HUD Secretary Julián Castro Discusses Rural Housing

This story appears in the 2015 Spring Edition of Rural Voices

This story appears in the 2015 Spring Edition of Rural Voices

At the recent 2014 HAC Rural Housing Conference, HUD Secretary Julián Castro sat down with HAC’s Executive Director, Moises Loza, to discuss HUD’s role in rural America, his passion for public service, and how he thinks HUD can better serve rural communities across the country.

Moises Loza: How is HUD working in rural America, and what should HUD’s role be in rural places?

Secretary Castro: We’re getting ready to celebrate 50 years of HUD, and of course the title of our department is Housing and Urban Development. But the more accurate description would be Housing and Community Development, because HUD is charged with making investments and working with communities that include not only your typical urban city, but also tribal communities and rural communities. So, even in our bread and butter investments, for instance, the Community Development Block Grant (CDBG), about 30 percent, or or $800 million, of CDBG funding annually goes to states for use in non-entitlement communities, which usually are communities of less than 50,000 people. Another example is HOME. About 40 percent of HUD HOME money goes to states for use in smaller localities.

In my four months as HUD Secretary, I’ve visited more than 20 different communities including places in Alaska, South Dakota, and North Dakota. I had a chance to see the breadth of what HUD is doing out there and I can say that we’re very committed to, and very interested in lifting up America’s rural communities, just like we’re investing in urban communities.

Secretary Castro: It was an eye-opening experience. The most poignant moment that I had in these last four months was at the Pine Ridge reservation in South Dakota. I visited two homes there and one of the homes had thirteen people living in one four-bedroom house. The other home had seventeen people, including two different families living in the basement. To the extent that we call ourselves at HUD, “the department of opportunity,” we want to help spark opportunity by realizing that housing is just one part of the equation. Somebody needs to have a roof over their head, but we also need to make sure that they have access to good education and employment or job training, so that they can become employable.

Loza: I know you have visited Native American reservations in North and South Dakota, the Turtle Mountain Chippewa among others. What kind of lessons have you taken from having seen those situations that’s going to help as Secretary of HUD?

The feeling that I got at Pine Ridge was just how distant all of that seems. The connections among those things and just in general opportunities seemed distant from the folks there. The unemployment rate on the Pine Ridge is something like

68 percent. So you have these inveterate challenges, but the needs out there are much greater than the resources that have been dedicated to them. At the federal agency level, how do we get better

at working together? The Department of Housing and Urban Development, Department of Education, USDA, Small Business Administration are all institu tions of opportunity working to empower rural and tribal communities. So we need to get on the ball at HUD about figuring out how do our CDBG program, Indian Housing Grant, and other HUD programs interact with the other departments? How are we intersecting with those tribal communities and the private sector as well to help spark that opportunity in those places? Because after my visit, I could understand how some folks would feel like they were so far away from opportunity.

Loza: Besides this collaboration, because they want to positively impact people’s are there any thoughts or plans about how HUD might be able to address some of these very difficult problems?

Secretary Castro: Sure, I’ll give you a very concrete example of something that the President has pushed for and we’re glad to see get through Congress – the reauthorization of the Native American Housing and Self-Determination Act (NAHASDA). We’re also very happy that NAHASDA now includes the ability for HUD and the VA to allow the use of HUD VASH (Veterans Affairs Supportive Housing) vouchers for use in tribal communities. These HUD VASH vouchers have helped reduce the rate of homelessness among veterans by 33 percent. One of the things that I learned when I visited Pine Ridge and Turtle Mountain was that you have a higher than average percentage of residents in tribal communities that are veterans than in the normal everyday population. However, these HUD VASH vouchers could not be used for housing in tribal communities because of a quirk in the statute. There have been folks on both sides of the aisle, as well as the President, who advocated for changing that. So that is one practical thing that we believe would allow us to dedicate more resources to a needy group in these tribal communities that would make a difference.

Loza: The theme of our conference is in part about the need for a new generation of leaders in affordable housing and community development. You of course are one of those young emerging leaders. How do you think we can motivate more young people to enter and stay in this field?

Secretary Castro: One of our big challenges at HUD is getting people over this hump of three years. You have to find ways to satisfy the mission-driven aspect of our work. It’s been my experience that the people who get into this work are doing it because they care, and because they want to positively impact people’s lives. So we have to create a greater connection between what people are doing on an everyday basis, and the outcomes of their work – the good things, the benefits that happen in people’s lives.

It’s important to note that there are measures that have been taken since we went through the housing crisis to help ensure that we’re not going to fall back to where we were before.

What does that mean at a practical level? That means you structure your employment so that folks who are often times sitting behind a desk get a chance to actually interact with the people that we serve. Ideally, staff should have a chance to visit projects so that they make that connection with their passion of helping people. We want them to see the benefits to what they actually do on a daily basis, which let’s face it, is often not glamorous work and is typically done behind a desk. I think if those of us in housing, or any of the departments that

depend on mission-driven people, can improve making that connection, we will attract more folks. That, and more money. That always helps. But I know that people are not doing it for the money. I believe that feeding the mission-driven aspect is the key.

Loza: The Rural Housing and Economic Development program is something that I think is very dear to the hearts of many people working in rural communities. Any thoughts about whether that initiative could be reinstated or brought back?

Loza: The Rural Housing and Economic Development program is something that I think is very dear to the hearts of many people working in rural communities. Any thoughts about whether that initiative could be reinstated or brought back?

Secretary Castro: I think that the work and the investments ought to be continued, whether it’s made under that line item or not. One of the things that has stuck most in my mind as I’ve done this travelling as HUD Secretary are the needs out there in our rural communities and our tribal communities. We’re very open to discussion about how to help ensure that sufficient resources are going to those communities. There is a lot of work to do. Whether there is a line item or not, we should make sure that those investments are made in these communities, and I want people to know that I’m going to be very vigilant about that.

Loza: I have heard you speak about your interest in credit enhancement, making credit more available, and the tightness of credit at this time. Can you talk a bit about that?

Secretary Castro: Because of risky market products and other practices a few years ago we had a housing crisis. It was probably too easy, in some instances, to get a home loan. But now the pendulum has swung completely in the other direction. I’m sure you see in your communities where it is too difficult for folks to get a home loan. We’re talking about folks who are respon- sible, who may not have a credit score of 750, but they have a decent credit score and they’re responsible folks. They’re ready to own, ready to buy a home, and they can’t get credit. I’ve said that there should not be a stigma these days to promoting homeownership. It seems like, understandably, for the last few years people were hesitant about saying we need to promote homeownership. We’re promoting homeowner- ship in a responsible way. It’s important to note that there are measures that have been taken since we went through the housing crisis to help ensure that we’re not going to fall back to where we were before.

At HUD we’re happy that FHA’s mutual mortgage insurance fund recently got back into the black. I believe that will allow the FHA to continue to ful- fill its traditional role of ensuring that first time homebuyers and people of modest means can get access to credit. We also are encouraging the lenders to open up that credit box and to lend to folks that have credit scores that are 600 – 620. Right now it’s very difficult if you have a credit score underneath 680 to get a home loan. There are millions of Americans that are not able to access credit because of that. We want to change that in a responsible, constructive way.

Loza: Thank you very much Mr. Secretary.

Secretary Castro: Thank y’all.

[youtube]IVF0CiMZ-Eo[/youtube]

Julián Castro was sworn in as the 16th Secretary of the United States Department of Housing and Urban Development in July of 2014. In this role, Mr. Castro oversees 8,000 employees and a budget of 46 billion dollars. Before HUD, Mr. Castro served as the mayor of the city of San Antonio, Texas. During this tenure he became known as a national leader in urban development. In 2010 the city launched the “Decade of Downtown,” an initiative to spark investment in San Antonio’s center city and older neighborhoods. This effort has attracted $350 million in private sector investment with a goal of developing 7,500 new homes by 2020. Previously, Mr. Castro served as a member of the San Antonio city council. He is also an attorney who worked at Akin Gump Strauss Hauer & Feld LLP before starting his own practice. Secretary Castro received a B.A. from Stanford University, and a J.D. from Harvard Law School.

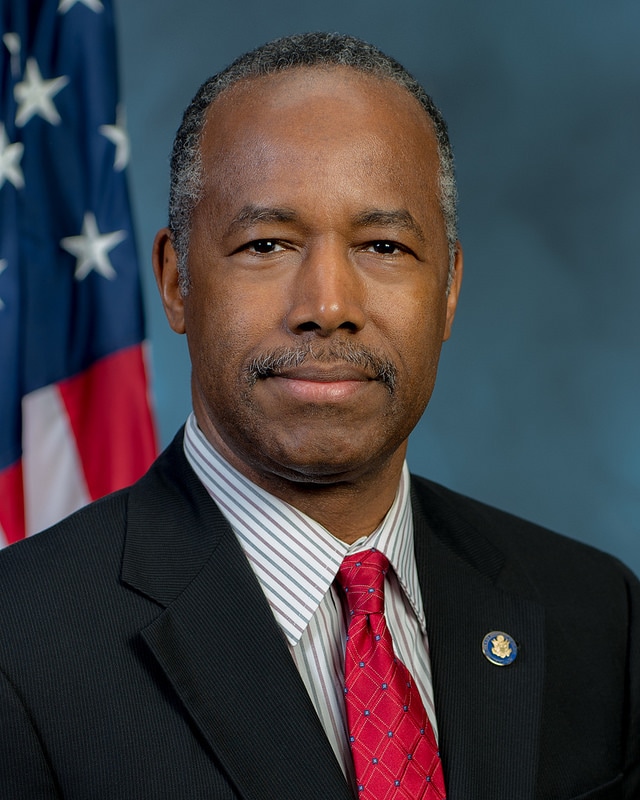

The Housing Assistance Council is pleased to announce that Ben Carson, Secretary of the US Department of Housing and Urban Development, will provide remarks at the upcoming HAC Rural Housing Conference.

The Housing Assistance Council is pleased to announce that Ben Carson, Secretary of the US Department of Housing and Urban Development, will provide remarks at the upcoming HAC Rural Housing Conference.

Loza: The Rural Housing and Economic Development program is something that I think is very dear to the hearts of many people working in rural communities. Any thoughts about whether that initiative could be reinstated or brought back?

Loza: The Rural Housing and Economic Development program is something that I think is very dear to the hearts of many people working in rural communities. Any thoughts about whether that initiative could be reinstated or brought back?