HAC News

Shawn Poynter / There Is More Work To Be Done

Shawn Poynter / There Is More Work To Be Done

HAC News Formats. pdf

April 15, 2021

Vol. 50, No. 8

TOP STORIES

Biden budget outline calls for more HUD funding and expanded Rural StrikeForce.

The Biden Administration’s first budget request, released on April 9, outlines priorities including increases in the HOME, CDBG and Native American housing programs, along with 200,000 new HUD vouchers. It proposes to increase funding above current levels for the Rural e-Connectivity broadband program, rural water and wastewater programs and USDA’s civil rights office but does not mention USDA’s rural housing programs. It includes $32 million to renew and expand an Obama administration StrikeForce initiative that aims to connect rural residents with federal resources. More information about the Biden proposal is posted on HAC’s website. A more detailed budget will be issued later this spring.

HUD launches process to restore fair housing rules.

One of President Biden’s early executive orders directed HUD to review two Trump administration fair housing regulations. On April 12, HUD sent replacement rules to OMB for review, the first step towards official Federal Register publication and eventual implementation. The documents themselves are not yet available online. Reinstatement of HUD’s Discriminatory Effects Standard is described as a proposed rule. Affirmatively Furthering Fair Housing; Restoring Statutory Definitions and Certifications is labeled an interim final rule.

Guidance provided for recently approved USDA Rental Assistance.

The American Rescue Plan Act appropriated $100 million in Section 521 RA for tenants at USDA-financed properties who are not already receiving rent support and are paying more than 30% of their income for rent. USDA explains that its RD staff will determine what tenants may be eligible and will contact property owners. Tenants currently paying more than 50% of their income toward rent will receive priority. Assistance will last for up to a year; further aid depends on appropriations. For more information, contact the relevant RD servicing official (on the linked page, click the Contact tab).

HAC offers flexible loans for rental preservation.

HAC has flexible loan capital available to support preservation of USDA Section 515 properties, HUD-subsidized properties and naturally occurring affordable housing in rural places. Eligible properties are existing affordable or mixed-income rental housing (with or without current income restrictions). Loans can be $50,000-$1.5 million, interest rates can be as low as 4.5%, and terms can be up to 180 months, with longer amortization periods based on project needs. Eligible borrowers include nonprofit organizations, for-profit developers, housing authorities and tribal entities. For more information, see HAC’s website or contact Kristin Blum, 207-596-0033, or Alison Duncan, 443-884-9960.

Congressional hearings consider race, infrastructure and housing.

On April 13 the Senate Banking, Housing and Urban Affairs Committee held a hearing titled Separate and Unequal: The Legacy of Racial Discrimination in Housing with witnesses from the NAACP Legal Defense and Educational Fund, the National Fair Housing Alliance, the Ohio State University and the American Enterprise Institute. An April 14 House Financial Services Committee hearing, Build Back Better: Investing in Equitable and Affordable Housing Infrastructure, focused on housing priorities for the upcoming infrastructure package negotiation and also touched on broader topics like the state of the job market, what constitutes infrastructure, and proposed corporate tax increases. Members on both sides of the aisle noted the specific needs of rural and tribal housing during the hearing.

RuralSTAT

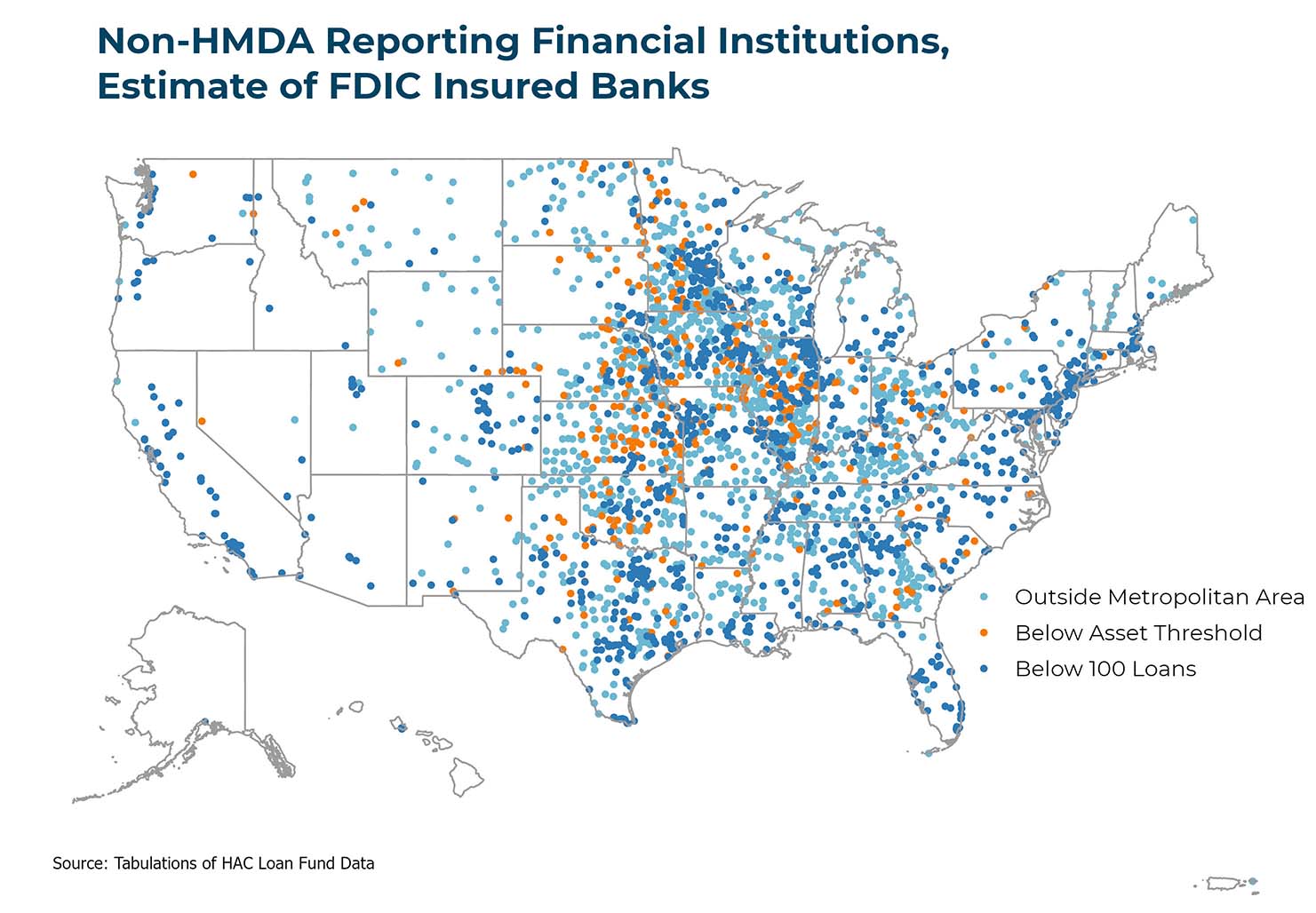

According to HAC estimates, approximately 2,838 FDIC insured banks do not report mortgage activity through the Home Mortgage Disclosure Act due to exemptions for asset threshold size, metropolitan location or level of mortgage loan activity. Source: HAC tabulations of FDIC and HMDA data.

OPPORTUNITIES

National Housing Trust Fund doubles last year’s funding.

Each state must use most of its portion of this year’s nearly $700 million in HTF funds to provide rental housing for low- and extremely-low income residents. HUD estimates the total will finance more than 5,400 units. The funding comes from Fannie Mae and Freddie Mac and increased this year because low interest rates during the pandemic led to high levels of mortgage financing for home purchases and refinances. For more information, contact a state administering agency.

April 20 listening session to cover tribal broadband access.

USDA will host an online listening session on April 20 to solicit comments and recommendations from tribal communities and tribal broadband industry experts on ways to help expand broadband access in tribal communities under the ReConnect Program. Register online here. For more information, contact Tedd Buelow, USDA. Written comments on USDA’s ReConnect regulation are due April 27.

HAC job openings: Community Facilities Housing Specialist and two internships.

For details, visit HAC’s website.

CORONAVIRUS

CFPB proposes to delay foreclosures for pandemic-affected homeowners, asks lenders to help.

Comments are due May 10 on a proposed regulation from the Consumer Financial Protection Bureau that would delay foreclosures on homeowners who have not been able to make mortgage payments for pandemic-related reasons. Forbearance (permission to delay making payments) will end for almost 1.7 million homeowners in September and the following months, CFPB states. Its changes would require lenders and servicers to wait until after December 31, 2021 before starting most foreclosures, to offer loan modifications to borrowers and to take other steps. For more information, contact Angela Fox, CFPB, 202-435-7700. CFPB has also issued a Compliance Bulletin and Policy Guidance urging mortgage servicers to prepare early for the wave of homeowners exiting forbearance and warning them it can base enforcement actions on their assistance to borrowers. For more information, contact Allison Brown, CFPB, 202-435-7107.

HAC provides round-up of recent federal housing actions.

Federal agencies have recently announced numerous policy and regulatory changes related to the pandemic and housing, and HAC summarized many of them on its website. All of HAC’s coronavirus resource pages can be accessed here.

“Covid racial disparities loom large in rural counties.”

This article, published by Stateline and the Daily Yonder, compiles findings from several studies that demonstrate the pandemic’s impact in rural places has been especially significant for people of color.

Eviction moratorium declaration now available in several languages.

The Centers for Disease Control has posted its revised form, which can be used by tenants to state their eligibility for the eviction moratorium, in Amharic, Haitian Creole, Hindi, Russian, Somali, Spanish and Traditional Chinese as well as in English.

Research looks at rental housing counseling during coronavirus pandemic.

The Urban Institute published Housing Counseling to Support Renters in Crisis, which outlines how housing counseling agencies have altered their approach to service provision in the wake of the pandemic. The report includes perspectives from counseling agencies that serve rural, urban and suburban populations.

Answers provided to immigrants’ questions about vaccines.

The National Immigration Law Center has posted Answers to Common Questions about Immigrants’ Access to the COVID-19 Vaccines. It explains there are no restrictions on vaccination based on immigration status and addresses several other possible concerns.

REGULATIONS AND FEDERAL AGENCIES

HUD and VA pledge to work together on veteran homelessness.

HUD secretary Marcia L. Fudge and VA secretary Denis McDonough issued a joint statement on April 12 committing to work together to end veteran homelessness. This is the first step, they said, in a multi-agency effort coordinated by the U.S. Interagency Council on Homelessness.

PUBLICATIONS AND MEDIA

Reports document poverty, income inequality, racial/ethnic disparities for children and youth.

The State of America’s Children 2021, published by the Children’s Defense Fund, is based primarily on pre-pandemic data because little real-time data is available, though each chapter includes a section on the pandemic’s impact. The report includes fact sheets for each state. Pre-pandemic state-level information is also the basis for the 2020 State Index on Youth Homelessness published by the National Homelessness Law Center and True Colors United, focusing on state systems, environment and laws as they relate to preventing and ending youth homelessness.

“‘In 2021 it should be different’: Martin County waits for water.”

Residents in part of Martin County, KY have relied for years on a token station where they can purchase water to haul to their homes, reports WYMT, until recently the token station broke down and could not be repaired promptly. A WCHS article describes residents driving miles to other places to find clean water. The county’s long history of water-related challenges is recounted by the Ohio Valley ReSource and the Appalachian Citizens’ Law Center.

“Why we must first be well before we can do the work of the people.”

Starting with a description of community leaders’ tendency to ignore their own trauma, this Shelterforce article addresses the need for organizations and staffs to care for themselves in order to do their work of caring for others. The author describes alternative approaches and links to a variety of resources.

HAC

Need capital for your affordable housing project?

HAC’s loan fund provides low interest rate loans to support single- and multifamily affordable housing projects for low-income rural residents throughout the U.S. and territories. Capital is available for all types of affordable and mixed-income housing projects, including preservation, new development, farmworker, senior and veteran housing. HAC loan funds can be used for pre-development, site acquisition, site development, construction/rehabilitation and permanent financing. Contact HAC’s loan fund staff at hacloanfund@ruralhome.org, 202-842-8600.

Please note: HAC is not able to offer loans to individuals or families. Borrowers must be nonprofit or for-profit organizations or government entities (including tribes).

USDA Rural Development Obligations FY 21 – March

USDA Rural Development Obligations FY 21 – March