News

Jennifer Emerling / There Is More Work To Be Done

Jennifer Emerling / There Is More Work To Be Done

Congress returned to work this week, facing the start of fiscal year 2026 on October 1. Legislators are expected to consider passing a continuing resolution to keep the government open because they will not be able to finish the 13 annual appropriations bills this month. A CR could last for a few months or for the entire fiscal year.

It is also possible that all or part of the federal government could shut down. There seems to be no new information to add to HAC’s web post from March summarizing what a shutdown could mean for rural housing. USDA’s January 2024 shutdown plans are still online, while HUD’s and Treasury’s plans have been removed and not replaced. OMB’s shutdown page is blank and its September 2023 FAQs remain online.

The full Senate has approved its FY26 appropriations bill for USDA, while the House’s USDA bill has passed the Appropriations Committee but has not yet been considered by the House itself. Transportation-HUD funding measures have passed the Appropriations Committees in both houses but have not been taken up by either body. Details are posted on HAC’s site for both USDA and HUD.

Comments on USDA’s reorganization plan, which was announced in late July, will now be accepted through September 30. Members of Congress and others had urged the department to provide more time for feedback, as well as to make comments public and to share a more detailed proposal when available.

FEMA encourages using the month to prepare for emergencies. The 2025 theme is Preparedness Starts at Home. HAC’s Rural Resilience website offers tools for readiness, response, and recovery, including HAC’s detailed guide, Prepare Your Organization to Respond and Recover from Natural and Man-Made Disasters.

The observance focuses on mental health and addiction recovery. The Substance Abuse and Mental Health Services Administration explains that the month is intended to promote and support new evidence-based treatment and recovery practices, the nation’s strong and proud recovery community, and the dedication of service providers and communities who make recovery possible. SAMHSA offers a digital toolkit and other resources.

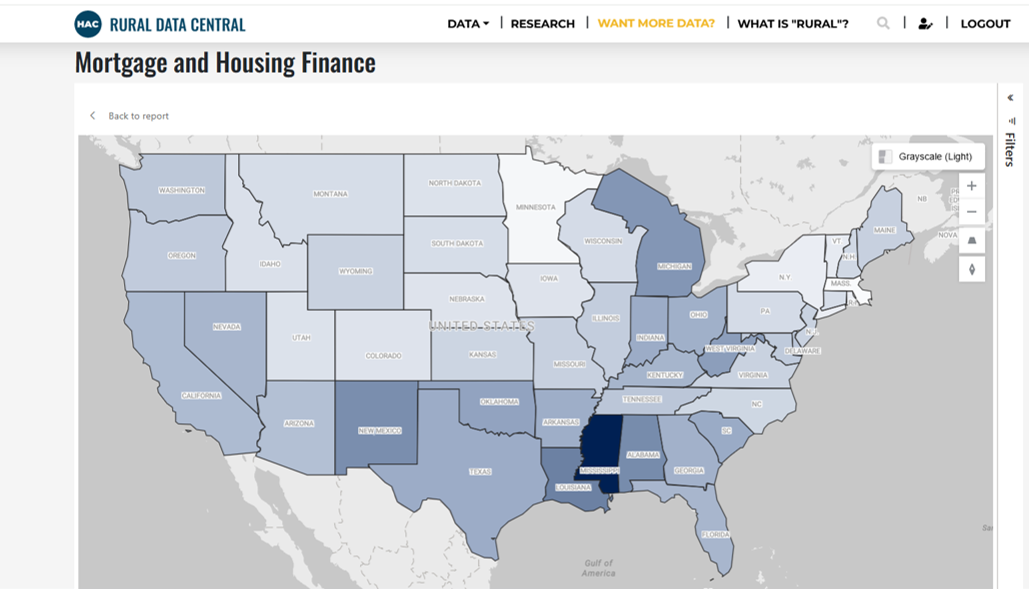

Approximately 8.5% of mortgage loans originated in rural and small-town areas in 2024 were considered “high cost” loans compared to 6% nationally. A mortgage loan is classified as “high cost” if its interest rate is 1.5% (or more) higher than the prime rate for first lien loans. Source: HAC tabulations of 2024 Home Mortgage Disclosure Act Data.

Data from the 2024 Home Mortgage Disclosure Act is now available on Rural Data Central! Visit Rural Data Central to learn more about housing finance in your community.

The Laura Jane Musser Fund Rural Initiative has grant funding available to encourage collaborative and participatory efforts among citizens in rural communities that will help to strengthen their towns and regions in civic areas such as economic development, business preservation, arts and humanities, public space improvements, and education. Eligible applicants are nonprofits and local units of government working in rural communities of 10,000 or less in Colorado, Hawaii, Minnesota, Wyoming, and select counties in New York, North Carolina, and Texas. Applications will be available from September 2 through October 2.

The 2018 Farm Bill has been extended twice and is now set to expire September 30. Some topics that are usually addressed in the five-year Farm Bill, including the Supplemental Nutrition Assistance Program and farm subsidies, were covered in July’s big budget reconciliation measure. Therefore there may be a lower sense of urgency about passing a “skinny” Farm Bill this month, resulting in another one-year extension.

The Department of Energy establishes energy conservation standards for manufactured housing based on the International Energy Conservation Code. Standards set by DOE in 2022 have not yet gone into effect. The IECC was updated in 2024 and costs have changed since 2022, so DOE is considering revisiting its analysis. Comments are due December 2.

A 2024 final rule made “non-permanent resident aliens” eligible for Section 184 loan guarantees, as well as U.S. citizens and “lawful permanent resident aliens.” HUD is now making “non-permanent resident aliens” ineligible. Explaining that only enrolled Tribal members can receive these guarantees and are almost always citizens, HUD states the change will have little impact, so it is publishing an interim final rule without taking comments or holding Tribal consultations first. The rule will be effective on October 6. Comments are due November 3.

HUD requests input on a demonstration program “designed to increase understanding of how enhanced recipient reporting can help reduce the risk of fraud, waste, and abuse across grant programs.” Nine voluntary recipients of funds from the public housing, CDBG-Disaster Recovery, and Continuum of Care programs will justify grant expenditures by uploading supporting evidence such as receipts, invoices, or pay records. Comments are due November 3.

HUD Secretary Scott Turner posted on X a letter asking public housing agencies to review the citizenship status of all residents in HUD-assisted housing, threatening loss of funding or program eligibility for PHAs that do not comply. HUD’s press office posted that the effort was aimed at preventing undocumented residents from receiving aid. HUD programs are already restricted to citizens and to noncitizens with specific statuses such as green card holders and refugees. Undocumented people may live with eligible family members in HUD-assisted housing and assistance is prorated according to the number of eligible and ineligible people in the household. A fact sheet on eligibility and information sharing requirements is available in English and Spanish from the National Housing Law Project. Turner’s announcement does not apply to the rural housing programs at USDA, which issued a notice in July about ineligibility based on legal status.

FEMA contracts for fiscal year 2025 tell states and disaster assistance groups their programs cannot assist undocumented people and must cooperate with immigration enforcement efforts. The Washington Post reports that aid groups and disaster experts believe these new requirements will be difficult to fulfill and may violate state and local laws. The FY25 contract terms also forbid advancement of diversity, equity, and inclusion.

On August 21, Agriculture Secretary Brooke Rollins announced presidential appointees for Rural Development and Farm Service Agency state director positions in several states.

A new Novogradac Opportunity Zones 2.0 Mapping Tool shows what census tracts are likely or unlikely to be eligible for designation as Opportunity Zones under the newly permanent OZ program. The process for nominating and designating the next set of OZs officially begins July 1, 2026.

The CSH Supportive Housing Services Staffing and Budget Tool is intended to support agencies, communities, and project planners to estimate comprehensive costs for supportive housing services. It allows the user to model out scattered site and project-based programs and input their average staffing costs, budget assumptions, and productivity expectations to determine rates needed for a fiscally sustainable program.

An opinion essay published by the New York Times, Wilted Lettuce. Rotten Strawberries. Here’s What Happens When You Round Up Farmworkers, describes how California’s $60 billion farm economy depends on immigrant labor but is struggling amidst recent ICE raids in fields and packing houses that are driving workers away, leaving strawberries, lettuce, and other crops to rot. With as many as 70% of farmworkers not showing up, the ripple effects include higher grocery prices, more food waste, and lost jobs across the food supply chain. The authors argue that treating longtime, law-abiding farmworkers as criminals threatens not just families but America’s food security itself.

HAC job listings and application links are available on our website.

HAC’s loan fund provides low interest rate loans to support single- and multifamily affordable housing projects for low-income rural residents throughout the U.S. and territories. Capital is available for all types of affordable and mixed-income housing projects, including preservation, new development, farmworker, senior and veteran housing. HAC loan funds can be used for pre-development, site acquisition, site development, construction/rehabilitation and permanent financing. Contact HAC’s loan fund staff at hacloanfund@ruralhome.org, 202-842-8600.

Please note: HAC is not able to offer loans to individuals or families. Borrowers must be nonprofit or for-profit organizations or government entities (including Tribes).

Please credit the HAC News and provide a link to HAC’s website. Thank you!

HAC News: September 18, 2025

HAC News: September 18, 2025