HAC News Formats. pdf

November 17, 2017

Vol. 46, No. 23

November is Native American Heritage Month • Fannie Mae and Freddie Mac approved for LIHTC equity investments • House and Senate tax bills advance • House passes flood insurance bill • USDA announces Rural Development state directors • CFPB director Cordray resigns • VA offers per diem assistance • Input requested on free access to credit scores • Section 504 handbook revised • Annual Adjustment Factors released for FY18 • Fannie and Freddie met most affordable housing goals in 2016 • 40,000-120,000 HUD Housing Choice Vouchers could be unfunded in FY18 • Research shows federal housing assistance widespread but insufficient — NEED CAPITAL FOR YOUR AFFORDABLE HOUSING PROJECT? —

HAC News Formats. pdf

November 17, 2017

Vol. 46, No. 23

November is Native American Heritage Month.

Fannie Mae and Freddie Mac approved for LIHTC equity investments. FHFA, which regulates Fannie Mae and Freddie Mac, has announced that, effective immediately, it will permit their limited re-entry into the LIHTC market as equity investors. The announcement said most of their investments will be used to facilitate transactions that support underserved markets and complement their Duty to Serve rural housing, affordable housing preservation, and manufactured housing.

House and Senate tax bills advance. On November 16, before adjourning for Thanksgiving, the full House approved its Tax Cuts and Jobs Act, H.R. 1 (see HAC News, 11/6/17), and the Senate Finance Committee approved its version of the bill. The Senate bill would keep the mortgage interest deduction and, unlike the House bill, would preserve the New Markets Tax Credit through 2019. Both bills retain the LIHTC, and the Senate – but not the House – also protects the use of private activity bonds that make 4% tax credits possible. Neither bill makes adjustments to prevent a negative impact on affordable housing investments that would be created by their substantial decrease in the corporate tax rate. In addition, aside from direct programmatic changes to housing-related programs, because the tax bills reduce revenue to the federal government they are expected to result in later funding cuts for domestic discretionary programs including housing.

House passes flood insurance bill. Passed by the full House on November 14, H.R. 2874 would reauthorize the National Flood Insurance Program, which expires December 8, for five years. It would also make changes, including alterations intended to introduce private market competition. Senators are still negotiating terms of their own NFIP bill.

USDA announces Rural Development state directors. A complete list of state directors for RD (and for the Farm Service Agency) was announced by Secretary of Agriculture Sonny Perdue.

CFPB director Cordray resigns. Richard Cordray, director of the Consumer Financial Protection Bureau since its inception, plans to leave his post by the end of the month. It is not clear yet what this will mean for the agency, created by the Dodd-Frank Act and repeatedly attacked in efforts to repeal or revise that law.

VA offers per diem assistance. Nonprofits, state and local governments, tribal governments, and faith-based and community-based organizations are eligible for Per Diem Only funds under the Homeless Providers Grant and Per Diem Program. Applicants can apply by February 21, 2018 to continue providing Transition in Place grants or to begin a TIP housing model to facilitate housing stabilization. For more information, contact Jeffery Quarles, VA, 877-332-0334.

Input requested on free access to credit scores. To learn more about the experiences of consumers, counseling providers, and others regarding access to free credit scores, the Consumer Financial Protection Bureau requests comments by February 12. For more information, contact Irene Skricki, CFPB, 202-435-7181.

Section 504 handbook revised. Several changes to USDA RD’s single-family program handbook impact Section 504 home repair loans and grants for homeowners. For more information, contact an RD state office.

Annual Adjustment Factors released for FY18. HUD’s AAFs are used to adjust Section 8 contract rents on their anniversaries. Contact people vary by program and are listed in the notice.

Fannie and Freddie met most affordable housing goals in 2016. The Federal Housing Finance Agency, which regulates Fannie Mae and Freddie Mac, reported recently that Freddie Mac met its single-family and multifamily goals in 2016, while Fannie Mae met its multifamily goals and some of its single-family goals. (The affordable housing goals are separate from the entities’ Duty to Serve requirements.)

40,000-120,000 HUD Housing Choice Vouchers could be unfunded in FY18. The Center on Budget and Policy Priorities has calculated that, due to rising rents and other factors, neither the House nor Senate appropriations bills for FY18 provides enough funding to renew all HUD vouchers currently in use or lost due to shortfalls in FY17. Both bills would add vouchers for specific populations, but not enough to offset the losses.

Research shows federal housing assistance widespread but insufficient. “Federal Rental Assistance Provides Affordable Homes for Vulnerable People in All Types of Communities,” published by the Center on Budget and Policy Priorities in partnership with HAC, covers the scope and limitations of federal rental assistance programs. The analysis uses HAC’s definition of “rural” places, which is based on Census tracts rather than on entire counties, as metropolitan and nonmetro designations are. Due primarily to funding levels for federal housing programs, the research found that, for every assisted household in the U.S., roughly three renter households pay half or more of their income for housing. Assistance is distributed proportionally, relative to need, across rural, suburban, and urban places. In rural areas, 70% of federal rental assistance is from project-based programs, while in urban and suburban places, use is evenly split between tenant-based and project-based.

NEED CAPITAL FOR YOUR AFFORDABLE HOUSING PROJECT?

HAC’s loan funds provide low interest rate loans to support single- and multifamily affordable housing projects for low-income rural residents throughout the U.S. and territories. Capital is available for all types of affordable and mixed-income housing projects, including preservation, farmworker, senior, and veteran housing. HAC loan funds can be used for pre-development, site acquisition, site development, and construction/rehabilitation. Contact HAC’s loan fund staff at hacloanfund@ruralhome.org, 202-842-8600.

Please note: HAC is not able to offer loans to individuals or families. Borrowers must be nonprofit or for-profit organizations or government entities (including tribes).

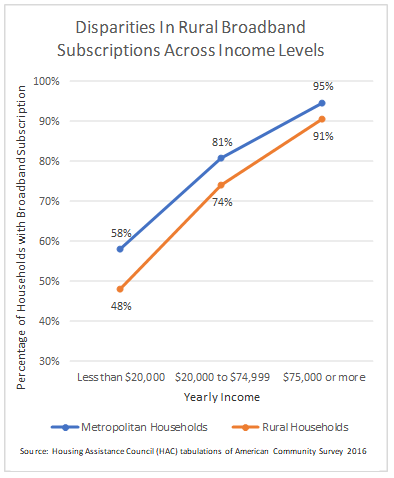

households, compared to 6 percent of metropolitan area households use satellite internet services. Greater isolation and more sparse populations in rural areas likely explain the more common use of satellite technology, where cable or fiber optic services are not available.

households, compared to 6 percent of metropolitan area households use satellite internet services. Greater isolation and more sparse populations in rural areas likely explain the more common use of satellite technology, where cable or fiber optic services are not available.