HAC News Formats. pdf

April 2, 2014

Vol. 43, No. 7

• April is National Fair Housing Month • House subcommittee hearing on FY15 RD budget set for Friday • Waters proposes GSE reform bill • USDA offers Household Water Well System grants • Deadline extended for RD environmental rules comments • NLIHC report confirms housing costs still out of reach • GAO addresses tribes’ housing challenges • New index shows wide opportunity gap for children of different races/ethnicities • Report stresses home- and community-based services for seniors • Rural housing and youth spotlighted in Rural Voices • HAC training “Housing for Seniors and Veterans in Rural America”

April 2, 2014

Vol. 43, No. 7

APRIL IS NATIONAL FAIR HOUSING MONTH. HUD offers information for download and a press release.

HOUSE SUBCOMMITTEE HEARING ON FY15 RD BUDGET SET FOR FRIDAY. At 10:00 a.m. Eastern time on April 4, USDA Rural Development officials will testify on the Administration’s FY15 budget request before the House Agriculture Appropriations Subcommittee. The hearing will be webcast. Updates will be posted on HAC’s site.

WATERS PROPOSES GSE REFORM BILL. On March 27 Rep. Maxine Waters (D-CA), Ranking Member of the House Financial Services Committee, released a discussion draft of a bill that would replace Fannie Mae and Freddie Mac with a lender cooperative and would fund the National Housing Trust Fund. It would also replace the affordable housing goals, instead requiring the cooperative to “facilitate” service to all income levels, including borrowers in underserved urban and rural markets. There are also two proposals in the Senate (see HAC News, 3/19/14) and H.R. 2767, introduced by Rep. Jeb Hensarling (R-TX), which passed the House Committee in July 2013 (see HAC News, 8/1/13).

USDA OFFERS HOUSEHOLD WATER WELL SYSTEM GRANTS. Nonprofits can use these funds to establish lending programs for homeowners, who can borrow up to $11,000 to construct or repair household water wells for existing homes. This year’s competition will give points to high-poverty places and to colonias or substantially underserved trust areas. Deadline is May 27. Contact Joyce M. Taylor, RUS, 202-720-9589.

DEADLINE EXTENDED FOR RD ENVIRONMENTAL RULES COMMENTS. Comments on environmental policies and procedures are now due May 7 instead of April 7. (See HAC News, 2/5/14.) Contact Mark S. Plank, RD, 202-720-1649.

NLIHC REPORT CONFIRMS HOUSING COSTS STILL OUT OF REACH. The National Low Income Housing Coalition’s annual Out of Reach report, prepared with HAC assistance for nonmetro data, shows a gap remains between rural rent and rural renters’ incomes. NLIHC estimates that the average hourly wage for nonmetro renters nationwide is $10.24, which falls $3 short of the Housing Wage necessary to afford a two-bedroom home at HUD’s Fair Market Rent. The nonmetro Housing Wage is out of reach for those earning the average renter wage in all but two states (Alaska and North Dakota), though the gap is very small in four other states (Arizona, Nevada, Oklahoma, and Wyoming). The report and data for states, counties, and metro areas are online, as is a HAC Rural Research Note.

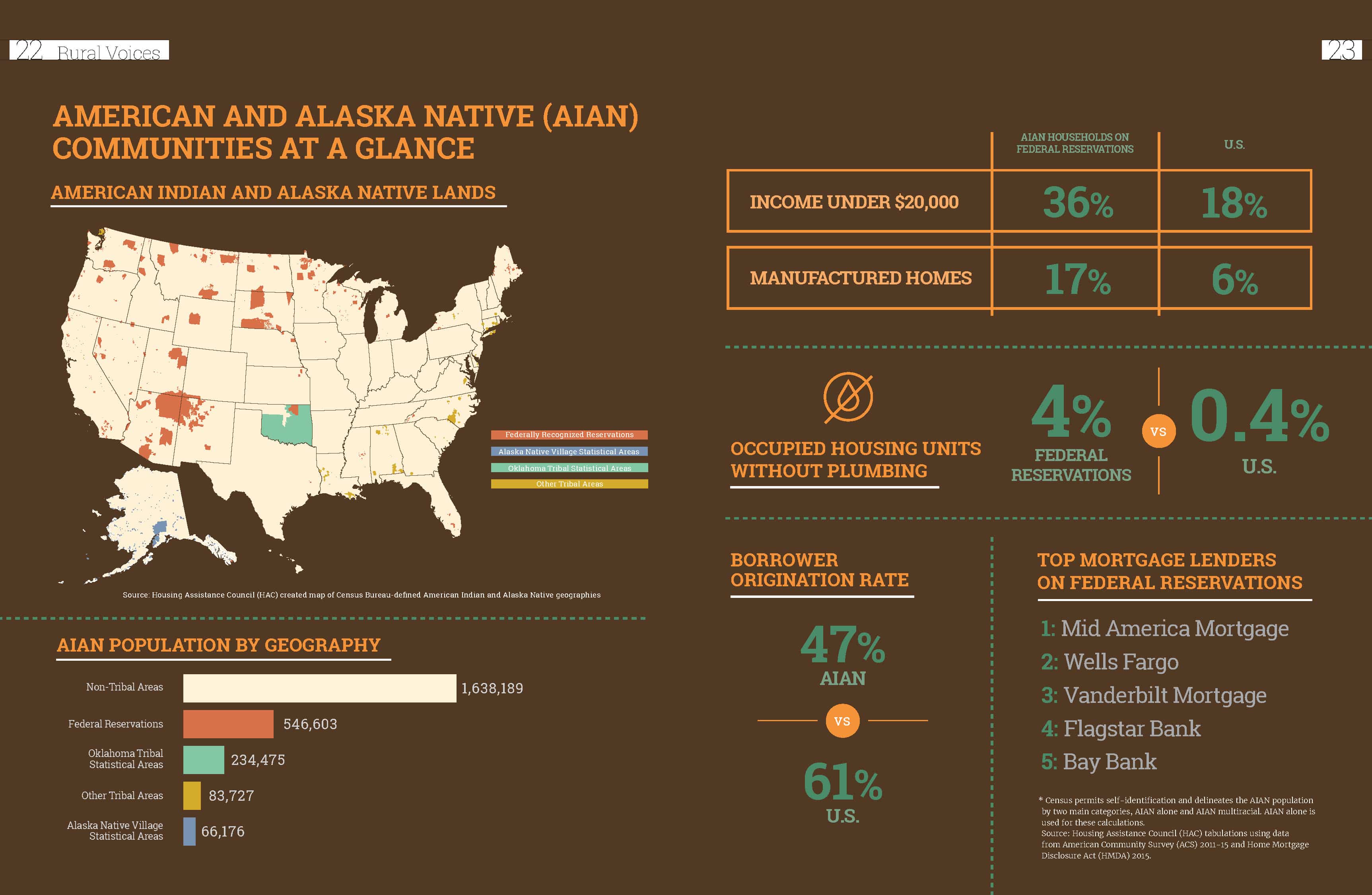

GAO ADDRESSES TRIBES’ HOUSING CHALLENGES. Native American Housing: Additional Actions Needed to Better Support Tribal Efforts, GAO-14-255, is based on site visits, interviews, and sources including HAC. It states that challenges tribes face in their use of Indian Housing Block Grant funds are “largely related to remoteness and other geographical factors, land use regulations, lack of adequate infrastructure, differing federal agency requirements, potential reduction in training opportunities and program support, limited administrative capacity, conflict within tribes, and cultural factors.” GAO recommends changes such as federal agency coordination of environmental impact requirements.

NEW INDEX SHOWS WIDE OPPORTUNITY GAP FOR CHILDREN OF DIFFERENT RACES/ETHNICITIES. Race for Results: Building a Path to Opportunity for All Childrencompiles indicators on health, education, family environment, and neighborhood poverty into a single index and presents results for each state. Nationally, Asian/Pacific Islander and White children have far higher index scores than Latino and Native American children, and African-American children have the lowest. At the state level, the lowest scores were among American Indian children in South Dakota. Scores vary across states for all groups, but the range of scores is widest for American Indian children and narrowest for Latino children.

REPORT STRESSES HOME- AND COMMUNITY-BASED SERVICES FOR SENIORS. Aging in Every Place: Supportive Service Programs for High and Low Density Communities says such services are a cost-effective way to help older adults maintain their quality of life as they age in their homes. Published by the Center for Housing Policy at the National Housing Conference, the report notes that successful programs in rural places often offer transportation, use existing community centers, or bring services to the homes of those who are unable to travel.

RURAL HOUSING AND YOUTH SPOTLIGHTED IN RURAL VOICES. Looking to the Future: Housing and Youth in Rural America is the latest issue of HAC’s magazine. Sign up online for email notices when new issues are published, or request one free print subscription per organization from Dan Stern, HAC, 202-842-8600.

|

JOIN HAC APRIL 22-23 FOR “HOUSING SENIORS AND VETERANS IN RURAL AMERICA: PRESERVATION, DEVELOPMENT, AND SERVICES,” held in Phoenix, AZ. The agenda, targeted to rural housing providers, will feature discussions of federal and other housing programs for veterans and the aging, including home repair, rental housing, and services for the homeless. Successful best practices will be featured. Register online.

|

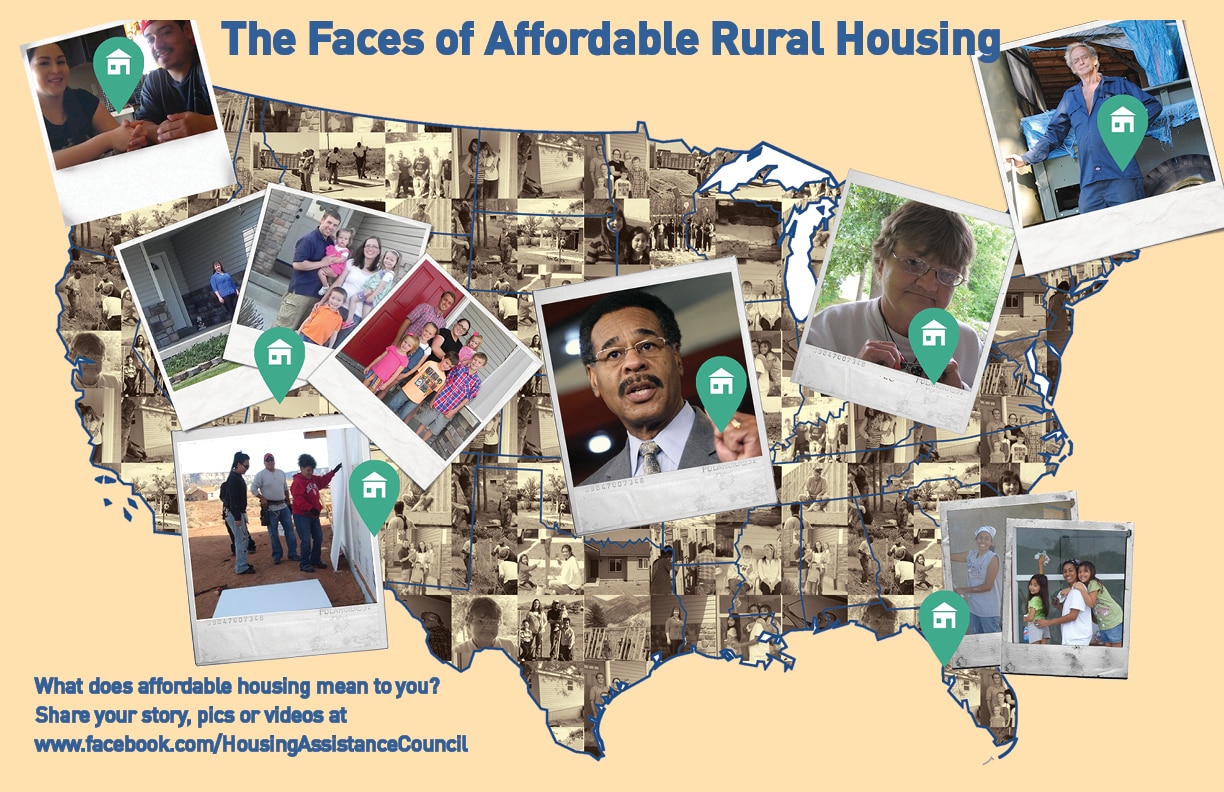

The Faces of Affordable Housing

The Faces of Affordable Housing