

|

|

542 Rural Hsg. Vouchers

|

10

|

12.6

|

8

|

8

|

8

|

7

|

|

Rural Cmnty. Dev’t Init.

|

6.1

|

6

|

0

|

5

|

6

|

4

|

|

a. Figures shown do not include 5% sequester or 2.5% across the board cut.

b. The final FY13 appropriation for RA included a $3 million 514/516 setaside; the final appropriations for FY14 and FY15 have no setasides.

|

HUD. The bill reduces funding for some HUD programs and provides level funding for others. Only Section 202 receives an increase. CDBG, HOME, rental assistance, and public housing have mostly small reductions below FY14 appropriated levels. SHOP, VASH vouchers for homeless veterans, Native American housing, AIDS housing, and lead hazard control all received the same levels as in 2014. The table below has details.

HUD Program

(dollars in millions) |

FY13

Approp.a

|

FY14

Approp.

|

FY15

Admn. Bdgt.

|

FY15 Hse. Bill

H.R. 4745

|

FY15 Sen. Bill

S. 2438

|

FY15 Final

H.R. 83

|

|

Cmty. Devel. Fund

CDBG

|

3,308

2,948

|

3,100

3,030

|

2,870

2,800

|

3,060

3,000

|

3,090

3,020

|

3.066

3,000

|

|

HOME

SHOP setaside

|

1,000

b

|

1,000

b

|

950

10

|

700

10

|

950

b

|

900

b

|

|

Self-Help Homeownshp. (SHOP)

|

13.5

|

10

|

b

|

b

|

10

|

10

|

|

Tenant-Based Rental Asstnce.

VASH setaside

|

18,939.4

75

|

19,177.2

75

|

20,100

75

|

19,356

75

|

19,562

75

|

19,304

75

|

|

Project-Based Rental Asstnce.

|

9,339.7

|

9,516.6

|

9,346

|

9,346

|

9,346

|

9,330

|

|

Public Hsg. Capital Fund

|

1,886

|

1,875

|

1,925

|

1,775

|

1,900

|

1,875

|

|

Public Hsg. Operating Fund

|

4,262

|

4,400

|

4,600

|

4,400

|

4,475

|

4,440

|

|

Choice Neighbrhd. Initiative

|

120

|

90

|

120

|

0

|

90

|

80

|

|

Native Amer. Hsg. Block Grant

|

650

|

650

|

650

|

650

|

650

|

650

|

|

Homeless Assistance Grantsc

|

2,033

|

2,105

|

2,406.4

|

2,105

|

2,145

|

2,135

|

|

Hsg. Opps. for Persons w/ AIDS

|

334

|

330

|

332

|

303

|

330

|

330

|

|

202 Hsg. for Elderly

|

377

|

385.3

|

440

|

420

|

420

|

436

|

|

811 Hsg. for Disabled

|

165

|

126

|

160

|

135

|

135

|

135

|

|

Fair Housing

|

70.8

|

66

|

71

|

56

|

66

|

65.3

|

|

Healthy Homes & Lead Haz. Cntl.

|

120

|

110

|

120

|

70

|

110

|

110

|

|

Housing Counseling

|

45

|

45

|

60

|

45

|

49

|

47

|

|

a. Figures shown do not include 5% sequester.

b. In FY13 and FY14 SHOP was funded under the Self-Help & Assisted Homeownership Opportunity Program account. For FY15 the Administration’s budget proposed making the program a setaside in HOME. The final FY15 bill specifically rejects that proposal.

c. Includes the Rural Housing Stability Program, which is not yet operational.

|

HOUSE PASSES NAHASDA REAUTHORIZATION. H.R. 4329 would authorize housing programs for Native Americans and Native Hawaiians through FY18, but would limit funding each year to not more than the current $650 million level. The Senate bill (see HAC News, 8/6/14) does not cap funding.

NEW APPROPRIATIONS PANEL CHAIRS ANNOUNCED. For the new Congress convening in January, Rep. Harold Rogers (R-KY) continues in another term as chairman of the House Appropriations Committee. Rep. Robert Aderholt (R-AL) continues as chairman of the Subcommittee on Agriculture and Rural Development. Rep. Mario Diaz-Balart (R-FL) will be the new chairman of the Subcommittee on Transportation-HUD.

MENSAH SWORN IN AT USDA. On December 5, Lisa Mensah was sworn in by USDA Secretary Tom Vilsack as the new Under Secretary of Agriculture for Rural Development.

USDA ISSUES LIMITED ENGLISH PROFICIENCY GUIDANCE. The guidance is intended to help recipients of USDA funding ensure they do not discriminate against LEP persons. Contact Anna G. Stroman, USDA, 202-205-5953.

VA ADOPTS FINAL HISA PROGRAM REGULATION. The Home Improvements and Structural Alterations program serves disabled veterans. (See HAC News, 12/4/13.) Contact Shayla Mitchell, VA, 202-461-0366.

HUD EXTENDS DEADLINE FOR 202/811 COMMENTS. A notice in the December 11 Federal Register will move the deadline for comments on suggested regulatory changes (see HAC News, 10/17/14) to January 15. A HUD webinar about the proposal is posted online. Contact Alicia Anderson, HUD, 202-708-3000.

EMAIL LIST FOR USDA DIRECT SINGLE-FAMILY HOUSING LOAN PROGRAMS LAUNCHED. USDA will use the list to distribute information about Section 502 direct, 504, and 523. Sign up for this or for lists covering the Section 502 guarantee program at https://www.rdlist.sc.egov.usda.gov/listserv/mainservlet.

HAC HONORS RURAL HOUSING LEADERS. At the HAC Rural Housing Conference, Sen. Patrick Leahy (D-VT) and Rep. Harold Rogers (R-KY) received the Henry B. González Award for elected officials. The Clay Cochran/Art Collings Award for national service went to former Sen. Kit Bond. Recipients of the Skip Jason Award for community achievement were Brad Bishop, Self-Help Homes, UT; Martha Mendez, Coachella Valley Housing Coalition, CA; Retha Patton, Eastern Eight Community Development Corporation, TN; and Andres Saavedra, Rural LISC, DC.

HAC RURAL HOUSING CONFERENCE MATERIALS AVAILABLE. The conference app will remain active for at least six months, offering materials from each workshop, lists of attendees and speakers, and more. Videos of the plenary sessions, as well as photos taken throughout the event, will be posted soon. Check HAC’s website for updates.

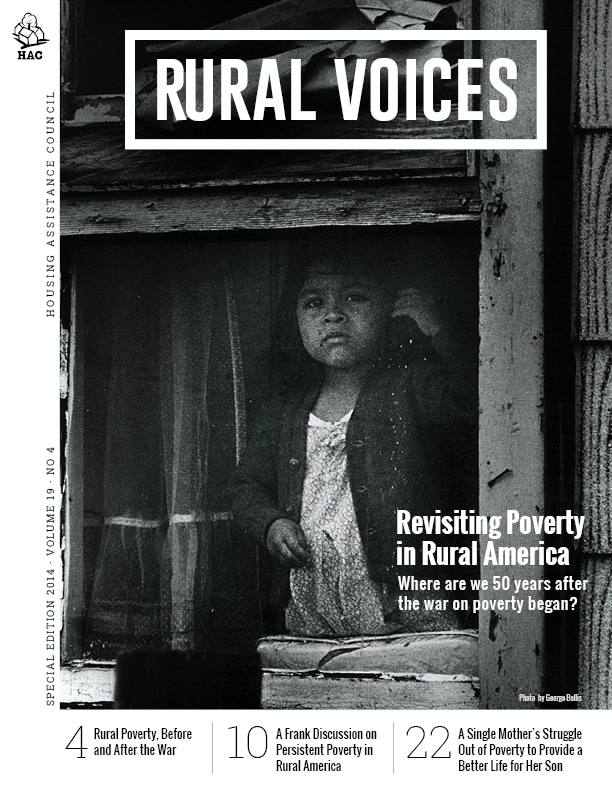

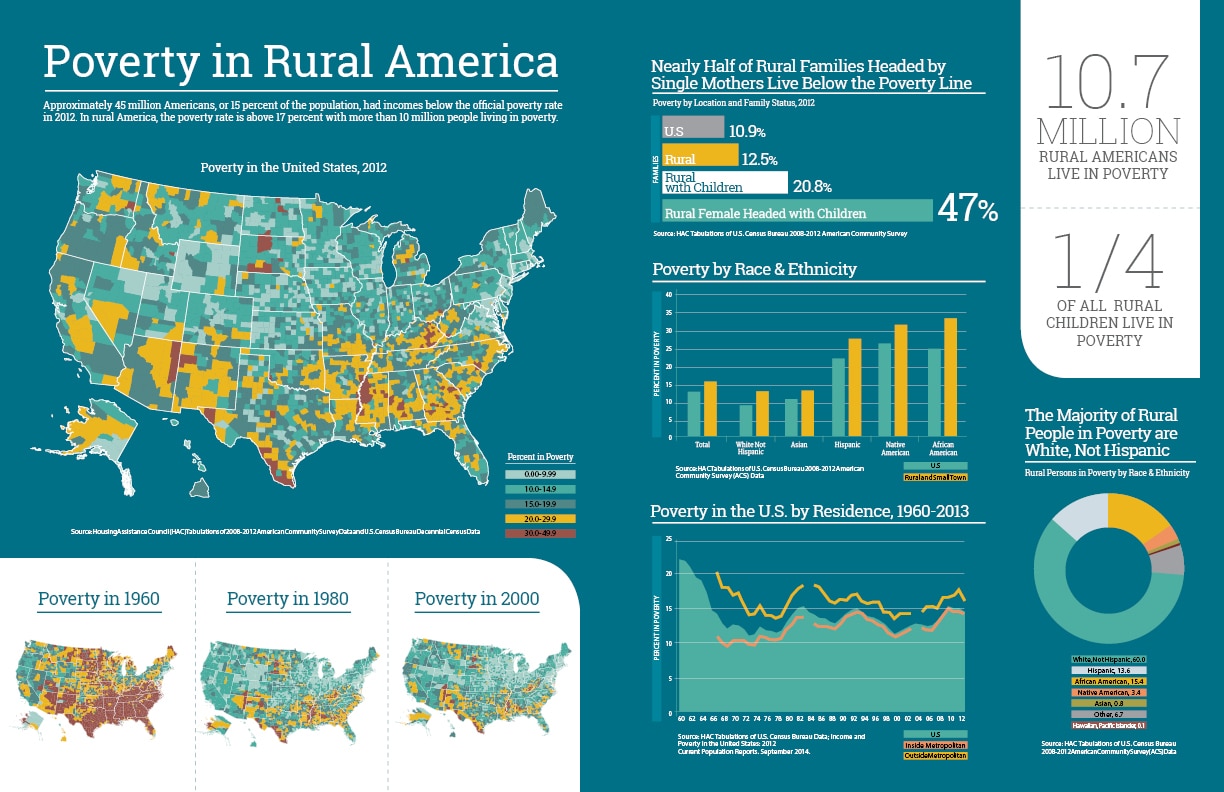

RURAL VOICES COVERS POVERTY IN RURAL AMERICA. A special edition of HAC’s quarterly magazine asks what has changed since the War on Poverty was declared 50 years ago, what has not, and what can be done. Sign up online for email notices when new issues are published.

NEW HAC REPORT EXAMINES SENIOR HOUSING. Housing an Aging Rural America: Rural Seniors and Their Homes looks at the demographic characteristics of rural elders and considers ways to provide quality, affordable housing for them.

Poverty in Rural America

Poverty in Rural America