HAC News

Shawn Poynter / There Is More Work To Be Done

Shawn Poynter / There Is More Work To Be Done

News Formats. pdf

January 15, 2019

Vol. 48, No. 1

Federal shutdown puts USDA loans on hold, tenants in limbo • National call about shutdown to include HAC • Some HUD Project-Based Rental Assistance contracts expiring during shutdown • House passes USDA and HUD funding bills • Regulators consider requiring evaluations for rural properties, raising appraisal threshold • Fannie Mae implements appraisal waiver in rural high need markets • RD plans to begin accepting Section 538 guarantee applications continuously • Podcast covering affordable housing and community development will feature HAC’s David Lipsetz • Site selection criteria issued for ERS and NIFA relocations • Patenaude resigns HUD position • Broadband access on tribal land lags national averages • White paper reports savings from energy and water efficiency for low- and middle-income renters • Rural Statistic: USDA Section 515 majority minority properties

HAC News Formats. pdf

January 15, 2019

Vol. 48, No. 1

Federal shutdown puts USDA loans on hold, some tenants’ future funding uncertain.

USDA and HUD are currently shut down. They are among the federal agencies permitted to conduct only essential business since their appropriations expired on December 22. Limited functions are continuing at USDA’s national office in Washington, DC and the Customer Service Center in St. Louis, but loan closings are not taking place and applications are not being processed. HAC will continue to post information about the shutdown on our website as it becomes available. To read accounts of the shutdown’s impact from local organizations around the country, visit the National Rural Housing Coalition’s website. The effect is being felt by homebuyers, self-help groups, farmworker housing construction, rental housing rehabilitation and organizational budgets. RD staff provided a great service by getting December’s Section 521 Rental Assistance payments made on schedule in early January, and have unofficially assured HAC and others that January’s RA payments will be made in early February. RA payments each month are for the RA contracts that expired during that month, and obligate a full year of RA funding. It is HAC’s understanding that if the shutdown continues into February, RA contracts expiring that month will not be paid. It is not clear whether Section 542 vouchers will be paid for February.

National call about shutdown to include HAC.

HAC CEO David Lipsetz will join a national call providing updates on the shutdown’s effects on affordable housing and community development programs. The call will be held Tuesday, January 15 at 4:00 Eastern, and is arranged by the National Low Income Housing Coalition. Register here.

Some HUD Project-Based Rental Assistance contracts expiring during shutdown.

About 21,500 households with average incomes under $13,000 per year are impacted by the expiration of 650 PBRA contracts that ended in December, and more are expiring in January and February. HUD will determine whether it has funds available to renew them. Property owners can use their reserves, if available, to cover shortfalls. Public housing capital funding is unavailable, and operating funds cannot carry public housing authorities beyond February.

House passes USDA and HUD funding bills.

Attempting to reopen the federal government, on January 10 the House passed H.R. 265, which would provide USDA appropriations for FY19, and H.R. 267 to fund the departments of Transportation and HUD. Senate Majority Leader Mitch McConnell (R-KY) reportedly does not plan to hold Senate votes on these or other measures that are not supported by President Trump.

Regulators consider requiring evaluations for rural properties, raising appraisal threshold.

The federal agencies that regulate banks and thrifts have proposed revising their appraisal rules to require evaluations (not appraisals) of property value for loans of less than $400,000 secured by rural real estate. Also, loans under $400,000 (rather than the current $250,000) for residential real estate with four or fewer units in any geographic area would receive evaluations rather than appraisals. Comments are due February 5. For more information, contact G. Kevin Lawton, OCC, 202-649-6670.

Fannie Mae implements appraisal waiver in rural high need markets.

For home purchase transactions meeting certain criteria and located in rural high-needs areas, Fannie Mae may waive an appraisal in exchange for a home property inspection. This waiver seeks to address appraisal complexities in remote rural markets and help low-income borrowers avoid unanticipated, potentially high-cost, post-purchase repairs.

RD plans to begin accepting Section 538 guarantee applications continuously.

Comments are due February 15 on a USDA proposal to stop issuing annual Notices of Funding Availability (NOFAs) for the Section 538 multifamily guarantee program. RD would accept applications at any time, using the standards from the most recent NOFA, which was published December 21, 2017. For more information (when USDA reopens), contact Monica Cole, RD, 202-720-1251.

Podcast covering affordable housing and community development will feature HAC’s David Lipsetz.

The Holistic Housing Podcast, hosted by NACCED, brings together thought leaders, policy makers and program implementers across the affordable housing, community development and economic development field. David Lipsetz, HAC’s CEO, will appear later in January discussing the unique nature of affordable housing and community development in rural communities. The podcast is available on iTunes, Stitcher, and TuneIn.

Site selection criteria issued for ERS and NIFA relocations.

In December, USDA Secretary Sonny Perdue announced the department will use criteria related to quality of life, costs, workforce and logistics/IT infrastructure in evaluating the proposals to house the relocated Economic Research Service and National Institute of Food and Agriculture. The Department announced its plan to move these vital agencies in August, basing the decision on “cost savings” despite having conducted no analysis or review of the cost. HAC has raised concerns that the move will further erode the voice of rural communities in federal policy.

Patenaude resigns HUD position.

On December 17, Deputy Secretary Pamela Hughes Patenaude announced she will leave HUD early in 2019. Media reports say FHA Commissioner Brian Montgomery will serve as Acting Deputy Secretary.

Broadband access on tribal land lags national averages.

On reservations, fewer than 55% of households have broadband access, compared to a 78% average for the nation and a 65% average for rural counties. Low rates of access are related to low incomes found on reservations, but lowered access also inhibits larger economic growth, reports the Center for Indian Country Development at the Minneapolis Federal Reserve. Tribes are working to increase access on reservations.

White paper reports savings from energy and water efficiency for low- and middle-income renters.

A new Freddie Mac paper, “Green Improvements in Workforce Housing,” examines the effects of the Green Advantage program, which finances water- and energy-saving upgrades in multifamily workforce housing. Borrowers focused on water-savings improvements, with a projected average cost of $470 per unit and projected average savings of $220 per unit per year.

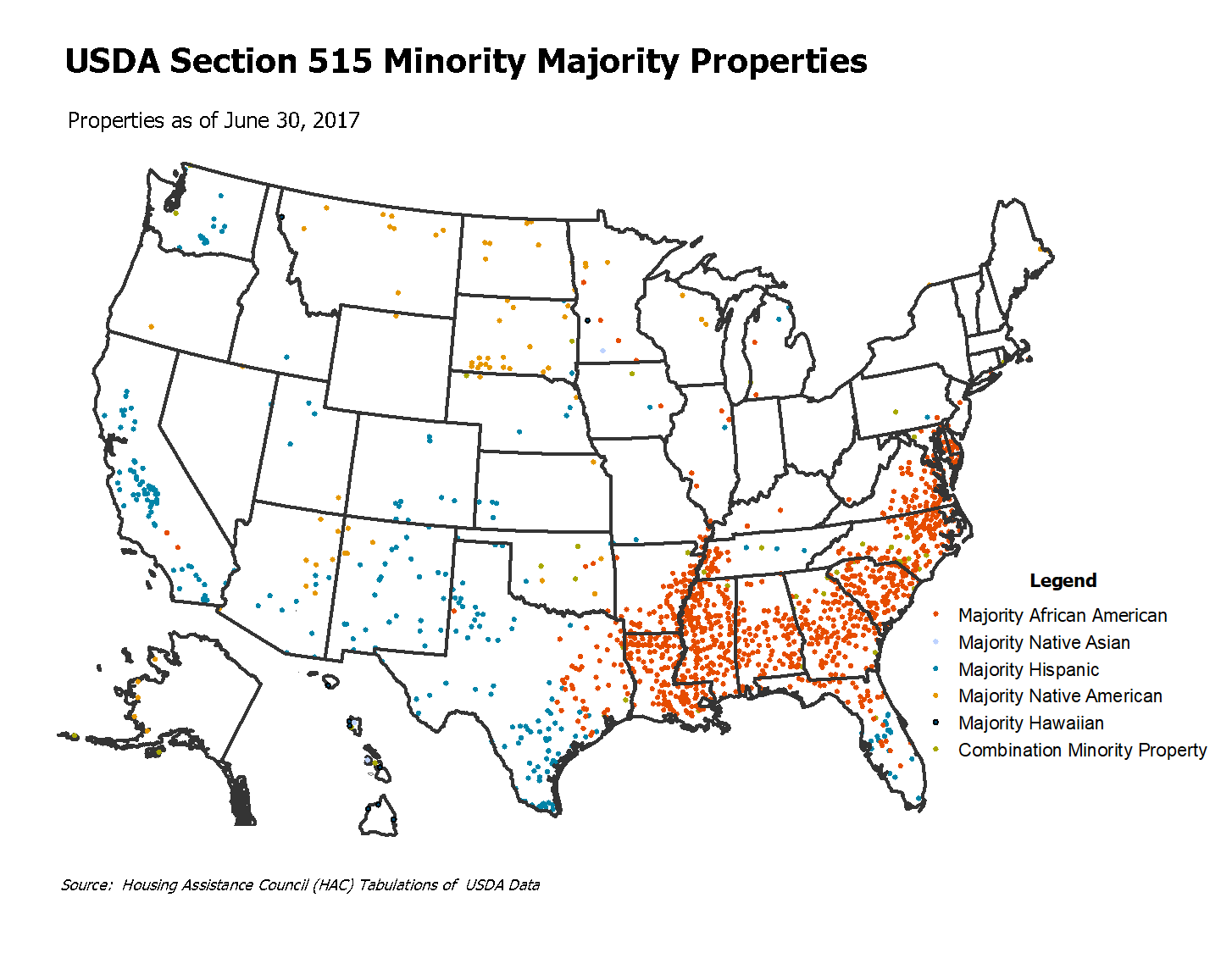

Rural Statistic: USDA Section 515 majority minority properties. In approximately 2,447 USDA Section 515 rural rental housing properties (79,406 occupied units) the majority of the tenants are racial or ethnic minorities. For more information on resident characteristics in USDA’s rural rental housing see HAC’s recently published report, Rental Housing for A 21st Century Rural America.

Need capital for your affordable housing project?

HAC’s loan funds provide low interest rate loans to support single- and multifamily affordable housing projects for low-income rural residents throughout the U.S. and territories. Capital is available for all types of affordable and mixed-income housing projects, including preservation, farmworker, senior and veteran housing. HAC loan funds can be used for pre-development, site acquisition, site development and construction/rehabilitation. Contact HAC’s loan fund staff at hacloanfund@ruralhome.org, 202-842-8600.

Please note: HAC is not able to offer loans to individuals or families. Borrowers must be nonprofit or for-profit organizations or government entities (including tribes).