HAC News: March 4, 2021

HAC News Formats. pdf

March 4, 2021

Vol. 50, No. 5

TOP STORIES

House passes coronavirus relief, Senate begins considering amendments.

On February 27 the House passed the American Rescue Plan Act (H.R. 1319). Beginning on March 4, the Senate will consider changes before it votes on the measure. Then its version will go back to the House for approval. The goal is to complete the process by March 14, when the enhanced unemployment benefits authorized in the December relief bill will expire.

CDC eviction moratorium still in effect despite court ruling.

The Justice Department has appealed a ruling by a federal district court in Texas, which held that the Centers for Disease Control’s eviction moratorium is unconstitutional. As Justice’s press release explains, the decision does not apply to any other landlords or tenants beyond this specific case and the moratorium remains in effect. A National Low Income Housing Coalition fact sheet cites three other federal district court decisions that upheld the moratorium. The National Housing Law Project provides a legal analysis of the Texas ruling.

Treasury updates FAQ on Emergency Rental Assistance program.

The Biden administration has revised the Treasury Department’s guidance on its program to provide pandemic relief rental assistance to state and local governments. The new document removes or modifies onerous requirements added by the previous administration.

HAC webinar to discuss proposed change to metropolitan area definition.

On Tuesday, March 9 at 2:00 Eastern time HAC will offer a webinar titled Redefining “Nonmetro”: What Does the Proposed Metropolitan Area Definition Change Mean for Rural America? The Office of Management and Budget’s definition of outside metropolitan areas, often used as a proxy for “rural” areas, is also frequently used by federal and state agencies to distribute billions of dollars in federal resources and to make policy decisions. Comments are due March 19 on proposed modifications to the metropolitan area definition that could substantially impact rural communities.

365 days of COVID-19 in rural America.

The first case of COVID-19 outside metropolitan areas was reported on February 20, 2020. One year later, there are more than 4 million reported cases of COVID-19 and 78,500 associated deaths in communities outside metropolitan areas. All counties outside metro areas have reported COVID cases and 96% have COVID-related deaths. HAC’s most recent analysis of data on the coronavirus pandemic’s impact includes illness and death rates, geographic distribution, economic and employment impacts and housing implications.

March is Women’s History Month.

Information and federal events are posted here.

RuralSTAT

From February 20, 2020 through February 20, 2021, approximately 14.4% of total reported COVID-19 cases in the U.S. and 15.7% of deaths were in rural communities. Source: HAC tabulations of New York Times data. For more information, visit HAC’s most recent update on the pandemic’s impact in rural America.

OPPORTUNITIES

HUD offers grant funds to modify homes for seniors.

Nonprofits, state and local governments, and PHAs can apply by May 4 for the Older Adult Home Modification Program to improve living conditions for low-income homeowners age 62 or older. Half the total funds available will go to “substantially rural” places, defined generally as places with populations under 50,000. For more information, contact Yolanda A. Brown, HUD, 202-402-7596.

Citizens’ Institute on Rural Design applications due March 12.

Up to four communities will be selected for a local Design Workshop and up to 15 communities will join CIRD’s expert-led online Design Learning Cohort program. Rural communities with populations less than 50,000 are eligible. CIRD encourages applications from nonprofits, tribal or municipal governments, regional planning organizations and other community partners. More details are available in recordings of a Facebook LIVE session and an informational webinar.

HAC job openings: Housing Specialist, Community Facilities Housing Specialist.

For details, visit HAC’s website.

- The Housing Specialist works with local partner organizations to identify financial resources and funding opportunities to support the preservation and development of affordable housing and community and economic development strategies specifically throughout expanses of Southwest and/or Western rural America. At least four years of relevant nonprofit or tribal organization work experience is required. Bilingual proficiency in English and Spanish is preferred.

- The Community Facilities Housing Specialist identifies and engages community stakeholders and provides direct technical assistance to rural organizations that are developing facilities such as parks, community centers, public libraries and childcare centers. This includes helping them identify, utilize and apply for financial resources such as USDA Community Facilities grants and loans. This a two-year position and is eligible for telecommuting.

CORONAVIRUS

New reports examine rental assistance programs and racial equity.

COVID-19 Emergency Rental Assistance: Analysis of a National Survey of Programs reviews the characteristics of 220 coronavirus-related state and local rental assistance programs, explores their outcomes and describes lessons learned for the future. Advancing Racial Equity in Emergency Rental Assistance Programs highlights lessons about strategies states and localities can use to make their emergency rental assistance programs more equitable. Both reports were prepared by the NYU Furman Center, the Housing Initiative at Penn and the National Low Income Housing Coalition.

11 million households significantly overdue on rents and mortgages.

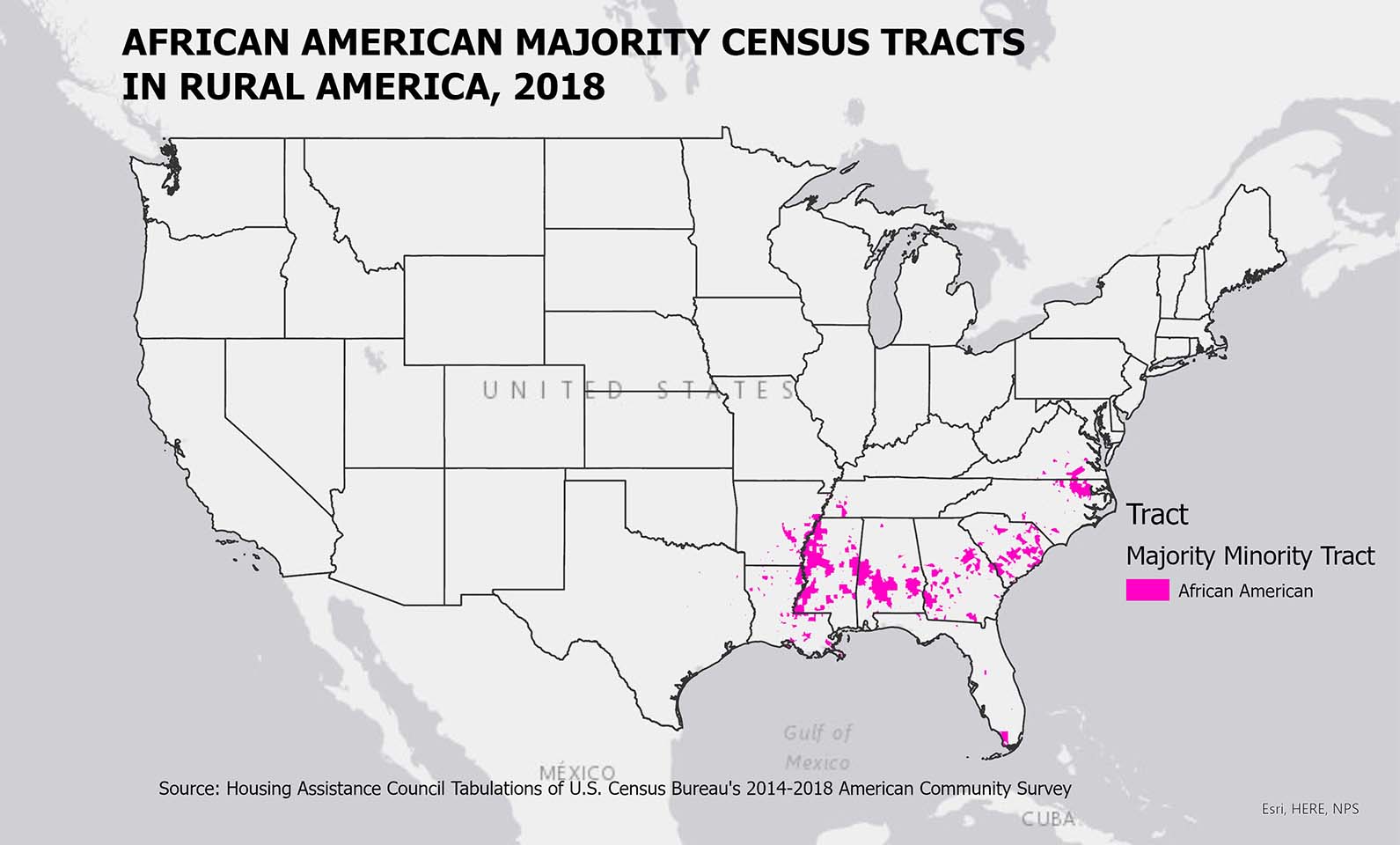

Housing Insecurity and the COVID-19 Pandemic, a new report from the Consumer Financial Protection Bureau, examines households at heightened risk of losing their homes to foreclosure or eviction. African-American and Hispanic households were more than twice as likely to report being behind on their payments as white households, and over 28% of manufactured home residents could not make their housing payments in December 2020.

Approaches to vaccinating farmworkers vary widely.

Three stories published on March 1 demonstrate the uncertainties about vaccinations for these essential, high-risk laborers. In Thousands of Farmworkers Are Prioritized for the Coronavirus Vaccine, the New York Times describes how the Riverside County, Calif. health department is vaccinating Coachella Valley farmworkers at their worksites without long waits in line or issues around citizenship. California is shifting its program away from county agencies, however, the Los Angeles Times says in Vaccine Rollout for Farmworkers is Fraught with Confusion and Bad Timing. A report by Documented is titled New York Farmworkers Removed From Vaccine Eligibility Without Explanation. An earlier article by the Midwest Center for Investigative Reporting, The CDC Recommended States Prioritize Farmworkers for the COVID-19 Vaccine. A Few Large Agricultural States Have Not, describes the approaches taken in Florida and Texas.

“How are Rural Areas Doing with COVID-19 Vaccinations? A Look at 3 Regions.”

This Healthline article discusses some of the challenges with administering the COVID vaccines in rural areas, highlighting interviews in Ohio, the Navajo Nation and North Carolina.

Rural public transit struggling during the pandemic.

More than a million rural households do not own vehicles and often depend on informal arrangements, ridesharing and public transportation to get around. The coronavirus pandemic has placed a strain on public transit options as services are contracted to accommodate shrinking budgets and ridership. The Institute for Policy Studies recommends increasing the amount of federal funding for transportation and changing the way that funding is allocated to create a more equitable system.

REGULATIONS AND FEDERAL AGENCIES

Senate approves Vilsack for USDA, committee holds hearing on Chopra for CFPB.

Tom Vilsack has been sworn in as Secretary of Agriculture after the full Senate approved his nomination on February 23. The Senate has not yet voted on the nomination of Rep. Marcia Fudge (D-OH) for Secretary of HUD. On March 2 the Senate Banking Committee held a hearing with Rohit Chopra, President Biden’s nominee to direct the Consumer Financial Protection Bureau.

Census proposes revising urban definition.

The Census Bureau invites input on changing its criteria for defining urban areas to focus on housing unit density rather than population density. An area would qualify as urban if it contains at least 4,000 housing units or has a population of at least 10,000 – increasing the current population threshold of 2,500. Places that do not fit the urban definition are considered rural. Comments are due May 20. For more information, contact Vincent Osier, Census, 301-763-1128.

USDA requests comments on Rural eConnectivity broadband program.

A final rule for the Rural eConnectivity Program (ReConnect), which provides loans, grants and loan/grant combinations to facilitate broadband deployment in rural areas, goes into effect on April 27, the same date comments are due. For more information, contact Laurel Leverrier, RUS, 202-720-9556.

RD clarifies priority access to rental properties after disasters.

An email from USDA RD’s multifamily housing office reminds stakeholders that tenants displaced by disasters are eligible for priority access to available units at RD rental properties. Their status may be documented by either an RD-issued Letter of Priority Engagement (for tenants from RD properties) or a registration letter issued by FEMA (for tenants from any properties). For more information, or to request a temporary waiver, property owners and management agents should contact their RD servicing representative (on the linked page, click the Contact tab). Tenants impacted by disasters can locate RD properties here and register with FEMA here or at 800-621-3362.

PUBLICATIONS AND MEDIA

“Philanthropy’s rural blind spot.”

This article in the spring 2021 issue of the Stanford Social Innovation Review examines the disparity between philanthropic giving in rural and urban areas and ways to address the gap. The authors define distressed communities as those with shortages of both human capital and economic advantage. They note that places without human capital are less likely to apply for philanthropic funding, so “if funders evaluate their grantmaking by considering only grant applications received, they are likely overestimating their equity in giving.” Many rural communities fall in this “blind spot.” Several examples show how funders can successfully modify their operations and programming to better serve these places.

“Tulare County’s homeless to be thrown off their levee sanctuary.”

This story and accompanying photographs published by Capital & Main describe law enforcement removals of encampments in Tulare County, Calif. where other affordable housing is not available. Author David Bacon is a California-based independent journalist and photographer who worked recently with HAC on a National Endowment for the Arts funded photography project. HAC will announce additional details on the photography exhibit soon.

“‘One thing after another’: Rural Texans faced the same storm – with unique hardships.”

The Texas Tribune describes how rural residents experienced a loss of water, power and heat after February’s storm, as well as issues from being isolated and having to care for livestock and crops.

HAC

Need capital for your affordable housing project?

HAC’s loan funds provide low interest rate loans to support single- and multifamily affordable housing projects for low-income rural residents throughout the U.S. and territories. Capital is available for all types of affordable and mixed-income housing projects, including preservation, farmworker, senior and veteran housing. HAC loan funds can be used for pre-development, site acquisition, site development and construction/rehabilitation. Contact HAC’s loan fund staff at hacloanfund@ruralhome.org, 202-842-8600.

Please note: HAC is not able to offer loans to individuals or families. Borrowers must be nonprofit or for-profit organizations or government entities (including tribes).