HAC News Formats. pdf

October 29, 2014

Vol. 43, No. 21

• Rent aid kept over 3 million people out of poverty in 2013 • Regulatory agencies align QRM with QM, drop requirement for large downpayments • HUD posts general section of FY15 NOFAs • Electronic signatures now accepted for Section 502 guaranteed loans • CFPB lists rural and underserved counties for 2015 • Public housing demolition and disposition proposal corrected • HUD provides guide to establishing smoke-free properties • GAO offers framework for assessing housing finance reform • Guide helps nonprofits to preserve Low Income Housing Tax Credit properties • 2013 American Housing Survey data released • Household participation in banking system increased, 2011 to 2013 • Have you investigated HAC’s Rural Data Portal? • HAC News e-mail subscribers get news faster

October 29, 2014

Vol. 43, No. 22

RENT AID KEPT OVER 3 MILLION PEOPLE OUT OF POVERTY IN 2013. The Supplemental Poverty Measure: 2013, published by the Census Bureau, presents data with adjustments that are not taken into account in the official poverty measure (see HAC News, 9/17/14), including the impact of government programs assisting low-income people. A Center on Budget and Policy Priorities analysis of the data shows that rental assistance alone kept 3 million people out of poverty, and all assistance programs lifted 39 million people above the poverty line.

REGULATORY AGENCIES ALIGN QRM WITH QM, DROP REQUIREMENT FOR LARGE DOWNPAYMENTS. As proposed in September 2013 (see HAC News, 9/25/13), final credit risk retention regulations define “qualified residential mortgages” the same way as the Consumer Financial Protection Bureau defines “qualified mortgages.” Private mortgage lenders are expected to focus on QRM lending when the rule takes effect in October 2015, so a 2011 proposal that included a 20% downpayment in the QRM definition would have made it more difficult for low-income, minority, and first-time homebuyers to obtain mortgages. USDA Section 502 mortgages are all considered QRMs until USDA issues its own regulations on the subject. Contact Ronald P. Sugarman, FHFA, 202-649-3208 or Mike Feinberg, HAC, 202-842-8600.

HUD POSTS GENERAL SECTION OF FY15 NOFAS. As in the past, the general section will apply to all of HUD’s funding announcements for individual programs when they are issued. Contact HUD’s Office of Strategic Planning and Management, 202-708-0667.

ELECTRONIC SIGNATURES NOW ACCEPTED FOR SECTION 502 GUARANTEED LOANS. Administrative Notice 4776 (September 23, 2014) “clarifies that lenders may use electronic signatures as long as the lender perfects and maintains a first lien position, an enforceable promissory note, and meets all other agency requirements.” Contact USDA RD’s Single Family Housing Guaranteed Loan Division, 202-720-1452.

CFPB LISTS RURAL AND UNDERSERVED COUNTIES FOR 2015. The designations apply to several Consumer Financial Protection Bureau regulations.

PUBLIC HOUSING DEMOLITION AND DISPOSITION PROPOSAL CORRECTED. The proposed rule (see HAC News, 10/17/14) included an erroneous definition. Comments are still due December 15.

HUD PROVIDES GUIDE TO ESTABLISHING SMOKE-FREE PROPERTIES. Change is in the Air: An Action Guide for Establishing Smoke-Free Public Housing and Multifamily Properties provides reasons, best practices, and step by step guidance.

GAO OFFERS FRAMEWORK FOR ASSESSING HOUSING FINANCE REFORM. Housing Finance System: A Framework for Assessing Potential Changes (GAO-15-131) describes and analyzes market developments since 2000 that have led to changes in the federal government’s role in the single-family housing finance system, and proposes a way to assess potential changes to the system. Contact Matt Scirè, GAO, 202-512-8678.

GUIDE HELPS NONPROFITS TO PRESERVE LOW INCOME HOUSING TAX CREDIT PROPERTIES. Beyond Year 15: Preserving Housing Credit Projects & Portfolio, published by Enterprise Community Partners, includes organizational procedures for preparing for Year 15 events as well as strategies for repositioning communities for the long term. It covers all types of LIHTC projects but focuses on issues around the most challenging projects and approaches to address those challenges.

2013 AMERICAN HOUSING SURVEY DATA RELEASED. HUD’s press release highlights the findings from questions on new subjects including neighborhood involvement, disaster planning, and use of public transportation. AHS data also include housing conditions, ownership rates, costs, and more. Nationwide, from 2011 to 2013, costs for renters rose slightly, while owners’ costs fell. Summary tables are posted in Excel format.

HOUSEHOLD PARTICIPATION IN BANKING SYSTEM INCREASED, 2011 TO 2013. A report on the 2013 FDIC National Survey of Unbanked and Underbanked Households credits changes in economic conditions and household demographics for the decline in “unbanked” households. In both 2011 and 2013, FDIC’s survey found the highest unbanked rates among non-Asian minorities and households who were lower-income, younger, or unemployed, though the unbanked rate for Hispanics dropped from 2011 to 2013. The report includes data at the national, state, and metro levels.

HAVE YOU INVESTIGATED HAC’S RURAL DATA PORTAL? The Rural Data Portal is an easy-to-use, on-line resource that provides essential information on the social, economic, and housing characteristics of communities in the United States. It is targeted toward rural communities, but a wide range of information is presented for the nation, states, and counties for rural, suburban, and urban areas.

HAC NEWS E-MAIL SUBSCRIBERS GET NEWS FASTER. Subscribe to the HAC News by e-mail and receive it sooner, plus updates when important news occurs between issues.

Housing Assistance Council

Housing Assistance Council

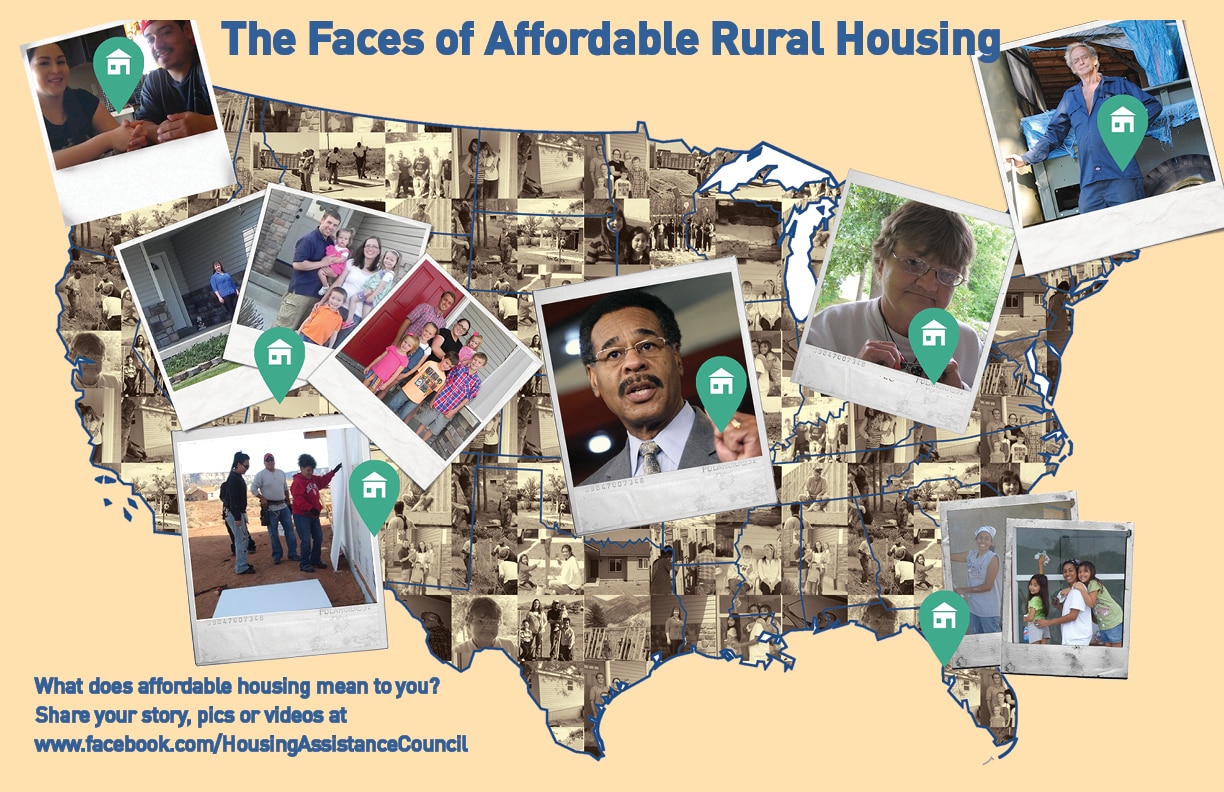

The Faces of Affordable Housing

The Faces of Affordable Housing