Children’s Economic Well-Being Continues to Suffer Since the Recession

Each year, the Annie E. Casey Foundation releases the KIDS COUNT Data Book,a report that assesses child well-being using an index of 16 indicators. The report ranks each of the 50 states on these indicators organized into 4 domains: (1) Economic Well-Being, (2) Education, (3) Health and (4) Family and Community. In particular, the Data Book focuses on children within the context of the United States’ post-recession economic recovery. The report presents a comparison of data from 2008 and data from 2013 (the most recently available) to assess how children have fared since the economic crisis.

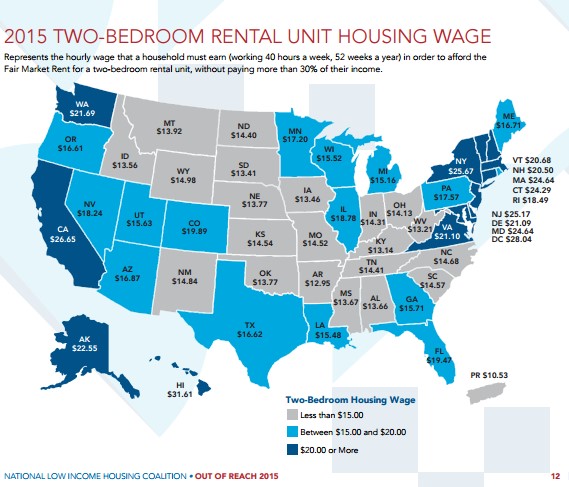

The National Low Income Housing Coalition (NLIHC) recently released its annual Out of Reach report. The report is known for defining the Housing Wage; the wage one must earn in order to afford a rental unit at Fair Market Rent (FMR) 1.

According to the most recent Out of Reach report, the 2015 Housing Wage is $19.35 for a two-bedroom unit, and $13.50 for a one-bedroom unit at FMR 2. This means that in order to afford a two-bedroom rental unit, a worker would have to make over 2.5 times the federal minium wage. In fact, in 13 states and Washington, DC the Housing Wage is more than $20 an hour. There is no state in the U.S. where a minimum wage earner can afford a one-bedroom apartment at Fair Market Rent, even if they work full time. NLIHC suggests that the nation needs to add 7.1 million units affordable to Extremely Low Income households in order to meet the demand.

How are Rural Renters Faring?

The Out of Reach report also highlights some of the special challenges faced by residents in rural communities. According to the report, hourly wages in rural areas are insufficient to meet the cost of living, despite lower housing costs compared to nonrural areas. For example, the estimated renter wage in West Virgina is $10.26 and $11.38 in Kentucky, and in both states about 70% of Extremely Low Income renters pay more than half of their incomes toward rent. Paying so much for rent means that there is less money left over for other necessities like food and healthcare.

Two-Bedroom Housing Wage Map 3

2 Estimates of Fair Market Rent are produced annually by HUD, and measure the 40th percentile of gross rents for typical, non-substandard rental units occupied by recent movers in a local housing market.

3 National Low Income Housing Coalition. (2015). Out of Reach 2015. Washington, DC. https://nlihc.org/sites/default/files/oor/OOR_2015_FULL.pdf

FOR MORE INFORMATION

Download the Out of Reach report published by National Low Income Housing Coalition

Additional HAC Resources on Housing

HAC’s Decennial Report: Taking Stock: Rural People, Poverty, and Housing in 21st Century.

Access data on housing affordability for your community at HAC’s