The Housing Assistance Council’s three-part series on CRA in Rural America

Download the Report

The Community Reinvestment Act (CRA), adopted in 1977, requires federally-insured depository institutions to help meet the credit needs of their entire communities, including low- and moderate-income neighborhoods. Assessments of CRA’s scope and effectiveness are typically conducted at a market-specific level, and those markets analyzed are almost exclusively metropolitan or urban in nature. Very little is known about the implementation of CRA in the rural context.

Download the Report

Download the Report

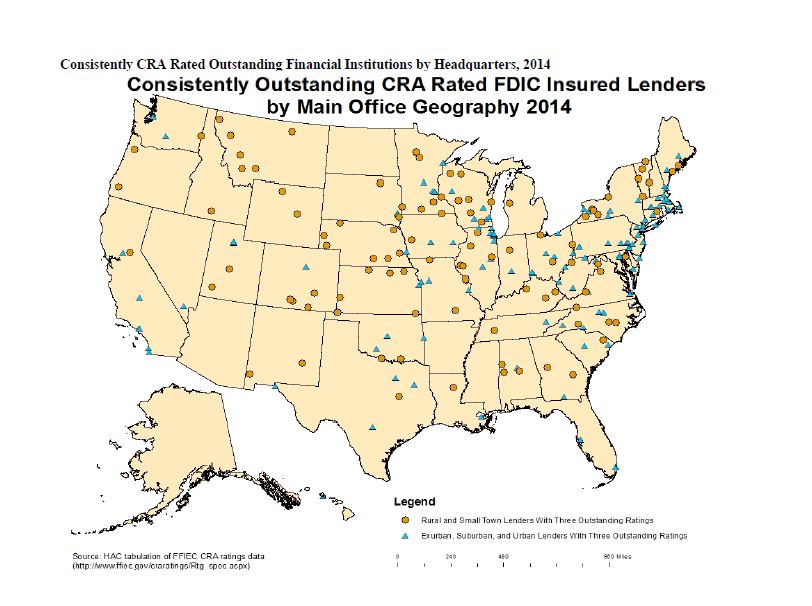

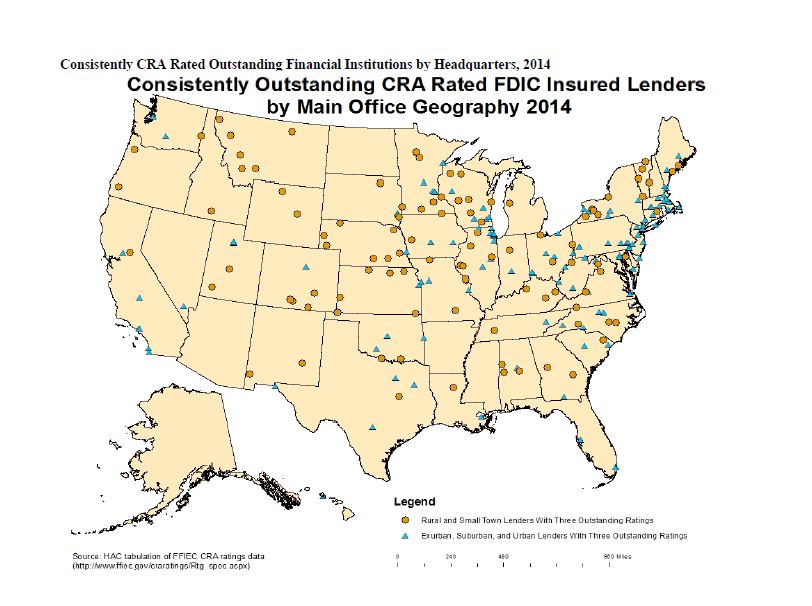

The overwhelming majority of financial intuitions earned Satisfactory CRA ratings on their most recent CRA examinations. Regulators awarded Outstanding ratings to only 9 percent of lenders. Consistently Outstanding-rated lenders are important because they serve as examples of institutions that continually exceed CRA requirements in serving all portions of their service area. While making up a majority of all FDIC-insured depository institutions, little is known about rural lenders in general and even less about how they fulfill their CRA obligations.

This report looked more closely at the lenders who consistently received Outstanding ratings on their last three examinations. The data show that this is an uncommon occurrence, only 4 percent of lenders are consistently outstanding, and these banks most often large asset, urban headquartered institutions. While the inclusion of distressed and underserved census tracts in lender service areas was associated with being consistently rated outstanding, the analysis found no association with being headquartered in rural areas. Additional research of these lenders is needed to better understand how they are able to successfully serve all communities.

Download the Report

Download the Report

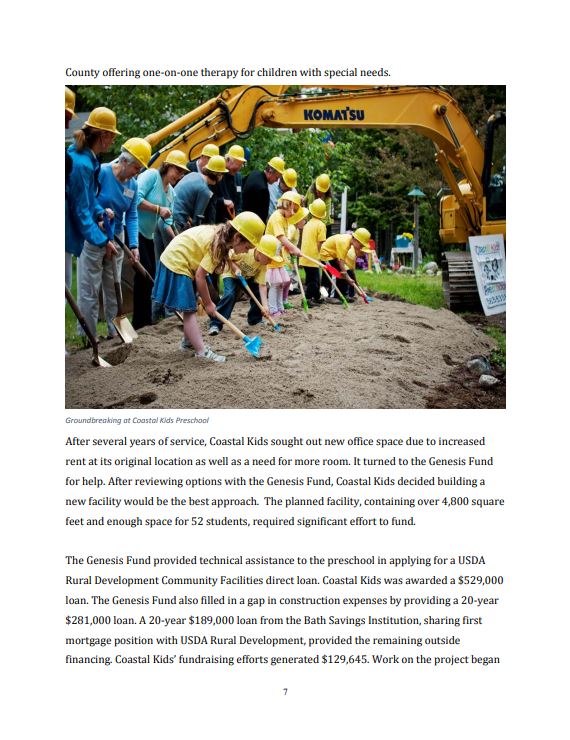

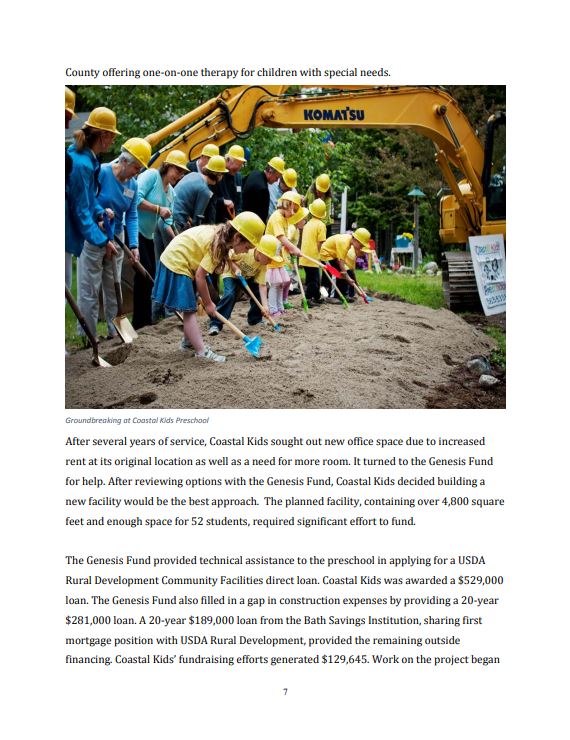

The case studies in this report explore a preschool expansion in Maine, construction of rental housing for farmworkers in Colorado, construction of low- and moderate income housing in Minnesota, and the donation of a bank branch to a local credit union in Mississippi.

The participants in the case studies identified the following key elements to the success of their projects and making the CRA work for rural areas:

- Strong relationships between the lenders and the involved organizations,

- Lender expertise in community lending, and

- Understanding of alternative funding streams by all involved parties.

Download the Report

Download the Report Download the Report

Download the Report

HAC

HAC