HAC News: February 11, 2019

News Formats. pdf

February 11, 2019

Vol. 48, No. 3

February is Black History Month • Government funded to February 15, another shutdown possible • Rural Rental Assistance payments obligated through April • USDA explains status of homeownership programs • HAC offers grants for housing aid to rural veterans • Puerto Rico disaster funds available • FY2020 budget process begins in March • Senator releases housing finance reform outline, White House developing a proposal • HAC symposium on rural veterans’ housing and services scheduled for April in Arkansas • Hazlett leaving USDA, Baxley to move to Secretary’s office • Rural broadband application deadlines to be extended • USDA raises loan-to-cost ratio for guaranteed rental housing loans

HAC News Formats. pdf

February 11, 2019

Vol. 48, No. 3

February is Black History Month.

House subcommittee to hold hearing on rural housing.

HAC will be one of several organizations testifying in a hearing titled “The Affordable Housing Crisis in Rural America: Assessing the Federal Response,” convened by the Housing, Community Development, and Insurance Subcommittee of the House Financial Services Committee. The hearing will be broadcast live online, February 14 at 10 a.m. eastern.

Government funded to February 15, another shutdown possible.

The partial government shutdown that began December 22 ended on January 25 with a short-term continuing resolution lasting through February 15. It is possible the same government agencies will close again if Congress and the President do not reach agreement on appropriations and border security.

Rural Rental Assistance payments obligated through April.

USDA RD shared with HAC a notice sent to owners and managers of USDA-financed properties with Section 521 Rental Assistance: “We are pleased to inform you that Rental Assistance for Section 514/515 properties has been obligated through April. The Management Interactive Network Connection (MINC) has been updated to reflect these obligations. We understand that the most recent lapse in appropriations created anxiety and uncertainty regarding the status of your contract obligations. We are hopeful that this communique and the fact that all contracts are obligated through April will provide you reassurance and operational predictability in your management of these critical low-income resources throughout rural America. Thank you for your partnership in delivering the Rural Housing Service affordable housing mission.”

USDA explains status of homeownership programs.

USDA’s single-family programs office says it will issue new Certificates of Eligibility to all Section 502 direct applicants who had valid COEs on December 21 before the government shut down. The agency does not have enough funding to obligate more Section 502 direct loans until it receives funding beyond February 15, however. Section 504 repair loans and grants are available; applicants with immediate health and safety hazards will receive priority. A funding plan for Section 523 self-help grantee organizations is being developed.

HAC offers grants for housing aid to rural veterans.

HAC’s Affordable Housing for Rural Veterans initiative supports local nonprofit housing development organizations that meet or help meet the affordable housing needs of veterans in rural areas. Grants may be up to $30,000 and must support bricks-and-mortar projects that assist low-income, elderly and/or disabled veterans with home repair and rehab needs, support homeless veterans, help veterans become homeowners, and/or secure affordable rental housing. This initiative is funded through the generous support of the Home Depot Foundation. Applications are due March 11. For more information, contact HAC staff, ahrv@ruralhome.org.

Puerto Rico disaster funds available.

HUD has released the initial $1.5 billion of CDBG-DR funds for Puerto Rico that were approved before the shutdown and then delayed.

FY2020 budget process begins in March.

Preparation of the Administration’s budget for the year that begins October 1, 2019 was delayed by the shutdown. Reportedly, summary budget information will be released the week of March 11 and details the week of March 18. Unless Congress and the President agree to raise the Budget Control Act caps on federal spending, as they have in recent years, the caps will come back into effect for FY20 and force significant cuts in appropriations.

Senator releases housing finance reform outline, White House developing a proposal.

Senate Banking Committee Chair Sen. Mike Crapo (R-ID) on February 1 released an outline for housing finance reform. The proposal would privatize Fannie Mae and Freddie Mac and would allow other mortgage guarantors as well. The current affordable housing goals and Duty to Serve requirements would be replaced by a new Market Access Fund. Funding for the Housing Trust Fund, Capital Magnet Fund, and Market Access Fund would be funded through an assessment on total annual loan volume. Joseph Otting, acting director of the Federal Housing Finance Agency, which regulates Fannie and Freddie, has reportedly told FHFA staff the Administration also plans to move forward on housing finance reform; a White House statement said their framework is still in development.

HAC symposium on rural veterans’ housing and services scheduled for April in Arkansas.

HAC’s 5th Annual National Symposium on Veterans Housing Issues will be held April 18-19 at Arkansas State University in Jonesboro, sponsored by the Home Depot Foundation. This year’s theme centers on addressing the critical needs around housing, homelessness and aging solutions for rural veterans, within the context of the Delta Regional Authority’s eight-state service area. There is no fee to attend, but space is limited and advance registration is required. For more information, contact Cheryl Cobbler, HAC.

Hazlett leaving USDA, Baxley to move to Secretary’s office.

Anne Hazlett is leaving her position as Assistant to the Secretary for Rural Development at USDA to go to the White House Office of National Drug Control Policy. Joel Baxley, currently RHS Administrator, will become the Acting Assistant to the Secretary for RD. USDA Secretary Sonny Perdue and the White House are working to find a nominee for the position of Under Secretary for Rural Development. That job was eliminated by Perdue but the recent Farm Bill required it to be filled. USDA’s announcement does not name an Acting RHS Administrator but Rich Davis, RHS Deputy Administrator for Community Facilities, is expected to serve in that role.

Rural broadband application deadlines to be extended.

The first application deadline for USDA RD’s new ReConnect Program was initially set for April, but the agency has announced it will shift that to May 31 or later. Specific deadlines will be posted in the Federal Register in late February.

USDA raises loan-to-cost ratio for guaranteed rental housing loans.

Effective February 7, 2019, the low loan-to-cost ratio required for a continuous guarantee (a single guarantee for construction and permanent loans) through the Section 538 rental guarantee program will be 70% rather than the previous 50%. For more information, contact Tammy Daniels, USDA, 202-720-0021.

Need capital for your affordable housing project?

HAC’s loan funds provide low interest rate loans to support single- and multifamily affordable housing projects for low-income rural residents throughout the U.S. and territories. Capital is available for all types of affordable and mixed-income housing projects, including preservation, farmworker, senior and veteran housing. HAC loan funds can be used for pre-development, site acquisition, site development and construction/rehabilitation. Contact HAC’s loan fund staff at hacloanfund@ruralhome.org, 202-842-8600.

Please note: HAC is not able to offer loans to individuals or families. Borrowers must be nonprofit or for-profit organizations or government entities (including tribes).

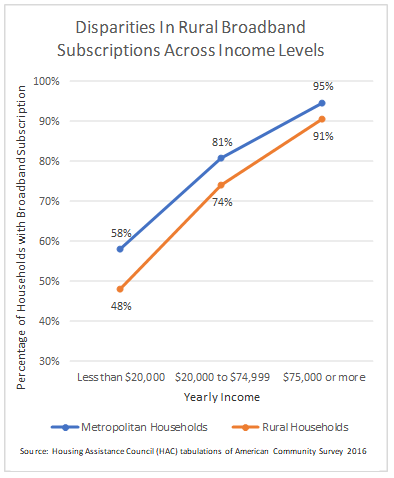

households, compared to 6 percent of metropolitan area households use satellite internet services. Greater isolation and more sparse populations in rural areas likely explain the more common use of satellite technology, where cable or fiber optic services are not available.

households, compared to 6 percent of metropolitan area households use satellite internet services. Greater isolation and more sparse populations in rural areas likely explain the more common use of satellite technology, where cable or fiber optic services are not available.