News Formats. pdf

September 9, 2019

Vol. 48, No. 18

Administration releases housing finance reform proposal • Congress to resume work on FY20 appropriations • House will consider rural rental preservation bill • USDA offers Community Facilities grants for disaster relief • Eligibility calculations for Section 504 repair loans and grants revised • Comments requested on economic development in distressed areas • Census Bureau hiring for help with 2020 Census • Fair market rents released • USDA extends manufactured housing pilots • Vermont incentivizes local and rural job creation • “Colonias Investment Areas – Texas” webinar set for September 26 • Need capital for your affordable housing project?

HAC News Formats. pdf

September 9, 2019

Vol. 48, No. 18

Administration releases housing finance reform proposal.

The Trump Administration’s proposed housing finance reform plan was released on September 5. In addition to the Treasury Department plan to release Fannie Mae and Freddie Mac from government conservatorship and limit the federal role in the housing market, a separate document presents a HUD plan for FHA and Ginnie Mae. The Senate Committee on Banking, Housing and Urban Affairs has scheduled a September 10 hearing on “Housing Finance Reform: Next Steps.” HUD Secretary Ben Carson, Treasury Secretary Steven Mnuchin and Federal Housing Finance Agency Director Mark Calabria will be witnesses and the hearing will be webcast live.

Congress to resume work on FY20 appropriations.

The week of September 9, after the House and Senate return from their August recess, the Senate Appropriations Committee will begin to consider funding bills for FY20, which starts on October 1, 2019. Earlier this year the House developed its 12 appropriations bills and passed 10 of them, though its numbers will need to be adjusted because the summer budget deal provided a lower amount for non-defense and a higher amount for defense than the House bills assumed. The House is expected to vote the week of September 16 on a continuing resolution carrying FY19 funding levels until late November or early December. Bloomberg reports the Administration has requested a number of “anomalies” – changes in FY19 provisions – to be included in a CR. No rural housing anomalies are listed, but the request does include authority for HUD to renew contracts for rental assistance to Section 202 properties for the elderly, as well as additional funding for the 2020 Census.

House will consider rural rental preservation bill.

The House of Representatives is scheduled to take up H.R. 3620, the Strategy and Investment in Rural Housing Preservation Act of 2019, on September 10, 11 or 12. The bill, which passed the House Financial Services Committee unanimously in July, would authorize the MPR and preservation technical assistance programs, authorize vouchers for tenants after a mortgage matures or is foreclosed (in addition to after prepayment), allow decoupling of Rental Assistance as a last resort, require USDA to develop a preservation plan and establish a stakeholders’ committee to advise USDA.

USDA offers Community Facilities grants for disaster relief.

Community Facilities grants will be awarded on a rolling basis to public bodies, nonprofits and tribes in rural areas impacted by FEMA-recognized natural disasters. For more information, contact a USDA Rural Development state office.

Eligibility calculations for Section 504 repair loans and grants revised.

USDA revisions to Handbook HB-1-3550, announced in Procedure Notice 527, change the methodology for determining eligibility for loan, grant and combination assistance. They also provide clarification to other program eligibility criteria including credit analysis, medical deductions, property considerations and construction contract considerations. The Section 504 program offers loans to low-income rural homeowners and grants to those who are age 62 or older. For more information, contact a local USDA Rural Development office.

Comments requested on economic development in distressed areas.

In connection with its work on the White House Opportunity and Revitalization Council, the Commerce Department seeks recommendations on spurring economic development in Opportunity Zones and other distressed areas. Comments are due October 18. For more information, contact Mara Quintero Campbell, 202-482-5479.

Census Bureau hiring for help with 2020 Census.

The U.S. Census Bureau needs to hire hundreds of thousands of workers to complete the upcoming census. Temporary jobs include census takers, recruiting assistants, office staff and supervisory staff, with locations throughout the U.S. and Puerto Rico.

Fair Market Rents released.

HUD has posted Fair Market Rents for FY20, effective October 1, 2019. Prices are available at the county and zip code levels for efficiency, one-bedroom, two-bedroom, three-bedroom and four-bedroom units.

USDA extends manufactured housing pilots.

Two pilot programs are extended through the end of August 2020. One allows the Section 502 direct and guarantee programs to finance existing manufactured homes that are not already financed by USDA. The second reduces the required land lease term for energy-efficient homes in nonprofit communities. For more information related to Section 502 direct, contact Jeremy Anderson, USDA, 202-690-3971; related to Section 502 guaranteed, contact Kevin Smith, USDA, 517-883-6147.

Recent publications and media of interest

- South Carolina Housing Needs Assessment estimates that high housing costs in the state cost a total of $8.4 billion in public assistance, private charity or personal deprivation. The report mentions that the housing crisis looks different in rural areas, where incomes are lower.

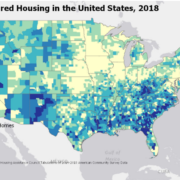

- #MapMonday is a weekly social media series from the Research and Training Center on Disability in Rural Communities at the University of Montana. For a new map each week related to people living with disabilities in rural America, follow RTC:Rural on Facebook, Twitter or LinkedIn.

Vermont incentivizes local and rural job creation.

The Remote Worker Grant Program, which offers remote workers as much as $10,000 in payments and incentives to relocate to Vermont, has seen greater than expected participation and engagement. Since January 2019 a total of 170 people have relocated to the state as part of this program (this number includes family members that moved with the workers). The Vermont Department of Economic Development is hoping to expand on this success by offering another incentive program aimed at creating local jobs, with higher payouts for jobs created in rural communities.

“Colonias Investment Areas – Texas” webinar set for September 26.

HAC, in partnership with Fannie Mae, will hold a webinar presenting data and research on Colonias Investment Areas, a geographic concept developed to target strategies and opportunities for mortgage finance and resource investment in colonia communities along the southwest U.S. border. The September 26 session will focus on colonias in Texas. Recent webinars on colonias in New Mexico and Arizona are available on HAC’s YouTube channel. For more information, contact HAC staff, 404-892-4824.

Need capital for your affordable housing project?

HAC’s loan funds provide low interest rate loans to support single- and multifamily affordable housing projects for low-income rural residents throughout the U.S. and territories. Capital is available for all types of affordable and mixed-income housing projects, including preservation, farmworker, senior and veteran housing. HAC loan funds can be used for pre-development, site acquisition, site development and construction/rehabilitation. Contact HAC’s loan fund staff at hacloanfund@ruralhome.org, 202-842-8600.

Please note: HAC is not able to offer loans to individuals or families. Borrowers must be nonprofit or for-profit organizations or government entities (including tribes).

HAC

HAC