HAC research explores the possibilities for improved mortgage finance on reservations

Contact: Christina Davila, christinad@ruralhome.org, 202-842-8600

Dan Stern, dan@ruralhome.org, 202-842-8600

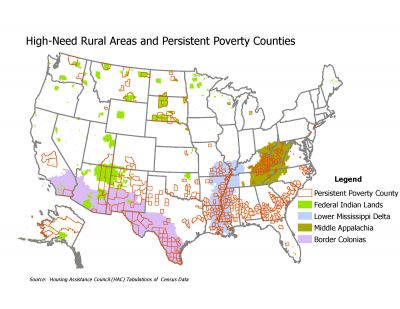

Washington, D.C., May 22, 2018- HAC’s recently released rural research report, Exploring the Challenges and Opportunities for Mortgage Finance in Indian Country, confirms mortgage lending activity is limited on many reservations and explores possible solutions to addressing the issues. The current lending conditions on many reservation lands include low origination rates, high denial rates, and involve a high proportion of loans for manufactured homes.

The report provides a sweeping picture of the mortgage market on reservations, where:

- Fewer than 1,000 mortgage loans are made annually

- Nearly half of mortgage loan applications are denied annually

- Almost one-fifth of homes are manufactured homes

- Two of the 20 largest-volume lenders are Native-owned institutions

Considering the findings in this report, HAC recommends that efforts to address the challenges of mortgage lending on reservations include improvements in education of lenders and borrowers, expanding the capacity of tribes, small lenders, and federal regulators, better targeted financial policies, and increased access to data.

“HAC is proud to present this report said David Lipsetz, HAC’s Executive Director. “This report improves our understanding of mortgage lending on tribal reservations and for Native American people, and we look forward to expanding our efforts to better serve organizations providing housing on tribal lands. HAC would like to thank the Wells Fargo Housing Foundation for their support of this research.”

“This report is a great resource for anyone working in housing on reservations,’ said Marvin Ginn, Executive Director of Native Community Finance based in Laguna, New Mexico. “It illustrates the challenges we face as housers for Native American populations, and provides recommendations that can help ease those challenges. This sort of research can help us better target our efforts and improve our work on reservations.”

HAC will present a more detailed analysis of the findings, and how they impact real-world practitioners in a webinar training on Wednesday, May 23, 2018 at 2 PM Eastern.

About the Housing Assistance Council

The Housing Assistance Council helps build homes and communities across rural America. Founded in 1971 and headquartered in Washington, D.C., HAC is a national nonprofit dedicated to helping local rural organizations build affordable homes by providing below-market financing, technical assistance, training, research, and information services. To learn more, visit www.ruralhome.org.

###