No, Minimum Rents Do Not “Encourage Financial Responsibility”

by Gideon Anders

March 13, 2014

President Obama’s 2015 Budget seeks to impose a $50 per month minimum rent on tenants living in USDA Rural Development (RD) financed Section 515 Rural Rental Housing and Section 514 and 516 Farm Labor Housing.

President Obama’s 2015 Budget seeks to impose a $50 per month minimum rent on tenants living in USDA Rural Development (RD) financed Section 515 Rural Rental Housing and Section 514 and 516 Farm Labor Housing.

This will only impact extremely low-income households with adjusted annual incomes of less than $2,000. These are the absolute poorest households residing in RD housing. They typically do not have a regular source of income. RD indicates this requirement will affect about 42,000, or 10 percent, of the households living in RD rental housing…

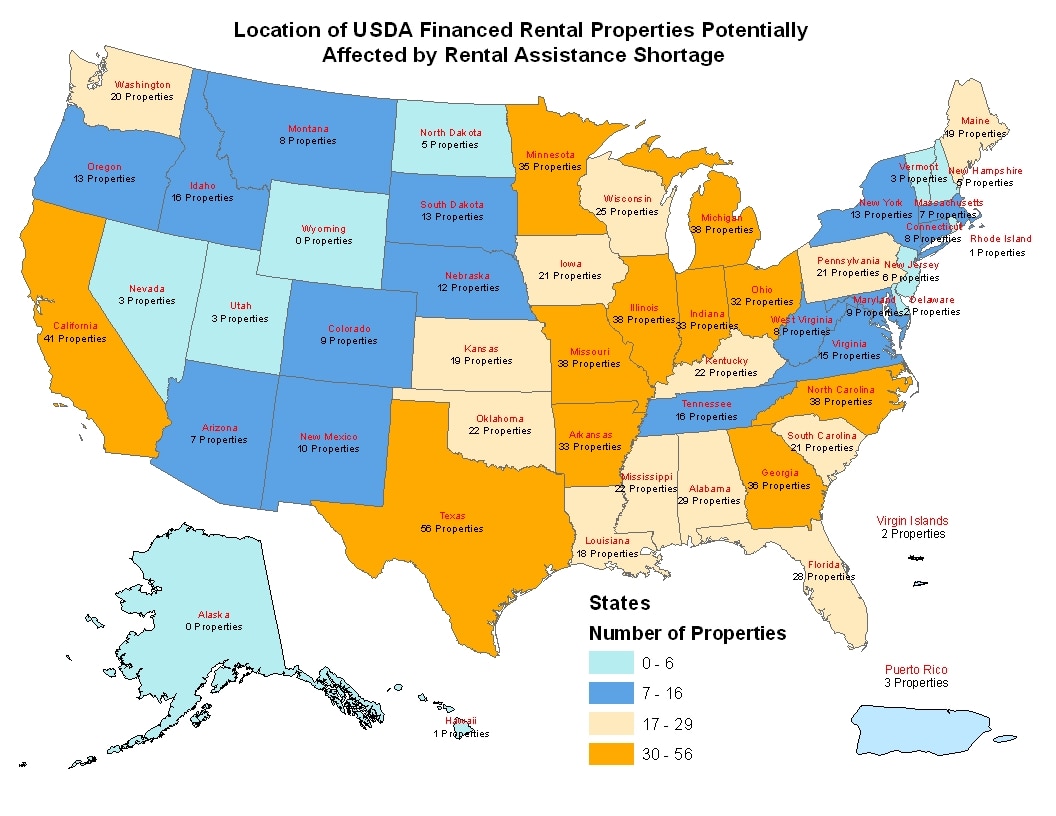

In March 2013, Congress passed a final appropriations bill for the current fiscal year. While the final language included full spending bills for USDA, it was also subject to a 5% sequester and a 2.5% across the board cut. This resulted in a reduction of approximately $65 million to the Section 521 Rental Assistance program. USDA recently

In March 2013, Congress passed a final appropriations bill for the current fiscal year. While the final language included full spending bills for USDA, it was also subject to a 5% sequester and a 2.5% across the board cut. This resulted in a reduction of approximately $65 million to the Section 521 Rental Assistance program. USDA recently  Stephen B. Fitzgerald, Senior Vice President of the Bank of America Charitable Foundation, presents a check to Moises Loza for support of HAC’s work in affordable rural housing. A key and very generous supporter of HAC for a number of years, Bank of America is also a major investor in HAC’s Rural Housing Loan Fund.

Stephen B. Fitzgerald, Senior Vice President of the Bank of America Charitable Foundation, presents a check to Moises Loza for support of HAC’s work in affordable rural housing. A key and very generous supporter of HAC for a number of years, Bank of America is also a major investor in HAC’s Rural Housing Loan Fund.