HAC News Formats. pdf

January 19, 2017

Vol. 46, No. 2

Perdue nominated for USDA Secretary, RD staff acting in administrative positions • Carson pledges to enforce laws, supports rental assistance • USDA offers rural broadband loans, loan guarantees, and grants • RD updates handbooks on multifamily ownership transfers and single-family housing • 2016 data show continuing trends for USDA tenants • Administration for Children and Families requests input from Native Americans • HUD revises Rental Assistance Demonstration • Register for notice of calls on Section 538 program • RD updates multifamily loan payoff guidance • FHFA proposes evaluation guidance for Duty to Serve • Duty to Serve Listening Sessions scheduled • OMB approves two fair housing assessment tools • Changes to blood lead level rule adopted • Final rule issued for HECM reverse mortgage program • HOTMA changes to project- and tenant-based vouchers implemented • Rural Voices magazine covers rural housing innovations • HAC seeks proposals for housing projects serving rural veterans

HAC News Formats. pdf

January 19, 2017

Vol. 46, No. 2

Perdue nominated for USDA Secretary, RD staff acting in administrative positions. On January 19, President-elect Trump named former Georgia governor Sonny Perdue, who has a background in agriculture, to become Secretary of Agriculture. Career employees will run RD and its agencies until appointments for those posts are made. Roger Glendenning will serve as Acting Deputy Under Secretary for Rural Development, Rich Davis as Acting Administrator for RHS, Chad Parker as Acting Administrator for the Rural Business-Cooperative Service, and Chris McLean as Acting Administrator for the Rural Utilities Service.

Carson pledges to enforce laws, supports rental assistance. At his January 12 confirmation hearing, HUD Secretary nominee Ben Carson advocated for a holistic approach connecting housing with economic development, health, and more. He hopes to enhance HUD’s lead exposure programs to prevent chronic illnesses. He spoke positively about VASH and other rental assistance. When asked about his commitment to fair housing requirements, Carson stated he would “enforce all the laws of the land.” Responding to questions from Sens. Heidi Heitkamp (D-ND), Mike Rounds (R-SD), and Jon Tester (D-MT), he expressed concern about Native American housing conditions. His written testimony mentions rural areas once, saying lead is a problem in urban, suburban, and rural places. None of the hearing questions focused on rural housing specifically. The Senate Banking, Housing and Urban Affairs Committee is scheduled to vote on January 24 whether to send his nomination to the full Senate for approval.

USDA offers rural broadband loans, loan guarantees, and grants. Loans and loan guarantees from the Rural Broadband Access program can be used for the construction, improvement, and acquisition of facilities and equipment to provide broadband service for rural areas. There are two application windows this year: March 1-31 and September 1-30. The Community Connect Grant Program offers grants to provide broadband service to all premises in currently unserved, lower-income, and extremely rural areas, with priority for places that demonstrate the greatest need for broadband. Its application deadline is March 13. For more information, contact Shawn Arner, Rural Utilities Service, 202-720-0800.

RD updates handbooks on multifamily ownership transfers and single-family housing. In HB-3-3560, the Project Servicing Handbook for Sections 515 and 514/516, Chapter 7 on ownership transfers has been completely revised, including (among other changes) updated underwriting requirements, incorporation of the Preliminary Assessment Tool, and use of industry-based underwriting standards where possible. There are a number of changes throughout HB-1-3550, which covers the Section 502 direct and Section 504 programs. For more information, contact an RD office.

2016 data show continuing trends for USDA tenants. In its annual release of data on tenant characteristics, RD reports slight changes: a drop in the number of rental units in the portfolio, a decline in the proportion of tenants who are white, an increase in low-income households (and a corresponding decrease in very low-income), and an increase in disabled tenants within the elderly/disabled category. There were 4,220 fewer units in the portfolio in September 2016 than in September 2015, a drop of almost 1%, and more than half the lost units had two bedrooms. The same proportion of Section 515 tenants receive Section 521 Rental Assistance (67%) as in 2015, and the same proportion are cost-burdened (13%).

Administration for Children and Families requests input from Native Americans. ACF, part of the federal Department of Health and Human Services, hopes to identify issues and challenges facing American Indian and Alaska Native populations and to gather recommendations for addressing the needs. Comments are due March 10. For more information, contact Camille Loya, ACF, 202-401-5964.

HUD revises Rental Assistance Demonstration. RAD allows the conversion of public housing and other HUD-assisted properties to project-based Section 8. Send comments to rad@hud.gov by February 21. For more information, contact HUD staff at rad@hud.gov.

Register for notice of calls on Section 538 program. RD will continue holding periodic calls or web meetings with stakeholders about the Section 538 guaranteed rental housing program. To receive notices when calls are scheduled – even if you registered for these calls in the past – contact Monica Cole, USDA, 202-720-1251.

RD updates multifamily loan payoff guidance. An Unnumbered Letter dated December 28, 2016 discusses the options available for handling properties where a Section 515 or 514 mortgage has reached its maturity date. For more information, contact an RD state office.

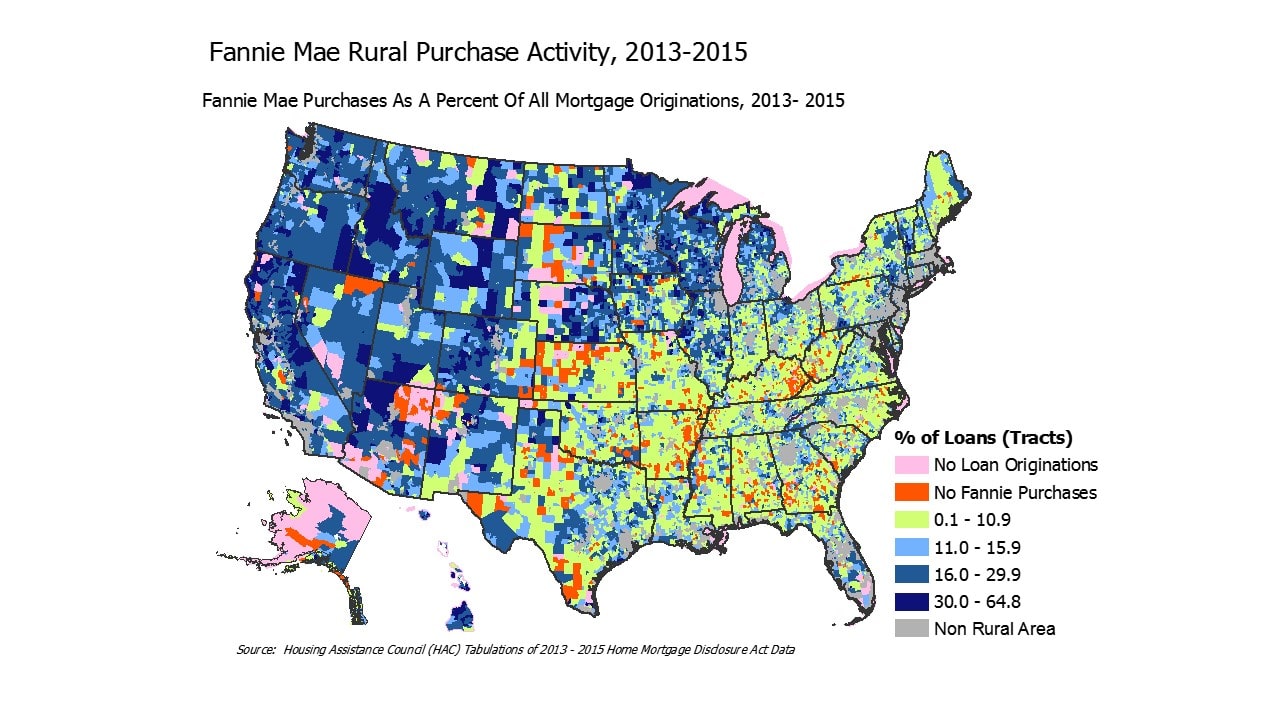

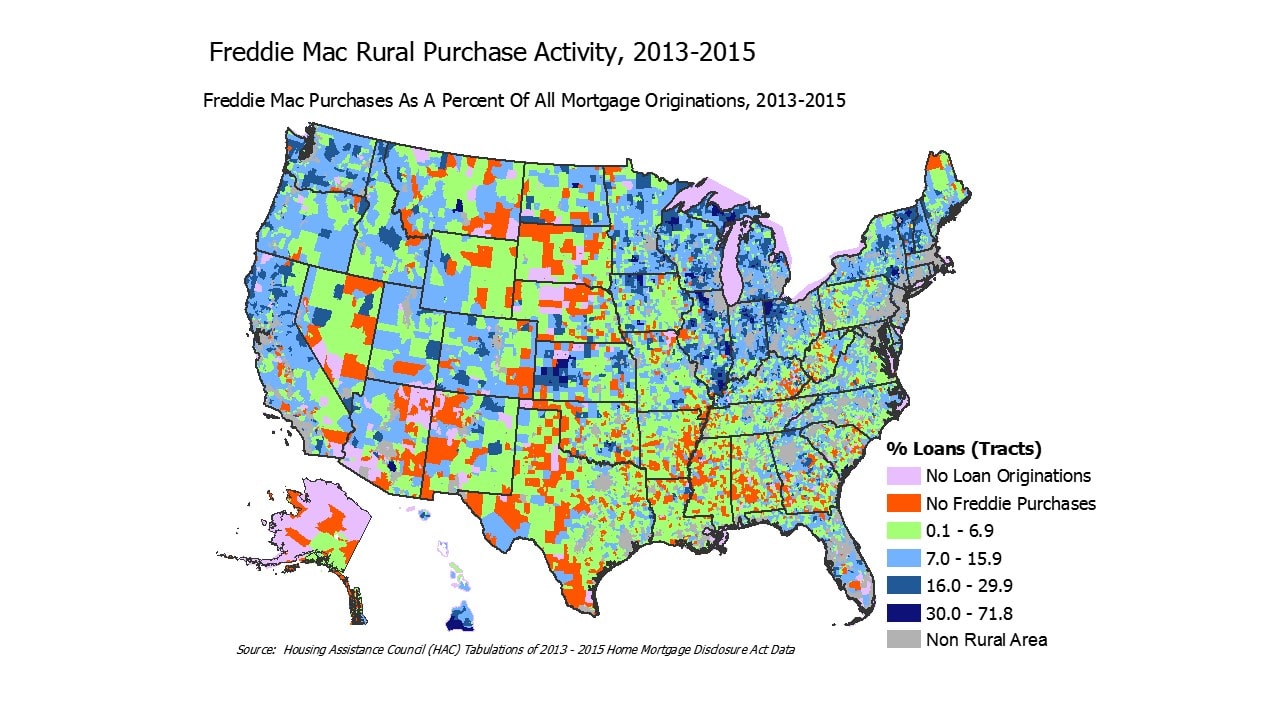

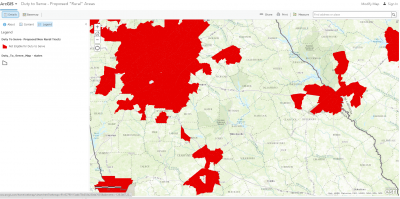

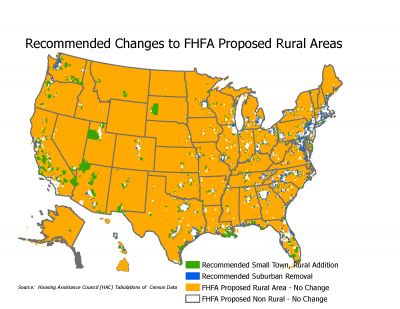

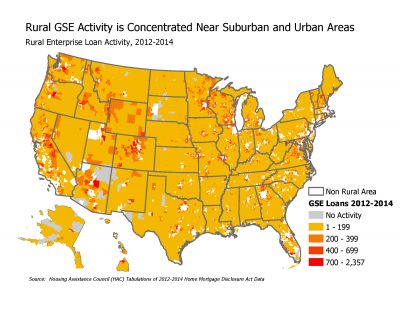

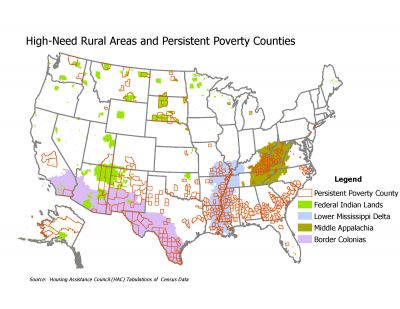

FHFA proposes evaluation guidance for Duty to Serve. The Federal Housing Finance Agency’s draft guidance indicates FHFA’s expectations for developing Fannie Mae and Freddie Mac’s Duty to Serve Underserved Markets Plans, and the process for evaluating their performance. Comments on the evaluation guidance are due May 12. For more information, email DutyToServeStakeholders@fhfa.gov.

Duty to Serve Listening Sessions scheduled. FHFA, Fannie Mae, and Freddie Mac will co-host a series of public listening sessions in early 2017 on Duty to Serve. The dates and locations are: January 25, Chicago; February 1, San Francisco; February 8, Washington, DC; February 9, Webinar. For more information and to register visit https://www.fhfa.gov/PolicyProgramsResearch/PROGRAMS/Pages/Duty-to-Serve.aspx.

OMB approves two fair housing assessment tools. The tools will be used by public housing agencies and by local governments that receive CDBG, HOME, ESG, or HOPWA funding when conducting and submitting their Assessments of Fair Housing. PHAs with 1,250 or fewer combined public housing and voucher units will provide less information than those with larger programs. For more information, contact Krista Mills, HUD, 866-234-2689.

Changes to blood lead level rule adopted. A final rule adopts a revised definition of “elevated blood lead level” in accordance with Centers for Disease Control and Prevention guidance. (See HAC News, 9/8/16.) It also establishes more comprehensive testing and evaluation procedures for housing where children under age six reside and makes some other changes. For more information, contact Warren Friedman, HUD, 202-402-7698.

Final rule issued for HECM reverse mortgage program. The Federal Housing Administration’s changes are intended to strengthen the Home Equity Conversion Mortgage program and increase its sustainability. For more information, contact Karin Hill, HUD, 202-402-3084.

HOTMA changes to project- and tenant-based vouchers implemented. A HUD notice implements several provisions of the 2016 Housing Opportunity Through Modernization Act. (See HAC News, 11/3/16.) Comments are due March 20. For more information, contact HOTMAquestionsPIH@hud.gov.

Rural Voices magazine covers rural housing innovations. Tiny houses, super energy efficiency, intensive planning, and more are included in the winter issue of HAC’s magazine. Sign up online to receive email notices when new issues are published.

|

HAC seeks proposals for housing projects serving rural veterans. Supported by The Home Depot Foundation, grants will go to nonprofits, tribally designated housing entities, and housing authorities serving veterans at or below 80% of area median income in rural areas. Projects may be new construction or rehab, temporary or permanent housing, in progress or beginning within 12 months. Grants will not normally exceed $30,000. Several smaller requests may be granted rather than a few larger ones. Letters of Interest are due February 3. For more information contact Shonterria Charleston, HAC, 404-892-4824.

|