HAC News

Shawn Poynter / There Is More Work To Be Done

Shawn Poynter / There Is More Work To Be Done

HAC News Formats. pdf

February 4, 2021

Vol. 50, No. 3

TOP STORIES

Jamal Habibi named Chief of Staff for the Rural Housing Service.

Habibi was most recently a Senior Associate at the Opportunity Finance Network. During the Obama Administration, he served as Outreach Director at the Department of Treasury and as a Special Assistant at USDA. The Biden administration has not yet named an Administrator for RHS or an Under Secretary for Rural Development.

Vilsack and Fudge nominations move forward.

On February 2 the Senate Agriculture Committee held a hearing on former USDA Secretary Tom Vilsack’s nomination to head the department again and then voted to send the nomination to the full Senate, which may hold its vote this week. Housing was not discussed during the hearing, but Vilsack and Sen. Michael Bennet (D-CO) agreed that capacity building is important for rural development, specifically mentioning areas of persistent poverty. The Senate Banking Committee is scheduled to vote February 4 on Rep. Marcia Fudge’s nomination to become Secretary of HUD, after a hearing on January 28.

PPP forgiveness rules revised.

A Treasury Department interim rule implementing changes to the forgiveness and review of Paycheck Protection Program loans will be published in the Federal Register on February 5. The rule is effective immediately, but public comments are invited and will be due in early March. For more information, contact the Small Business Administration’s call center, 833-572-0502, or an SBA field office.

Biden addresses fair housing, tribal consultation and immigration public charge restrictions.

Actions taken by the new administration since January 20 include the following.

Eviction moratorium official documentation published.

On January 29 the Centers for Disease Control moratorium on evictions was formally extended through the end of March. USDA implemented the longer moratorium and extended some other flexibilities for multifamily properties with USDA financing. HUD extended its moratorium for residents with assistance through its Public and Indian housing programs. Federal Housing Administration moratoriums on foreclosure and eviction of homeowners were also extended through March 31.

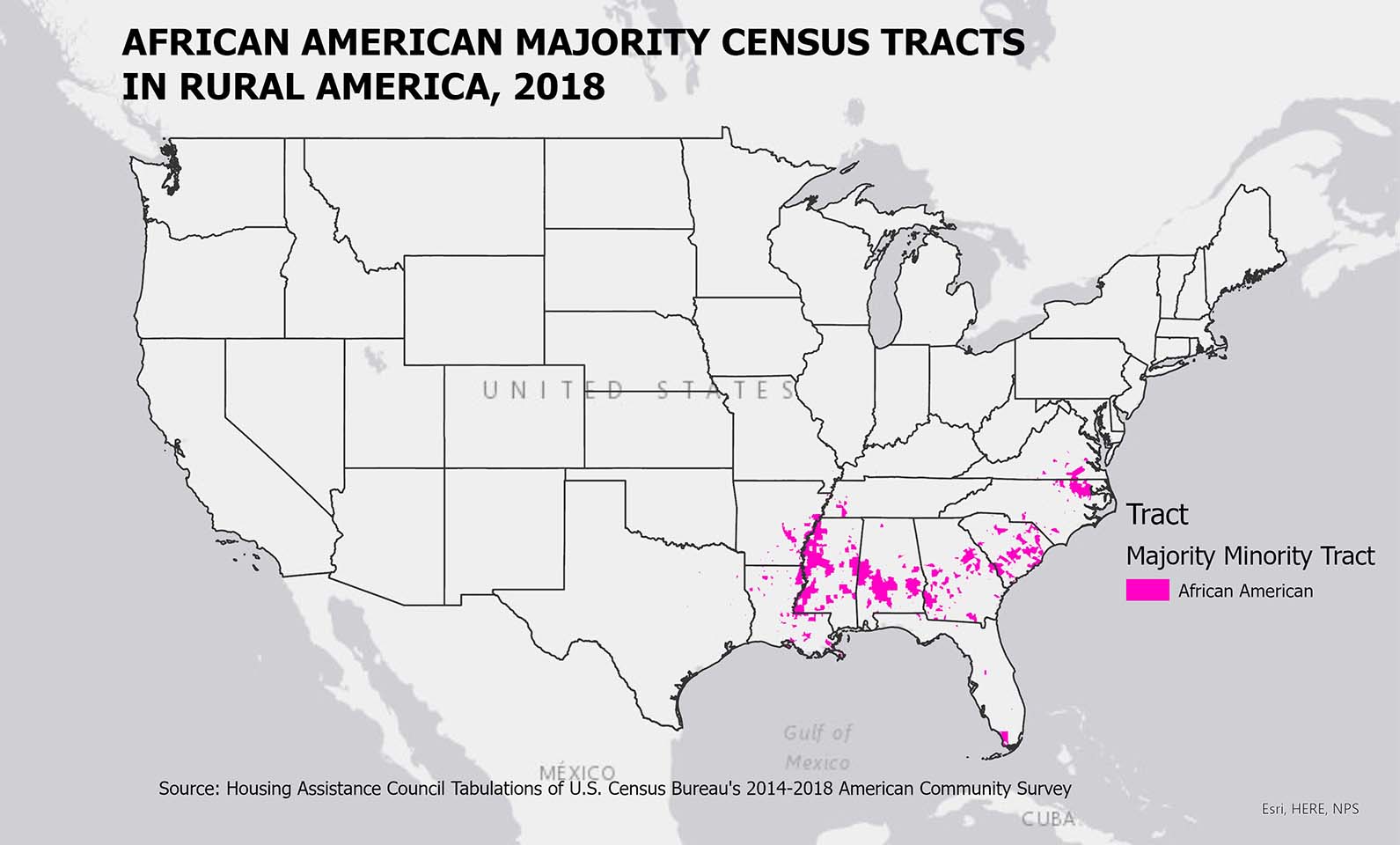

February is Black History Month.

RuralSTAT

There are 647 rural and small-town census tracts where African Americans make up the majority of the population. Source: Housing Assistance Council tabulations of the U.S. Census Bureau’s 2014-2018 American Community Survey.

OPPORTUNITIES

Section 514/516 farmworker housing funds available.

USDA’s funding notice provides the schedule for three application rounds in 2021 and 2022. Pre-applications are due April 1, 2021 for the first round and November 1, 2022 for the third round. For more information, contact Jonathan Bell, USDA, 254-742-9764.

Citizens’ Institute on Rural Design now open for applications!

This year, the CIRD program is being led by the National Endowment for the Arts in partnership with HAC and the design lead, Omar Hakeem of TBD Studio. CIRD will offer four local Design Workshops that address specific community challenges, and an online Design Learning Cohort program that will allow up to 15 communities to engage in peer learning and expert-led sessions online. Communities of 50,000 or less are eligible to apply for the programs by March 12. CIRD encourages applications from nonprofits, tribal or municipal governments, regional planning organizations and other community partners. Click here to view the request for applications and register here for a February 9 informational webinar to learn more and ask questions.

Native homeownership development training offered.

Enterprise Community Partners’ Rural and Native American Program will select 25 participants for Enhancing and Implementing Homeownership Programs in Native Communities training. The curriculum consists of 12 online sessions beginning March 25, including nuts and bolts of homeownership and other topics. Tribes, tribally designated housing entities, community development organizations, and Native CDFIs are eligible to apply by the February 22 deadline.

Project engages youth in exploring their town’s past and thinking about its future.

Rural communities can apply by March 15 for Coming Home: Stories from Main Street, a new collaboration between the Rural Community Assistance Partnership and the Smithsonian Institution’s Museum on Main Street program. The program is flexible, to work with each organization’s existing resources with the goal of helping strengthen or develop new relationships, particularly with kids, youth groups, teachers or schools. For more information, contact the MoMS Youth Program Coordinator, 973-617-7485.

HAC job openings: Community Facilities Housing Specialist, Loan Officer, Senior Portfolio Manager.

For details, visit HAC’s website.

CORONAVIRUS

Research and recommendations issued for emergency rental assistance programs.

In a January 25 letter to Treasury Secretary Janet Yellen, HAC provided suggestions to ensure that rural areas are equitably served in the Emergency Rental Assistance program. COVID-19 Emergency Rental Assistance: Analysis of a National Survey of Programs, a research brief from the University of Pennsylvania, the NYU Furman Center and the National Low Income Housing Coalition, presents the results of an in-depth survey of 220 COVID-19 rental assistance programs across the country and extracts lessons learned that should inform such programs in the future. Emerging Best Practices for COVID-19 Emergency Rental Assistance Programs, a slide deck produced by the Aspen Institute, lays out best practices for the design and administration of these programs.

“Additional Covid-19 vaccines bring choices – and complications – to the rollout.”

This article in STAT, produced by Boston Globe Media, explains that the Johnson and Johnson vaccine requires only one dose, is cheap, and is easier to store and transport than other approved vaccines, making it possible to vaccinate residents in hard-to-reach areas. There is concern of inequity if this less effective vaccine (66%) is the only option in rural areas, although experts advise that its effectiveness meets requirements.

REGULATIONS AND FEDERAL AGENCIES

Comments requested on changes that would redefine size of metropolitan areas.

The Office of Management and Budget requests public input on recommendations for changes to the standards it uses to delineate and update metropolitan and micropolitan statistical areas as new data becomes available. It would change the threshold size of metropolitan areas’ central cities from 50,000 to 100,000 so places with populations up to 100,000 would be considered outside metro areas. Comments are due March 19. For more information, contact James D. Fitzsimmons, OMB, 301-763-1465.

CORRECTION: USDA Strategic Economic and Community Development setasides apply to housing programs.

The January 21, 2021 HAC News incorrectly identified the USDA Rural Development programs in which funds will be set aside for projects that support multi-jurisdictional and multi-sectoral strategic community investment plans. The setaside has been expanded to include Section 514/516 farm labor housing, Section 523 self-help technical assistance, Section 523 and 524 site loans, Section 533 Housing Preservation Grants, Section 538 multifamily guarantees and RCDI. To apply for the setaside, applicants must include a specific form and other information with their program application. For more information, contact a USDA RD State Office.

USDA sets area loan limits for single-family direct programs.

Loan limits that will be used in fiscal year 2021 for the Section 502 direct homeownership loan program and the Section 504 home repair program are now available online. For more information, contact a USDA Rural Development service center.

PUBLICATIONS AND MEDIA

National poverty rate rising even as unemployment falls.

Using calculations that provide poverty data with a lag of only a few weeks, economists at Zhejiang University, the University of Chicago and the University of Notre Dame found that poverty declined in the first half of 2020, but rose sharply from 9.3% in June to 11.8% in December. At the same time, the unemployment rate fell from 11.1% in June to 6.7% in December. An interactive chart allows comparisons across categories such as race, age and education and a report with interim data explains the research.

Data suggests immigrants avoiding coronavirus assistance.

Immigrant Families Continued Avoiding the Safety Net during the COVID-19 Crisis, a fact sheet from the Urban Institute, reports that “the prior administration’s changes to the ‘public charge’ rule intensified immigrant families’ reluctance to participate in public benefit programs and supports that address basic health, nutrition, and housing needs. … The continued chilling effects experienced by immigrant families in 2020 are alarming in the context of the pandemic, during which people of color, many of whom are part of immigrant families, have disproportionately experienced economic and health hardships.”

HAC

Need capital for your affordable housing project?

HAC’s loan funds provide low interest rate loans to support single- and multifamily affordable housing projects for low-income rural residents throughout the U.S. and territories. Capital is available for all types of affordable and mixed-income housing projects, including preservation, farmworker, senior and veteran housing. HAC loan funds can be used for pre-development, site acquisition, site development and construction/rehabilitation. Contact HAC’s loan fund staff at hacloanfund@ruralhome.org, 202-842-8600.

Please note: HAC is not able to offer loans to individuals or families. Borrowers must be nonprofit or for-profit organizations or government entities (including tribes).

USDA Rural Development Obligations FY 21 – January

USDA Rural Development Obligations FY 21 – January