News Formats. pdf

April 5, 2019

Vol. 48, No. 7

April is Fair Housing Month • Experts tell Congress federal support for rural housing is essential • Calabria confirmed for FHFA • Legislators question HUD budget requests • Special authorizations issued to help USDA use all Section 502 direct mortgage funds • HUD offers funds for development of new Section 202 housing for elders • Grants available for household water wells and water/wastewater systems • Revisions proposed to HUD’s Section 3 regulations • USDA properties again encouraged to host summer meals program • Bill introduced to target more federal funding to persistently poor areas • USDA seeks site manager and maintenance person of the year • RuralSTAT • Flooding creates emergency for South Dakota Indian reservations • President requests housing finance reform plan • Current and past USDA officials disagree on ERS/NIFA relocation • Nearly one-fourth of the most rural counties see increase in severely cost-burdened housing • HAC offers Section 502 packaging training for nonprofits in May • Local solutions go national at People & Places 2019 • HAC symposium on rural veterans’ housing and services scheduled for April in Arkansas • Need capital for your affordable housing project?

HAC News Formats. pdf

April 5, 2019

Vol. 48, No. 7

April is Fair Housing Month.

To mark the occasion, HUD launched a new campaign against sexual harassment in housing. The House Financial Services Committee convened a hearing April 2 on “The Fair Housing Act: Reviewing Efforts to Eliminate Discrimination and Promote Opportunity in Housing.” To learn more about fair housing or to file a complaint, visit HUD’s site or call 1-800-669-9777.

Experts tell Congress federal support for rural housing is essential.

On April 2, HAC CEO David Lipsetz was one of five panelists at “The Affordable Housing Crisis in Rural America: Assessing the Federal Response,” a hearing convened by the House Financial Services Committee’s Subcommittee on Housing, Community Development and Insurance. Covered topics included the need to address rental properties’ maturing mortgages, the need for local capacity building and the need for new construction of rental housing in rural areas, as well as the possibility of moving the USDA rural housing programs to HUD – an idea not supported by any of the panelists.

Calabria confirmed for FHFA.

The Senate confirmed Mark Calabria on April 4 to be Director of the Federal Housing Finance Agency. As a Director at the Cato Institute, and later as a Chief Economist for Vice President Pence, Calabria voiced strong views about the existing housing finance system. At his recent confirmation hearing he assured the Senate Banking Committee that as FHFA Director he would carry out the existing law, including the Duty to Serve requirements related to manufactured housing, affordable housing preservation and rural housing.

Legislators question HUD budget requests.

HUD Secretary Ben Carson testified at April 3 hearings before both the House and Senate Agriculture Appropriations Subcommittees. Members of both parties criticized the deep funding cuts proposed in the Administration’s FY20 budget.

Special authorizations issued to help USDA use all Section 502 direct mortgage funds.

As it has done in the past, USDA is waiving some requirements for Section 502 direct applications in order to reduce processing time and help use all the funds. This year’s temporary authorizations relate to credit scores, student loan payments, and oral verification of employment. For more information, contact an RD office.

HUD offers funds for development of new Section 202 housing for elders.

For the first time since 2010, HUD has capital advances available for nonprofits and coops to develop and operate rental housing for very low-income elderly residents. Applications are due August 28. For more information, email 202CapitalAdvanceNOFA@hud.gov.

Grants available for household water wells and water/wastewater systems.

Recipients of Household Water Well System Grants can reloan the funds to individuals to construct, refurbish and service their rural household well systems. Revolving Fund Program grants can be reloaned to finance predevelopment costs or small capital projects for water/wastewater systems. For both programs, applications are due May 27 and the contact for more information is Derek Jones, RUS, 202-720-9640.

Revisions proposed to HUD’s Section 3 regulations.

Section 3 requires that employment and other economic opportunities generated by HUD assistance be directed to low- and very low-income people, especially those receiving HUD aid. Comments are due June 3 on a proposed update to the regulations and initial benchmarks for measuring compliance. Contacts for more information vary by program and are listed in the proposals.

USDA properties again encouraged to host summer meals program.

Rental properties, self-help developments with common spaces, and community facilities funded by the Rural Housing Service are invited to participate in USDA’s Summer Food Service Program. For more information, contact a USDA RD state office or Food and Nutrition Service regional office. HAC has published a new research note on USDA-financed housing developments’ summer meals participation.

Bill introduced to target more federal funding to persistently poor areas.

Sen. Cory Booker (D-NJ) and Rep. James Clyburn (D-SC) have introduced a bill to expand the 10-20-30 formula, which requires at least 10% of a federal program’s funds go to communities where the poverty rate has been at least 20% over the past 30 years. Their proposal would apply the formula to additional programs and would target some resources to census tracts with current poverty rates over 20%. Sen. Booker’s announcement quotes a statement of support from HAC’s David Lipsetz.

USDA seeks site manager and maintenance person of the year.

Nominations are due May 17 for USDA Rural Development’s Multi-Family Housing Site Manager and Maintenance Person of the Year program, recognizing those who go above and beyond to assure the success of USDA-financed rental and farmworker housing properties. For more information, contact Charlene Broussard, USDA, 337-262-6611, ext. 142.

RuralSTAT.

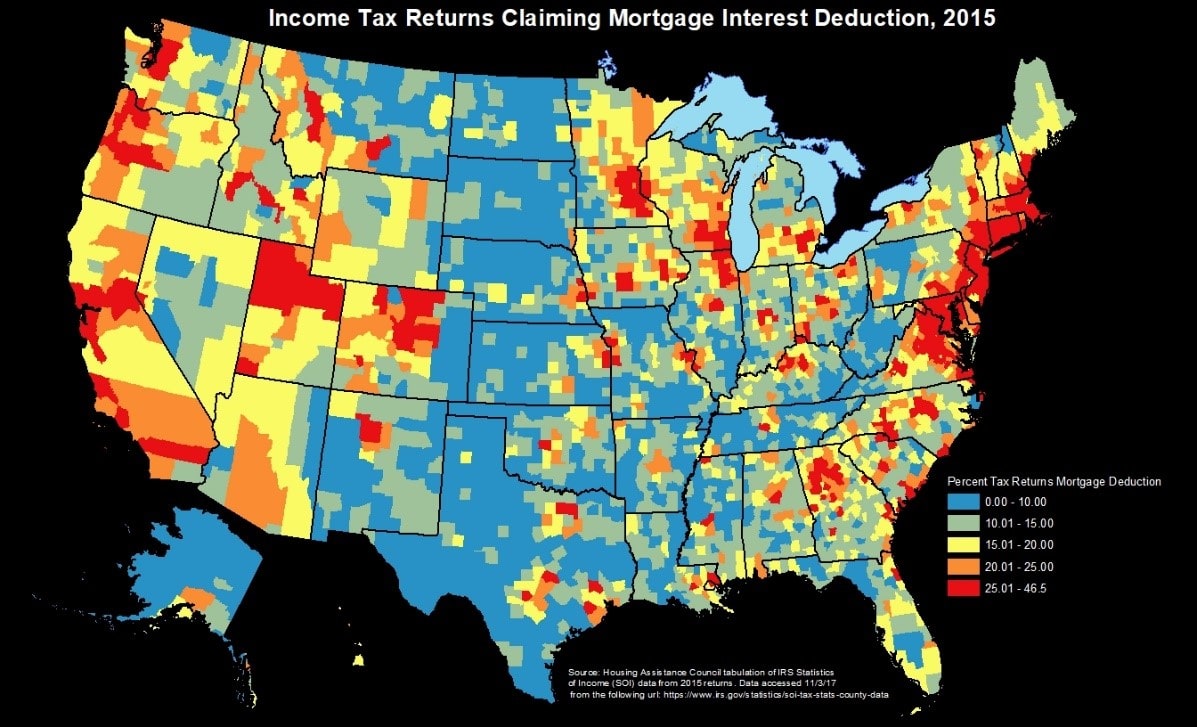

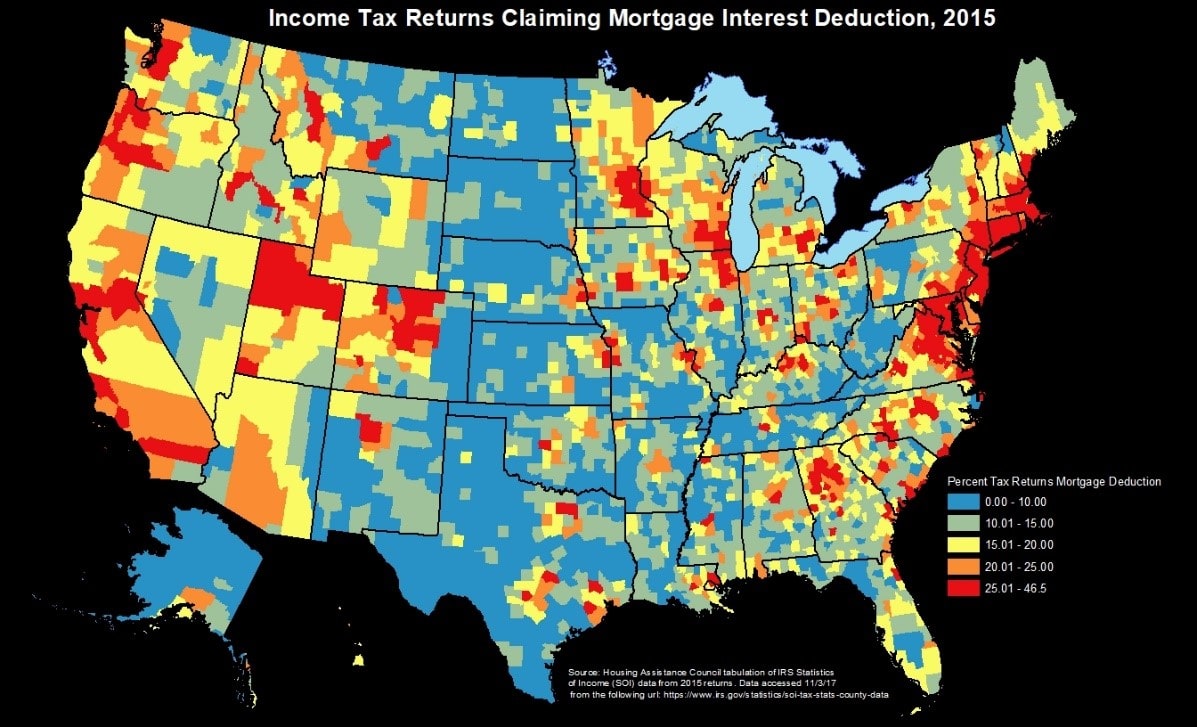

Taxpayers in counties outside metropolitan areas filed 13.5% of all tax returns in 2015 but accounted for just 8.5% of filers claiming a mortgage interest deduction. For more information on the mortgage interest deduction in rural America, see HAC’s Rural Research Note on the subject.

Flooding creates emergency for South Dakota Indian reservations.

Storms and flooding in March struck not only Nebraska and Iowa, where the federal government has declared states of emergency, but also tribes in South Dakota. Tribal officials for the Cheyenne River, Pine Ridge, Rosebud and Standing Rock reservations have declared states of emergency. The Red Cross is assisting people on those reservations. Media stories report the National Guard distributed water on Pine Ridge, the Red Cross delivered supplies on Pine Ridge, dozens of Cheyenne River residents were evacuated during record-breaking floods, flooding was imminent at Standing Rock, and Pine Ridge families were trapped for days without access to food or medical care.

President requests housing finance reform plan.

A memorandum from President Trump tells the Secretary of the Treasury to develop a housing finance reform plan to end the conservatorships of Fannie Mae and Freddie Mac, facilitate competition in the housing market, increase the private sector’s participation in the mortgage market and more. It tells the HUD Secretary to develop a reform plan emphasizing FHA and Ginnie Mae, reducing taxpayer exposure and more. Both plans must be submitted “as soon as practicable.” Meanwhile, the Senate held hearings March 26 and March 27 on an outline for housing finance reform released by Senate Banking Committee Chair Sen. Mike Crapo (R-ID) in February.

Current and past USDA officials disagree on ERS/NIFA relocation.

Kristi J. Boswell, Senior Advisor to USDA Secretary Sonny Perdue, defended the proposed relocation of the Economic Research Service and National Institute of Food and Agriculture at a House Agriculture Appropriations Subcommittee hearing on March 27. Four past ERS administrators and USDA Under Secretaries testified against the idea. Subcommittee members’ support or opposition to the move and the budget’s proposed cuts in ERS funding split along party lines, though some supporters criticized the current list of possible new locations.

Nearly one-fourth of the most rural counties see increase in severely cost-burdened housing.

Articles by the Pew Trusts and Curbed cited HAC data and interviewed HAC staff to report that nearly one-fourth of the nation’s most rural counties have seen a sizeable increase this decade in the number of households spending at least half their income on housing. Many rural areas are facing increased pressure on rental market from economic revivals, bringing in new workers and pushing up rental prices. Meanwhile, federal investments in housing support and affordable housing construction have been limited in rural areas.

HAC offers Section 502 packaging training for nonprofits in May.

This three-day advanced course trains experienced participants to assist potential borrowers and work with RD staff, other nonprofits, and regional intermediaries to deliver successful Section 502 loan packages. The training will be held May 7-9 in Kansas City, MO. For more information, contact HAC staff, 404-892-4824.

Local solutions go national at People & Places 2019.

HAC is a co-host of People & Places 2019 on April 15-17 in Arlington, VA and has organized a workshop titled “Rural Arts & Design: A Proven Strategy Toward Equity, Affordable Homes and Stronger Local Economies.” Register by April 9.

HAC symposium on rural veterans’ housing and services scheduled for April in Arkansas.

HAC’s 5th Annual National Symposium on Veterans Housing Issues will be held April 18-19 at Arkansas State University in Jonesboro, sponsored by the Home Depot Foundation. This year’s theme centers on addressing the critical needs around housing, homelessness and aging solutions for rural veterans, within the context of the Delta Regional Authority’s eight-state service area. There is no fee to attend, but space is limited and advance registration is required. For more information, contact Cheryl Cobbler, HAC.

Need capital for your affordable housing project?

HAC’s loan funds provide low interest rate loans to support single- and multifamily affordable housing projects for low-income rural residents throughout the U.S. and territories. Capital is available for all types of affordable and mixed-income housing projects, including preservation, farmworker, senior and veteran housing. HAC loan funds can be used for pre-development, site acquisition, site development and construction/rehabilitation. Contact HAC’s loan fund staff at hacloanfund@ruralhome.org, 202-842-8600.

Please note: HAC is not able to offer loans to individuals or families. Borrowers must be nonprofit or for-profit organizations or government entities (including tribes).