HAC News Formats. pdf

March 29, 2018

Vol. 47, No. 7

April is Fair Housing Month• Final FY18 funding bill supports housing programs • Carson testifies on FY19 HUD budget proposal and HUD oversight • Rural broadband applications now accepted • Area eligibility changes proposed for rural housing programs • CFPB seeks more comments, extends deadlines • Pilot program to evaluate feasibility of mixed income occupancy in farmworker housing • GAO suggests improvements to RAD • USDA continues two-tier income pilot for single-family housing • USDA’s updated area loan limits go into effect January 17 and March 30 • Last Keepseagle appeals rejected by Supreme Court • NLIHC releases 2018 Advocates’ Guide

HAC News Formats. pdf

March 29, 2018

Vol. 47, No. 7

April is Fair Housing Month.

This year also marks the 50th anniversary of passage of the Fair Housing Act.

Final FY18 funding bill supports housing programs.

On March 23 President Trump signed into law an omnibus funding bill for fiscal year 2018, which began on October 1, 2017. Under the increased cap on FY18 spending, the final agreement raises funding levels for several housing programs above the amounts in both the House and Senate FY18 bills. These include Section 502 direct, Section 515, Section 542, and others at USDA, as well as HOME, CDBG, Section 202, Section 811, the Public Housing Capital Fund, tenant- and project-based vouchers, and others at HUD. The law makes some program changes as well. It increases Low Income Housing Tax Credit allocations for 2018-2021 and allows income averaging in LIHTC properties, making 60% of area median income the average income limit for all units in a property rather than the income limit for each individual apartment. It expands HUD’s Rental Assistance Demonstration for public housing, including raising the cap to 455,000 units, covering some Section 202 units, and extending the program to 2024. There is enough funding for this year’s preparations for the 2020 Census. A new pilot program of rural broadband loans and grants receives $600 million, to be administered by USDA’s Rural Utilities Service; USDA says that amount will leverage nearly $1 billion in total new rural broadband projects. [tdborder][/tdborder]

USDA Rural Dev. Prog.

(dollars in millions) |

FY16 Approp.

|

FY17 Approp.

|

FY18 House Bill (H.R. 3268)

|

FY18 Senate Bill (S. 1603)

|

FY18 Final Approp.

|

|

502 Single Fam. Direct

Self-Help setaside(b)

|

$900

5

|

$1,000

5

|

$900

5

|

$1,000

5

|

$1,100

5

|

|

502 Single Family Guar.

|

24,000

|

24,000

|

24,000

|

24,000

|

24,000

|

|

504 VLI Repair Loans

|

26.3

|

26.3

|

24

|

26.3

|

28

|

|

504 VLI Repair Grants

|

28.7

|

28.7

|

a

|

28.7

|

30

|

|

515 Rental Hsg. Direct Lns.

|

28.4

|

35

|

28.4

|

35

|

40

|

|

514 Farm Labor Hsg. Lns.

|

23.9

|

23.9

|

15

|

23.8

|

23

|

|

516 Farm Labor Hsg. Grts.

|

8.3

|

8.3

|

6

|

8.3

|

8.4

|

|

521 Rental Assistance

|

1,390

|

1,405

|

1,345

|

1,345

|

1,345

|

|

523 Self-Help TA

|

27.5

|

30

|

25

|

30

|

30

|

|

533 Hsg. Prsrv. Grants

|

3.5

|

5

|

a

|

5

|

10

|

|

538 Rental Hsg. Guar.

|

150

|

230

|

230

|

230

|

230

|

|

Rental Prsrv. Demo. (MPR)

|

22

|

22

|

15

|

22

|

22

|

|

542 Rural Hsg. Vouchers

|

15

|

19.4

|

20

|

19.4

|

25

|

|

Rural Cmnty. Dev’t Init.

|

4

|

4

|

0

|

4

|

4

|

a. Section 504 grants and Section 533 grants would have been rolled into a new Rural Economic Infrastructure Grant program. This change is not included in the final bill.

b. Figures shown represent budget authority, not program levels.

HUD Program

(dollars in millions) |

FY16 Approp.

|

FY17 Approp.

|

FY18 House Bill (H.R. 3353)

|

FY18 Senate Bill (S. 1655)

|

FY18 Final Approp.

|

|

CDBG

|

$3,000

|

$3,000

|

$2,900

|

$3,000

|

$3,300

|

|

HOME

|

950

|

950

|

850

|

950

|

1,362

|

|

Self-Help Homeownshp. (SHOP)

|

10

|

10

|

10

|

10

|

10

|

|

Veterans Home Rehab

|

5.7

|

4

|

0

|

4

|

4

|

|

Tenant-Based Rental Assstnce.

VASH setaside

Tribal VASH

|

19,628

60

0

|

20,292

40

7

|

20,487

577a

7

|

21,365

40a

5

|

22,015

40

5

|

|

Project-Based Rental Asstnce.

|

10,622

|

10,816

|

11,082

|

11,507

|

11,515

|

|

Public Hsg. Capital Fund

|

1,900

|

1,942

|

1,850

|

1,945

|

2,750

|

|

Public Hsg. Operating Fund

|

4,500

|

4,400

|

4,400

|

4,500

|

4,550

|

|

Choice Neighbrhd. Initiative

|

125

|

137.5

|

20

|

50

|

150

|

|

Native Amer. Hsg. Block Grt.

|

650

|

654

|

654

|

655

|

655

|

|

Homeless Assistance Grants

|

2,250

|

2,383

|

2,383

|

2,456

|

2,513

|

|

Hsg. Opps. for Persons w/ AIDS

|

335

|

356

|

356

|

330

|

375

|

|

202 Hsg. for Elderly

|

432.7

|

502.4

|

573

|

573

|

678

|

|

811 Hsg. for Disabled

|

150.6

|

146.2

|

147

|

147

|

230

|

|

Fair Housing

|

65.3

|

65.3

|

65.3

|

65.3

|

65

|

|

Healthy Homes & Lead Haz. Cntl.

|

110

|

145

|

130

|

160

|

230

|

|

Housing Counseling

|

47

|

55

|

50

|

47

|

55

|

a. The House bill specified that its entire VASH appropriation would be for renewals. The Senate bill would have renewed current VASH vouchers and provided $40 million for new ones.

Carson testifies on FY19 HUD budget proposal and HUD oversight.

On March 20, HUD Secretary Ben Carson appeared before a House appropriations subcommittee to discuss the Administration’s budget proposal for the fiscal year that begins October 31, 2018. He stated repeatedly that the new Opportunity Zones program would provide significant financing for local community and housing development. Asked about rural housing needs, he cited the importance of manufactured housing. Subcommittee members also asked about the recently canceled $31,000 furniture order for Carson’s office. On March 22, Carson faced similar questions at a Senate Banking Committee oversight hearing.

Rural broadband applications now accepted.

RUS will process applications for the Rural Broadband Access Loans and Loan Guarantees Program on a rolling basis from now through September 30, 2018. For more information, contact Shawn Arner, RUS, 202-720-0800.

Area eligibility changes proposed for rural housing programs.

Proposed changes to eligible areas, based on the “rural in character” criterion, are posted online. To see changes, select a tab to view a map for single-family, multifamily, or other programs, then select eligible properties, previously eligible areas, or proposed ineligible areas. Send comments by April 23 to RD State Directors, who will make final eligibility decisions, effective June 4, 2018.

CFPB seeks more comments, extends deadlines.

The Consumer Financial Protection Bureau has issued more requests for comments on specific aspects of its work and has extended the deadlines for some of its recent requests. All are summarized in the table below.

Pilot program to evaluate feasibility of mixed income occupancy in farmworker housing.

Section 514/516 properties that are fully operational before March 28 are eligible for this pilot under an Unnumbered Letter dated February 28, 2018. USDA will study the programmatic and logistical advantages and disadvantages of mixed occupancy in properties that are separated operationally but not physically. For more information, contact an RD state office.

GAO suggests improvements to RAD.

A Government Accountability Office report, Rental Assistance Demonstration: HUD Needs to Take Action to Improve Metrics and Ongoing Oversight, makes recommendations to HUD intended to improve leveraging metrics, monitoring of the use and enforcement of resident safeguards, and compliance with RAD requirements.

USDA continues two-tier income pilot for single-family housing.

An Unnumbered Letter dated March 5, 2018 announces that USDA will continue to use income banding for all single-family housing programs in 23 states and territories: AZ, AR, CA, FL, GA, IN, KY, MI, MS, MO, NE, NM, NC, ND, OR, PA, PR, TN, UT, VT, VI, WA, and WV. For more information, contact an RD state office.

USDA’s updated area loan limits go into effect January 17 and March 30.

On January 17, new limits are effective for the states participating in the FHA mortgage limit pilot. Non-pilot states’ new limits are effective March 30. For more information, contact an RD state office.

Last Keepseagle appeals rejected by Supreme Court.

Indianz.com reports that on March 26 the Supreme Court declined to hear the final appeals related to distribution of settlement funds from the Keepseagle case, which claimed USDA’s farm loan programs denied Native Americans equal access to credit. This means the money remaining in the settlement fund can now be sent to individuals, tribes, nonprofits, and educational institutions.

NLIHC releases 2018 Advocates’ Guide.

The National Low Income Housing Coalition’s Advocates’ Guide 2018: A Primer on Federal Affordable Housing & Community Development Programs provides information about advocacy and specific programs.

SAVE THE DATE FOR THE 2018 HAC RURAL HOUSING CONFERENCE!

The conference will be held December 4-7 at the Capital Hilton in Washington, DC. The HAC News will announce when conference registration opens and when the hotel room block is available for reservations.

NEED CAPITAL FOR YOUR AFFORDABLE HOUSING PROJECT?

HAC’s loan funds provide low interest rate loans to support single- and multifamily affordable housing projects for low-income rural residents throughout the U.S. and territories. Capital is available for all types of affordable and mixed-income housing projects, including preservation, farmworker, senior, and veteran housing. HAC loan funds can be used for pre-development, site acquisition, site development, and construction/rehabilitation. Contact HAC’s loan fund staff at hacloanfund@ruralhome.org, 202-842-8600.

Please note: HAC is not able to offer loans to individuals or families. Borrowers must be nonprofit or for-profit organizations or government entities (including tribes).

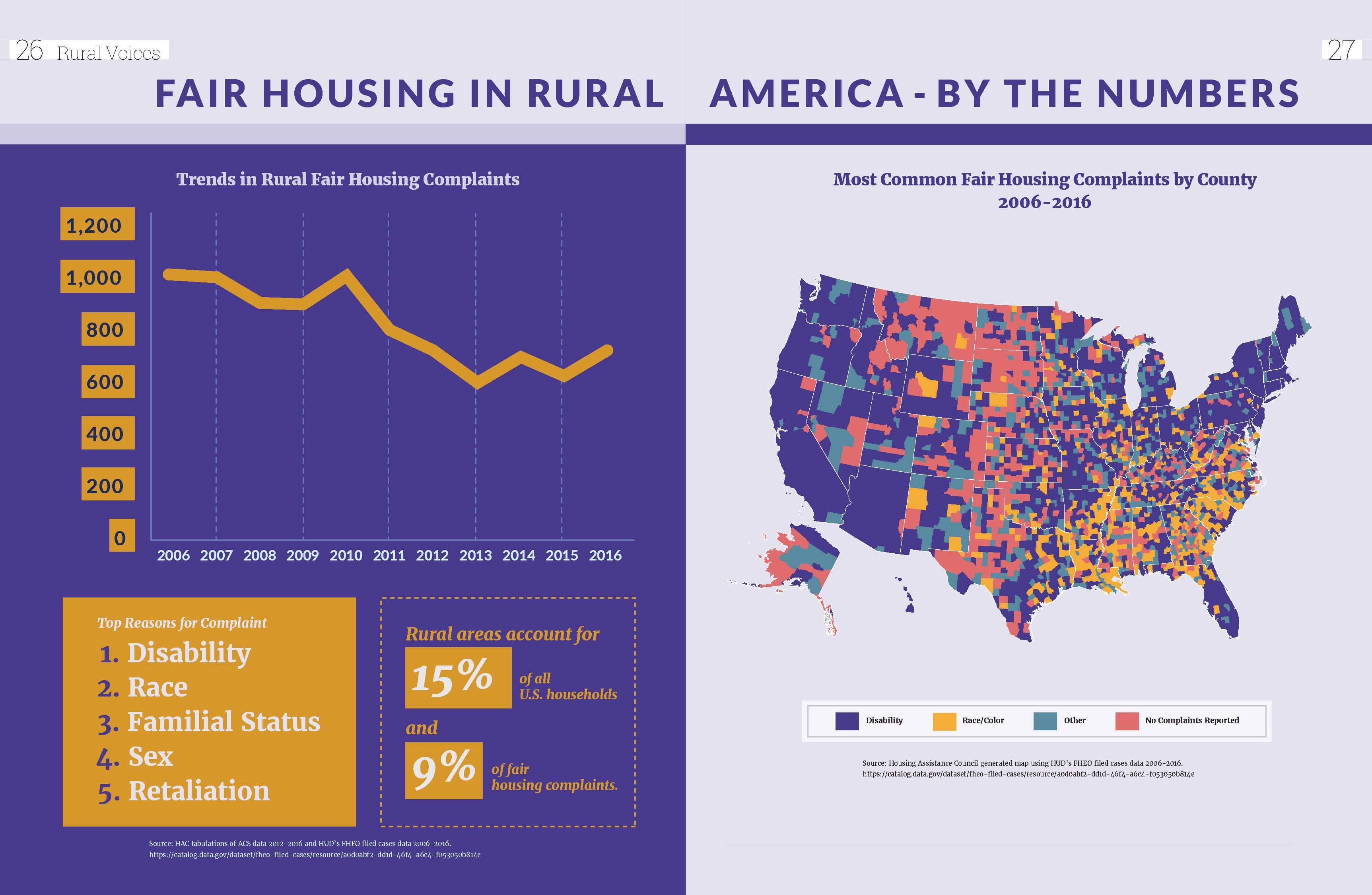

Fair Housing in Rural America – By the Numbers

Fair Housing in Rural America – By the Numbers