HAC News: June 10, 2021

June 10, 2021

Vol. 50, No. 12

TOP STORIES

HAC honors the legacy of Gordon Cavanaugh.

Gordon Cavanaugh, who served as HAC’s first Executive Director from 1971 until President Carter appointed him to lead the Farmers Home Administration in 1977, passed away on May 26 at the age of 93. Throughout his long career in affordable housing, Gordon was an inspiring leader and a fierce advocate. His commitment to serving the poorest of the poor still lies at the heart of HAC’s work.

USDA housing budget proposes increases in Section 502 mortgages and rental preservation, HUD budget would raise many programs’ funding.

The Biden administration’s first full budget request would increase the Section 502 direct loan program from $1 billion to $1.5 billion and Section 502 guarantees from $24 billion to $30 billion. Fiscal year 2022 funding for most other rural housing programs would remain at the same levels as in FY21. The budget proposes to eliminate some protections for Section 521 Rental Assistance. It also indicates that the American Jobs Plan – the administration’s infrastructure proposal – would provide an additional $2 billion in rural housing spending, without providing details. Under the administration’s FY22 HUD request, HOME and CDBG would see large funding increases, as would Native American and Native Hawaiian housing programs, tenant vouchers, and programs that serve people experiencing homelessness, elders, people with disabilities, people with AIDS, and more. The SHOP program would remain at its FY21 level of $10 million. In addition to the budget proposal, the infrastructure plan would provide significant funding for many HUD programs. Each house of Congress will now craft its own proposal and differences will be worked out in the months to come.

2015 Affirmatively Furthering Fair Housing rule partially reinstated, disparate impact changes expected soon.

HUD has issued an interim regulation, effective on July 31, 2021, that repeals its August 2020 AFFH regulation and reinstates definitions and certifications from the AFFH rule it adopted in 2015. This interim final rule does not require jurisdictions receiving HUD funding to undertake any specific type of fair housing planning to support their certifications, but HUD offers assistance to jurisdictions that choose to do so. HUD will issue a separate proposal on implementation of AFFH obligations, stating that it “will seek to build on and improve the processes set forth in the 2015 AFFH rule to further help funding recipients comply with their statutory obligation while reducing the regulatory burden on them.” Comments on this interim rule are due July 12. For more information, contact Sasha Samberg-Champion, HUD, 202-402-3413. HUD is also expected to announce revisions soon to its September 2020 rule on fair housing disparate impact.

As attacks on eviction moratorium continue in court, it remains in effect but will expire June 30.

A federal appellate court agreed with a lower court judge that the eviction moratorium imposed by the Centers for Disease Control should remain effective while the appellate court considers its validity. Landlord representatives appealed that ruling to the U.S. Supreme Court, which could issue a decision as early as June 11. The moratorium is set to expire on June 30, even if there is no final court decision by that date.

June is National Homeownership Month.

Building on President Biden’s proclamation, USDA and HUD are observing the occasion. Follow HAC on social media for relevant policy recommendations, homeownership stories, and more.

June is Pride Month.

President Biden proclaimed June as Lesbian, Gay, Bisexual, Transgender, and Queer Pride Month. HAC recognizes and celebrates the diversity that makes every community unique.

RuralSTAT

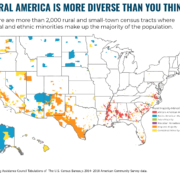

There are more than 2,000 rural and small-town census tracts where racial and ethnic minorities make up the majority of the population. Source: Housing Assistance Council tabulations of the U.S. Census Bureau’s 2014-2018 American Community Survey.

OPPORTUNITIES

Section 533 Housing Preservation Grant applications open.

USDA Rural Development will make HPG grants to public agencies and nonprofits to assist low- and very low-income rural homeowners in repairing and rehabilitating their homes, and to cooperative housing complexes and rental property owners to repair and rehabilitate units in rural areas available to low- and very low-income persons. Pre-applications are due July 19. For more information, contact Bonnie Edwards-Jackson, RD, 202-690-0759.

USDA expands water/wastewater programs.

The Rural Decentralized Water Systems Grant program funds nonprofit or tribal lenders to make affordable loans to homeowners who need new household water systems in places with populations up to 50,000 including tribal lands and colonias. The program now includes building or repairing septic systems, and lenders can provide grants to homeowners with incomes under 60% of area median. Deadline is July 19. For more information, contact Taylor Marable, RD, 615-772-8726, or an RD state office. The Water and Wastewater Projects Revolving Funds Program enables nonprofits to make loans for water and wastewater treatment projects’ pre-development costs or for short-term and small capital improvement projects. Places, including tribal lands and colonias, with populations up to 10,000 are eligible. The maximum loan amount for FY21 is $200,000 rather than the previous $100,000. Deadline is July 16. For more information, contact Lois East, RD, 660-492-4268, or an RD state office.

HUD offers Lead Hazard Reduction funds.

Grants are available to help local governments and some states and tribes undertaking comprehensive programs to identify and control lead-based paint hazards in privately owned rental or owner-occupied housing where children under age six are at risk. Deadline is July 12. For more information, contact Yolanda Brown, HUD, 202-903-9576.

HOPWA Special Projects of National Significance grants available.

Nonprofits, states, and local governments are eligible for grants to produce new projects that align with initiatives aimed at ending the HIV/AIDS epidemic and elevate housing as an effective structural intervention in ending the epidemic. Apply by July 6. For more information, contact HUD staff.

Hometown Grants aim to revitalize community spaces.

Grants of up to $50,000 are available from T-Mobile, in partnership with Smart Growth America and Main Street America, to build, rebuild, or refresh community spaces that help foster local connections in cities and towns with populations under 50,000. Local governments or nonprofits are eligible. Deadlines are June 30, September 30, and December 31.

Conference Coordinator and Community Facilities Housing Specialist positions open at HAC.

For details, visit HAC’s website.

- The Conference Coordinator is a full-time, temporary position and is eligible for telecommuting.

- The Community Facilities Housing Specialist is a two-year position and is eligible for telecommuting.

CORONAVIRUS

Forbearance for multifamily property owners extended.

Owners of multifamily rental properties with mortgages backed by Fannie Mae or Freddie Mac can now request mortgage forbearance through September 30. Owners must inform tenants about their rights and cannot evict tenants for nonpayment of rent during the forbearance period.

REGULATIONS AND FEDERAL AGENCIES

Changes proposed for USDA single-family guaranteed loan program regulations.

The revisions to the Section 502 guaranteed program would update the requirements for federally supervised lenders, minimum net worth and experience for non-supervised lenders, approved lender participation requirements, treatment of applicants with delinquent child support payments, and builder credit requirements. Comments are due August 9. For more information, contact Ana Placencia, USDA, 254-721-0770.

GAO study recommends ways to increase 10-20-30 impact in persistent poverty counties.

Areas with High Poverty: Changing How the 10-20-30 Funding Formula Is Applied Could Increase Impact in Persistent-Poverty Counties examines the requirement for some programs of USDA Rural Development, the Economic Development Administration, and the CDFI Fund to allocate at least 10% of their funds to counties with poverty rates of at least 20% over the last 30 years. The report recommends using the formula selectively, since some programs achieve this allocation without a requirement and others cannot achieve it because of program design. It also supports creation of a single list of persistent poverty counties.

Interim appraisal requirements adopted for USDA’s Community Facilities loan programs.

Because of the coronavirus emergency, USDA RD has established interim requirements, effective until December 31, for appraisals of real estate being used as collateral for direct or guaranteed Community Facilities loans.

PUBLICATIONS AND MEDIA

Building materials’ costs and shortages increase.

A National Association of Home Builders survey in May found costs for building materials have increased an average of 26.1% over the last 12 months. NAHB also reports an all-time high in the number of builders experiencing material shortages.

“Doubly disadvantaged: rural communities left out in federal income limits formula.”

Flaws in the use of area median incomes to determine aid eligibility are described in a Spotlight on Poverty and Opportunity op-ed, written by Joshua Stewart from Fahe and H. Luke Shaefer from the University of Michigan. Where rural poverty is concentrated, AMIs are low, so fewer households qualify for aid. The problem is particularly common in Appalachia, the Mississippi Delta, the colonias, and tribal lands.

“Redefine rural.”

The Katy (Texas) Times notes the dramatic implications of OMB’s proposal to change the minimum population threshold for identifying metropolitan areas from 50,000 to 100,000. This definition is used to determine how certain federal program funds are distributed. For more information on this issue, see HAC’s website.

“Evictions at a Kentucky trailer park highlight Ohio Valley’s lack of affordable housing.”

The Ohio Valley Resource reports on manufactured home community evictions in Morehead, KY and draws attention to the larger affordable housing crisis happening in rural areas, including limited housing stock and looming mass evictions if the federal eviction moratorium is not extended beyond its June 30 expiration date. In addition to barriers to transportation, “a lack of tenant protections, rising rents, and high poverty rates” leave few options for low-income renters.

“In rural South Carolina, a groundbreaking broadband project takes root.”

Roll Call describes how the town of Allendale, SC has used existing broadcasting towers to make high-speed internet available to residents. The state broadband coordinator says other communities can use the same system by mounting equipment on water towers or other tall structures.

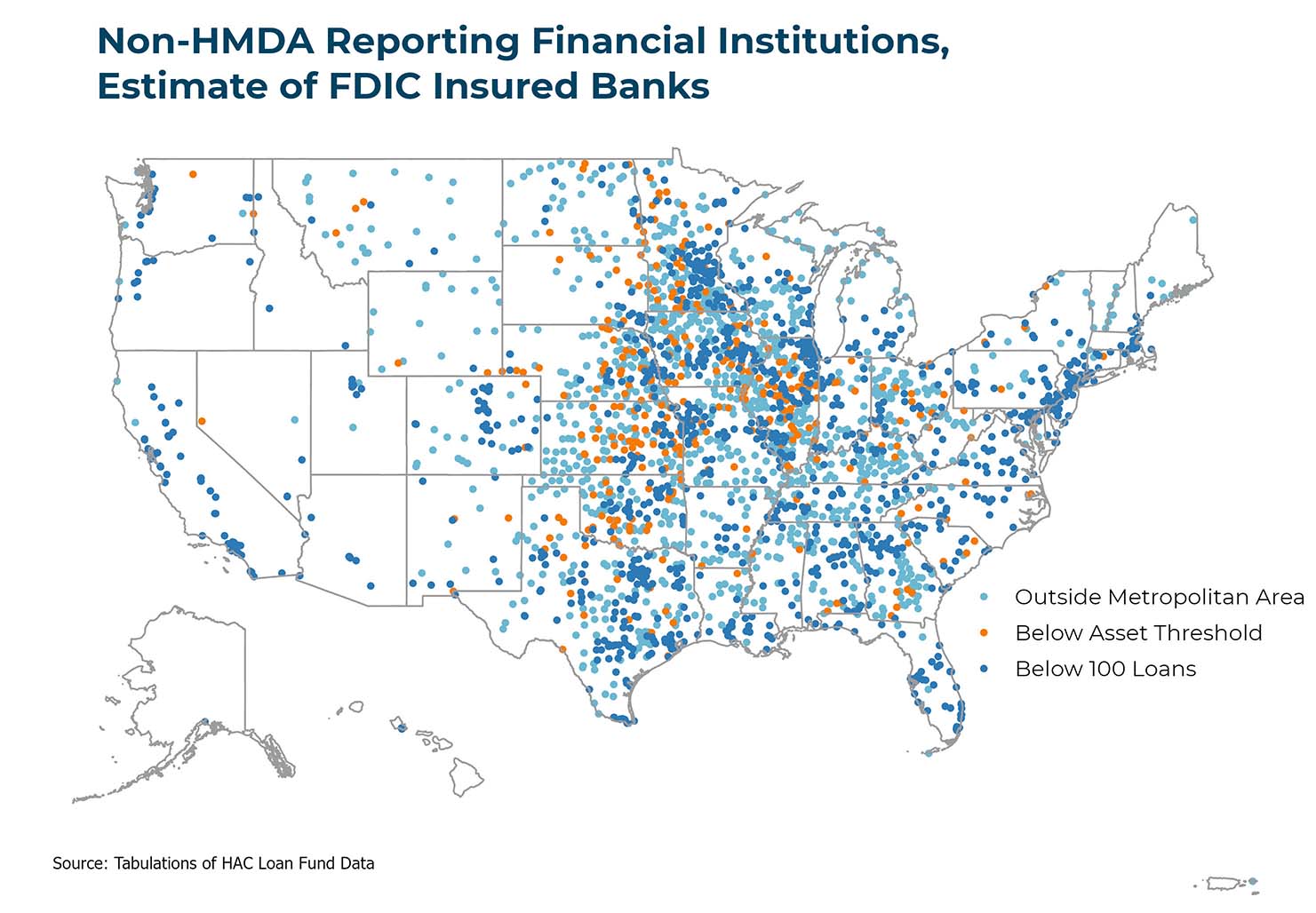

Need capital for your affordable housing project?

HAC’s loan fund provides low interest rate loans to support single- and multifamily affordable housing projects for low-income rural residents throughout the U.S. and territories. Capital is available for all types of affordable and mixed-income housing projects, including preservation, new development, farmworker, senior and veteran housing. HAC loan funds can be used for pre-development, site acquisition, site development, construction/rehabilitation and permanent financing. Contact HAC’s loan fund staff at hacloanfund@ruralhome.org, 202-842-8600.

Please note: HAC is not able to offer loans to individuals or families. Borrowers must be nonprofit or for-profit organizations or government entities (including tribes).

Housing Assistance Council

Housing Assistance Council