News

Jennifer Emerling / There Is More Work To Be Done

Jennifer Emerling / There Is More Work To Be Done

On July 20 the House passed a minibus appropriations bill, approving funding levels for several federal agencies including USDA and HUD. The Senate has not yet begun actions on FY23 appropriations, and a continuing resolution is expected to be needed to begin the fiscal year on October 1, 2022.

USDA proposes to waive Build America, Buy America (BABA) Act requirements for small awards, small parts of larger awards, and minor components of infrastructure projects financed by the department. Comments are due by August 2 to sm.OCFO.ffac@usda.gov. These waivers would be in effect for five years. USDA did not include any RD housing or community facilities programs on an initial list of programs that finance infrastructure, but it does mention multifamily housing and CF in the new waiver proposal, indicating it may be considering some of these activities to be infrastructure. (USDA has also requested the BABA requirements be suspended for all Rural Development-financed activities for six months.) For more information, contact Tyson Whitney, USDA, 202-720-8978. HAC has posted a summary of BABA requirements and their status, along with comments HAC submitted to HUD about its implementation of the law.

On July 14 when the House passed H.R. 7900, the FY23 National Defense Authorization Act, it included (p. H6599) an amendment that would permanently authorize HUD’s Community Development Block Grant-Disaster Recovery program. Authorization could make the program’s funding more predictable and reliable. The provision must be adopted by the Senate as well in order to become law.

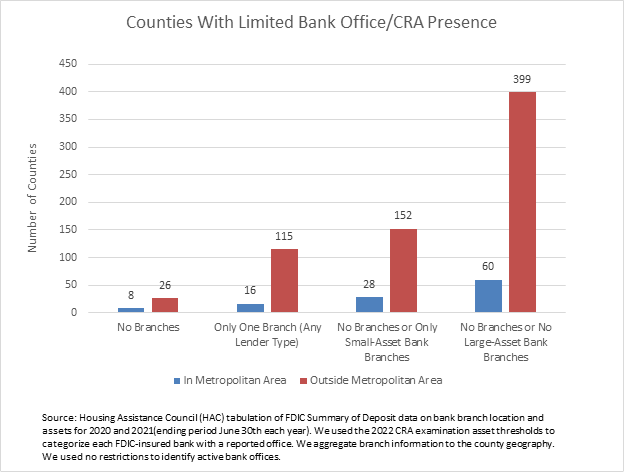

Sixty counties in metropolitan areas have limited banking options, compared to 399 counties outside metro areas. Source: HAC tabulation of FDIC data.

Nonprofit organizations offering nationwide or statewide programs that primarily serve veterans or low-income individuals are eligible for the Veterans Housing Rehabilitation and Modification Pilot Program from HUD and VA. Grants may be used to modify or rehabilitate eligible veterans’ primary residences or to provide grantees’ affiliates with technical, administrative, and training support related to those services. Apply by August 24. For more information, contact Jovette Bryant, HUD, 877-787-2526.

HAC’s 2022 Creative Placemaking for Rural Initiative, under USDA’s Rural Placemaking Innovation Challenge Initiative, will provide support and technical assistance to create and implement innovative placemaking strategies. USDA RD defines placemaking as a collaborative process among public, private, philanthropic, and community partners to strategically improve the social, cultural, and economic structure of a community. For more information, contact HAC staff, cpr@ruralhome.org.

The CDFI Equitable Recovery Program will make awards to certified Community Development Financial Institutions to expand lending, grant making, and investment activity in low- or moderate-Income communities and to borrowers, including minorities, that have significant unmet capital or financial services needs and were disproportionately impacted by the COVID-19 pandemic, and to enable CDFIs to build organizational capacity to accomplish these activities. Applications are now due September 22. For more information, contact CDFI Fund staff, erp@cdfi.treas.gov, 202-653-0421.

Shelterforce offers a roundup of feedback about the proposed CRA rule. Including explicit references to race, imposing stronger requirements for small banks serving rural areas, and making bank data available to the public are suggested. The deadline to submit comments is August 5.

The Treasury Department has updated its Frequently Asked Questions on Emergency Rental Assistance for pandemic-impacted tenants. Among the changes, new answer 44 makes clear that ERA administrators may not impose additional eligibility criteria, including employment or job training requirements, as a condition of providing ERA assistance. Other new posts on the ERA site include a notice regarding ERA1 recapture for Tribal governments.

HUD’s methodology for calculating Fair Market Rents relies on the American Community Survey, but the Census Bureau is not releasing 2020 ACS data because of the pandemic’s impacts on data collection, so HUD proposes to changes the way it calculates FMRs for FY23. Comments are due August 12. For more information, contact Adam Bibler, HUD, 202-402-6057.

HUD proposes to adopt amendments to the Federal Manufactured Home Construction and Safety Standards, along with relevant regulations and installation standards, recommended by the Manufactured Housing Consensus Committee. Comments are due September 19. For more information, contact Teresa B. Payne, HUD, 202-402-2698.

FY23 fee rates will be effective October 1 with applications for guaranteed loans under USDA Rural Development’s Community Facilities, Water and Waste Disposal, Business and Industry, and Rural Energy for America programs. These fees may be adjusted after passage of final FY23 appropriations. For more information, contact Michele Brooks, USDA, 202-690-1078.

Housing Underproduction™ in the U.S. 2022, published by Up for Growth, reports that the U.S. needed 3.8 million more homes in 2019, twice as many as in 2012. The report includes some rural data and some at the state level – noting, for example, that the extent of underproduction and the reasons for it vary from place to place – although it emphasizes metropolitan areas. The writers propose policy changes, but say that “socially vulnerable communities” need different, more targeted approaches.

Rural Outdoor Recreation Economies: Challenges and Opportunities, from the Aspen Institute Community Strategies Group, suggests tactics including collaborations, careful planning, workforce training, and requiring short-term rentals to be owner-occupied.

A National Housing Law Project survey of legal aid attorneys found that in many places evictions in HUD-assisted housing are returning to pre-pandemic levels or higher. Tenants with housing vouchers have fared worse than tenants in public housing. Although HUD provided ways to adjust rents quickly, it did not require PHAs to use them and also did not require PHAs or voucher holders’ landlords to apply for emergency rental assistance, so many did not. The survey report includes recommendations for improvement.

Learning Through Collaboration: Field Leaders Drive Critical Conversations, a post on the Aspen Institute’s community development blog, describes the work and learnings on equitable rural prosperity developed through the Rural Opportunity and Development (ROAD) collaboration among the Aspen Institute Community Strategies Group, HAC, the Rural Community Assistance Partnership, Rural LISC, and the Federal Reserve Board. For more information, contact Devin Deaton, Aspen Institute.

Low-Income Housing Tax Credit (LIHTC) at Risk examines the risks of expiring LIHTC restrictions and the outcomes for properties that exit the program. Freddie Mac researchers found that about 61% of units that left the LIHTC program remained affordable for tenants with incomes at 60% of area median. The analysis did not include properties outside metropolitan areas because they were considered to have a lower risk of exiting.

HAC’s loan fund provides low interest rate loans to support single- and multifamily affordable housing projects for low-income rural residents throughout the U.S. and territories. Capital is available for all types of affordable and mixed-income housing projects, including preservation, new development, farmworker, senior and veteran housing. HAC loan funds can be used for pre-development, site acquisition, site development, construction/rehabilitation and permanent financing. Contact HAC’s loan fund staff at hacloanfund@ruralhome.org, 202-842-8600.

Please note: HAC is not able to offer loans to individuals or families. Borrowers must be nonprofit or for-profit organizations or government entities (including tribes).

Please credit the HAC News and provide a link to HAC’s website. Thank you!

Eastern Kentucky Flooding Disaster Guide

Eastern Kentucky Flooding Disaster Guide