HAC News: October 21, 2019

News Formats. pdf

October 21, 2019

Vol. 48, No. 21

Senate may begin considering FY20 spending bills the week of October 21 • Apply by November 15 for grants to support housing aid to rural veterans • HUD offers funds for new Section 811 housing and rental aid for persons with disabilities • USDA obligated all Section 502 direct funds for FY19, but not Section 504 • USDA to begin accepting Section 538 rental guarantee applications continuously • Lawsuit charges Texas’s Hurricane Harvey recovery discriminates against low-income renters of color • Executive Orders increase scrutiny of agency guidance • Administration tells agencies to pay as they go • Senate committee considers homeownership in Indian Country • USDA names Deputy Administrator for rental housing office • Threshold raised for single-family appraisal requirements • HUD sets expediated process for PHAs in disaster countries • NEW! HAC offers Section 502 packaging training for nonprofits, Nov. 12-14 in Tampa • HAC training for housing counselors set for November in Tampa • Need capital for your affordable housing project?

HAC News Formats. pdf

October 21, 2019

Vol. 48, No. 21

Senate may begin considering FY20 spending bills the week of October 21.

The first FY20 appropriations bill to be debated on the Senate floor may be a package that includes funding for HUD and USDA, along with other agencies. Even after the Senate passes its measures, differences between its bills and the House’s will need to be resolved, as will differences with White House priorities.

Apply by November 15 for grants to support housing aid to rural veterans.

HAC’s Affordable Housing for Rural Veterans initiative supports local nonprofit housing development organizations that meet or help meet the affordable housing needs of veterans in rural areas. Grants typically range up to $30,000 per organization and must support bricks-and-mortar projects that assist low-income, elderly and/or disabled veterans with home repair and rehab needs, support homeless veterans, help veterans become homeowners and/or secure affordable rental housing. This initiative is funded through the generous support of the Home Depot Foundation. Applications are due November 15 by 5:00 pm Eastern time. For more information, contact HAC staff, ahrv@ruralhome.org.

HUD offers funds for new Section 811 housing and rental aid for persons with disabilities.

For the first time since 2010, capital advances and rental assistance contracts are available for nonprofits to develop permanent supportive rental housing for very low-income adults with disabilities. For the first time since 2013, project-based rental subsidies are also offered to state agencies, to be used for existing, rehabilitated or new permanent supportive housing units that do not have capital advances from HUD’s Section 811 or 202 programs. Applications for both funding pools are due February 10, 2020. For more information, contact HUD staff at FY18811NOFA@hud.gov.

USDA obligated all Section 502 direct funds for FY19, but not Section 504.

Despite the federal government shutdown early in the fiscal year, USDA obligated all available funds for Section 502 direct loans this year, using just over $1 billion for a total of 6,194 mortgage loans to new low-income homebuyers. About 37% of the loans and 42% of the dollars went to very low-income applicants. HAC appreciates RHS Administrator Bruce Lammers’s approval of overtime for field staff and other special authorizations, which made this possible.

There was, however, a significant shortfall in the agency’s use of Section 504 loans and grants for repairs to homes owned by very low-income people. USDA obligated 2,735 Section 504 loans, representing $17.4 million of the $28 million available, and 3,908 grants, using $24.8 million of the $30 million appropriated. The remaining grant funds can be used in FY20, but the loan monies cannot.

Use of resources for rental housing preservation exceeded last year’s performance, with 85 loans from Section 515 and 205 loans and three grants from the MPR program.

More information is provided in HAC’s obligation report, and HAC will also publish a more detailed FY19 performance report.

USDA to begin accepting Section 538 rental guarantee applications continuously.

As proposed in December, USDA will no longer publish annual NOFAs for the Section 538 rental housing guarantee program. It will publish an announcement when funds are available and will then accept applications at any time. For more information, contact Monica Cole, RD, 202-720-1251.

Lawsuit charges Texas’s Hurricane Harvey recovery discriminates against low-income renters of color.

Low-income Hispanic and African-American renters have sued HUD and the state of Texas alleging discrimination in the distribution of CDBG Disaster Recovery funds after Hurricane Harvey in 2017. The suit claims that the state’s decision to target aid to homeowners, landlords and developers while excluding renters is discriminatory because low-income renters are more likely to be African-American or Hispanic.

Executive Orders increase scrutiny of agency guidance.

On October 9 President Trump signed two Executive Orders, one requiring federal executive agencies such as USDA and HUD to increase transparency around their use of guidance documents and the other limiting agency reliance on past enforcement activities to establish standards of compliance with laws or regulations. The Office of Management and Budget is given authority to implement the provisions on guidance documents, including to require OMB review of “significant” guidance documents. The Executive Order does not refer to OMB review authorities announced in an April 11, 2019 memo from OMB’s Acting Director Russell Vought, though the two seem to overlap.

Administration tells agencies to pay as they go.

An Executive Order issued on October 10 intends to “reinvigorate administrative PAYGO,” requiring federal departments and agencies to reduce spending in one area when they propose a spending increase in another area unless a law requires the increase. OMB is given authority to waive the requirements and to issue instructions for implementing the order.

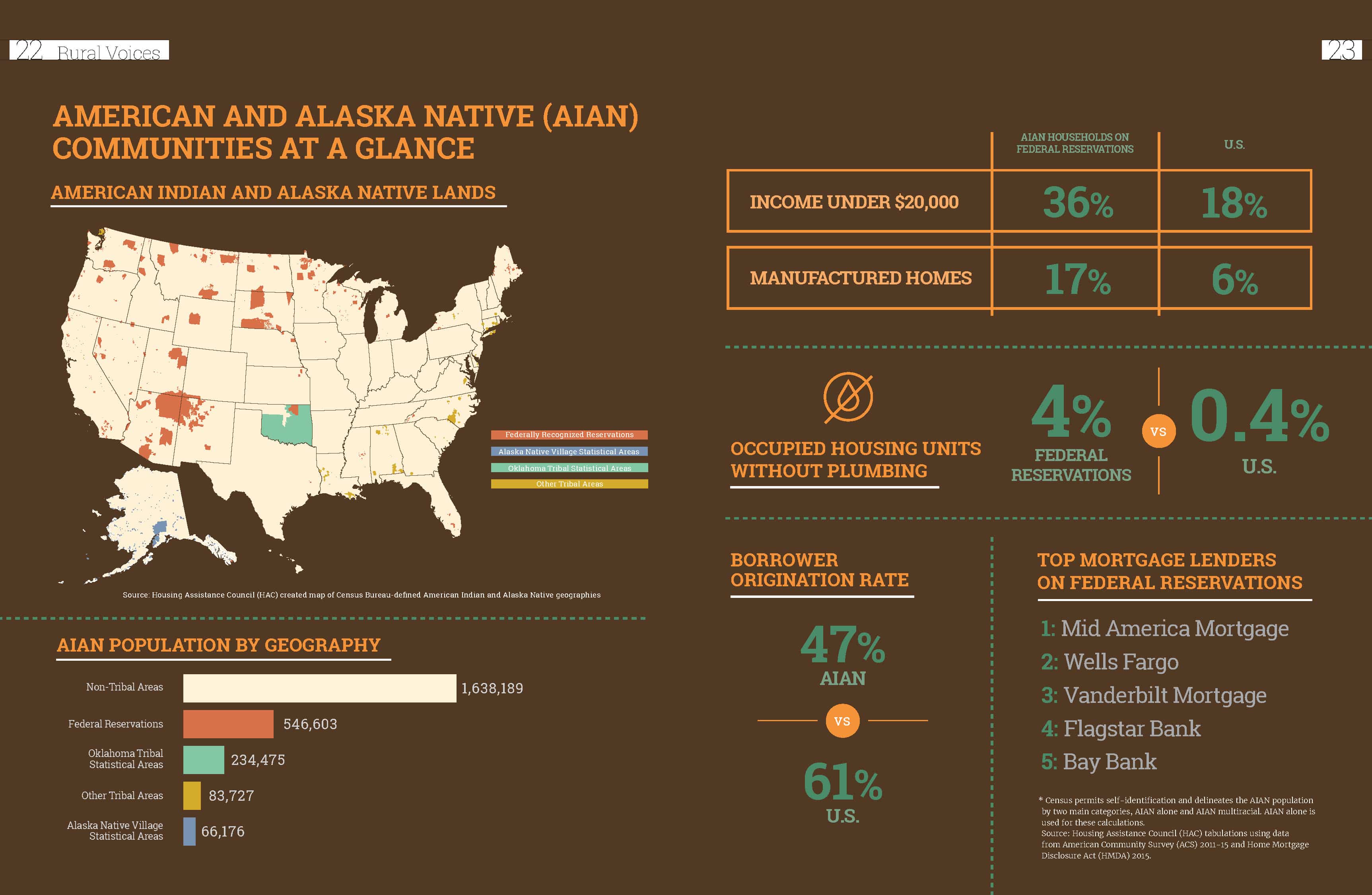

Senate committee considers homeownership in Indian Country.

On October 16, the Senate Indian Affairs Committee held a hearing entitled “Lending Opportunities: Opening the Door to Homeownership in Indian Country.” Witnesses included HUD Assistant Secretary for Public and Indian Housing Hunter Kurtz, Governor Max Zuni of the Pueblo of Isleta, Council Member Nate Mount of the Ft. Belknap Indian Community, BIA Director Darryl LaCounte and Patrice Kunesh from the Center for Indian Country Development at the Federal Reserve Bank of Minneapolis. Discussions focused on the need for capital in Indian Country, the role Native CDFIs can play in bringing lending capacity to tribal areas and potential modernizations to the HUD Section 184 program. For more on challenges and opportunities for mortgage finance in Indian Country, review HAC’s recent report here.

USDA names Deputy Administrator for rental housing office.

Nancie-Ann Bodell, who became Acting Deputy Administrator for Multi-Family Housing several months ago, has been selected to fill the position on a permanent basis. She oversees USDA’s programs for the production and preservation of rental housing as well as the existing portfolio of affordable rental housing and farm labor housing.

Threshold raised for single-family appraisal requirements.

The agencies that regulate banks and thrifts are raising the threshold level at which appraisals are not required for single-family (one to four units) real estate transactions from $250,000 to $400,000. Some rural properties are exempt from the appraisal requirement altogether. When appraisals are not required, lenders must obtain evaluations, consistent with safe and sound banking practices. For more information, contact G. Kevin Lawton, Office of the Comptroller of the Currency, 202-649-7152.

HUD sets expedited process for PHAs in disaster counties.

HUD has established an expedited process to review requests for relief from HUD regulatory and/or administrative requirements for public housing agencies in counties that are included in major disaster declarations in calendar year 2019. For more information, contact HUD staff, PIH_Disaster_Relief@hud.gov.

*NEW!* HAC offers Section 502 packaging training for nonprofits, Nov. 12-14 in Tampa.

This three-day advanced course trains experienced participants to assist potential borrowers and work with RD staff, other nonprofits and regional intermediaries to deliver successful Section 502 loan packages. The training will be held in Tampa, FL on November 12-14. For more information, contact HAC staff, 404-892-4824.

HAC training for housing counselors set for November in Tampa.

HUD’s final rule on new certification requirements for housing counselors requires that by August 1, 2020 counseling for or in connection with any HUD programs must be provided by HUD Certified Housing Counselors. Get ready! Elevate your knowledge in the six essential competency areas, including financial management, housing affordability, homeownership, avoiding foreclosure, tenancy and fair housing. Set yourself up for success in meeting HUD’s counselor certification requirements by starting your prep with this three-day course scheduled for Tampa, FL on November 12-14. The registration fee is $500. For more information, contact HAC staff, 404-892-4824.

Need capital for your affordable housing project?

HAC’s loan funds provide low interest rate loans to support single- and multifamily affordable housing projects for low-income rural residents throughout the U.S. and territories. Capital is available for all types of affordable and mixed-income housing projects, including preservation, farmworker, senior and veteran housing. HAC loan funds can be used for pre-development, site acquisition, site development and construction/rehabilitation. Contact HAC’s loan fund staff at hacloanfund@ruralhome.org, 202-842-8600.

Please note: HAC is not able to offer loans to individuals or families. Borrowers must be nonprofit or for-profit organizations or government entities (including tribes).