The New CRA Rule: A Preliminary Look at Potential Implications for Bank Investment in Rural Community Development

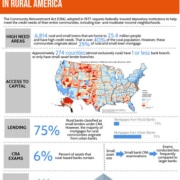

On October 24, 2023, the Office of the Comptroller of the Currency (OCC), the Federal Reserve Board, and the Federal Deposit Insurance Corporation (FDIC) issued a final rule overhauling the regulations that implement the Community Reinvestment Act (CRA), which encourages federally insured banks to meet the credit needs of the communities in which they do business, especially low- and moderate-income (LMI) communities. This is the most significant joint effort in over three decades to modernize the way regulators evaluate bank performance under the CRA.

HAC is committed to helping our partners understand the potential impact of this new CRA rule. The rule, however, is nearly 1,500 pages in length, is highly complex, and will take effect over a nearly three-year period. Accordingly, this and forthcoming analyses must be considered preliminary.

The Evaluation Framework

Banks receive CRA ratings of “Outstanding,” “Satisfactory,” “Needs to Improve,” or “Substantial Non-Compliance.” The final rule continues the regulators’ longstanding approach of tailoring the CRA examination tests to bank size and type.[1] The final rule raises the current asset threshold for each of the bank size categories.

- Large Banks (over $2 billion in assets) are subject to two tests of equal weight.

- A Retail Lending Test evaluates a bank’s origination and purchase of loans, including home mortgage loans and multifamily loans if it offers them.

- A Community Development (CD) Test consists of a CD Financing Subtest (40 percent of the total) and a CD Services Subtest (10 percent of the total).

- A HAC analysis in 2016 found that 2.4 percent of banks headquartered in rural or small-town census tracts that consistently received “Outstanding” or “Satisfactory” ratings were subject to the large bank exam.

- Intermediate Banks ($600 million-$2 billion in assets) are also subject to equally weighted Retail Lending and CD Tests.

- The Retail Lending Test evaluates a bank’s origination and purchase of loans, including home mortgage loans and multifamily loans if it offers them.

- Intermediate Banks may opt in or out of the new rule’s CD Test and CD Financing and CD Services Subtests.

- Intermediate Banks that opt out are subject to the current CD Test, which has three subtests:

- CD Lending

- CD Investment

- CD Services

- HAC’s 2016 analysis found that 5.4 percent of banks headquartered in rural or small-town census tracts which consistently received “Outstanding” or “Satisfactory” ratings were subject to the intermediate bank exam (then known as the intermediate small bank exam).

- Small Banks (less than $600 million in assets) may opt into the new rule’s Retail Lending Test – or may choose to continue to be evaluated under the current small bank test. They are not subject to a CD test.

- HAC’s 2016 analysis found that 79.4 percent of banks headquartered in rural or small town census tracts that consistently received “Outstanding” or “Satisfactory” ratings were subject to the small bank exam.

- Limited purpose banks—with just one primary product line such as credit cards (e.g., Amex Bank, Capital One)—are subject only to the CD Financing Subtest.

- A Strategic Plan option allows banks of all sizes to choose to seek the regulators’ approval of a CRA strategic plan tailored to the bank’s lines of business and specific credit needs identified through a formal input process by the communities the bank serves.

Historically, bank examiners would conduct both quantitative and qualitative assessments of CRA performance under both the Retail Lending and CD Test and its subtests. Banks would be measured against benchmarks for lending and CD investment volume among other metrics relative to their size, business model, and comparable institutions. Quantitative ratings would be supplemented with qualitative assessments including taking account of the bank’s “performance context”—e.g., the economic conditions in the places it served—and determining whether a bank’s lending and CD investments were especially “responsive to a community’s credit and community development needs.” This qualitative element also allowed examiners to consider the terms and flexibility of bank CRA capital offered in particular LMI communities. Rural geographies benefitted especially from a qualitative component to CRA evaluation given their relatively greater capacity-constrained CD ecosystems and limited deal flow and transaction size.[2]

The final rule maintains the combined quantitative and qualitative CRA evaluation framework, but modifies and augments it in several important ways. The remainder of this analysis focuses on the rule’s approach to the new CD Test and Subtests and the potential ramifications for affordable housing and community development in rural America.

Opportunities for Rural Community Development Under the New CD Test

CRA-motivated bank investments, loans, and services have always played a role in rural community development.[3] But it has been challenging under the current CRA framework to increase bank commitments in rural communities, for a number of reasons—some of which are unique to rural areas and some of which are shared with urban and suburban communities.

First, as noted above, the large majority of banks headquartered in rural areas and small towns—and most likely to have branch and ATM networks there—are small banks not subject to a community development test at all. Intermediate-small and large banks were evaluated under the current rule primarily on their CD investments, lending, and services within their Assessment Areas (AAs), selected by the banks themselves and defined as the geographic areas that could reasonably be served by each of a bank’s locations, including its main office, any branches, and deposit-taking ATMs. Relatively few of their AAs encompassed rural geographies. As HAC’s research highlighted, large and intermediate bank support for rural communities faced an obstacle in their uncertainty about whether they would receive CRA credit for work outside their AAs.

The final rule makes major progress on addressing this challenge. While the new CD Test requires large banks and opting-in intermediate banks to meet the CD Financing and Services needs of their facility-based AAs, it also creates a “nationwide AA” to ensure that all CD Financing and Services activities contribute to an institution’s CRA rating.[4]

Second, the final rule highlights several factors that examiners will specifically take into account when conducting the qualitative “impact and responsiveness review” of a bank’s CD Financing and Services. These include whether the investment, loan, or service benefits or serves:

- one or more Persistent Poverty Counties (PPCs);

- residents of Native Land Areas; or

- one or more geographic areas with low levels of community development financing.

Each of these factors will tend to reward bank CD Financing and Services in rural areas given their 1) demonstrable overrepresentation among PPCs, and Native Land Areas; and 2) likely overrepresentation among geographic areas with low levels of community development financing given consistent findings of underinvestment from other sources, such as philanthropy.[5]

Additional impact and responsiveness review factors specifically mentioned by the rule include bank financing that:

- supports a Community Development Financial Institution (CDFI);

- takes the form of a grant or donation; or

- invests in a Low Income Housing Tax Credit (LIHTC) or New Markets Tax Credit (NMTC) project.

Given the scarcity of other public and private sector community development resources in rural areas, coupled with often challenged local economies, rural communities especially need the patient, flexible capital provided by CDFIs. Similarly, they have a disproportionate demand for grant funding and investments in CD projects and organizations rather than loans. Accordingly, an evaluation framework that specifically recognizes the impact and responsiveness of these approaches has the potential to benefit rural America.

For rural places, these factors may also interact positively with the above-mentioned addition of a “nationwide AA.” For example, a bank that today might hesitate to invest in a LIHTC or NMTC project outside of its facility-based footprint may choose to do so under the final rule, leading to a more geographically varied distribution of resources over the long term.[6]

Third, CRA-motivated investment in all communities—urban, suburban, rural and small town—suffered under the prior CD Test from a lack of clarity around what loans, investments, or services were eligible for CRA credit. Other than a few long-deemed eligible activities, such as LIHTC or NMTC investments, banks and their community partners were often uncertain about the CRA impact of a new, innovative, or complex CD or affordable housing activity—often the very kinds of financial products and services needed by the most distressed rural communities.

The final rule states that the regulators will jointly “maintain a publicly available, non-exhaustive illustrative list of examples of community development activities that qualify for CRA consideration, including examples of qualifying affordable housing activities. The list will be periodically updated.” Additionally, the rule sets forth a formal process by which a bank can seek advance confirmation that a community development will be considered CRA-eligible.

Conclusion

As previously noted, the new CRA rule is a massive and complex document, representing a major shift in the implementation of this landmark statute. HAC and others will continue to analyze the rule—as well as early feedback from our partners as the transition period begins—and provide periodic updates. In the meantime, we urge our partners to consider approaching current or potential CRA-motivated funders of your work to inquire whether the aspects of the final rule described here might provide incentives for them to begin, increase, or modify favorable their CD financing and services investments in rural communities.

Footnotes

[1] The current CRA examination process is described in Making CRA Work in Rural America: Finding “Outstanding” Financial Institutions, part of HAC’s three-part series of reports “CRA in Rural America” published in 2016.

[2] When in 2019-2020, then-Comptroller of the Currency Joseph Otting put forth a CRA modernization rule shifting CRA evaluation to an entirely metrics-based approach, HAC submitted comments (as did numerous other affordable housing groups) expressing concern about the negative impact removing the qualitative element would have on banks’ incentive to invest in the most distressed rural and urban LMI communities.

[3] Indeed, CRA-motivated investments are a major driver of affordable housing and community development investment in general. For example, CohnReznick estimates that approximately $24.5 billion of capital was committed to housing tax credit investments in 2022 and that the CRA-motivated capital was the source for approximately 82 percent of that amount.

[4] Large national banks play an outsized role in CRA-motivated affordable housing and community. National banks control about 70 percent of the banking systems total assets. Over 99 percent of investments in LIHTC in 2022 from national banks were made by banks with over $10 billion in assets.

[5] The regulators note that currently there is not sufficiently comprehensive local CD financing data to implement this review factor, but expect to be able to do so in the near future, aided in significant part by the more detailed and robust bank CD data reported under the final rule itself.

[6] It should be noted that HAC joined other commenters on the proposed rule expressing concern that collapsing the prior CD Investment and Lending Subtests into a single CD Financing test might incentivize banks to make loans rather than investments in LIHTC and NMTC.