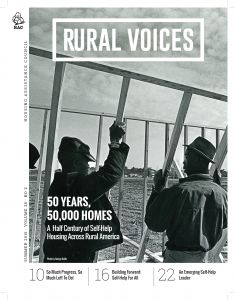

50 Years, 50,000 Homes

Rory Doyle / There Is More Work To Be Done

Rory Doyle / There Is More Work To Be Done

This story appears in the 2015 Summer Edition of Rural Voices

This story appears in the 2015 Summer Edition of Rural Voices

Affordable housing, specifically self-help housing, is very dear to my heart. This program, or one like it, could have made a difference for my family when I was a young girl. My father’s family is from the Native Village of Port Heiden, a traditional Alutiiq community on the Aleutian Peninsula. When I was born, my first home was a 500 square foot cabin on my paternal grandparents’ homestead in Ninilchik, not far from where I live and work today. While pregnant with my brother, my mom cared for me on her own while my father was away many weeks at a time commercial fishing. We lived a subsistence life, eating fish and game and foraging off the land;

we made do with very little and had no access to transportation. Mom hauled all of the water we used to cook and clean and collected the coal used to heat the cabin from the beach. The cabin had no indoor plumbing or electricity.

My parents divorced when I was young. My mom struggled during this time, sacrificing her most basic needs to keep my brother and me fed and clothed with a roof over our heads. She worked several minimum wage jobs just to make ends meet, but she never complained and we never felt poor. As I grew up, I witnessed my mom’s determination while she worked her way up and out of poverty as a single mother. I learned a great deal from her about perseverance and making do with what you have.

After graduating high school, my first job was a receptionist at a local bank. After two years, I was promoted to a mortgage loan closer. I was with the bank for 15 years. After a difficult divorce, I found myself alone, with no home, no source of income, and two young sons to support. I took a minimum-wage position that brought in just enough to pay the rent and provide basic necessities for my children. I knew there should be better opportunities for someone with my banking and lending background, but jobs in the field were scarce in my rural community, compounded by the 2008 mortgage lending crisis. I was awarded a scholarship through my Alaska Native corporation of Cook Inlet Region, Inc. and put myself through college while working full time and supporting my children. I received my Associates degree in General Business in 2009 and graduated at the top of my class – the first college graduate on either side of my family.

In October of 2009, I applied for a homeownership program coordinator position at Rural Alaska Community Action Corporation (RurAL CAP) in their Self-Help Housing Program. It was exactly the type of position I was looking for. I could apply my mortgage lending experience and education to help make a difference in my community. It was my first job interview in over a decade. Mustering my confidence, I presented my credentials and experience and discussed my passion for helping people in my community. Because of my mortgage lending background, communication skills, compassion and desire to help others, and business education, RurAL CAP felt that I was the best fit for the position and decided to give me a chance.

I feel the self-help housing model is the perfect example of how a family with limited income can achieve homeownership. What I find so compelling about the program is that families are not simply given their home like it’s some kind of an entitlement, which is sometimes the case in rural Alaska. They have to work hard for it. Because of that, the sense of accomplishment they have when they move in is undeniable. They know how to maintain their home. They can afford their home. They have learned new life skills and, most importantly, they have pride in what they have accomplished. This transcends into every other facet of their lives. Self-help housing is not easy, but that is what sets it apart from all other programs.

Self-help is also very rewarding on a personal level. I am making a real difference in my families’ lives. I see defeated people every day as they begin the application process. I see people who have been beaten down and had everything taken from them. It is such a fulfilling experience for me to tell them ‘yes’, when so many times they have heard ‘no’. That simple word, ‘yes’, changes them and that sense of accomplishment is empowering. Their confidence grows when they start to take the steps that make a real change in their lives. I see them looking people in the eye and holding their heads high. I see them taking the chance and applying for that higher paying job. I see how successful their children are becoming in school. I see the tight knit community the families become. It is rewarding knowing that I help my families and my community with the job I do here every day. It is incredibly hard work – for the families as well as for our staff – and the work is incredibly rewarding.

This year RurAL CAP is building its 50th self-help home in the central Kenai Peninsula area. I believe that for self-help to continue to make the impact it does here, marketing and education are key. Many people don’t know this opportunity exists. We must market this program to the families who will benefit so they know it’s available. We need to educate our elected officials. They need to know the benefits of self-help housing, not just to the individual families, but also the community as a whole. This is vital so we can continue receiving the funding for the program.

They know how to maintain their home. They can afford their home. They have learned new life skills and, most importantly, they have pride in what they have accomplished.

Another challenge is recruiting qualified individuals and families. Many applicants have credit and budgeting challenges. Very low- and low-income individuals often do not have the resources needed to overcome these obstacles. They also have no idea where to start and need guidance throughout the process. Unfortunately, the Kenai Peninsula does not have a local credit counseling agency. The nearest one is located 150 miles away in Anchorage. A local credit counseling agency is needed. To assist in recruiting self-help families into the future, it is critical that our young people are taught the skills they need to take care of themselves financially. Our children are largely unprepared for the financial responsibilities of being an adult when they get out on their own. I would like to see personal finance become a core class taught in all of the local high schools covering budgeting, fiscal responsibility, credit, loans, investments, and savings. Well-educated children become well-educated adults and are better able to support themselves and their families. If these personal finance classes were offered a year or two before the families are ready to become homeowners and a local credit counseling agency were available to them, my recruitment numbers would increase dramatically.

For self-help housing to continue for another 50 years, funding must be available to support it. At this time, self-help is dependent upon government funding both to operate it (USDA’s Section 523 Technical Assistance (TA) Grant) and to fund the construction of the individual homes for each homeowner (USDA Rural Development Section 502 Direct loan). Reliance on federal funding is a challenge for several reasons. First, we never know from year-to-year if the funding will be available or how deep the cuts will be in any given year. It’s going to take continued presence on Capitol Hill and communication with our elected officials. Policymakers must be informed about the need for ongoing federal support for this program. This program does and will continue to stimulate housing production in underserved, rural communities where private developers can’t meet the entire demand for affordable homes. They need to see success stories firsthand to understand that this program works and is helping to provide the ongoing need for decent, affordable homeownership in rural America. Second, we must seek alternative ways to model the program to form partnerships with other lenders for the individual construction and permanent loans our families need. There may be a time in the future when the federal funding is severely reduced or is not available. We must address this distinct possibility by having alternate funding sources available when that time comes. To do this, we need to start forming partnerships with housing authorities, technical assistance providers, and local lenders.

The Self-Help Housing program provides a time-tested way for low-income families to achieve the goal of homeownership. It extends tangible resources that these families can use to be successful. It teaches valuable life skills that flow into all other areas of their lives. It gives hope, pride, determination, strength, and accountability. It is my sincere hope that we can continue providing this program in rural America for many years to come.

Mi’shell French is the Homeownership Program Supervisor at the Rural Alaska Community Action Program, Inc (RurAL CAP), a private, statewide, nonprofit organization working to improve the quality of life for low-income Alaskans.