HAC News: June 27, 2019

News Formats. pdf

June 27, 2019

Vol. 48, No. 13

House passes USDA and HUD funding for FY20 • U.S. housing supply falls far short of needs, Harvard analysis finds • Supreme Court rules citizenship question on census needs a better rationale. • USDA expands pilot to help nonprofits preserve rural rentals, creates two-step transfer • Most USDA Research Service staff to quit, not move, union says • HUD offers grants for lead reduction and tribal healthy homes • White House council on regulatory barriers created • GAO suggests centralizing information on services to rural elders • Senate confirms two HUD appointees • RuralSTAT • Final rule adopts income banding for USDA single-family housing programs • The 2019 AARP Rural Livability Workshop •How to Make College Accessible to Students from Rural Communities • The June 24 Power Station podcast • A Town with No Bank: How Itta Benna, Mississippi, Became a Banking Desert • 2020 Democrats Offer Up Affordable Housing Plans Amid Surging Prices • NEW! HAC and Fannie Mae to hold webinars on colonias in New Mexico and Arizona • NEW! HAC offers Section 502 packaging training for nonprofits, August 6-8 in Michigan • Need capital for your affordable housing project?

HAC News Formats. pdf

June 27, 2019

Vol. 48, No. 13

House passes USDA and HUD funding for FY20.

On June 25 the House passed H.R. 3055, a “minibus” that combines five appropriations bills for FY20, including both USDA and HUD. The measure would maintain or increase funding for housing programs in both departments. The Administration has threatened to veto the bill. Congress and the White House have not yet been able to agree to lift the spending caps imposed by the 2011 Budget Control Act, which would require drastic funding cuts, and the Senate has not yet begun to consider appropriations bills.

U.S. housing supply falls far short of needs, Harvard analysis finds.

Harvard’s Joint Center on Housing Studies reports in The State of the Nation’s Housing 2019 that U.S. housing production has not kept pace with increases in household formation and a large proportion of new homes are for the higher end of the market. Cost-burden rates have declined for homeowners but 47.4% of renters still pay more than 30% of their incomes for housing. HAC is one of the sponsors of this yearly report.

Supreme Court rules citizenship question on census needs a better rationale.

The Supreme Court ruled on June 27 that including a citizenship question on the decennial census is permitted by the Constitution, but that the Commerce Department’s stated reason for adding the question is not supported by the facts. The case will return to a lower court and it is not clear whether a final determination can be made in time to include the question on the 2020 Census, even if different justification is provided.

USDA expands pilot to help nonprofits preserve rural rentals, creates two-step transfer.

USDA RD’s pilot program to assist nonprofits preserving Section 515 properties has been extended through April 30, 2021. An Unnumbered Letter dated June 14, 2019 announces the extension and expands the options for nonprofits to include a “two-step transfer process.” A nonprofit can now request permission to purchase a property before it has all funding in place for rehabilitation and, so long as it addresses health, safety and accessibility needs immediately, will have up to two years to do other rehab. The pilot will also expand to cover properties with mortgage maturations through 2035 (instead of 2030, the limit when the pilot began). Another UL dated June 14, 2019 offers guidance on using the Section 538 program to preserve Section 515 properties.

Most USDA Research Service staff to quit, not move, union says.

Politico (subscription required) reports that a preliminary survey by the American Federation of Government Employees found at least two-thirds of Economic Research Service staff who have been asked to relocate from Washington, DC to the Kansas City area will leave the agency instead of moving. Workers at ERS and the National Institute of Food and Agriculture recently voted overwhelmingly to join AFGE. Separately, the Agricultural & Applied Economics Association has calculated that USDA’s cost-benefit analysis seriously underestimated the cost of moving ERS and NIFA, partly because it did not take into account the lost value of research from staffers who resign or retire rather than move.

HUD offers grants for lead reduction and tribal healthy homes.

State and local governments, some states and some tribes can apply by August 9 for HUD’s Lead Hazard Reduction Grant Program to identify and control lead-based paint hazards in privately owned housing. For more information, contact Yolanda Brown, HUD, 202-402-7596. August 9 is also the deadline for tribes and TDHEs to apply for the Healthy Homes Production Grant Program, which assists in identifying and remediating housing issues that contribute to health and safety concerns in urban tribal communities. For more information, contact Michelle Miller, HUD, 202-402-5769.

White House council on regulatory barriers created.

President Trump issued an executive order establishing a White House Council on Eliminating Regulatory Barriers to Affordable Housing. The order blames the current housing affordability crisis on a supply shortage caused by barriers such as restrictive zoning, rent controls, environmental regulations and labor requirements. Chaired by HUD, the council includes representatives from USDA and other departments and is charged with producing a report by June 25, 2020. HUD has worked for decades to reduce regulatory barriers imposed by federal, state, local and tribal governments, and since 2001 has maintained a Regulatory Barriers Clearinghouse.

GAO suggests centralizing information on services to rural elders.

HHS Could Help Rural Service Providers by Centralizing Information on Promising Practices addresses services such as in-home care, meal delivery and transportation to medical appointments, which are funded by the Department of Health and Human Services to assist older adults to stay in their homes. Rural residents receive some services less frequently than their urban counterparts. GAO recommends that HHS centralize access to and promote awareness of promising practices or other resources to better serve rural seniors.

Senate confirms two HUD appointees.

On June 20, the Senate confirmed Seth Appleton as Assistant Secretary of Policy Development and Research and Hunter Kurtz as Assistant Secretary of Public and Indian Housing.

RuralSTAT.

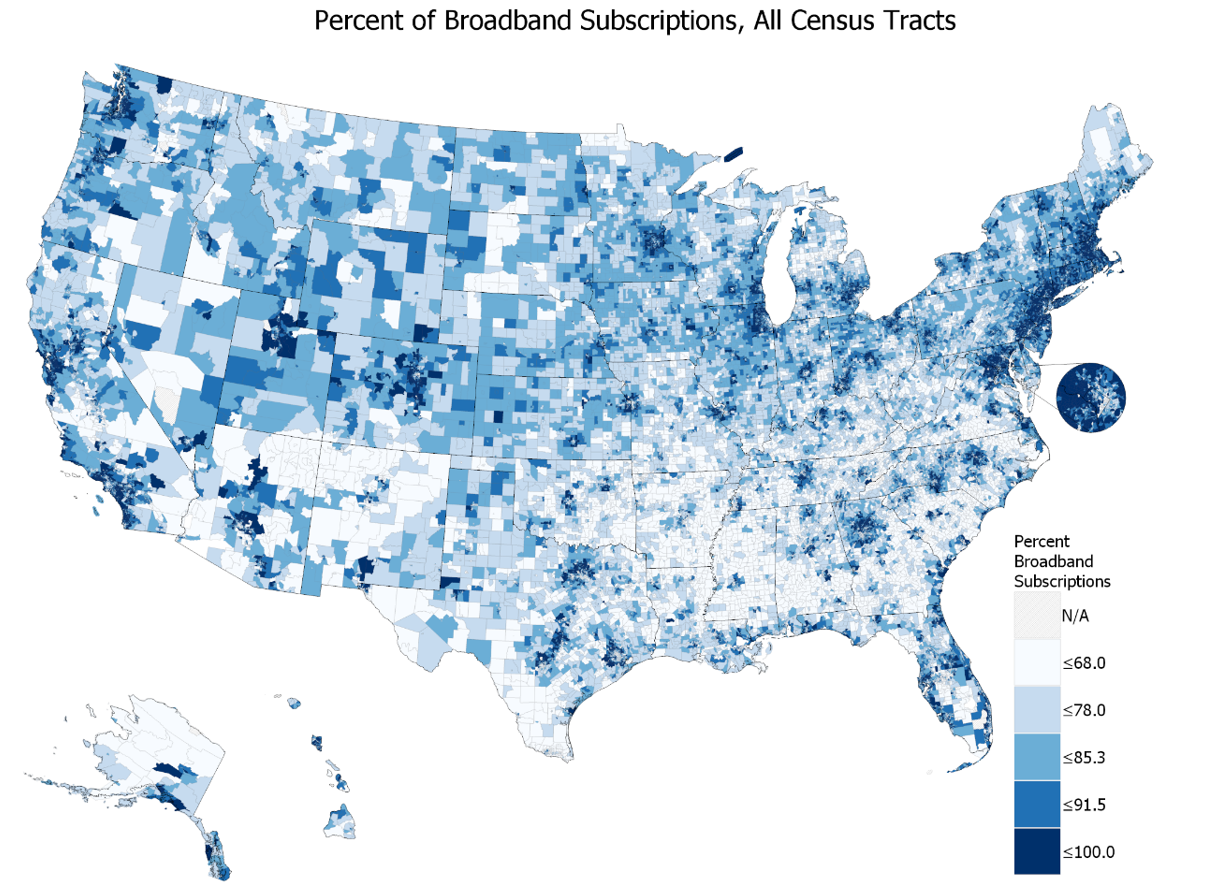

Approximately 78.1% of American households have broadband subscriptions in their homes. In rural homes, the broadband subscription rate is 69.5%. (HAC tabulations of 2017 American Community Survey)

Final rule adopts income banding for USDA single-family housing programs.

Since 2016 USDA has tested broadening eligibility for the Section 502 direct loan program and the Section 504 loan and grant programs by establishing one income limit for families with one to four people and another for families with five to eight people, rather than eight different income limits. A new rule puts the change into effect nationwide as of July 22. RD will publish new income limits online. The definition of net family assets is also revised and, effective August 5, area loan limits will be calculated as a percentage of HUD’s Section 203(b) limits. For more information, contact Shannon Chase, RD, 515-305-0399.

Recent publications and media of interest

- The 2019 AARP Rural Livability Workshop featured speakers from around the country discussing ideas like building intergenerational communities, expanding access to transportation, improving housing affordability, improving infrastructure and preparing for disasters. HAC CEO David Lipsetz joined Tony Walters of the National American Indian Housing Conference to discuss housing access and affordability for seniors living in rural areas. Watch a recording of the event here (registration required).

- How to Make College Accessible to Students from Rural Communities argues for increased efforts to ensure more rural students can attend college. The article, written by faculty at Cornell University, cites successful programs like Cornell’s Summer College Program, which help expand access.

- The June 24 Power Station podcast featured HAC CEO David Lipsetz discussing rural issues and how policymakers, foundations and other industries can work together to create solutions designed for rural areas. Listen on Soundcloud and iTunes.

- A Town with No Bank: How Itta Benna, Mississippi, Became a Banking Desert from NBC news follows the story of several residents of a small rural town on the Mississippi Delta that has seen all of its bank branches close over the years. What happens to a town where all banking options have disappeared, how do people adjust and how do nonprofits like Hope Credit Union attempt to fill the gap?

- 2020 Democrats Offer Up Affordable Housing Plans Amid Surging Prices, a National Public Radio story, reports that affordable housing plans from the presidential hopefuls range from providing grants to tax credits to increasing the number of housing vouchers available.

NEW! HAC and Fannie Mae to hold webinars on colonias in New Mexico and Arizona.

HAC, in partnership with Fannie Mae, will hold webinars in July and August presenting data and research on Colonias Investment Areas, a geographic concept developed to target mortgage finance and resource investment in colonia communities along the southwest U.S. border. A webinar on July 17 will focus on New Mexico, and one on August 7 will focus on Arizona. For more information, contact HAC staff, 404-892-4824.

NEW! HAC offers Section 502 packaging training for nonprofits, August 6-8 in Michigan.

This three-day advanced course trains experienced participants to assist potential borrowers and work with RD staff, other nonprofits and regional intermediaries to deliver successful Section 502 loan packages. The training will be held in East Lansing, MI on August 6-8. For more information, contact HAC staff, 404-892-4824.

Need capital for your affordable housing project?

HAC’s loan funds provide low interest rate loans to support single- and multifamily affordable housing projects for low-income rural residents throughout the U.S. and territories. Capital is available for all types of affordable and mixed-income housing projects, including preservation, farmworker, senior and veteran housing. HAC loan funds can be used for pre-development, site acquisition, site development and construction/rehabilitation. Contact HAC’s loan fund staff at hacloanfund@ruralhome.org, 202-842-8600.

Please note: HAC is not able to offer loans to individuals or families. Borrowers must be nonprofit or for-profit organizations or government entities (including tribes).