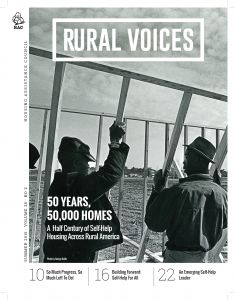

With Many Dedicated Partners, USDA Helps 50,000 Families Achieve the American Dream

This story appears in the 2015 Summer Edition of Rural Voices

This story appears in the 2015 Summer Edition of Rural Voices

by Tom Vilsak, Secretary of Agriculture

USDA Secretary Tom Vilsack discusses USDA’s Self-Help Housing Program

As Secretary of Agriculture I’ve had the opportunity to visit hundreds of small towns all across America. I’ve seen firsthand the strength and resilience of rural business and families, and the positive impact of USDA employees and programs to help rural communities thrive.

Still, too many of our fellow citizens are being left behind. Too many of our small towns are struggling. Although they are some of the hardest working folks I know, rural Americans earn, on average, $11,000 less than their urban counterparts each year. They are more likely to live in poverty.

I have a specific memory of rural poverty from a long time ago that has left an indelible mark on me. My son and I volunteered to help build homes for migrant farmworkers in McAllen, Texas. That experience exposed us to the tough lives these families live.

Despite their circumstances, they are extraordinary, hardworking and humble people. They deserve to live in safe houses. They deserve the opportunity to turn those houses into homes for their families. I know the Housing Assistance Council and other housing advocates feel the same way.

That experience made me proud to serve at a Department that provides programs and services that help rural families climb out of poverty and move into the middle class. For example, our nutrition programs help hardworking moms and dads as they search for good paying jobs that will allow them to put healthy food on the table for their kids without assistance.

Another example is our self-help housing program, which for the past fifty years has helped low- and very low-income families build their own homes. For many of these families, their self-help house is the first time in their lives they’ve lived in a real house.

Hard work and dedication reduces construction costs and, paired with an affordable USDA mortgage, makes homeownership possible for families that would not otherwise be able. Working with local support organizations, families spend long hours in the evenings and on weekends working on their homes. The families frame the houses, install roofs, put up windows and siding, and paint. Each of the 870 families that participated in the program last year built about $27,500 in sweat equity in their brand-new homes.

This program also helps increase homeownership among women and minorities living in rural communities. Over half of agency-financed self-help homes are built by minorities. Since 2008, 41 percent of self-help homes have been built and bought by women-led households, many of whom are single mothers.

For example, in the span of just three years, Christy Milburn and her two young children lived in fifty-five different places. A couple weeks on a couch here, stay in a spare room there, and by 2006 she had run out of friends and couches. As a homeless single mother in Montana, Christy came to Missoula to once again try to get her life back on track. A string of bad luck and regrettable personal decisions had put her in a position she didn’t want to face, yet didn’t know how to escape.

“I would take my kids out for a walk, just for something to do,” said Christy. “We’d be walking down a street and I’d see a family inside their home – behind that picture window – and I’d wonder if I could ever get my life straightened out, and find that stability to just live in the same place for more than a few weeks.”

USDA and partners in Montana, including the Missoula Housing Authority and NeighborWorks Montana, teamed up to help Christy and her kids build and move into one of ten affordable homes in a subdivision just west of Missoula. Today, Christy is able to provide the stability for her children that she had dreamed about for so long.

Recently, the first successful self-help project in Indian Country has provided homeownership to three women-headed families, the first of twelve planned homes in the Zuni Pueblo of New Mexico. These families have never owned a home and many have been renting for 15 years or more. Kay, one of the participants in the program, described her motivation for putting in the long hours and hard work needed: “I live for my kids, so, what I do is practically just for them.”

Stories like Kay’s and Christy’s make me proud of the work that USDA does in rural communities. I am proud to say that we will soon celebrate a new milestone-our 50,000th self-help home-this summer. Together with dedicated partners like the Housing Assistance Council, we are helping rural families achieve the American dream of homeownership. Thank you for your partnership and keep up the good work.

Tom Vilsack serves as the Nation’s 30th Secretary of Agriculture. As leader of the U.S. Department of Agriculture (USDA), Vilsack is working hard to strengthen the American agricultural economy, build vibrant rural communities and create new markets for the tremendous innovation of rural America. In six years at the Department, Vilsack has worked to implement President Obama’s agenda to put Americans back to work and create an economy built to last. USDA has supported America’s farmers, ranchers and growers who are driving the rural economy forward, providing food assistance to millions of Americans, carrying out record conservation efforts, making record investments in our rural communities and helped provide a safe, sufficient and nutritious food supply for the American people.