News

Jennifer Emerling / There Is More Work To Be Done

Jennifer Emerling / There Is More Work To Be Done

The FY26 budget outline released by the Trump administration on May 2 proposes no funding for some key USDA housing programs, including USDA Section 502 direct home loans, the self-help housing program, and Section 542 vouchers. It does request $1.7 billion for Section 521 Rental Assistance and says that is enough to renew all current RA contracts. It also proposes a new $100 million Rural Financial Award Program that would require 60% of CDFIs’ loans and investments to go to rural areas. The budget also targets key HUD programs, suggesting elimination of HOME and CDBG, competitive Indian housing programs, and others. It would combine HUD’s rental assistance programs into a block grant to states with reduced funding. Rent aid and homeless assistance would be limited to two years. The administration is expected to provide a complete budget request by the end of May. Congress will develop spending bills, which may or may not resemble the proposed budget. Responding to the “skinny budget,” HAC President and CEO David Lipsetz issued a statement emphasizing the federal government’s essential role as an investor and partner for rural America. HAC also posted a summary.

The Housing Assistance Council is seeking engaging, hands-on workshop proposals for the National Rural Housing Conference to be held November 4-7 in Washington, DC. The deadline to submit your proposal is June 15. If your work advances housing or community development in rural America, we want to hear from you! Learn more about HAC workshops and how to submit a proposal here.

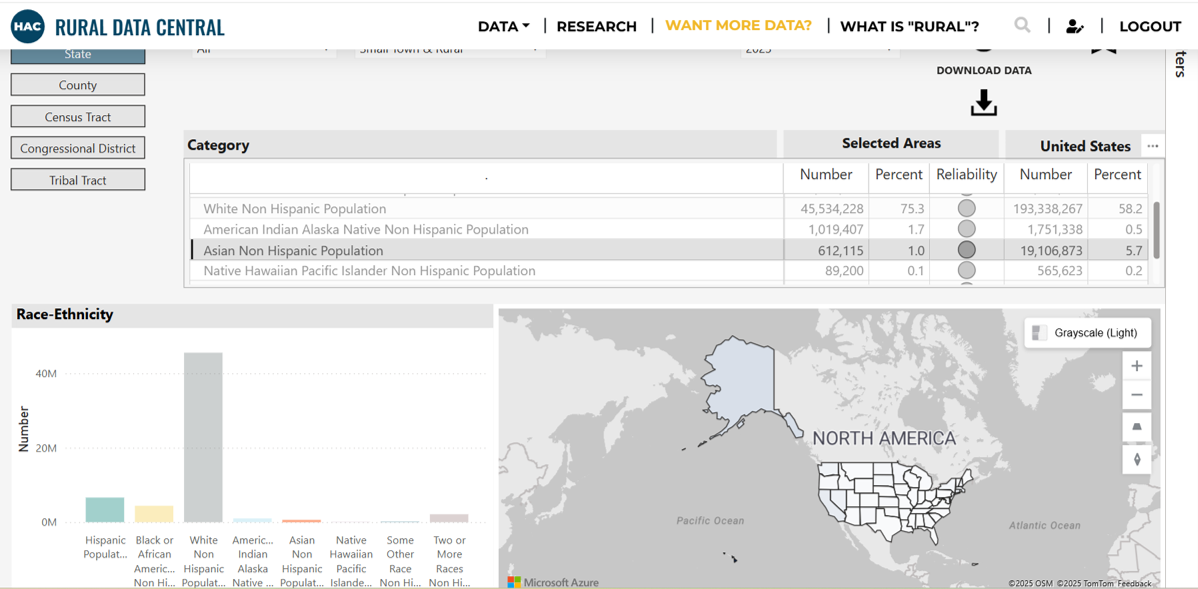

May is Asian American and Pacific Islander Heritage Month. Over 700,000 Asian and Pacific Islanders live in rural and small-town communities across the United States. Hawaii has the largest number and percentage of rural Asian and Pacific Islanders among the states with nearly one-third of Hawaiians identifying as Asian, Hawaiian Homelander, or Pacific Islander. Source: Rural Data Central – HAC tabulations of the U.S Census Bureau’s 2019-2023 American Community Survey.

Data is Central. To learn more about the demographic, economic, and housing composition of your community, visit Rural Data Central.

Transitional housing assistance funding is available for nonprofits and state, local, or Tribal governments to provide six to 24 months of transitional housing and support services for victims of domestic violence, dating violence, sexual assault, or stalking. Apply by June 9. The Rural Domestic Violence, Dating Violence, Sexual Assault, and Stalking Program supports cooperative efforts among law enforcement officers, prosecutors, victim service providers, and other related parties to investigate and prosecute sexual assault, domestic violence, dating violence, and stalking; treatment, advocacy, counseling, legal assistance, or other victim services for victims in rural communities; or programs addressing sexual assault. Apply by July 8. Information about other open grant programs is available from the Justice Department’s Office on Violence Against Women and on grants.gov.

The Community Heart & Soul Seed Grant Program serves U.S. cities and towns with populations under 30,000, including in U.S. territories. The program provides $10,000 grants and requires a $10,000 cash match for a resident-driven process that engages the entire population of a town in identifying what they love most about their community, what future they want for it, and how to achieve that. Applications are reviewed monthly.

Updated guidance from USDA RD confirms that the agency still has funds available for repairs to owner-occupied homes in Section 504-eligible places where presidentially declared disasters occurred in calendar year 2022. The document explains how the Rural Disaster Home Repair Grant Program differs from the Section 504 Home Repair Grant Program.

House committees have now approved all the sections of a budget reconciliation bill, which is becoming known as “the one big beautiful bill.” Some of the last pieces revealed were the provisions to extend or refine tax cuts. They were approved by the Ways and Means Committee on May 14 and include changes in the Opportunity Zones and Low Income Housing Tax Credit programs. The bill would set current OZ designations to expire in 2026 rather than 2028, the date in existing law. A new round of OZs would be identified. In an effort to improve the program’s performance in rural areas, about one-third of the new OZs would have to be rural and incentives would be offered for rural OZ investments. The bill’s revisions to the Low Income Housing Tax Credit include a 30% basis boost for properties in rural and Native communities. The bill would repeal or phase out clean energy tax credits created by the Inflation Reduction Act. It would allow the New Markets Tax Credit to expire. It does not include the homeownership tax credit provisions of the Neighborhood Homes Investment Act. The full budget reconciliation package will now be considered by the House Budget Committee, then the full House. The Senate will craft its own version. HAC issued a statement on the House’s tax provisions.

On May 7, the Disaster Relief for Farmworkers Act was introduced in both the Senate and the House. The bill would provide crucial financial assistance to farmworkers who lose income due to natural disasters or public health emergencies and also offer support to farmers facing crop losses during such events.

In one of the many lawsuits filed challenging the administration’s firing of federal workers, a federal judge issued a May 9 temporary restraining order halting the layoffs at 21 agencies, including USDA and HUD, through May 23. The judge also ordered the administration to release agency reduction in force and reorganization plans on May 13, but then postponed that deadline. According to the administration, publicly releasing those plans would reveal management strategies and hurt employee recruiting and retention. While the lower court is still considering whether to require release of the plans, the government has appealed the temporary restraining order. A Government Executive article describes some of the differing actions taken by agencies subject to the temporary restraining order.

Government Executive reports that HUD has issued reduction in force (RIF) notices to all employees in the Office of Field Policy and Management at the General Schedule-13 level and below, effective May 18. The article adds that HUD is expected to issue RIFs to staff in other offices in the near future.

Over 15,000 USDA employees – about 15% of the department’s workforce – have signed up for deferred resignations, which allow them to leave their jobs immediately and be paid through September, Politico reports. These departures are in addition to previous layoffs of probationary staff, some of whom have been rehired. More staff will be let go through reductions in force carried out by the administration. Questioned about the departures at a Senate subcommittee hearing on May 6, Secretary Brooke Rollins said USDA is actively recruiting to fill some jobs. She noted that the department loses 8,000-10,000 employees every year and hires to fill their positions.

At least two high-level staff in the Rural Housing Service’s headquarters have left: Jacki Ponti-Lazaruk, who was the Acting Deputy Under Secretary for Rural Development, and Angilla Denton, who was the RHS Deputy Administrator for Multifamily Housing and then the Acting Administrator. Christine Mechtly, who became Deputy Administrator for Single-Family Housing in 2024, is now the RHS Acting Administrator.

USDA Secretary Brooke Rollins recently announced the appointments of new state directors for the Farm Service Agency and Rural Development.

HUD asks Tribal leaders to provide comments by May 25 on improvements to the environmental review process.

CFPB is withdrawing a number of documents that were issued to provide non-binding policy guidance. The agency explains that the cancellation is not necessarily final, but these documents will not be enforced or otherwise relied upon by the Bureau while it continues reviewing them. They cover a variety of topics including mortgage lending rules for surviving family members, consumer protections for home sales financed under contracts for deed, and enforcement priorities related to housing insecurity.

Jonathan McKernan’s nomination to become Consumer Financial Protection Bureau director has been cancelled and President Trump has nominated him instead to be Undersecretary of Domestic Finance at the Treasury Department. No new CFPB nominee has been announced.

Seeding Economic Development in Rural America, with Ann Eisenberg is an episode of Resources for the Future’s podcast. Eisenberg, a professor and research director at the West Virginia University College of Law, explains how rural economies become vulnerable to decline when macroeconomic and societal changes weaken or displace local industries. She provides examples of successful economic diversification and revitalization; strategies to support rural communities that are facing economic hardship; and explanations about ways policies that have strengthened rural economies have also bolstered broader national economic stability.

“Although billions of state and federal dollars flow into the majority-Latino communities along the nearly 2,000-mile U.S.-Mexico border, many remain among the poorest places in the nation,” observes a report by ProPublica and the Texas Tribune. The article describes the depths of the region’s need for water and hospital access.

HAC’s loan fund provides low interest rate loans to support single- and multifamily affordable housing projects for low-income rural residents throughout the U.S. and territories. Capital is available for all types of affordable and mixed-income housing projects, including preservation, new development, farmworker, senior and veteran housing. HAC loan funds can be used for pre-development, site acquisition, site development, construction/rehabilitation and permanent financing. Contact HAC’s loan fund staff at hacloanfund@ruralhome.org, 202-842-8600.

Please note: HAC is not able to offer loans to individuals or families. Borrowers must be nonprofit or for-profit organizations or government entities (including Tribes).

Please credit the HAC News and provide a link to HAC’s website. Thank you!

Rural Veterans and Nonprofits Gain Critical Housing Support Through Partnership...

Rural Veterans and Nonprofits Gain Critical Housing Support Through Partnership...